The Visible Alpha AI Monitor aggregates publicly traded U.S. technology companies, providing a comprehensive measure of the current state and projected growth of the core AI industry. This encompasses the AI-exposed revenues for companies that are building AI infrastructure and capabilities for both enterprises and consumers.

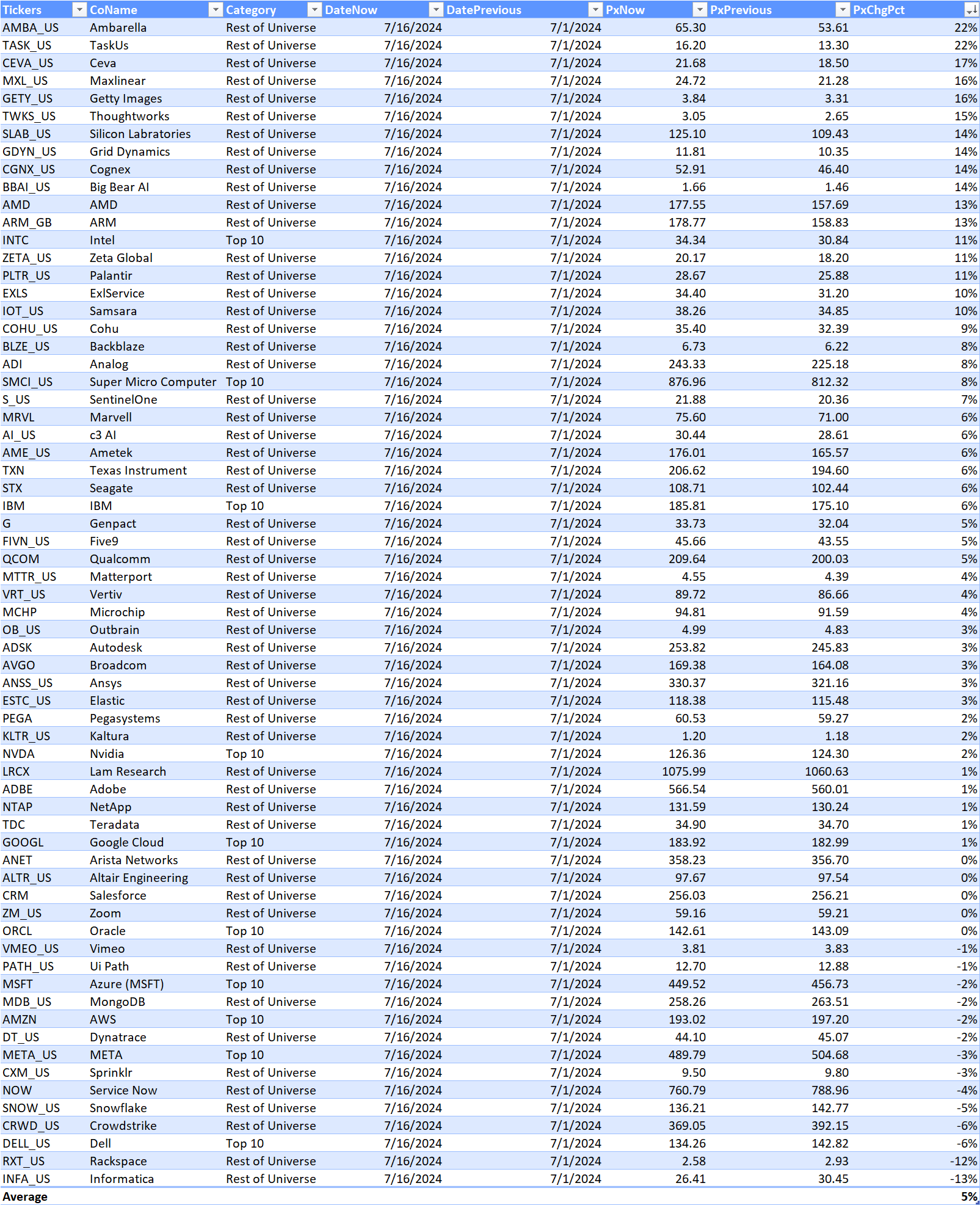

Since the beginning of July 2024, the smaller companies in the AI Monitor started to see strong stock price performance, while many of the mega-caps have seen underperformance. This recent performance dichotomy has raised questions about a possible rotation out of mega-cap technology stocks and into both other sectors and smaller-cap technology stocks. Sentiment around smaller companies may be shifting as investors look for firms with strong growth and cheaper valuations against the backdrop of the Fed potentially starting to cut rates. However, the mega-caps still dominate the upward revisions to AI-exposed revenues. Is this the start of a broader rotation? What will be the catalyst for upward revisions across a broader array of companies in the AI Monitor?

