Teva Pharmaceutical Industries is down ~60% year-to-date amid competitive concerns surrounding its portfolio of drugs. Competitive concerns have largely been focused on two areas: the company’s Generic Medicines segment and the company’s Multiple Sclerosis drug, Copaxone. A closer look at the size of the revisions and investor growth expectations provides a justification for the poor stock performance for the year.

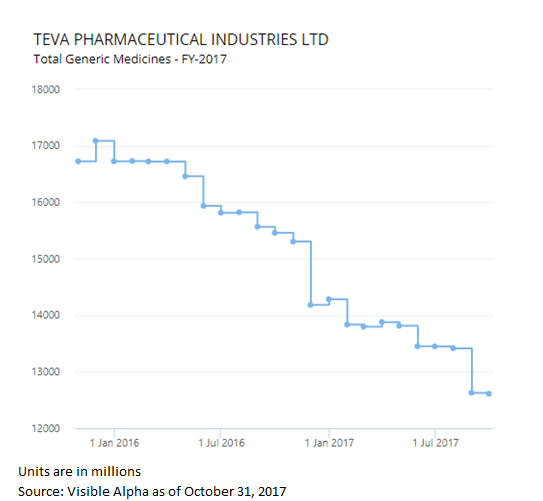

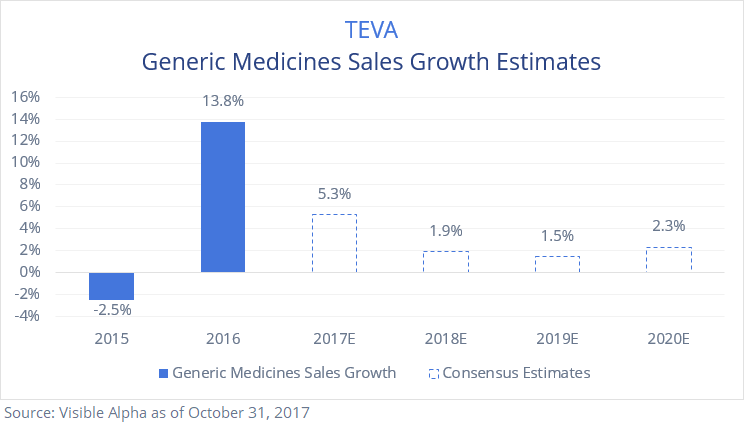

In regard to the Generic Medicines segment, the pricing environment has become more competitive in recent months, and investors have lowered growth expectations considerably for the next several years. Investors now expect the Generic Medicines segment to grow by 5% in 2017 and 1-2% growth annually thereafter. Generic Medicines sales for 2017 have been revised down by roughly $4.5 billion over the last two years.

For the Copaxone segment, expectations have been similarly revised downward. Recall that Copaxone is the leading Multiple Sclerosis treatment and was responsible for 19% of the company’s total sales in 2016. Mylan recently received approval for its Copaxone generic in early October – much earlier than most investors were anticipating. Since the approval, analysts have revised estimates for TEVA’s Copaxone down by about $200 million in 2017 and $600 million in 2018 and 2019.