OpenAI and Microsoft

In an unusual series of announcements, OpenAI CEO Sam Altman was ousted, hired by Microsoft and then brought back to OpenAI under a different Board within a week. According to OpenAI’s LinkedIn post on November 22, “We have reached an agreement in principle for Sam Altman to return to OpenAI as CEO with a new initial board of Bret Taylor (Chair), Larry Summers, and Adam D’Angelo.” It should be noted that LinkedIn is owned by Microsoft and that the OpenAI blog has not been updated since November 17, 2023. This situation highlighted the complexities of a combined for-profit and non-profit entity, and how governing the future of Artificial General Intelligence, AGI, would be no easy task.

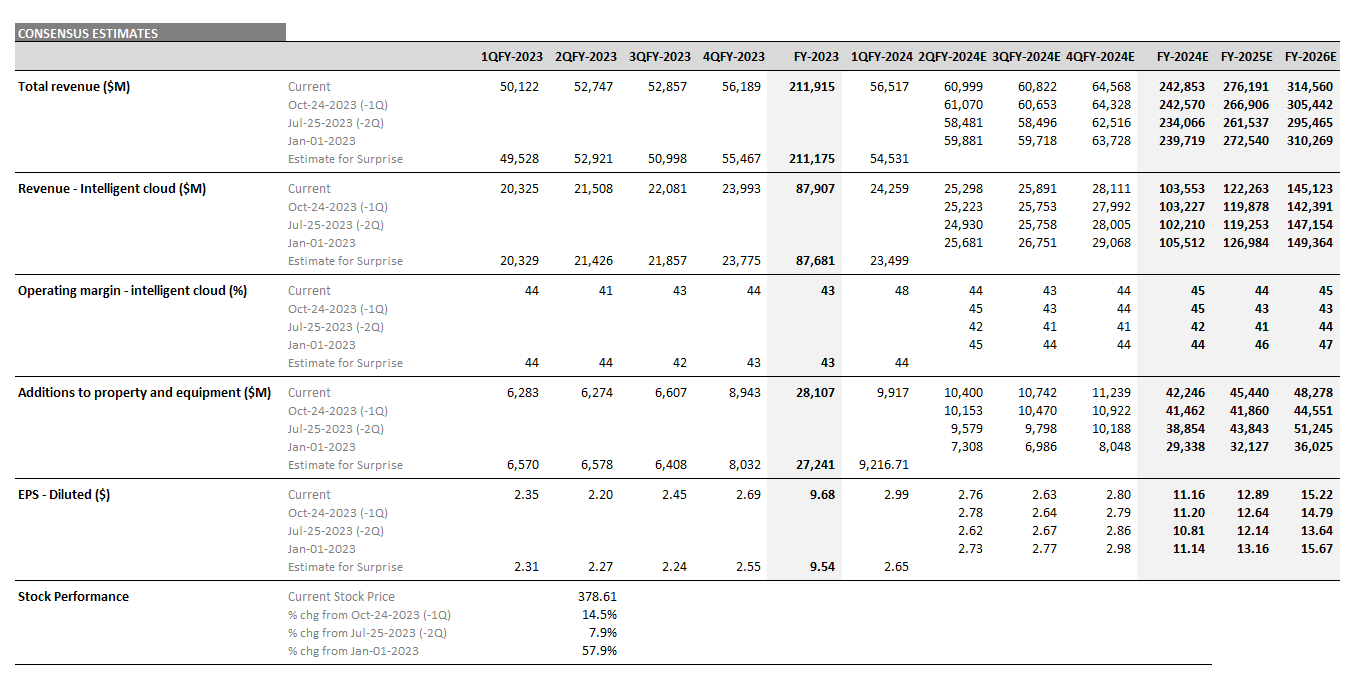

Overall, Microsoft’s (MSFT) stock continued to grind higher throughout the turmoil at OpenAI. Microsoft shares traded down slightly on November 21-22, 2023, the peak of the OpenAI drama, but regained their resilience, closing at this year’s high today. Since the company’s earnings release on October 24, 2023, the stock increased 14%, driven by upward revisions to FY 2025 and FY 2026 estimates, especially in its Intelligent Cloud segment.

Figure 1: Key Consensus Trends for Microsoft

Source: Visible Alpha consensus (November 27, 2023). Stock price data courtesy of FactSet. Microsoft’s current stock price is as of the market close on November 24, 2023.

Thoughts on the new OpenAI Board

Based on my own Board experience, the board at OpenAI likely had a fiduciary duty to remain objective, make decisions to minimize risks and protect the organization. This desire to contain and remove the risks may have been what prompted the original OpenAI board to move quickly to remove Altman. In addition, the OpenAI board’s potential need to maintain confidentiality may have led it to operate in a relatively opaque way, which means we will likely never really know the facts behind this surprising story.

The decisions that unfolded after the ousting of Altman might have been driven by the potential of OpenAI and its valuation. After Altman’s firing, approximately 750 employees threatened to leave OpenAI. Given Microsoft’s substantial investment in the firm, it was no surprise that CEO Nadella, moved aggressively to try to bring on these key employees from OpenAI, likely for a much lower price tag than simply acquiring the organization for an estimated valuation of $80-90 billion. This move also would have given Microsoft full control over the OpenAI engineers, instead of OpenAI.

In a twist last week, the board at OpenAI was reshuffled and Altman brought back, which seemed to have quieted down the situation and moved it out of the public eye. In addition, bringing Altman back might be the least risky choice under the new OpenAI board, given his deep knowledge of AGI and the issues between OpenAI and Microsoft.

The current, new board is very different from the previous one. First, bringing on Larry Summers, former president of Harvard University and U.S. Treasury Secretary, to the new OpenAI board demonstrates a commitment to bringing a seasoned professional who should be able to triangulate the various issues of this emerging technology with business, government and higher education. Having heard Summers speak on numerous occasions, he is a straight-shooting economic pundit and strong voice that will hopefully be complemented by tech leaders, Bret Taylor, former CEO of Salesforce, and Adam D’Angelo, previous board member of OpenAI and co-founder and CEO of Quora. It will certainly be interesting to see how OpenAI, AGI and this new board evolve over the next year.