In our weekly round-up of the top charts and market-moving analyst insights: Oracle’s (NYSE: ORCL) cloud services segment is anticipated to maintain robust growth; Uber (NYSE: UBER) just recorded its first-ever profit, and its Rides segment is poised for robust growth; and ASMPT’s 2023 revenue outlook dims amid semiconductor market challenges.

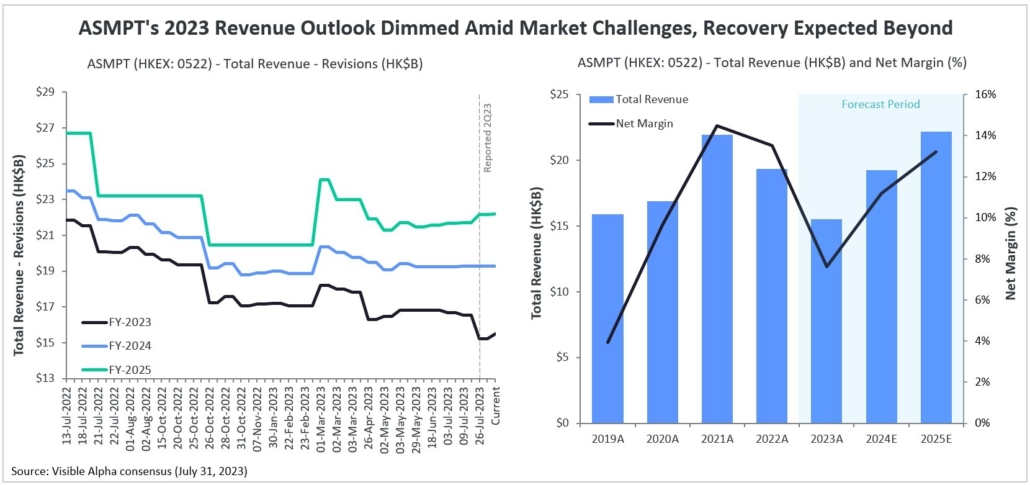

Oracle’s Cloud Services Poised for Substantial Growth

Oracle’s (NYSE: ORCL) cloud services segment is anticipated to maintain robust growth in the forecasted period through fiscal year 2026, according to Visible Alpha consensus. Cloud services accounted for approximately one-third of the company’s total revenue in FY 2023. Analysts forecast a strong upward trajectory, with revenues expected to reach $20 billion in FY 2024 (+29% YoY), and further rise to $25 billion by FY 2025 (+25% YoY).

Over the FY 2023-2026 period, the cloud services segment is projected to grow at a CAGR of 25%. In contrast, other segments of the company are expected to experience much more modest growth, or declines. In FY 2024, the license support segment is projected to grow by 1% YoY, the services segment at 3% YoY, and the hardware segment is expected to see a revenue decline of -3% YoY.

