Meta Platforms, Inc. (NASDAQ: META) will report Q3 2023 results on Wednesday, October 25, 2023. Here are the key numbers that we’re watching.

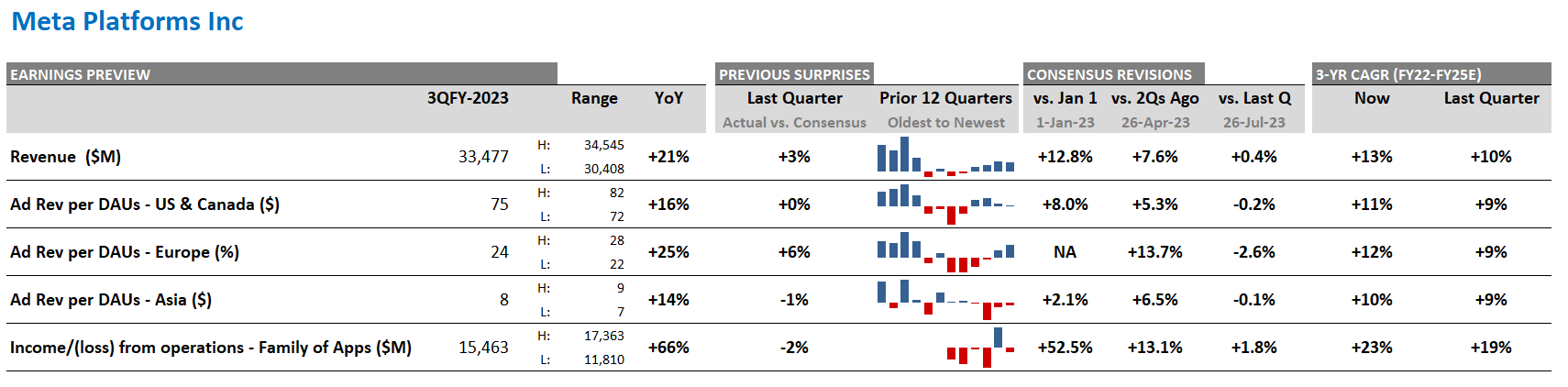

Figure 1: Meta Platforms – consensus expectations for Q3, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (October 23, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Source: Visible Alpha consensus (October 23, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Meta Q3 Earnings Preview

According to Visible Alpha consensus, total revenues expected for Q3 have come up from the beginning of the year, from $29.7 billion to $33.5 billion, driven by an increase in expectations for Meta’s Family of Apps.

In addition, Q3 expectations for operating income have increased significantly from $5.8 billion at the beginning of the year to $11.6 billion ahead of Q3 earnings, driven by both better profitability in the Family of Apps and smaller losses for Reality Labs. Expectations increased by 50% for the Family of Apps’ income from operations, taking the consensus number from $10.1 billion to $15.5 billion into Q3. However, there is a significant range of analyst estimates into Q3 for this business, from $11.8 billion to $17.4 billion.

The stock has been a big outperformer this year, up more than 150% year to date. Coming out of the META Connect 2023 event, the company’s new products and features have increased focus around the potential to increase the revenue generated per DAU (daily active user), especially outside the U.S. What new information will come out of the Q3 release that could potentially maintain the positive momentum?

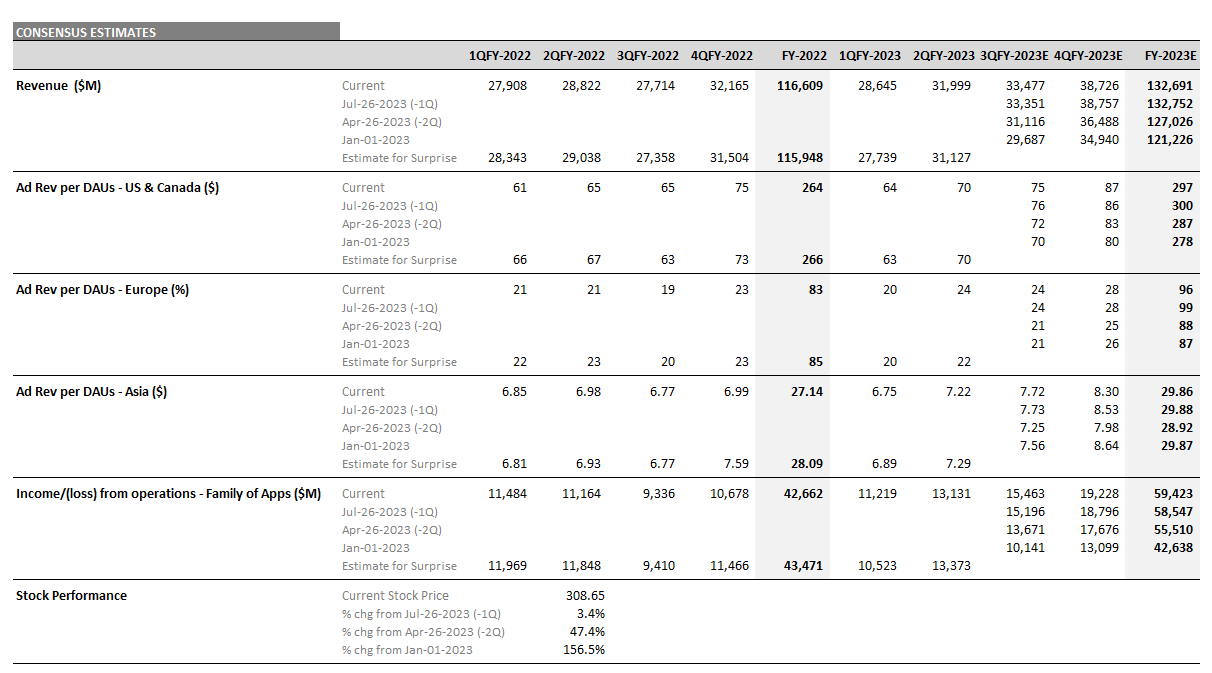

Figure 2: Meta consensus estimates

Source: Visible Alpha consensus (October 23, 2023). Stock price data courtesy of FactSet. Meta stock price is as of the market close on October 20, 2023.

Source: Visible Alpha consensus (October 23, 2023). Stock price data courtesy of FactSet. Meta stock price is as of the market close on October 20, 2023.