Oracle Corp. (NASDAQ: ORCL) hosted a Data and AI Forum on March 28, 2024. Here are some of our key observations from the forum.

Oracle Data and AI Forum

Oracle hosted a Data and AI Forum on Thursday, March 28, 2024. There were a host of speakers from both Oracle and its partners, including Nvidia. While many of the presentations had a sales angle to them, the event provided an insightful snapshot about the future for generative AI in enterprises.

Oracle shared a few interesting numbers from studies done by PWC and Grand View Research quantifying the impact of AI, estimating that AI’s predicted CAGR from 2023 to 2030 will be 37% and add $15.7 trillion to global GDP by 2030. Based on analysis from Insider Intelligence and ITU, Oracle highlighted that the adoption curve of AI has been much faster than smartphones and PCs.

The forum presentations highlighted the benefits of using Retrieval Augmented Generation (RAG), as it can move multi-modal data to production faster because it is not as prone to hallucinations. The process of adopting generative AI can help enterprises address data gaps, automate manual processes and simplify the organization. An important dimension to this transformation is that the AI prefers Remote Direct Memory Access (RDMA), as it provides a smoother experience moving from GPU to GPU. According to Oracle, RAG can enhance the overall accuracy of the generative AI experience and, as a result, has become increasingly adopted in enterprises.

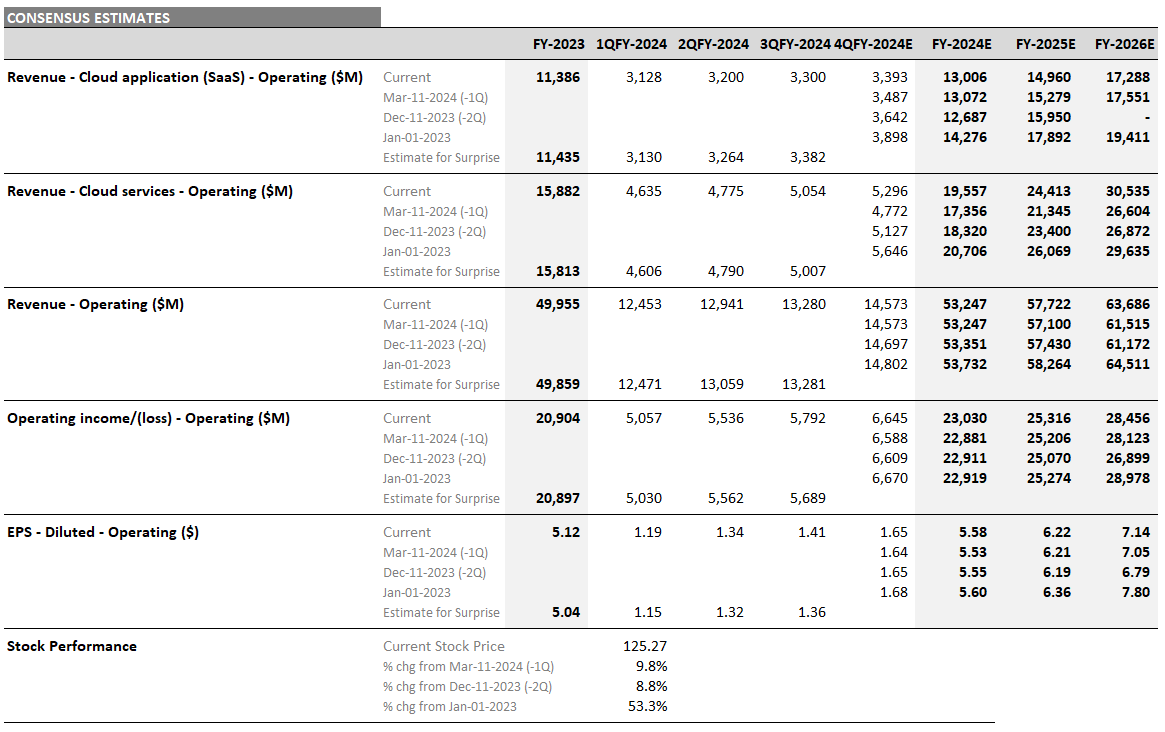

This analysis suggests that momentum for generative AI adoption by enterprises may be stronger than current expectations. Based on Visible Alpha consensus, Oracle estimates for its Cloud businesses have been grinding back to levels expected in FY 2023. Could there be a catalyst on the horizon for further upside to these numbers?