Microsoft Corporation (NASDAQ: MSFT) will report Q1 2024 results on Tuesday, October 24, 2023, after the market close. Here are the key numbers that we’re watching.

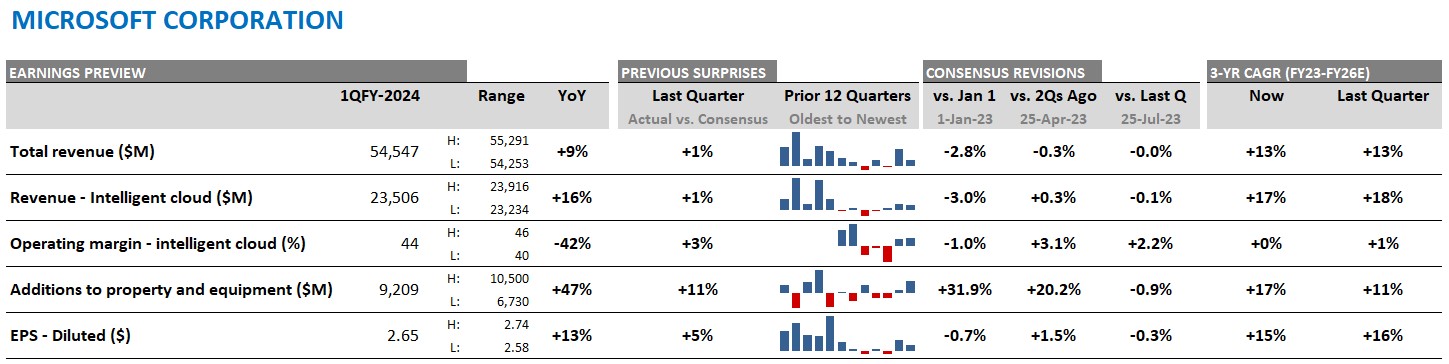

Figure 1: Microsoft – consensus expectations for Q1 2024, past earnings surprises, consensus revisions, and CAGR

Source: Visible Alpha consensus (October 19, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Microsoft Q1 2024 Earnings Preview

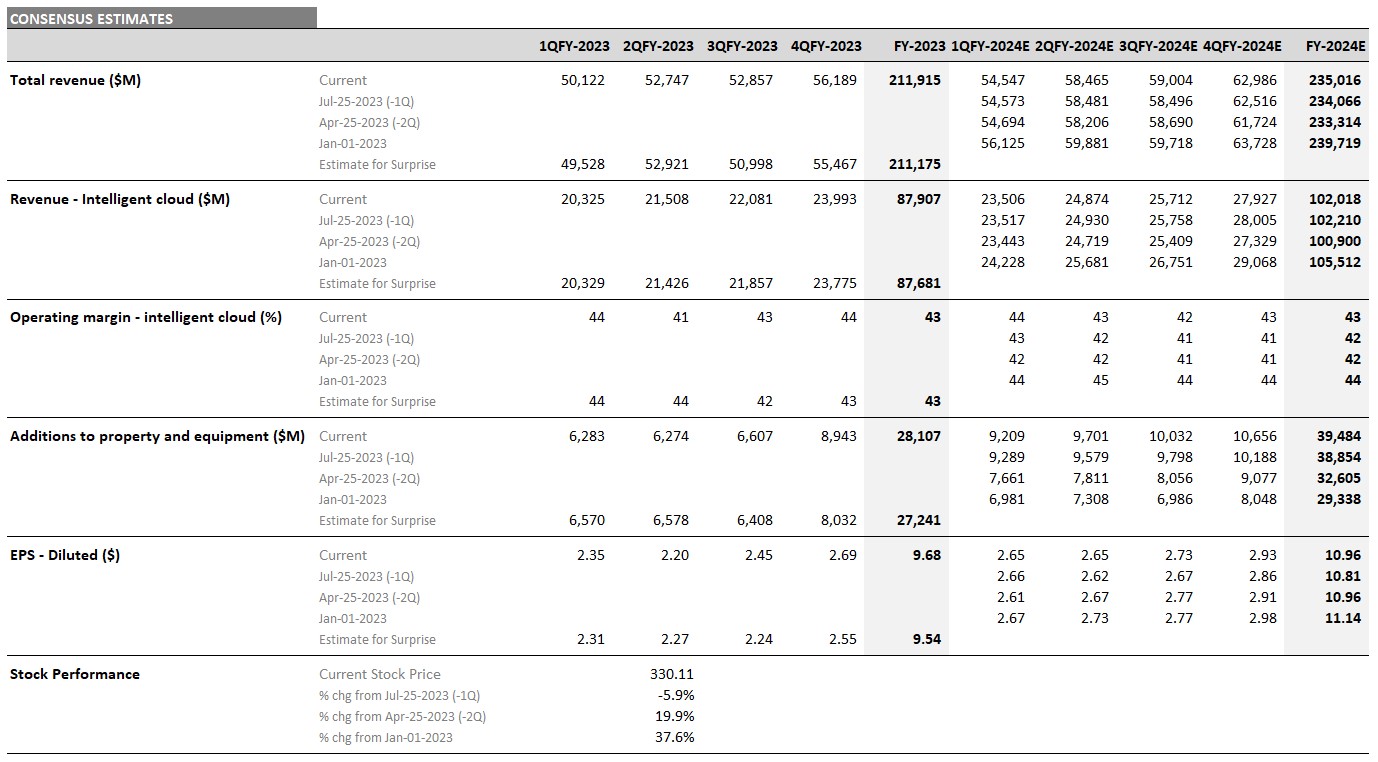

According to Visible Alpha consensus, total revenues expected for Q1 have remained around $54.5 billion since April, driven by resilience in its core business segments. We are closely watching what the company will say about the outlook for AI and Copilot, as Microsoft’s FY 2024 CapEx numbers have continued to increase steadily since January. According to consensus projections, CapEx estimates have climbed over $10 billion from $29.3 billion to $39.5 billion in FY 2024, up 3x from FY 2019 and ahead of both Meta’s (NASDAQ: META) and Alphabet’s (NASDAQ: GOOGL) estimated CapEx levels.

In particular, the Intelligent Cloud segment, which makes up over 40% of total revenues, is projected to remain solid, with consensus estimates around $102 billion for FY2024, driven by Azure. The profitability of this segment is a source of debate among analysts and may explain some of the stock’s recent sluggish performance. Currently, the FYQ1 consensus of 12 analysts for the Intelligent Cloud business’s operating profit margin is 44%, but ranges from 40% to 46%, suggesting this segment may deliver a surprise in the Q1 release.

Microsoft stock has traded down -5.9% since the July earnings release, but is up 37.6% from January 1, 2023. Could the Q3 release provide a positive catalyst to get the stock back on an outperformance path?

Figure 2: Microsoft – consensus revenues, operating income, EPS, and stock performance

Source: Visible Alpha consensus (October 19, 2023). Stock price data courtesy of FactSet. Microsoft stock price is as of the market close on October 18, 2023.