At last month’s Morgan Stanley Technology, Media and Telecom 2023 conference held on March 9, 2023, Meta Platforms’ (NASDAQ: META) CFO Susan Li and COO Javier Olivan gave a mid-quarter update on the company. Three key questions emerged from the conference.

Key Takeaways

|

1. How will META’s focus on efficiency impact Reality Labs?

- Lower OpEx outlook: In Q4, META lowered 2023 operating expense (OpEx) guidance to a range of $89-95B from $94-100B. The company called out at the March 9 conference that they want to deploy their more limited resources to the highest margin businesses and streamline management layers, which implied Reality Labs was destined for fewer resources and to have expenses reduced.

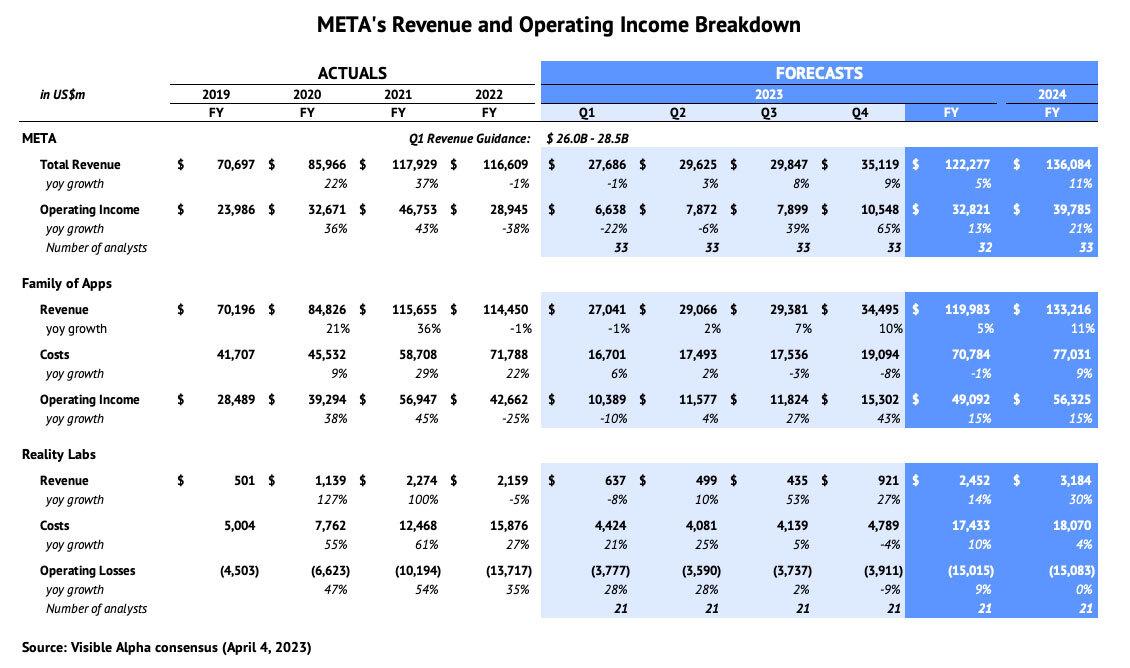

- Reality Labs cost containment: At the beginning of the year, consensus showed 2023 Reality Labs costs of $19.6B, a 24% increase from 2022. Expectations dropped $1B to a 17% forecasted increase (to $18.6B) after the company reported results, but dropped another $1B to only 10% growth after the company’s comments at the conference (to $17.4B). Indeed, the consensus understates the full drop in expectations, as some analysts have not yet revised their numbers over the last few weeks. Of the 15 analysts that have made new forecasts since the March 9 conference, the average Reality Labs cost estimate for 2023 is only $16.6B, a further $1B lower than current consensus, and representing only 4% year-over-year growth.

- Income expectations improving: These lower cost expectations are projected to flow directly through to META’s bottom line as revenue forecasts for the division have remained largely unchanged this year – currently 14% growth year over year for 2023. The $1B reduction in the consensus forecast for Reality Labs’ losses ($2B reduction for the 15 most up-to-date analysts) helps boost expectations for the company’s income from operations from $31.6B to $32.8B for the year ($33.7B for post-conference forecasts), with all other revisions to revenues and costs effectively netting themselves out.

