Apple (NASDAQ: AAPL) reported earnings for fiscal Q4 2023 after the market close on Thursday, November 2, 2023. After the earnings release and looking ahead to Q1 and FY 2024, what are the questions we are focusing on?

1. What happened with iPhone sales and what does the outlook look like?

Apple’s fiscal Q4 2023 total company revenues came in right in line with consensus at $89.5 billion. Drilling down into the revenues, Services outperformed and iPhone was in line, but Mac, Wearable, and iPad were disappointing.

The company highlighted again that the opportunity in India continues. However, it is unclear how big this market can be for Apple/iPhone. While India may not generate the same volume of revenues as China’s estimated $69 billion, it may still increase penetration and make a meaningful contribution to revenue over the next few years. This market may begin to break away from other emerging markets as penetration increases. The company noted strength overall in many emerging markets.

Coming into earnings, analysts were expecting the company to guide Q1 2024 to be up 5% for iPhone revenues. However, Apple guided below expectations to flat year-over-year when adjusted for FX (2pts) and an extra week (7pts).

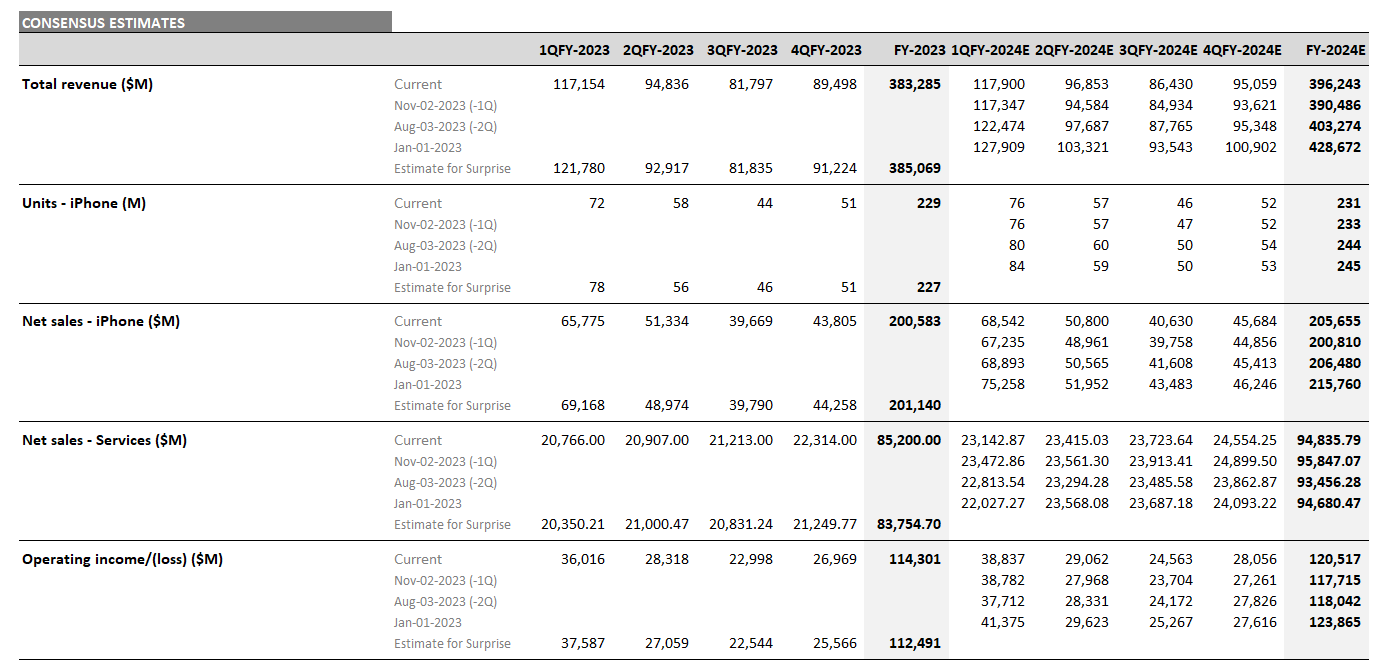

There has been increasing bearish sentiment on the iPhone outlook. The current iPhone estimates for FY 2024 revenues and units have come down since August, driven by projected lower growth assumptions in core markets and foreign exchange. However, as of November 3, the range of unit estimates still skewed to the high end, with unit expectations ranging from 72 million to 85 million for Q1 2024 and consensus settling at 76 million units.

Figure 1: Expectations for FY 2024

Source: Visible Alpha consensus (November 3, 2023)

New Question: How will the iPhone do this holiday season and how might that color the outlook for the rest of the year?

2. How did the Services segment perform and what is next for this segment?

Services outperformed expectations by nearly $1 billion, coming in at $22.3 billion, and given the much higher gross margin (71%), this segment was able to offset a meaningful decline in operating income.