Investors may use the Visible Alpha AI Monitor to generate new ideas to capture growth emanating from the core AI industry, as well as to evaluate the potential AI exposure of technology stocks in their existing portfolios. We have identified specific line items that capture potential growth of AI-related revenues that are available in the Visible Alpha Insights platform (see the goals, objectives, and methodology of the AI Monitor towards the bottom of this page).

Key Takeaways

|

The Visible Alpha AI Monitor: Generative AI Adoption

The generative AI (GAI) trend gained momentum in 2023 as Cloud Service Providers invested heavily. In 2024, the GAI theme is continuing to evolve and gain momentum. This year looks poised to be the year of GAI adoption in enterprises. Visible Alpha is observing GAI make a greater push into organizations and attempt to drive efficiency and growth, while enhancing the client experience. The verdict is still out on whether or not GAI will yield real value for businesses and support stronger fundamentals and earnings growth. However, the trend toward GAI adoption is undeniable.

AI growth and performance overview

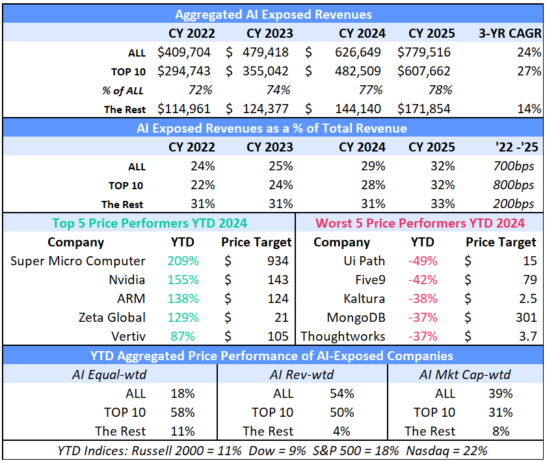

Source: Visible Alpha consensus (July 17, 2024). Stock price data courtesy of FactSet. Current stock prices are as of the market close on July 16, 2024. TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Super Micro Computer, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI.

