Key Takeaways

|

Indian cement manufacturers are expected to see a growth surge in 2023 and beyond, buoyed by a combination of robust demand and a decline in coal prices. Key players in the industry, including UltraTech Cement (NSE: ULTRACEMCO), ACC (NSE: ACC), and Ambuja Cements (NSE: AMBUJACEM) are expected to achieve steady growth, with revenue up 21%, 9%, and 13% respectively in 2023, according to Visible Alpha consensus.

Capacity expansion and a positive demand environment are expected to drive this growth, while the easing of input costs along with cost optimization measures are projected to improve margins.

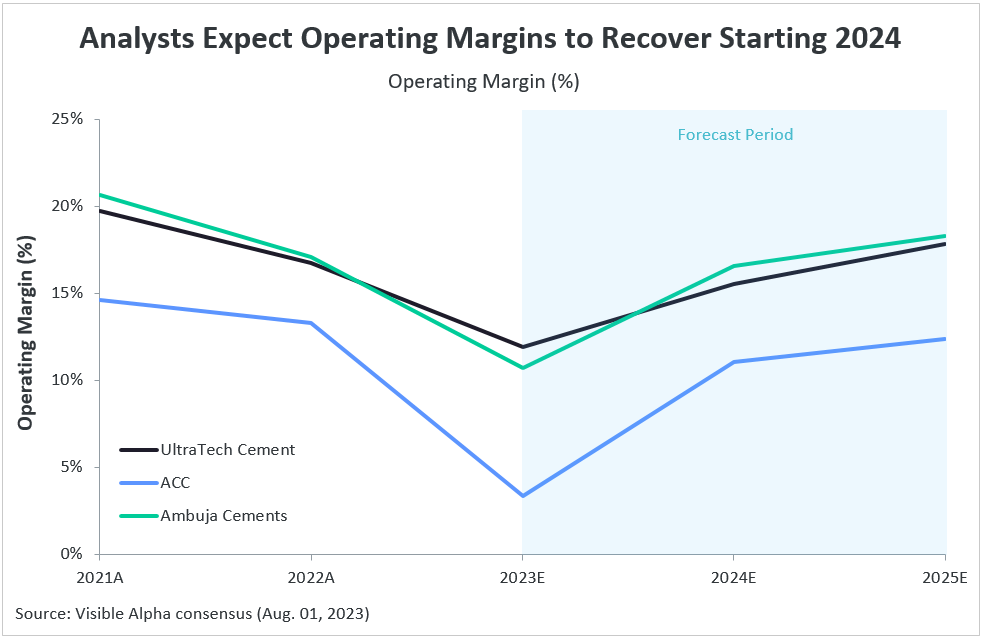

Revenues are expected to continue to grow in the forecasted years. Among the leading players, UltraTech, India’s largest cement manufacturer, is expected to outpace peers with strong revenue expectations throughout the forecast period. Demand in the industry is projected to remain strong as India’s government remains focused on infrastructure developments while rapid urbanization fuels demand for real estate.

