Nvidia Corp. (NASDAQ: NVDA) reported fiscal Q2 2025 results on Wednesday, August 28, 2024. What happened during the release and earnings call, and what are the key points to focus on?

Nvidia’s Fiscal Q2 2025 Earnings Release

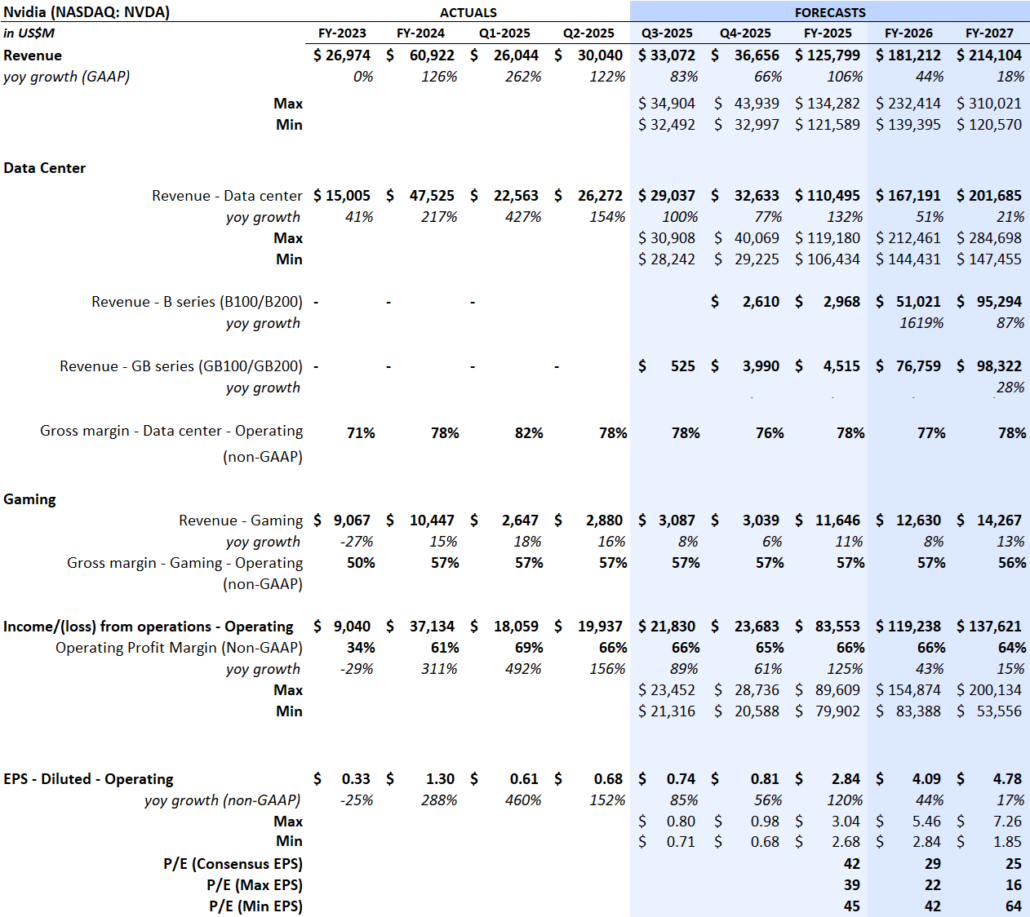

Nvidia delivered total revenues for Q2 of $30.0 billion, beating Visible Alpha’s consensus estimate of $28.7 billion by $1.3 billion, driven by continued revenue growth of Nvidia’s Data Center segment. The segment saw its Q2 revenue surge to $26.3 billion, $1.3 billion ahead of the $25.0 billion consensus estimate coming into the quarter and capturing all of the beat to expectations.

This revenue surge has continued to be driven by strong demand for Hopper GPUs, particularly from cloud service providers. On the earnings call, the company highlighted that Hopper supply and availability have improved. Blackwell demand is well above supply and is expected to continue into next year.

However, the Data Center segment’s non-GAAP gross margin dipped to 78% in Q2, in line with consensus. This muted the magnitude of the surprise to the EPS line with non-GAAP diluted EPS of $.68/share, exceeding the consensus of $.65 by 4.6%, less than previous beats. In addition, Nvidia announced approval of a $50 billion buyback, which some viewed as a bearish sign.