AI Monitor Post-Q2

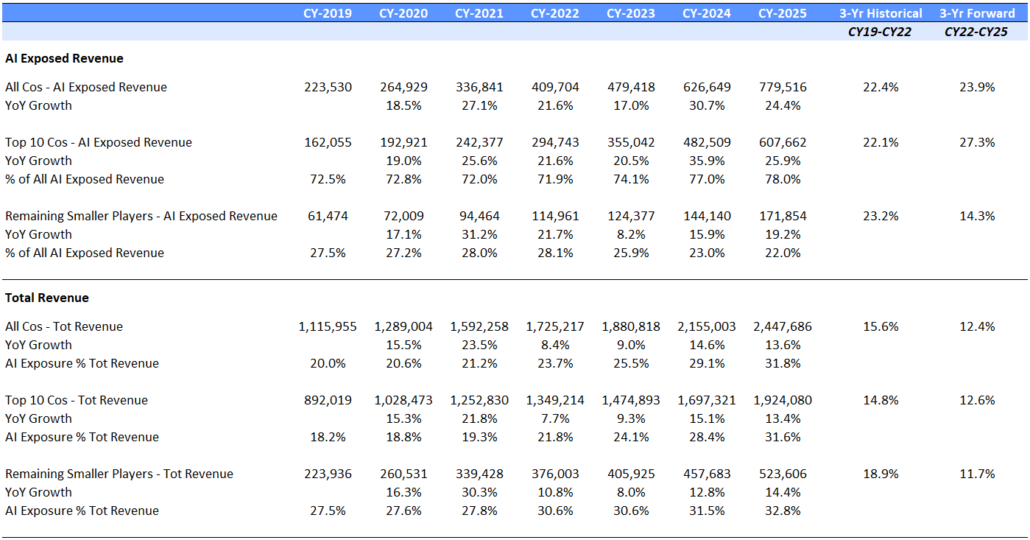

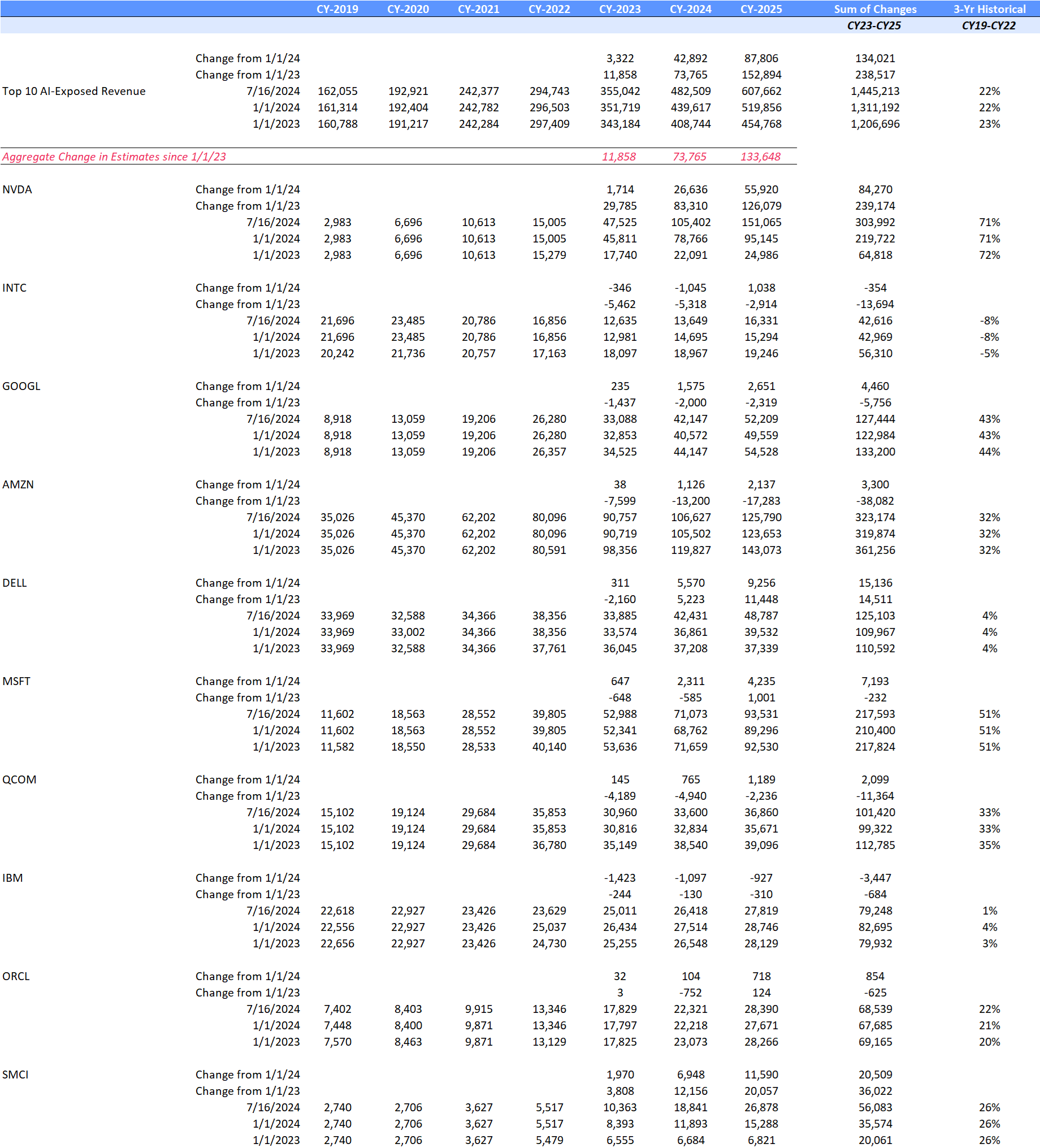

In 2023, eight out of the 10 largest AI-exposed revenue generators drove strong stock price outperformance, while more than 50% of the smaller-cap AI stocks underperformed. Post-Q1, AI-exposed revenues were expected to grow by nearly $330 billion, from $410 billion at the end of 2022 to $740 billion at the end of 2025, driven overwhelmingly by the Top 10 largest in the AI Monitor.

Post-Q2, AI-exposed revenues are now expected to be over $370 billion, from $410 billion at the end of 2022 to $780 billion at the end of 2025, continuing to be driven overwhelmingly by the Top 10 largest. Sequentially, AI-exposed revenue expectations increased a further $40 billion quarter-on-quarter, demonstrating the optimism the market is pricing into the future of AI.

AI-exposed revenue aggregations

Source: Visible Alpha consensus (July 17, 2024). Stock price data courtesy of FactSet. Current stock prices are as of the market close on July 16, 2024. TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Super Micro Computer, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI.

Nvidia Continued to Dominate in H1 2024

The H1 2024 revenue growth of the Top 10 is driven by the $360 billion, up a further $50 billion in Q2, of upward revisions analysts have made to Nvidia’s AI-exposed data center and Super Micro Computer’s AI-exposed server and storage systems revenues, which contributed significantly to both the AI-exposed revenue concentration and stock performance of the AI Monitor. In the H1 2024, Nvidia, Super Micro Computer, and Dell have been the drivers of higher expectations for revenue growth in the AI Monitor.

