Nvidia Corp. (NASDAQ: NVDA) will report fiscal Q1 2025 results on Wednesday, May 22, 2024, after the market close. Here are the key numbers that we’re watching.

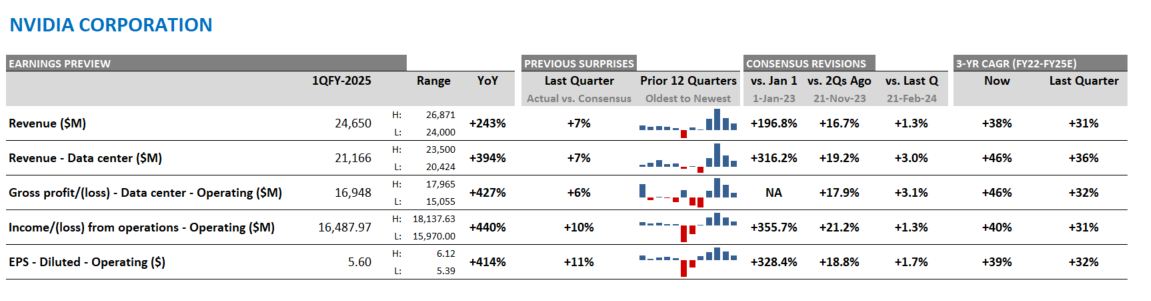

Figure 1: Nvidia – consensus expectations for Q1 2025, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (May 15, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Nvidia’s Q1 2025 earnings preview

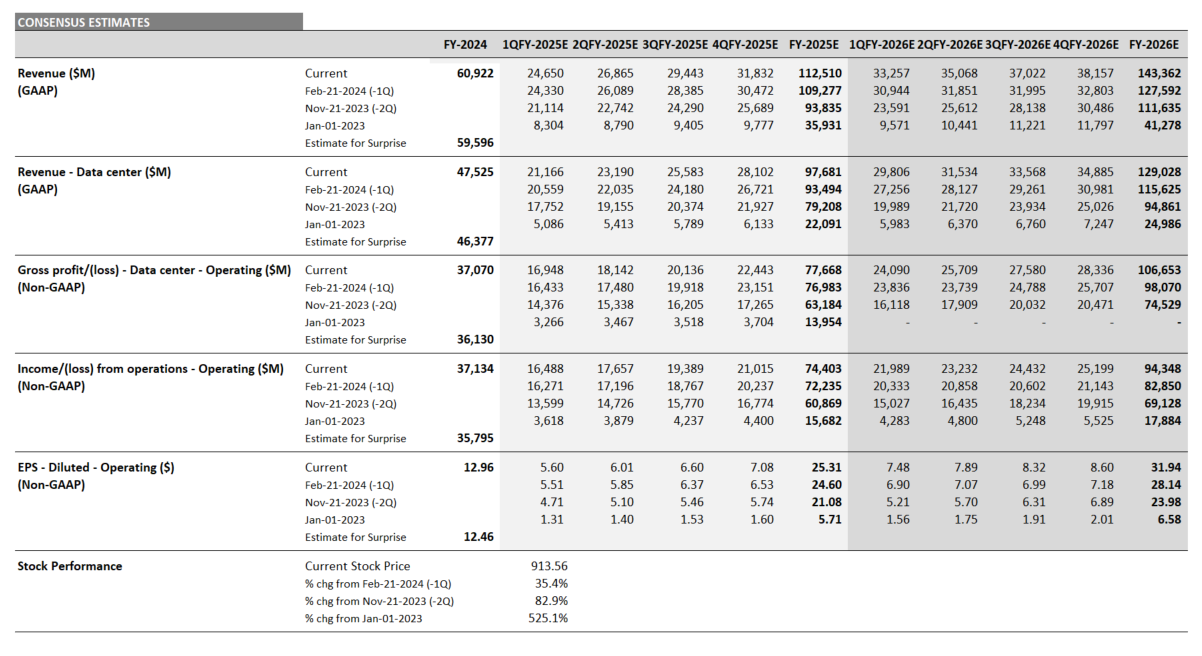

According to Visible Alpha consensus, total revenues of $24.7 billion expected for fiscal Q1 2025 have not moved much from fiscal Q4 2024 earnings in February. Overall growth continues to be driven by optimism about the strength of Nvidia’s Data Center segment. This segment has seen its expected top line performance for Q1 increase from a mere $5.1 billion in January 2023 to its current projection of $21.2 billion, up over 4x. This revenue surge has been driven by strong demand for its GPUs from cloud service providers, and the move to accelerated computing in the data centers for AI.

More recently, the Data Center segment’s expected revenues in Q1 moved slightly higher from $20.6 to $21.2, according to consensus. While the pace of analysts’ upward revisions to the Data Center segment has stabilized since the Q3 release in late November, it will be important to see how Nvidia guides the market for Q2 and FY 2025, and to what extent higher pricing and volumes will be expected to continue.

Currently, there is significant debate about the performance of the Data Center segment. Based on Visible Alpha consensus, this business is projected to generate $23.2 billion in revenues in Q2 2025. For FY 2025, Visible Alpha consensus for this segment has increased an additional $4.2 billion to $97.7 billion since the Q4 2024 release in February. However, the estimates now range from $87.5 billion to $117.5 billion, a significant narrowing from the February range of $65.4 billion to $121.2 billion. The FY 2026 expected Data Center revenue range from $96.4 billion to $187.0 billion remains significant, causing expected FY 2026 P/Es to range from 20x to 45x.

The stock has traded up an incredible 83% since the November release, and is up around 35% since the February release. Could the Q1 release provide the next positive catalyst for the stock or are expectations largely priced in for now?

Figure 2: Nvidia consensus estimates

Source: Visible Alpha consensus (May 15, 2024). Stock price data courtesy of FactSet. Nvidia’s current stock price is as of the market close on May 14, 2024.

Figure 3: Nvidia’s key financial items

Source: Visible Alpha consensus (May 15, 2024). Stock price data courtesy of FactSet. Nvidia’s current stock price is as of the market close on May 14, 2024.

Also check out our latest AI Monitor for a view of Nvidia’s AI-exposed revenues and growth potential.