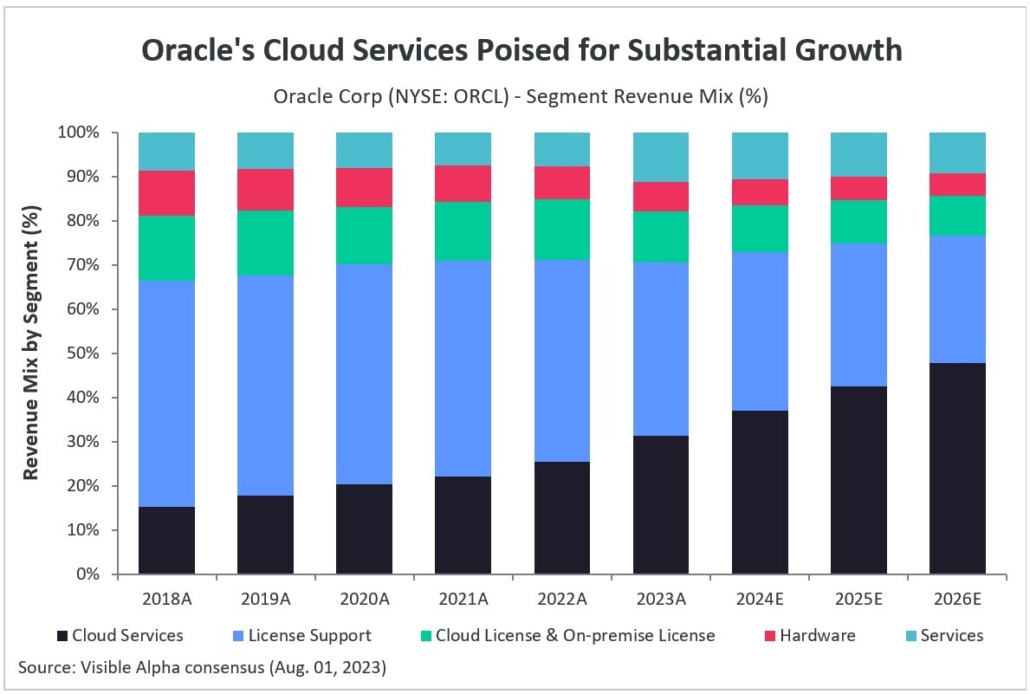

Uber’s Rides Segment Poised for Robust Growth, Analysts

Uber (NYSE: UBER) recorded its first-ever profit with income from operations of $326 million in its recent 2Q 2023 earnings report. According to Visible Alpha consensus, Uber is expected to generate $808 million in income from operations in 2023 up from an operating loss of $1.8 billion last year.

Revenue from rides is expected to experience robust growth, reaching $19.5 billion in 2023, representing a 39% year-over-year increase. Uber Eats revenue is also projected to rise by 16% year-over-year, reaching $12.7 billion. However, freight revenue is expected to decline by 24% to $5.2 billion. Based on analysts’ expectations for 2023, the strongest revenue growth is expected in the EMEA region at 34%, followed by Latin America at 26%. Asia Pacific follows closely with a projected growth of 25%. The UCAN region (United States, Canada) is also expected to experience growth, albeit at a relatively lower rate of 10%.

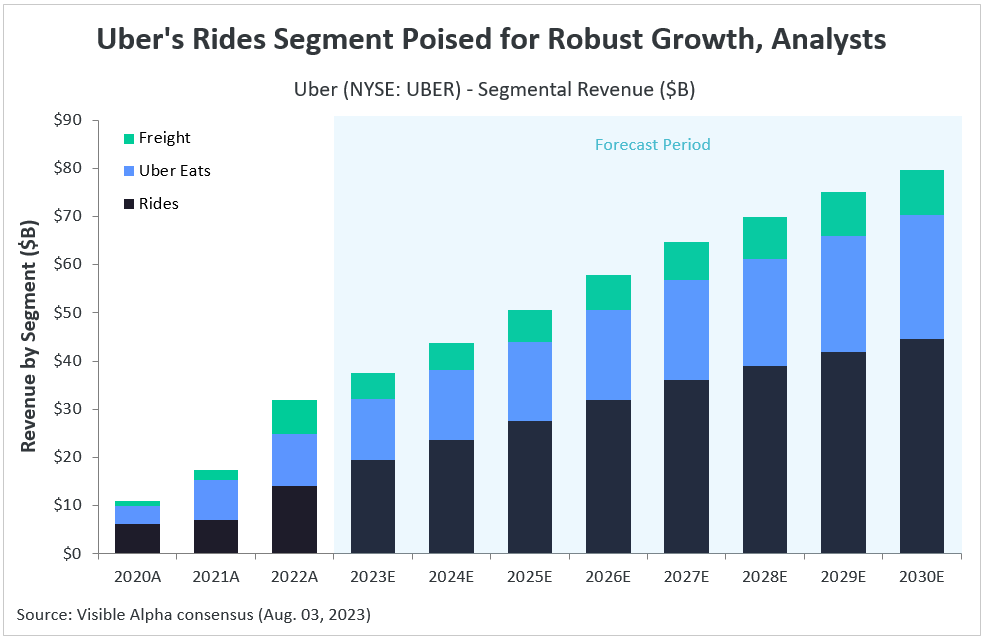

ASMPT’s 2023 Revenue Outlook Dimmed Amid Market Challenges, Recovery Expected Beyond

Analysts have slashed 2023 revenue expectations for ASMPT (HKEX: 0522), an equipment and materials company for semiconductor assembly and packaging, following weaker-than-expected 2Q 2023 results. The downward trend for revenue projections in 2023 has occurred amid a semiconductor downcycle, marked by weakened demand and supply chain rationalization.

Analysts remain optimistic about future growth, however, with total revenue projected to reach HK$19.3 billion (+24% YoY) in 2024 and HK$22.2 billion (+15% YoY) by 2025. This growth is expected to be driven by strong demand in the advanced packaging segment for AI servers and high-performance computing (HPC), along with continued demand from memory and automotive customers. According to Visible Alpha consensus, the company’s operating and net margins in 2023 are expected to improve from an estimated 10.9% and 7.6%, respectively, to 17.7% and 13.2% by 2025.