In the H1 2024, Nvidia revenue growth estimates jumped by a further $84 billion from the beginning of the year, making up 63% of the upward revisions of the Top 10. Super Micro Computer’s AI-exposed revenue in H1 increased an additional $20 billion. How may these dynamics change through the rest of 2024? Will Nvidia continue to dominate the upward revisions? Will new players emerge in the Top 10?

AI-exposed revenue revisions summary

Source: Visible Alpha consensus (July 17, 2024). TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Super Micro Computer, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI.

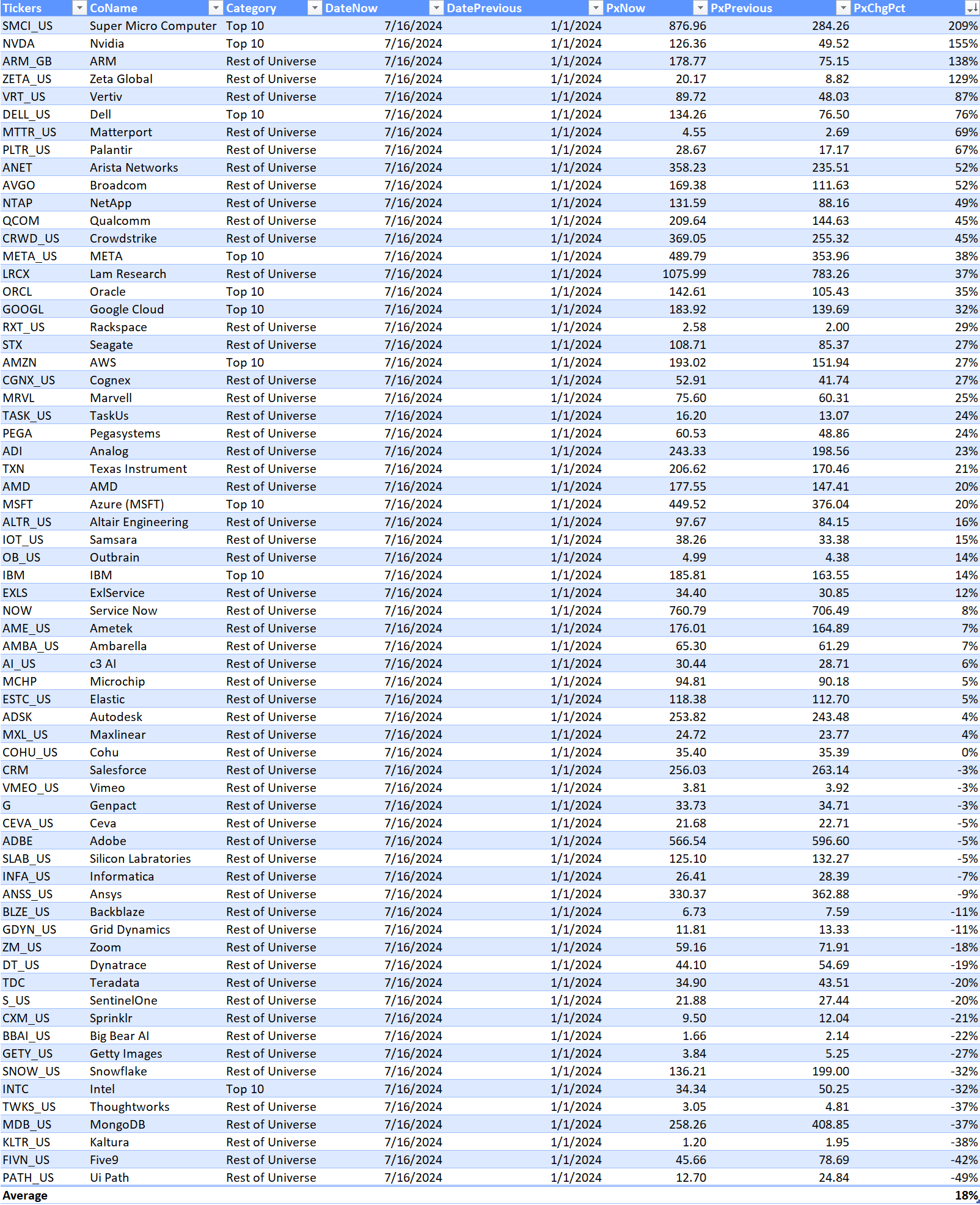

Revenue Revisions & Stock Performance Summary

Currently, the Visible Alpha AI Monitor universe of 66 publicly traded U.S. companies is 77% weighted to the 10 largest companies, with the remaining 23% dispersed among 56 companies.

