Nvidia Corp. (NASDAQ: NVDA) hosted GTC (GPU Technology Conference) 2024, the company’s major AI conference for developers, in mid-March. Here are some of our key observations post-GTC.

Estimates continue to go up

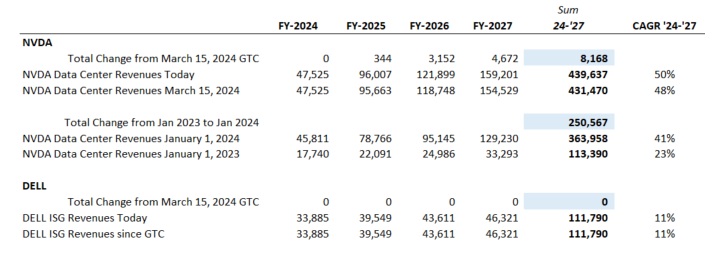

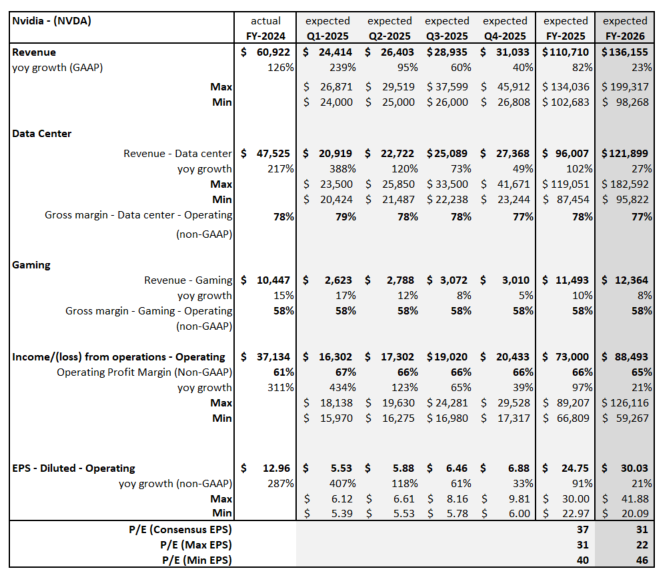

Since GTC, analysts’ estimates have continued to grind higher. From January 1, 2023 to January 1, 2024, FY 2024 – FY 2027 aggregated Visible Alpha consensus expectations for Data Center revenues increased a whopping $250 billion, from $113 billion to $364 billion. Despite these enormous upward revisions, numbers are still moving up. From March 15, 2024, right before Nvidia’s GTC event kicked off on March 18, aggregated consensus increased a further $8 billion. Further optimism around the FY 2026 and FY 2027 outlook drove the bulk of the increases. What’s getting the investment community excited about the outlook?

Figure 1: Nvidia and Dell consensus estimates

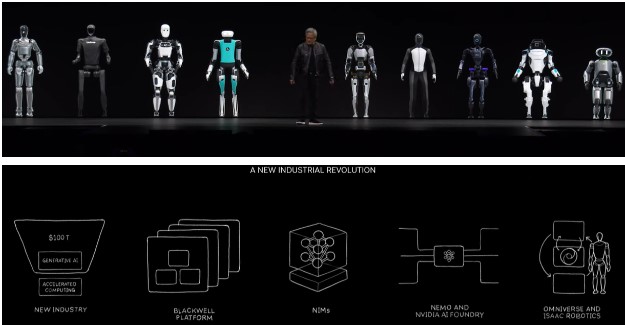

Figure 2: CEO Jensen Huang: Moving toward an Industrial Revolution = $100 trillion

Birth of a new industry

According to CEO Jensen Huang at GTC, accelerated computing and Generative AI are moving the world to a new industrial revolution. While many of his comments echoed similar themes from his keynote at Computex 2023 in Taiwan last fall (see our report on that conference), he emphasized larger models, better performance and, ultimately, higher prices.

