Here’s a look at the key highlights from Nvidia’s (NASDAQ: NVDA) Q2 FY2024 earnings release and the company’s strong outlook.

- Could Nvidia be the next $2 trillion market cap company?

- Will the platform shift to accelerated computing happen by 2027?

- Will the bulls continue to be right about the magnitude and pace of Data Center demand?

Nvidia’s Big AI Moment Continues

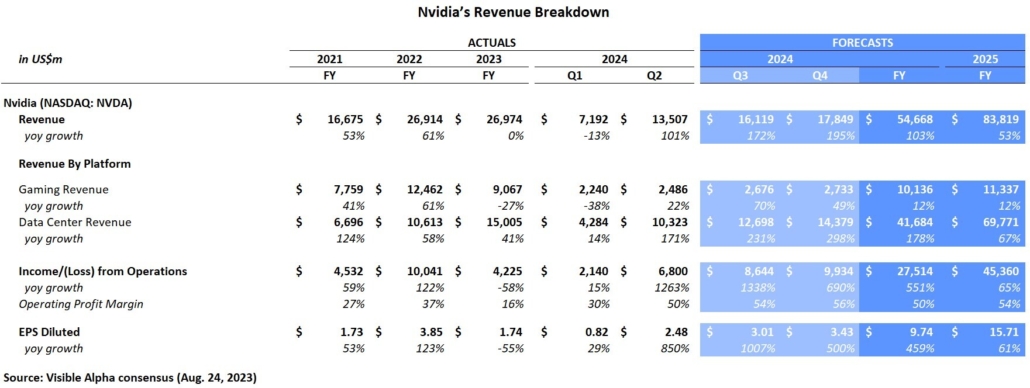

Nvidia announced a topline beat of $2.2 billion in Q2 FY 2024, which dropped almost completely to operating income, driving further upside in the stock. Customer demand in Q2 came primarily from cloud service providers (just over 50% of revenue) and consumer internet. However, this quarter was all about the outlook and supply, which both exceeded expectations. The combination of clear supply visibility and the Q2 beat and Q3 guidance delivered a surprise of over $5 billion above consensus expectations. Nvidia will be presenting at a number of sell-side conferences in early September and it will be valuable to get further clarity on the outlook on both demand and supply.

The company guided Q3 revenues to $16 billion, over $3 billion ahead of where Q3 consensus was at the end of Q2. The company guided gross margins to expand to 71.5-72.5% in Q3, ahead of the previous estimate of 68% for FY2024.

Ahead of the Q2 announcement, analysts had been expecting the company to generate $14 billion in revenues and $7 billion in operating income in Q4. However, post-Q2, numbers were revised up and the new consensus number for Q4 revenues is now $18 billion and nearly $10 billion in operating income.

FY2024 is now expected to generate $9.74/share, driven by $54.7 billion in revenues and $27.5 billion in operating income.

Could Nvidia be the next $2 trillion market cap company?

Platform Shift to Accelerated Computing

On the Q2 earnings call, the company called out that “data center demand is tremendous,” driven by the move from general purpose computing to accelerated computing. According to Nvidia CEO Jensen Huang, the trend is very clear and Nvidia is seeing this platform shift. The shift to accelerated computing reduces cost and energy, driving higher throughput, and the industry is responding to this improved efficiency. This is driving the development of new applications.

According to Huang, $1 trillion of data centers are populated by CPUs, not accelerated computing. He noted on the call that he believes $250 billion/year in CapEx dollars will lean into generative AI infrastructure (Training and Inference). With generative AI (GAI) continuing to move toward accelerated computing, this shift is continuing to drive significant order flows to build out the accelerated computing in data centers.

Prior to the Q1 earnings release, revenue from data centers was expected to generate a mere $23 billion by the end of FY2025. Prior to the Q2 earnings release, analysts projected $51.6 billion, but the Data Center segment is now expected to reach nearly $70 billion in revenues, tripling from the initial Q1 expectations.