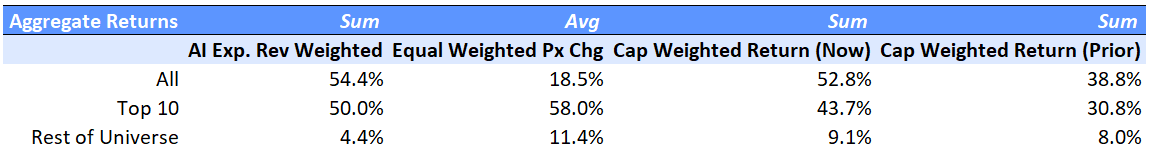

On a market-cap-weighted and AI-exposed revenue-weighted basis, the Visible Alpha AI Monitor continued to be driven by substantial stock price outperformance (vs. the S&P 500 index) of the largest companies this year. In addition, the smaller companies continued to underperform (vs. the S&P 500 index), especially on an equal-weighted basis year-to-date.

On an equal-weighted basis, the AI Monitor would have generated a significantly lower return when compared to the market-cap and AI-exposed revenue-weighted aggregations this year, driven by the drag of a lower return generated by the smallest names.

AI Monitor aggregated stock return breakdowns

Post-Q2 YTD (as of 7/17/2024)

Post-Q1 YTD (as of 4/15/2024)

Source: Visible Alpha consensus (July 17, 2024). Stock price data courtesy of FactSet. Current stock prices are as of the market close on July 16, 2024. TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Adobe, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI.

Top 10

Based on an analysis of the 10 largest players, 2025 revenue forecasts for AI-exposed revenue segments doubled from $44 billion in Q1 to now $88 billion at the end of Q2 2024. However, $55 billion of the 2025 increase is from Nvidia, $11.6 billion from Super Micro Computer, and a further $9.3 billion increase from Dell, all significantly higher from Q1. The declines in revenue estimates that the rest of the Top 10 has seen since January 2023 have largely stopped since the beginning of 2024. The downward revisions were driven by lower expectations for AWS, Google Cloud, and Qualcomm QCT. The estimates for these companies have now started to tick up, suggesting that the cuts to 2025 revenue expectations may have been too deep.

The Rest (smaller contributors)

The remaining list of 56 companies may serve as a good place for investors to discover new ideas by surfacing expanding new players. While smaller companies in aggregate have not performed as well as the Top 10, there have been some clear outperformers relative to the composite. From July 1, 2024, the stock price performance of smaller contributors saw a clear uptick with 17 companies up 10% or more. Is this trend sustainable for the H2?

Among the smaller firms, revenue growth expectations are very mixed. Strong double-digit revenue growth is expected at some firms, while others are seeing estimates decline. These dynamics may help investors identify emerging trends in the space.

In H1 2024, we have already seen that to be true with Zeta Global delivering strong outperformance (vs. the Russell 2000), which may help position this firm longer term as an up-and-comer in the space. Vertiv and Palantir are mid-caps with strong AI-exposed revenues and stock prices showing positive outperformance.

In contrast to these outperformers, more than half of the smaller companies in the AI Monitor substantially underperformed the Russell 2000 return of 11% YTD. This weakness may imply that these companies are under pressure and may be seeing compression in their valuations. This weakness may make some of these companies acquisition candidates by larger firms. Five9 and UiPath fell by more than 40% YTD in 2024.

AI Monitor detailed breakdown (YTD)

Source: Visible Alpha consensus (July 17, 2024). Stock price data courtesy of FactSet. Current stock prices are as of the market close on July 16, 2024. TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Adobe, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI. Based on higher analyst counts, we are using the non-GAAP revenue number for Oracle and Ansys.

AI Monitor detailed breakdown (MTD)

Source: Visible Alpha consensus (July 17, 2024). Stock price data courtesy of FactSet. Current stock prices are as of the market close on July 16, 2024. TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Adobe, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI. Based on higher analyst counts, we are using the non-GAAP revenue number for Oracle and Ansys.

Visible Alpha 2024 Watchlist: Companies to Watch in 2024

In 2024, we are watching the pace at which companies will be moving more of their data to the cloud and enabling innovation with AI. The AI Monitor aims to help users observe the pace of data migration to the cloud by highlighting companies and line items. In particular, we have been watching several companies since the beginning of the year, and have recently added Apple after the Apple Intelligence announcement at WWDC on June 10, 2024. Apple will get added to the AI Monitor next quarter.