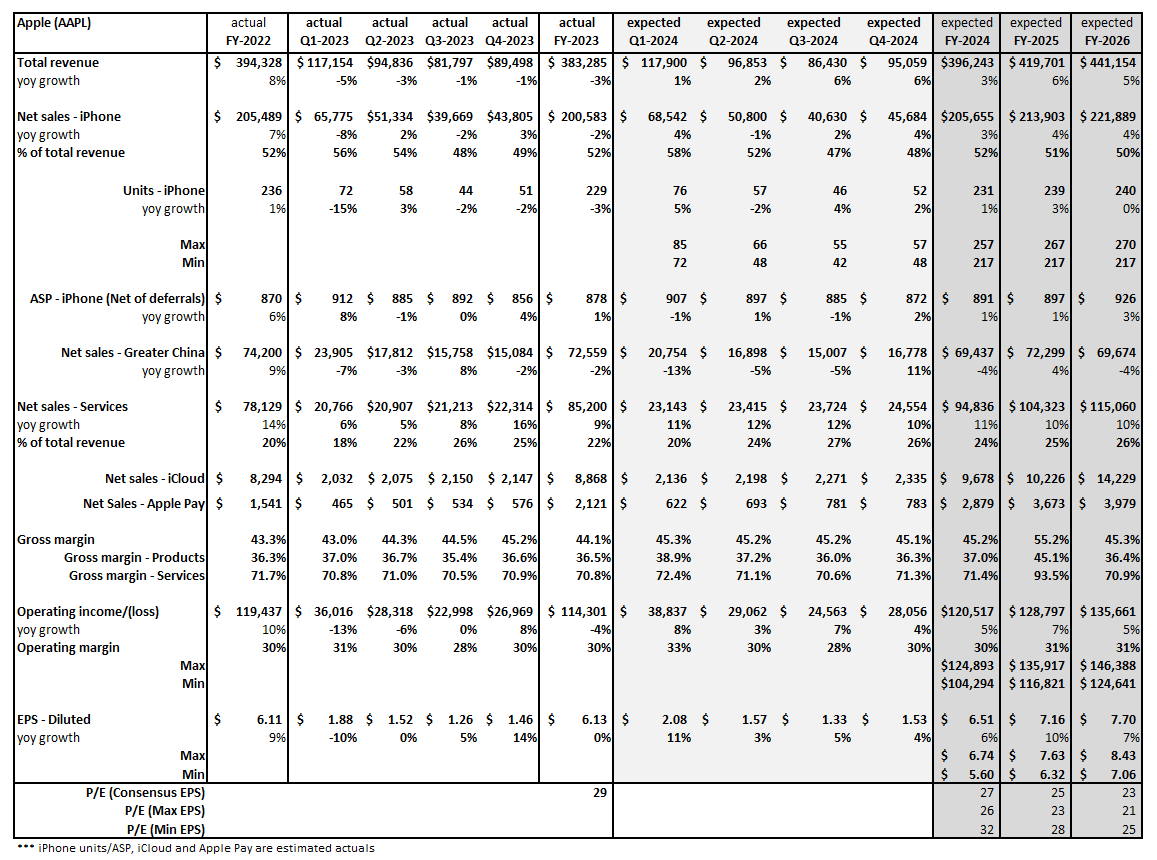

For Q1 2024, Services are expected to deliver $23.1 billion, up 11% year over year, driven by cloud, music, and ads. For FY 2024, analysts currently forecast Services revenue to jump 11% to $95 billion, and another $20 billion to $115 billion by the end of FY 2026.

Cloud: For FY 2024, Apple is projected to generate nearly $10 billion in cloud sales. Based on color from Q4 earnings, growth in cloud looks poised to continue.

Apple Pay: For FY 2024, analysts, on average, are projecting $3 billion in sales.

Margins: Services currently generate a 71% gross margin, nearly double the 36% for the Products segment, and could shift Apple toward higher profitability. The company’s total operating profit is expected to grow 5% year over year in FY 2024 to $120 billion, driven by an increase in mix toward Services.

Growth: Apple’s significant installed base of 2 billion devices, with nearly 1 billion estimated to be iPhone, may be a great platform for growing ads, cloud, payments, and other content revenues (like music, games and TV). It is worth noting that Apple has been relatively quiet about Generative AI and we wonder if an announcement may emerge in this segment in FY 2024.

New question: What could drive higher-than-expected Services revenue in Q1 and FY 2024?

3. What did Apple’s performance in China reveal?

In Q4, Greater China generated $15 billion in revenues, but this was $1.3 billion below projections. While CEO Tim Cook noted his optimism for the China market, questions linger about the company’s performance in this market. There is some debate about what the region will deliver for sell-through units in FY 2024 and beyond.

Competition is likely to weigh on Apple in the China market, as sales are expected to drop 13% year-over-year to $20.8 billion in Q1. For FY 2024, analysts project China to deliver $69.4 billion in revenues, down 4% from 2023 levels. For FY 2024, expectations have declined 10% from $76.6 billion back in the spring. The verdict is still out on how China will perform in FY 2024 and beyond. Currently, analysts expect China to hit $72 billion by the end of FY 2025, flat with FY 2023.

New question: Will China sales resume a growth trajectory?

Figure 2: Apple’s key financial items

Source: Visible Alpha consensus (November 3, 2023)