Analysts have raised revenue growth estimates for the world’s two largest gold mining companies – Newmont Corporation (NYSE:NEM) and Barrick Gold Corporation (TSX: ABX, NYSE:GOLD) – as prices rose last year. The SPDR Gold ETF is up over 20% since 2020, and gold prices rose above $2,000/ozt last summer for the first time as demand for the precious metal increased in part to it being long viewed as an alternative reserve currency.

Historically, gold prices have correlated to a declining U.S. dollar and increasing money supply and real rates. In response to the pandemic, central banks around the world have dramatically increased their money supply to fund stimulus programs. In the United States, the Federal Reserve announced they would allow inflation to run higher than their traditional 2% target, and a new unified government may be more likely to enact additional stimulus measures. The pandemic suppressed jewelry demand last year, but many analysts expect this source of demand to recover going forward.

Analysts revised estimates higher for both gold miners and currently forecast NEM and ABX gold sales will grow at a 14.5% and 9.2% CAGR, respectively, through 2022, according to Visible Alpha consensus.

Excel Add-In codes: ‘Total revenue – Gold equivalent’ or ‘S_56229’

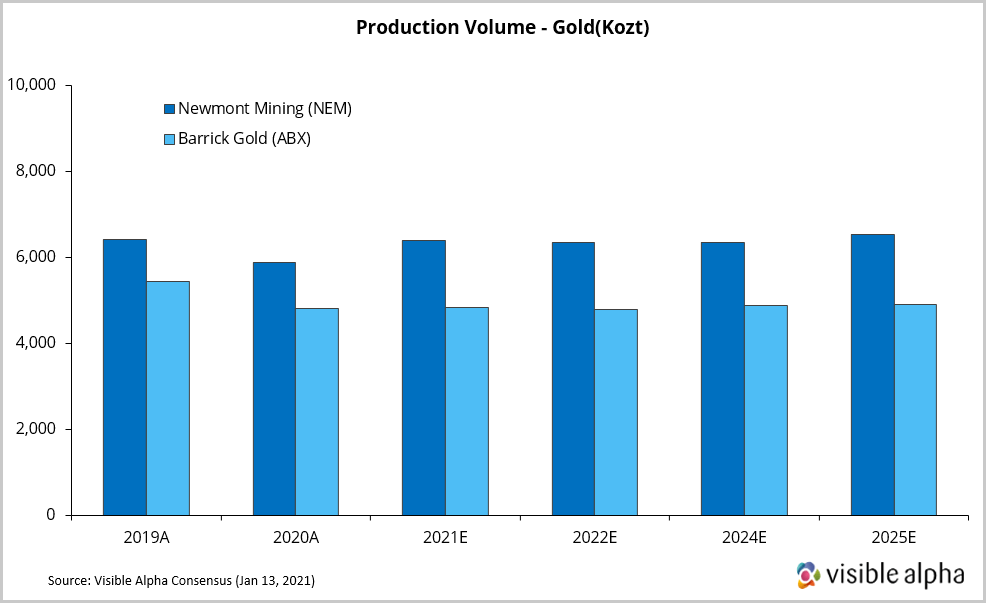

The pandemic negatively impacted gold production last year, as mines around the world shuttered during lockdowns. Analysts expect production to resume growth again this year, but below pre-pandemic levels.

NEM’s larger production increase can be attributed to a ramp-up at Musselwhite, one of Canada’s largest gold mines. The company guided 2021 gold production to be around 6.5Moz, while analysts are expecting about 2% less. ABX is expanding production at several mines, but overall output is expected to remain stable in the coming years as new reserves become harder to find.

Excel Add-In codes: ‘Production Volume – Gold(Kotz)’ or ‘S_129236’