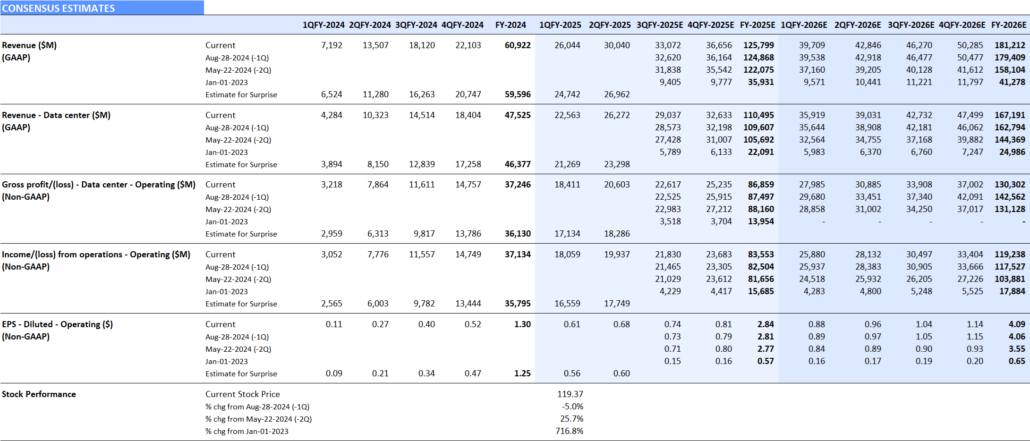

Figure 1: Nvidia estimate trends

Source: Visible Alpha consensus (August 30, 2023). Stock price data courtesy of FactSet. Nvidia’s current stock price is as of the market close on August 29, 2024

The Outlook

Near-term growth

For fiscal Q2 2025, Nvidia guided $1 billion ahead of expectations to $33.1 billion in total revenue, with analysts now projecting the Data Center segment to make up $29.1 billion, up from $28.0 billion. In addition, Nvidia guided total gross margin to continue to be around 75% levels, down 50bps from 75.5% last quarter, driven by a mix shift in the Data Center business.

Looking further out, analysts remain bullish on the Data Center segment. Since the Q2 release, analysts have increased their full-year Data Center revenue estimates by another $1 billion for FY 2025 to $110.6 billion, driven by continued optimism around GPU demand and the release of Blackwell. According to Visible Alpha consensus, Data Center revenues for FY 2026 are now expected to jump to $168 billion, up from $144 billion on May 22, 2024, with consensus EPS increasing over 15% to $4.10/share. It is worth noting that since last year, Data Center revenue revisions for Nvidia have increased by over $200 billion and reflect where current expectations are for the company’s outlook.

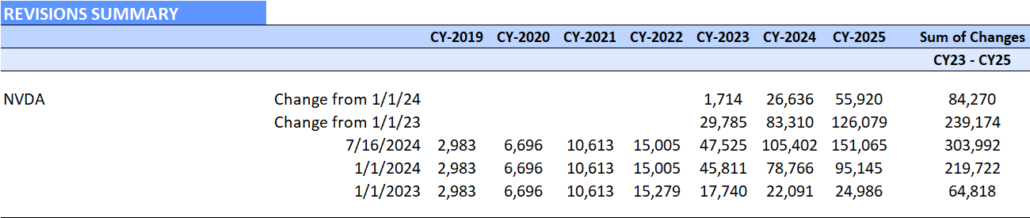

Figure 2: Nvidia Data Center revenue revisions

Source: Visible Alpha consensus (August 30, 2024). Stock price data courtesy of FactSet. Nvidia’s current stock price is as of the market close on August 29, 2024

On the earnings call, the company highlighted that the new Blackwell production ramp has been pushed out and is now scheduled to begin in the fourth quarter and continue into FY 2026. In Q4, Nvidia expects to get several billion dollars in Blackwell revenue. He also noted that ”demand for Blackwell is incredible” and that it “provides 3-5x more AI throughput in a power-limited data center than Hopper”. While analysts debate the quarterly pace and timing of the B-series and GB-series ramps, the long-term expected growth is projected to add to revenues in FY 2026 and FY 2027.

P/E debate: The range of Data Center estimates

The range of estimates has continued to narrow for the Data Center business in FY 2025, suggesting the market has increased conviction in the direction of this segment this year. For FY 2026, however, the range of estimates has narrowed slightly but remains substantial, implying that there is still significant debate about Nvidia’s growth outlook. The top-end estimate expects $212.5 billion, up from $189.9 billion, while the low-end estimate is now at $144.4 billion, up from $119.5 billion, driven by differing views about GPU demand and the ramping pace of new GPUs.

Non-GAAP diluted consensus EPS for FY 2026 is now projected to be $4.10/share, up 15% from Q1 2025. But there is a nearly $2.60/share range in expectations, from $5.46/share to $2.84/share. Current FY 2026 P/E ratios range from 23X to 44X. For FY 2027, the range expands from 17X to 68X, driven by different assumptions about the timing and magnitude of Data Center revenue growth.

NVDA stock has traded down over 6% since the earnings release, and is up nearly 24% since the Q1 release on May 22, 2024. Will the ramp of Blackwell drive the Data Center business to beat expectations in Q4 and into FY 2026?

Figure 3: Nvidia consensus estimates

Source: Visible Alpha consensus (August 30, 2024). Stock price data courtesy of FactSet. Nvidia’s current stock price is as of the market close on August 29, 2024

Long-term growth

Huang continued to emphasize that the industry is experiencing a major change. He expressed his optimism about the Data Center’s move to accelerated computing to create AI factories and noted that accelerated workloads will save power and cost. Leveraging Nvidia’s accelerated computing capabilities is enabling cloud service providers to provide a foundation for enterprises to begin integrating generative AI into their workflows. What will earnings look like in three years?