We are closely tracking the performance of Oracle’s Cloud Services and Microsoft Azure’s Infrastructure and Platform as a Service business. Together, this partnership may bring more organizations to the cloud and position enterprises to integrate AI into their workflows. As enterprises shift to the cloud and look for end-to-end solutions to support working with generative AI, Dell looks well-positioned.

As more data goes into the cloud, we are also monitoring Snowflake’s growth. This stock is down over 30% since it delivered lackluster guidance and changed CEOs. Snowflake enables organizations to de-silo their data and compare/share it with other data sources across the enterprise, serving as a good starting point for leveraging AI across their enterprise. At a recent tech conference, Snowflake management said “the most common type of data going into Snowflake is CRM data.”

And as more customer relationship data moves to the cloud and into Snowflake for sharing between marketing, sales, and other teams, Zeta Global may benefit from the need to unify and understand customer interactions.

As companies large and small establish their data, cloud, and AI strategies, what new innovations and companies will drive AI-exposed revenues in 2024 and beyond?

- Apple (NASDAQ: AAPL) – (newly added for Q3)

- Dell (NYSE: DELL)

- Oracle (NYSE: ORCL)

- Microsoft (NASDAQ: MSFT)

- Snowflake (NYSE: SNOW)

- Zeta Global (NYSE: ZETA)

Apple

Apple entered the Generative AI (GAI) movement and announced its version of a new personal intelligence system, Apple Intelligence, at WWDC on June 10, 2024. In the keynote, Craig Federighi, SVP of Software Engineering, showcased the updates and highlighted the new partnership with OpenAI. Apple Intelligence is only available on iPhone15 Pro/Pro Max, select iPads, and Macs.

The success of Apple Intelligence has the potential to drive a hardware replacement cycle, which could be a catalyst for the broader adoption of GAI. Given the enormous installed base of iPhones, Pre-15 Pro users may be motivated to upgrade their earlier version phones to leverage the new Apple Intelligence capabilities. Based on Visible Alpha, analysts expect iPhone 15 unit sales to range from 126 million to 158 million with consensus at 144 million this fiscal year. How will Apple Intelligence help to drive GAI usage by consumers and enterprises?

Dell

Dell has been seeing strong demand for its AI servers. However, the stock reacted negatively to the commentary around the AI server backlog last quarter. An over-optimistic backlog expectation seemed to have been impacting Dell’s growth expectations. While the company delivered a respectable AI server backlog of $3.8 billion in Q1, the disappointment in the stock came from the lack of ISG operating profit growth generated by an additional $1.7 billion in AI server shipments year over year in Q1.

Recently, Dell also highlighted new, embedded-AI capabilities for laptops. There is some debate in the market about the enterprise adoption of AI and, if it does happen, what the pace of it will be. Some analysts are forecasting it to be broad and fast, while others question if the adoption will even happen. Will Dell’s next-generation, AI-enabled laptops help broaden adoption within enterprises?

Oracle and Microsoft: How will this partnership help to drive cloud migration and AI in 2024 and 2025?

Access to data will be a critical dimension to anything a customer wants to do with AI. Back in the fall of 2023, Oracle CTO Larry Ellison and Microsoft CEO Satya Nadella explained that their partnership will enable customers to co-locate the Oracle hardware and software within the Azure Data Center, which will be key for fine-tuning, pre-training, or meta-prompting a model for AI.

With a large portion of data still located on-premise, they believe this collaboration should encourage companies to move to the cloud by lowering latency and increasing security. Once the data is in the cloud, customers can begin to innovate with it. From the Azure portal, users can provision an Oracle database, then marry that to Open AI and, ultimately, to the library of Microsoft technology.

Both Microsoft and Oracle estimates have ticked up since January. Currently, analysts are expecting Microsoft’s June 2024 Azure revenue to be $74 billion and to more than double to $155 billion by June 2027, driven by the growth of Infrastructure and Platform as a Service businesses within Azure. While Microsoft has been a driver of the move to GAI, it has not seen the significant upward revisions observed at Nvidia. In addition, the company has tripled capex spending from FY 2020 to close to $45 billion. Similarly, Oracle’s May 2024 revenue from Cloud Services is projected to double from $20 billion to over $40 billion by May 2027. Given the partnership, when will Microsoft’s Azure and Oracle’s Cloud Services revenue lines begin to meaningfully outpace expectations?

Snowflake

Speaking at a tech conference in December, Snowflake CFO Mike Scarpelli echoed points around the cloud, data, and AI that were similar to Oracle and Microsoft. He explained that to reap the benefits of generative AI, companies are going to use it in the cloud, instead of on-prem. Therefore, organizations will need to ensure their data is clean and in the cloud for their large language models to be useful.