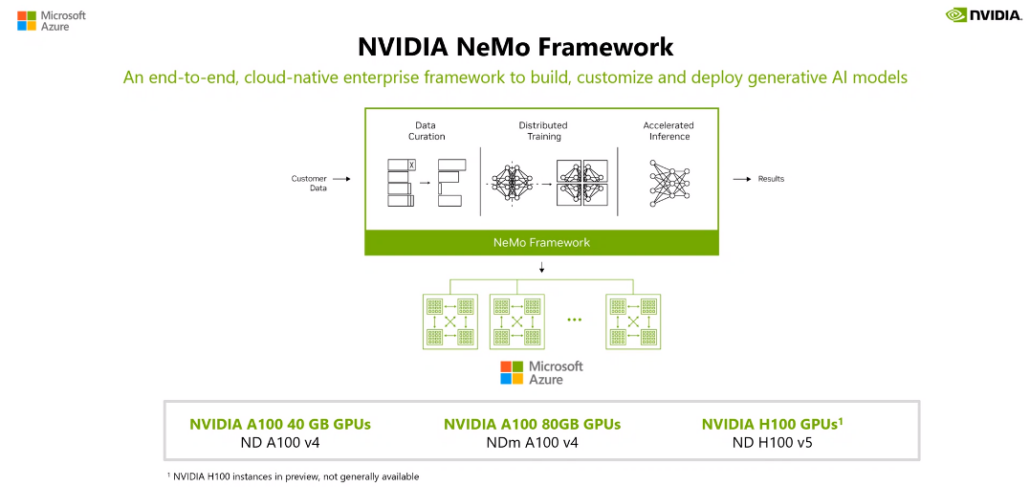

As the gold standard in AI infrastructure, Nvidia together with Microsoft will enable Machine Learning Training and Inference. In addition, this partnership will enable an Omniverse cloud to live within the Microsoft Azure cloud which will allow new applications to be built and serviced together. Also, Nvidia’s CUDA applications can operate with Windows and allow for integration of existing software, bringing innovation and freshness to existing applications with GAI.

Nvidia has also partnered with Hugging Face, the world’s largest AI community, to offer a new service to enable training directly on the Nvidia DGX cloud. Training models directly can support both more scalable and more curated integration into a new or existing legacy application, which is ultimately what can bring GAI to life for large organizations or individuals.

Figure 1: From data to results: How Microsoft and Nvidia will work together

Source: Microsoft Build (May 24, 2023)

Will the platform shift to accelerated computing happen by 2027?

Data Center Demand Drives Upside

The company highlighted strong demand for their products in data centers, driven by customers racing to integrate AI. In response to the Data Center demand visibility into H2 and next year, the company has procured supply that is substantially larger and expects supply to increase each quarter into next year. The company noted that this will lower cycle times and add capacity.

The pace of potential growth in computing and networking is driving lofty analyst expectations for Nvidia. Looking ahead to FY2025, analysts have taken up their estimates substantially on the strong Data Center demand and the company’s ability to secure supply into next year. Analysts now estimate NVDA to deliver $15.71/share with the most aggressive analysts expecting $19.18/share. Consensus revenues for the Data Center business in FY2025 are expected to come close to $70 billion. Several analysts have over $80 billion in Data Center revenues already baked into FY2025 forecasts and the most aggressive analyst is projecting over $100 billion from this division.

Will the bulls continue to be right about the magnitude and pace of Data Center demand?

Figure 2: Nvidia’s revenue breakdown

The Bottom Line

The potential for AI developers to create the next generation of must-have applications at scale has only just started. Over the next 4-5 years, there will likely be significant CapEx investment in data centers, development, and integration to ready the world for what’s to come next. The magnitude of the shifts is likely to blur the lines between cloud, chip, software, and search providers. Both workplaces and consumers are likely to win in the end with enhanced efficiency and productivity coupled with better-curated information. Like it or not, AI is here to stay.