Meta Platforms, Inc. (NASDAQ: META) will report Q4 2023 results on Thursday, February 1, 2024. Here are the key numbers that we’re watching.

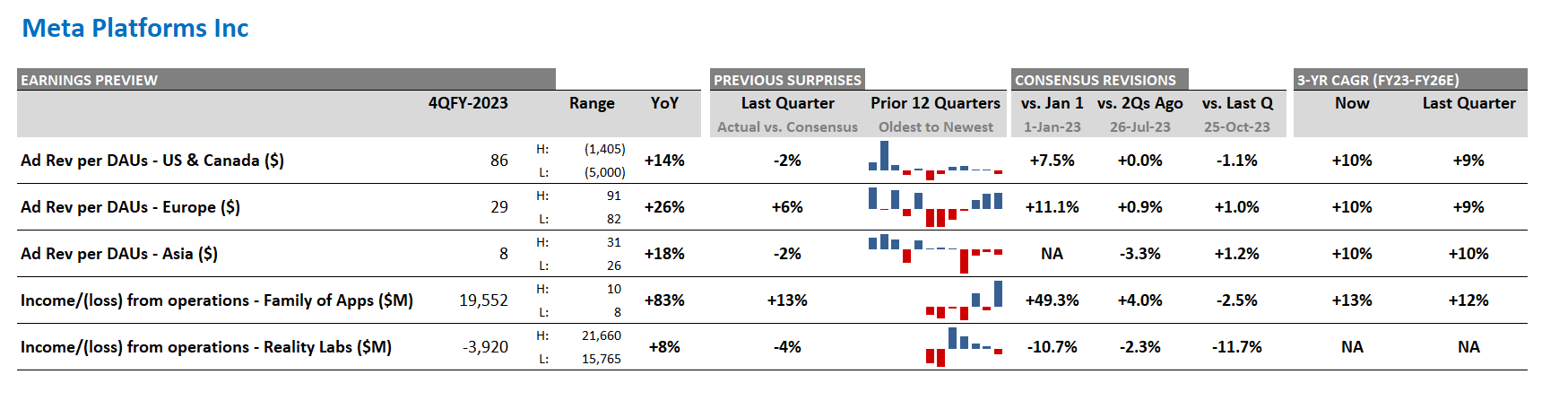

Figure 1: Meta Platforms – consensus expectations for Q4, past earnings surprises, revisions, and CAGR

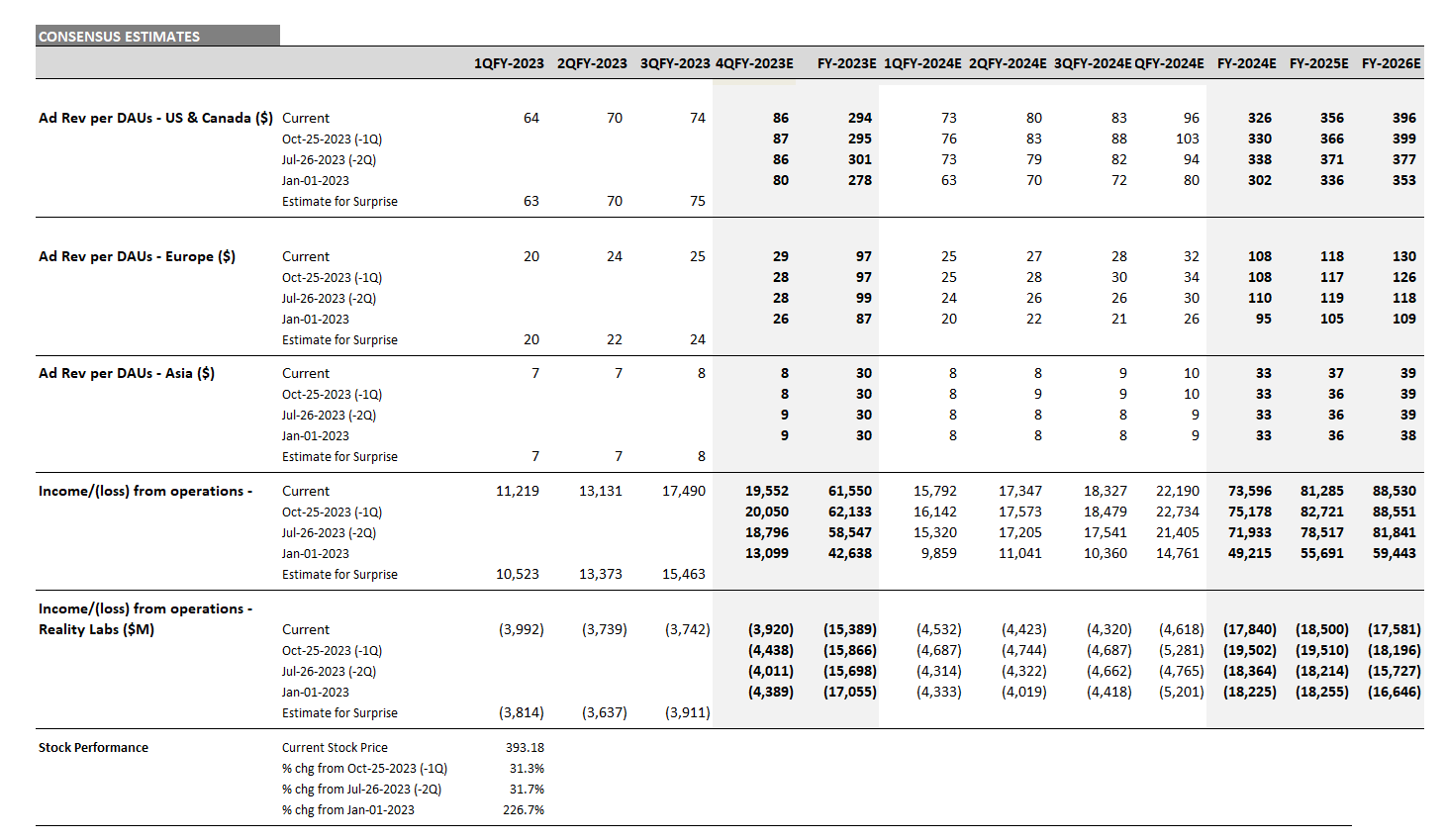

Source: Visible Alpha consensus (January 26, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Meta Platforms Q4 2023 Earnings Preview

According to Visible Alpha consensus, total revenues expected for Q4 have remained at $39 billion and operating profit from the Family of Apps at $20 billion since Q2 2023, driven by solid performance. However, there is debate among the analysts into Q4 for the Family of Apps’ income from operations, with estimates ranging from $15.8 billion to $21.7 billion.

For 2024, expectations for operating income from the Family of Apps have increased from $71.9 billion last quarter to $73.6 billion ahead of Q4 earnings, driven by better efficiency in the business. In addition to the continued expected efficiencies in the Family of Apps segment, projected losses from Reality Labs have decreased further since last quarter for both 2024 and 2025, suggesting efficiency is expected to continue to have an impact here too. Will Meta be able to continue managing costs in 2024?

The stock has been an outperformer since last quarter, up more than 30%. What new information will come out of the Q4 release that could potentially maintain the positive momentum?