When the pandemic first hit, property and casualty (P&C) insurance companies were called to rise to the occasion. Thankfully, crisis management is the insurance industry’s bread and butter – these are the moments they prepare for and help others to navigate.

And all things considered, they did pretty well Pre-pandemic, most P&C insurance companies had already invested in their networks, cybersecurity, mobile applications, employee laptops, and other assets that made the switch to remote work more manageable. How have P&C insurance companies fared over the past couple of years?

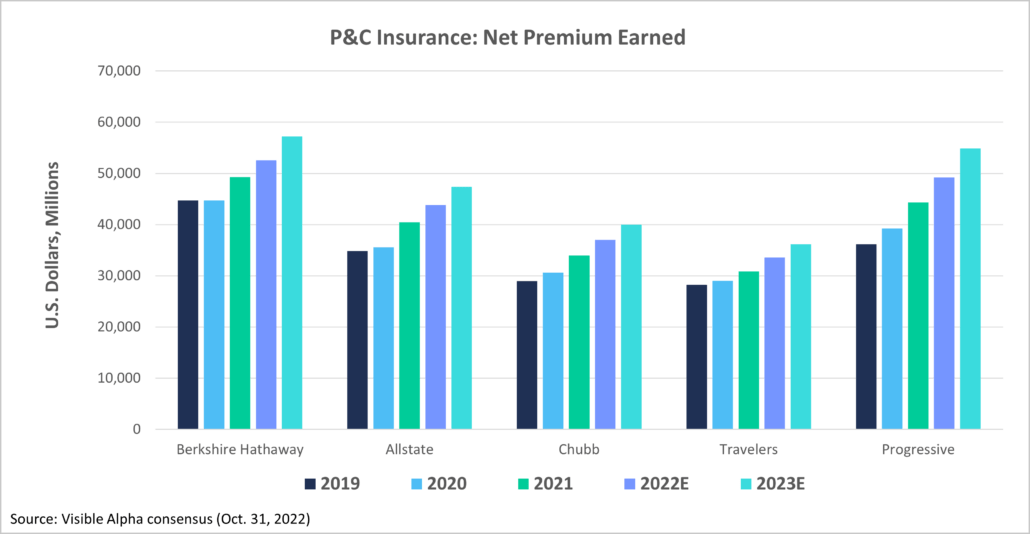

P&C insurance by the numbers

Net premium earned is the premium earned on the portion of an expired insurance contract, essentially the amount of a premium the company keeps in return for assuming risk. Net premium earned helps assess an insurance company’s health – an increase in net premiums shows the company has signed new policies, while a decrease points to a decline in written policies.

Berkshire Hathaway Inc., Allstate Corp., and Chubb Ltd. show a flat-to-slight increase from 2019 to 2020. But over the last two years, all three have increased their net premiums earned. Travelers Cos Inc. experienced slow but steadier growth over the past few years. Analysts predict all four of these P&C insurance companies will continue to increase in net premium earned into 2023.

Net investment income is an insurance company’s income derived from assets, be it bonds, stocks, mutual funds, loans, or other investments. Allstate’s investment income decreased in 2020 but experienced a significant jump in 2021. While it is forecast to dip again in 2022, analysts predict another increase for 2023. Travelers followed a similar path– a dip in 2020, an increase in 2021, a slightly-smaller drop in 2022, and another increase forecast for 2023. Chubb experienced much slower growth in net investment income: It dipped ever so slightly in 2020 and has grown slowly since then. Progressive’s net investment income decreased all the way into 2021, and only gained upward trajectory again within the past year. Analysts predict Progressive’s investment income will continue to grow into 2023. In summary, analysts predict Chubb and Progressive will close 2022 with slight increases in net investment income, and while Allstate and Travelers are predicted to end the year down, all four P&C brands are forecast to resume growth in 2023.

![Blog2_NetInvestment_V2[1]](https://visiblealpha.com/wp-content/uploads/2022/11/Blog2_NetInvestment_V21-1030x600.png)

Underwriting margin is the profit generated from underwriting activities. It is the difference between the number of premiums an insurance company collects and the total amount of claims it pays. For an insurance company to be healthy, total premiums must outweigh total claim costs. Chubb’s underwriting margin dropped in 2020, but by 2021, it had risen above its highest point in 2019. While it continued to climb in 2022, analysts forecast a slight decrease for 2023.

P&C insurance outlook

With the pandemic currently moving back into the rearview mirror, P&C insurance companies are in strategic planning mode for long-term changes. Many are raising premium prices to account for rising inflation. Increasing climate disasters are putting more strain on the insurance industry overall –increasing risk and upping the number of significant claims filed. Advanced driver assistance systems are used in more and more cars, which alters the landscape for driving expectations and auto insurance. Finally, geopolitical events, such as the war between Russia and Ukraine, affect cybersecurity claims and other P&C insurance coverage, although, according to CEO Evan Greenburg of Chubb, the war in Ukraine hasn’t yet caused any significant industry changes.

With all the global disruption of the past few years, customers have high expectations for insurance coverage. P&C insurance companies would do well to assess their current place in the market and make intentional, data-driven plans for ongoing challenges.