As companies look to integrate AI into their organizations, the market for the Snowflake product looks poised to reaccelerate over the next year. However, the stock has declined 30% since the disappointing guidance in March and the surprising CEO change. CEO Sridhar Ramaswamy brings the engineering lens to the role. The Q1 earnings call did little to reset expectations for Ramaswamy and the stock. Have expectations been corrected enough? Could Q2 be a positive catalyst for the stock or could there be another leg down?

According to Visible Alpha consensus, AI-exposed revenues are estimated now to be $4.1 billion in CY 2025, down from last year’s expectation of $4.5 billion levels. The FY 2026 expected gross margin declined from an initial expectation of 74.6% to now 72.9%, driven by the slower expected top-line growth. There is currently debate about the earnings outlook for the company. The Q2 performance will likely be important for new CEO Sridhar Ramaswamy’s first year in the job.

According to Scarpelli, the most common type of data going into Snowflake is customer relationship management data. Therefore, we wanted to highlight a smaller-cap company that is bringing AI innovations to their client’s marketing teams: Zeta Global.

Zeta Global

With a market cap of $4.4 billion, Zeta Global is a smaller-cap company that looks well-positioned to benefit from its exposure to AI. Through the Zeta Marketing Platform (ZMP), COO Steve Gerber’s vision is to leverage their proprietary AI and data tools to unify identity, intelligence, and omnichannel activation into a single platform. Having clean data in the cloud for data sharing within organizations may become an increasingly important driver as customers look to centralize data for AI applications. Zeta Global’s partnership with data-sharing platform Snowflake may play a critical role in supporting the company’s growth.

According to Visible Alpha consensus, Zeta Global’s AI-exposed revenues are estimated to surpass $1 billion by year-end 2025, from $709 million in CY 2023, as organizations adopt more advanced marketing technology.

Regulatory Backdrop

The regulatory backdrop can have an impact on the potential adoption and growth of AI. Increased regulatory scrutiny is one potential obstacle to scaling GAI applications in organizations. In addition, there may be more regulatory hurdles around acquisitions that could bring about consolidation in the space. In the fall of 2023, President Biden issued an Executive Order to “ensure that America leads the way in seizing the promise and managing the risks of artificial intelligence (AI).” The Order contained initiatives to strengthen AI safety and security, privacy protections, innovation, and competition, along with supporting consumers, workers, and equity. In January 2024, the agencies completed more than two dozen activities around AI talent, risks, and implications for the U.S. In addition, the White House has created a blueprint for an AI Bill of Rights (ai.gov).

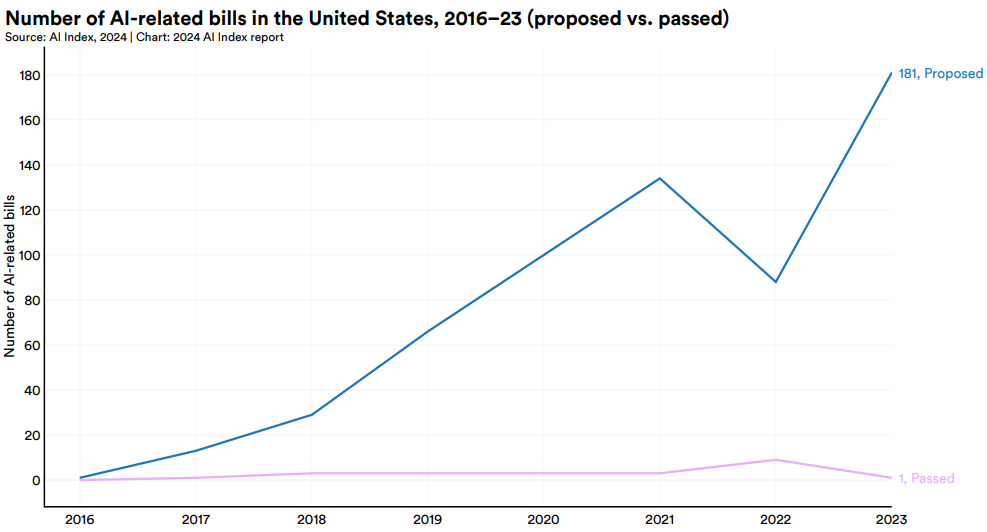

As the government continues to focus on AI and its implications for the U.S., Stanford University released an update in April 2024 to its AI Index. The report captures the number of new AI-related regulations by the agency in 2023 and shows the surge in proposed bills. The trajectory of the proposed regulations suggests we may see more regulations in 2024 and 2025. In addition, a wider range of agencies may be looking to add specific regulations going forward.