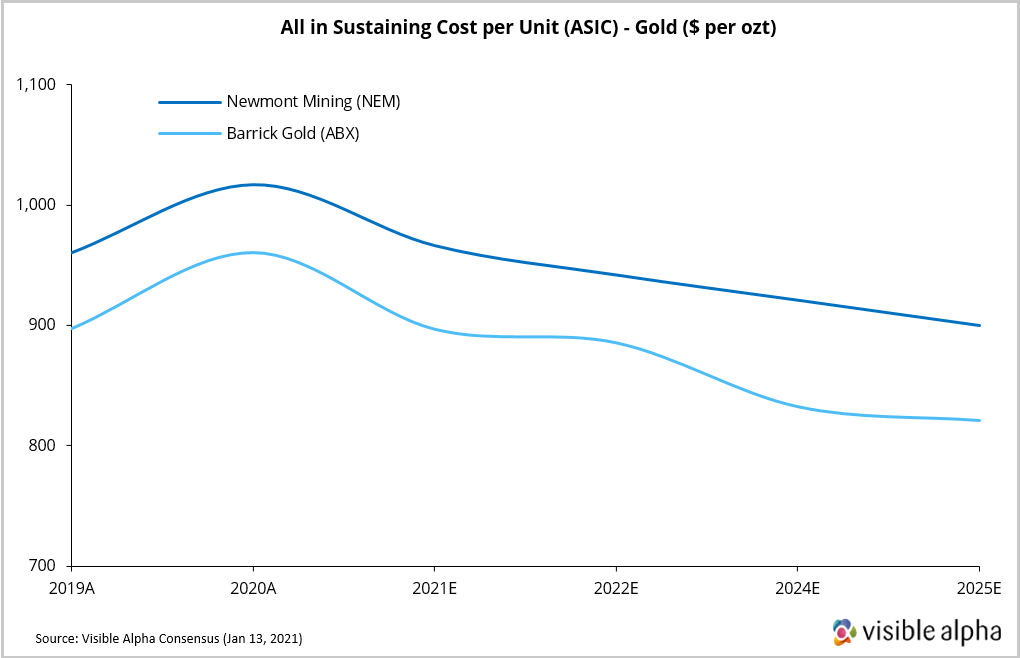

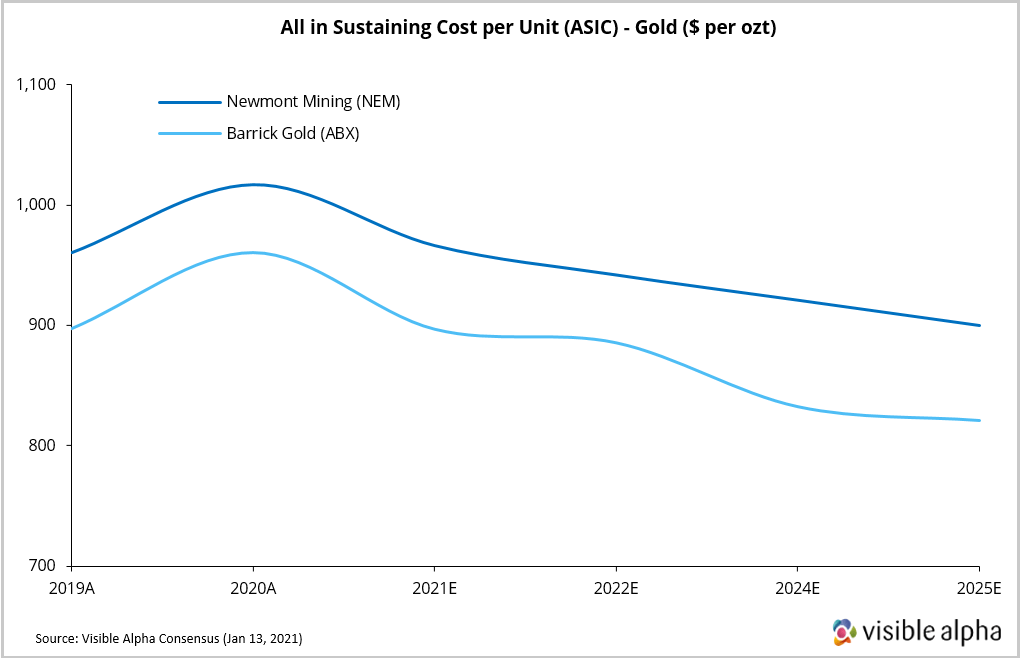

NEM has suggested their all-in sustaining costs (ASIC) per troy ounce of gold will decline to about $900/ozt by 2022, but analysts are modeling an almost 4% higher cost of about $940/ozt. Analysts expect ABX will be able to produce gold at a 6% lower cost next year compared to NEM – translating into a higher operating margin of about 44%, nearly 7 points higher than NEM.

Excel Add-In codes: ‘All in Sustain Cost per Unit (AISC) – Gold(per ozt)’ or ‘S_135177’

For more information on the key performance indicators in the gold and silver mining industry, read our industry KPI guide.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.