Figure 1: Total Revenue Projections

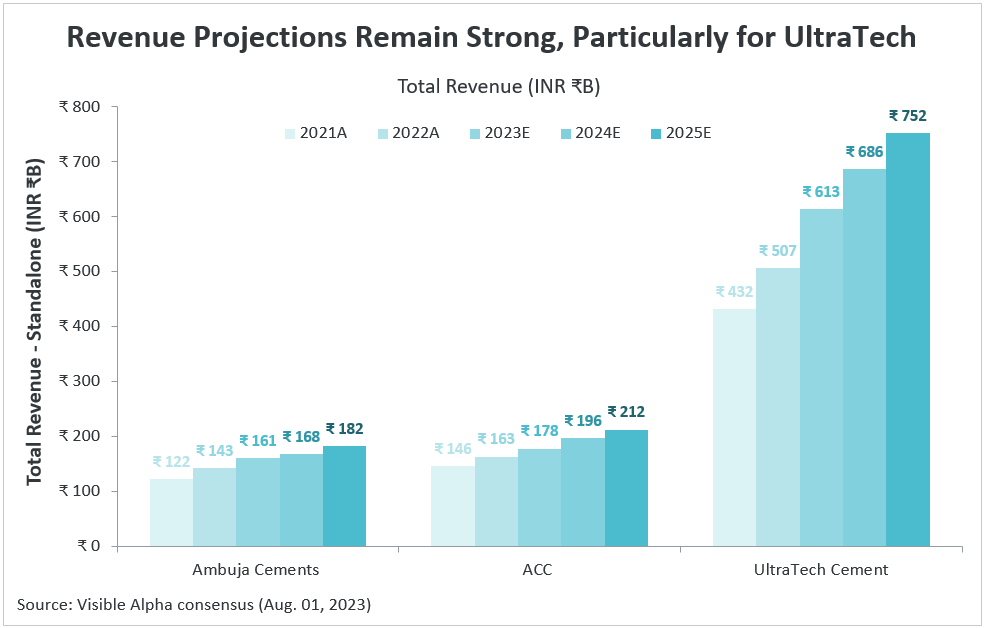

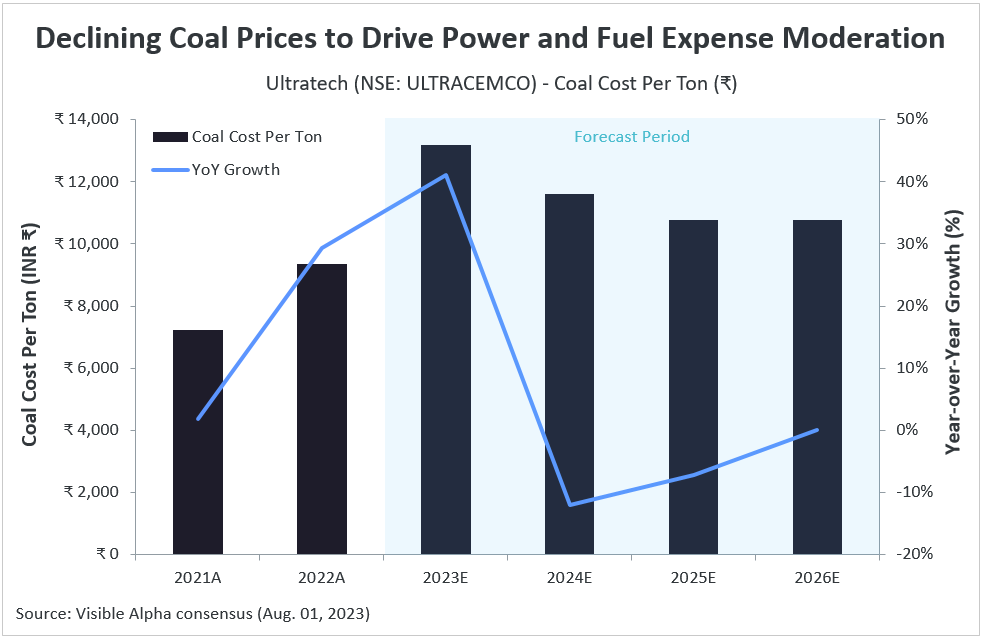

Operating margins for these leading players have been declining over the last two years due to high input costs. In 2023, analysts expect operating margins for leading cement manufacturers to decline sharply, mainly driven by a substantial 45% year-over-year increase in power and fuel expenses, along with a 41% increase in raw material expenses.

Figure 2: Power & Fuel Expenses

Note: YoY growth calculated based on the annual aggregates of major expense lines for UltraTech Cement (NSE: ULTRACEMCO), ACC (NSE: ACC), and Ambuja Cements (NSE: AMBUJACEM).

However, analysts expect margin prospects to be positively influenced starting in 2024, due to the anticipated reductions in power and fuel expenses, which constitute a significant portion of the overall expenses for cement manufacturers.

According to Visible Alpha consensus, in 2023, UltraTech Cement, ACC, and Ambuja Cements are estimated to spend 31%, 27%, and 35% of their total costs and expenses, respectively, on power and fuel. However, by 2024, these percentages are projected to decrease, with power and fuel expenses expected to represent 28%, 24%, and 31% of the total costs and expenses for UltraTech Cement, ACC, and Ambuja Cements, respectively.

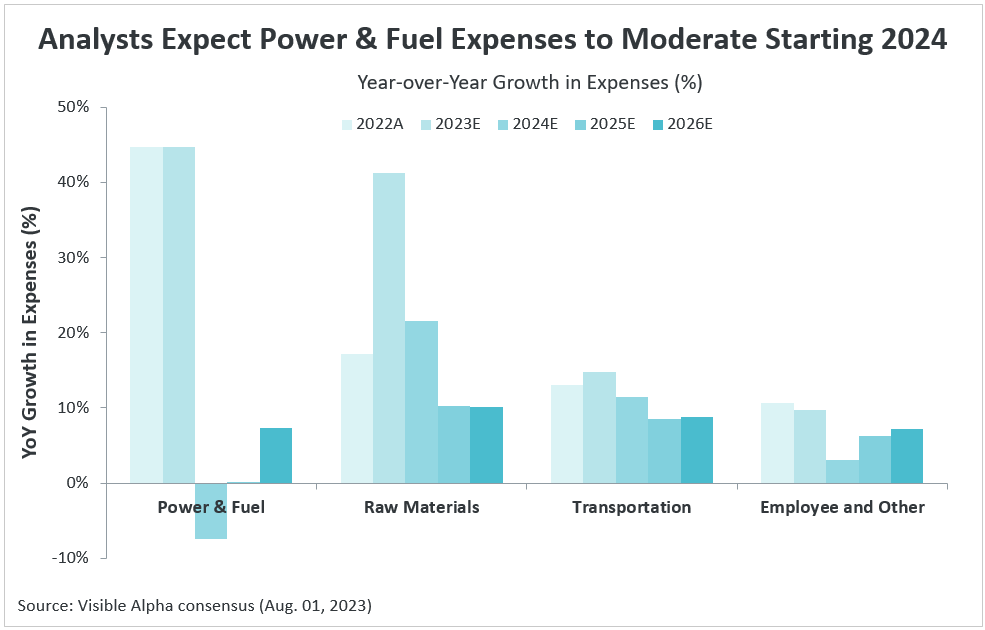

Figure 3: Coal Prices

The projected declines in power and fuel expenses can be attributed mainly to coal, a crucial component in the cement manufacturing process and a key expense line in power and fuel expenses for cement companies. Coal prices surged in 2021-22 as production failed to keep pace with rebounding coal demand post-COVID.

However, India’s coal production is expected to recover starting in 2023, resulting in improved availability and easing prices. This easing of coal prices is expected to bring relief to cement manufacturers as costs go down. Lower fuel prices along with strong volume growth is projected to drive margin improvements starting in 2024.

Figure 4: Operating Margins