Proposed AI-related regulations by agency in the U.S.

The year 2023 witnessed a remarkable increase in AI-related legislations at the federal level, with 181 bills proposed, more than double the 88 proposed in 2022.

Source: Stanford University AI Index 2024 (https://aiindex.stanford.edu/report/)

U.S. AI-related regulations by agency

The number of U.S. regulatory agencies issuing AI regulations increased to 21 in 2023 from 17 in 2022, indicating a growing concern over AI regulation among a broader array of American regulatory bodies. Some of the new regulatory agencies that enacted AI-related regulations for the first time in 2023 include the Department of Transportation, the Department of Energy, and the Occupational Safety and Health Administration.

Source: Stanford University AI Index 2024 (https://aiindex.stanford.edu/report/)

Final Thoughts

In H1 2024, Nvidia continued to lead in the space, comprising over 60% of the total upward revisions to CY 2025. Super Micro Computer was the best performer so far this year, up over 200%. Nvidia, Vertiv, and ARM were all up over 100% in H1 2024 and have emerged as this year’s big performers so far as the industry looks for scalable infrastructure solutions. The focus seems to be shifting from cloud service providers (CSPs) to scalable enterprise applications and broadening adoption for GAI. For many firms, however, it is not clear how they will participate in bringing GAI to enterprises and grow the impact of AI-exposure in their business models. Going forward, it will be interesting to see how Apple Intelligence influences the landscape.

In 2024, we are watching the pace at which companies will be moving more of their data to the cloud and enabling innovation with AI in enterprises. We are interested to see how the partnership between Oracle and Microsoft could help drive more organizations to the cloud and set up their enterprises for integrating AI into their workflows. Through its data sharing and analytics capabilities, Snowflake is likely to play a role in the rollout of the AI ecosystem. Snowflake’s clients seem to be increasingly aiming to de-silo their data and organizations to understand how best to serve their customer base. As more customer relationship data moves to the cloud and into Snowflake for sharing and AI, it will be interesting to see if Zeta Global will continue to benefit from these dynamics happening in different parts of the tech stack.

Will the recent small-cap winners continue to drive the Visible Alpha AI Monitor for the rest of 2024?

AI Monitor Goals and ObjectivesThe objective of the Visible Alpha AI Monitor is to show the investment community which companies are likely to drive AI going forward. As the world embraces AI and its applications to enterprise workflows and our daily lives, big questions exist about how AI’s impact on company business models will unfold over the next 3-5 years. AI can potentially free people from tedious gruntwork to enable more focus on critical workflows that require human creativity and analysis. A primary goal of the Visible Alpha AI Monitor is to show which U.S. companies and specific line items we are keeping an eye on as the embryonic AI theme emerges across company fundamentals and begins to scale broadly across the economy. We are monitoring how AI may be reflected in the numbers and which companies may be benefitting more or less. This universe attempts to be comprehensive and to show investors the dynamics of both the large and smaller U.S. players. Additionally, it aims to help investors identify new names that may be smaller and less covered, but potentially growing and emerging more quickly. AI Monitor MethodologyUsing Visible Alpha’s comprehensive database of detailed estimates pulled directly from sell-side analysts’ spreadsheet models, we have assembled an aggregation with a universe of 69 publicly traded companies that are contributing to the infrastructure and broad scaling of AI capabilities. This monitor aims to provide a current and future snapshot as to where AI-related revenues are and are not growing across each of these 69 companies, particularly the 10 largest. We have aggregated the revenues of specific business segments at firms that are driving the wider AI trend. For larger firms, we have attempted to pinpoint where in their revenue model AI is driving growth. For some smaller firms, we are simply incorporating 100% of revenues. The AI-exposed revenue lines we identify are intended to be used as a proxy for monitoring the growth of each company’s AI business. Given both the lack of discrete company disclosures and how intertwined AI and conventional technologies and services can be, these lines should not be taken as exact quantifications of AI revenues, but are, we believe, the best systematic approximation available. The AI Monitor provides three measures of stock performance for its universe. These metrics are meant to show the returns of various weighting schemes. The returns are calculated on both an equal-weighted and market-cap-weighted basis. The universe performance of the AI Monitor is also weighted based on AI-exposed revenues and calculated in aggregate. From 2024, the return calculations were standardized, and market-cap-weighted now reflects year-over-year changes. For Visible Alpha subscribers, details of these companies can all be found within the Visible Alpha Insights platform. Each company included in the monitor has coverage by at least four sell-side analysts. In addition, given the quickly evolving state of the AI space, these line items are subject to change and may shift significantly over time. We plan to refresh the data on an ongoing basis and provide regular updates. |