The move to accelerated computing is laying the groundwork and positioning heavy industry to scale innovative solutions in manufacturing. Omniverse Digital Twins will be able to simulate real world experiences and solutions that can help automotive and electronics manufacturers reduce risk and cost, while improving efficiency and creativity. The Omniverse enables everything to be manufactured digitally first.

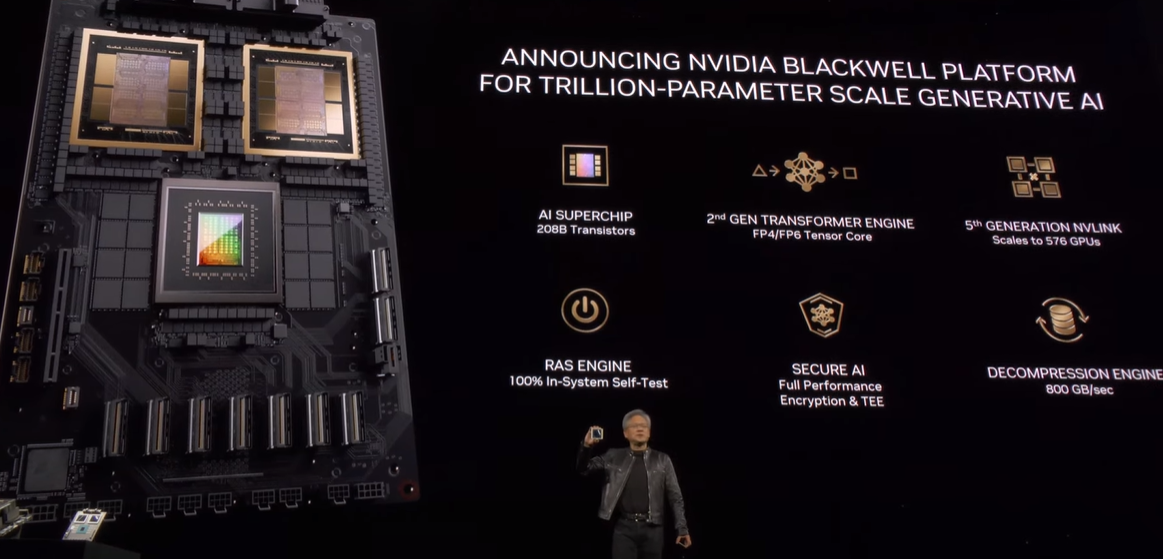

Blackwell and Dell

Nvidia also announced the Blackwell platform at GTC. According to Huang, Blackwell will be “a very, very big GPU” for the Generative AI era. The combination of the FP4 Tensor Core, the new transformer engine, and the NVLink switch, which will enable GPUs to communicate with each other 10x faster, will support the proliferation of generative AI.

As organizations build out their chatbots and generative AI capabilities, Huang highlighted the need for an AI factory. In order to scale the generative AI capabilities across a full enterprise, firms are probably going to need to build AI factories. He then pointed to Michael Dell, CEO/founder of Dell, in the audience and explained that “nobody is better at building end-to-end systems of very large scale for the enterprise than Dell.” Has this been baked into Dell’s estimates?

Figure 3: CEO Jensen Huang: Blackwell

Longer-term, going higher?

For FY 2026, the range of estimates remains substantial and implies that there is significant debate about Nvidia’s growth outlook and whether the company will deliver the industrial revolution dream. The top-end estimate is currently at $182.6 billion, while the low-end estimate is at $95.8 billion for Data Center revenue. Non-GAAP diluted consensus EPS for FY 2026 is now projected to be $29.5/share, but ranges from $20.1/share to $41.9/share, with current P/E ratios at 39x to 19x. Will the gap close further and drive consensus estimates higher going forward?

NVDA stock has not reacted much since the GTC, but is up over 86% since the beginning of the year. Will the Data Center business continue to beat expectations in FY 2025 and continue to drive upside in the stock?