2. How will ad sentiment shake out for the EU, APAC, and the U.S.?

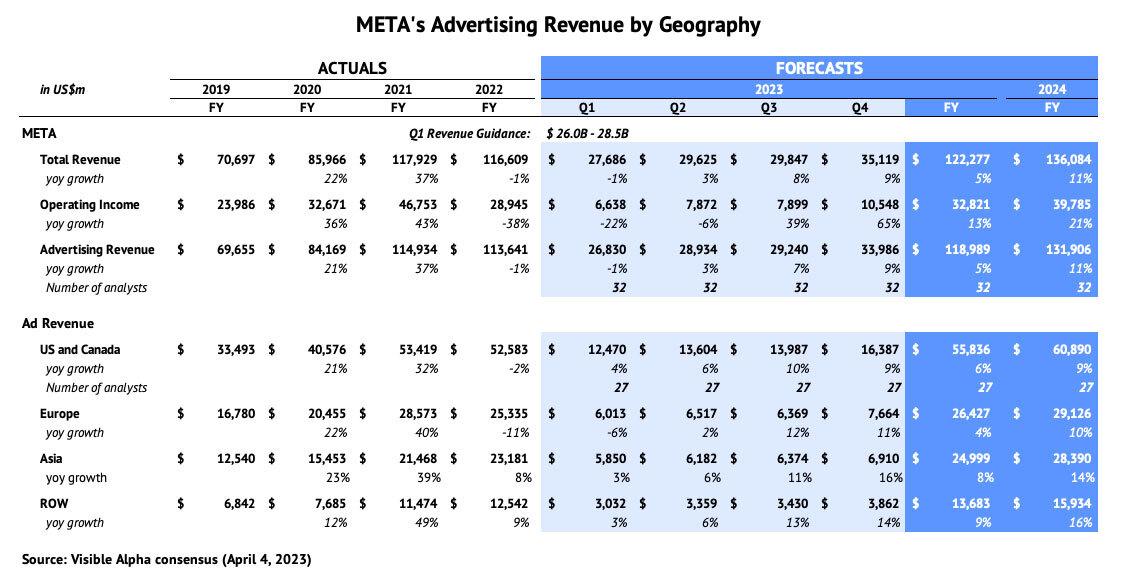

- Ad revenue in Q1 up in U.S./Asia, down in EU: Based on Visible Alpha consensus, the U.S. and Asia are expected to continue to show growth in Q1 (4% and 3%, respectively), while Europe is forecast to decline (by -6%). META called out at the conference that ad sentiment from the EU has been less positive, APAC more positive, and the U.S. mixed.

- Ad revenue growth for 2023 is still positive: In 2023, META’s ad revenues are projected to show a 5% increase against 2022’s -1%. Consensus is maintaining positive ad revenue growth for the U.S., Asia, and Europe for the remainder of 2023 and for 2024.

- Outlook: While META expects flattish to slightly negative growth in Q1 total revenues of $26.0-28.5B and consensus expects ~$28.0B, it is worth continuing to watch the direction of revisions here, as 2023 total revenues are expected to grow 5% and a further 11% in 2024, driven by U.S. ad revenues. It is possible that continued deterioration in ad revenue expectations could put pressure on META to further accelerate cost-cutting measures to maintain stock price performance.

3. Where will CapEx as a percentage of sales bottom?

- CapEx outlook: In Q4, META reduced 2023 capital expenditure (CapEx) to flattish growth of $30-33B from a previously expected $34-37B, then representing a 9-18% year-over-year increase. At the conference, META management reiterated that CapEx as a percentage of revenue is expected to come down over time. Management explained that they are trying to optimize capacity and CapEx.

- CapEx expectations: Based on the range of analyst estimates, revenues are expected to remain relatively stable, but there is significant debate about the level of CapEx META will spend for 2023 and 2024. CapEx in 2022 was $31.2B and, in 2023, Visible Alpha consensus now expects it to remain flattish at $31.6B, down from an expected 12% increase in January of $35.0B. Currently, for 2023, CapEx estimates range from $29.4B to $34.2B with some analysts expecting a decline and others still estimating a positive 10% increase. For 2024, the divergence further expands to a range of $23.6B to $37.8B with CapEx spending ranging from 25% below to 20% above 2022 levels.

- CapEx as a percentage of sales: Based on Visible Alpha consensus forecasts, 2023 CapEx as a percentage of sales is expected to be 25.8%. With revenue forecasts remaining stable and a debate about CapEx levels, there is a significant range of estimates among analysts (27.5% to 24.0%) that make up the Visible Alpha consensus. For 2024, the ratio of consensus forecasts indicate a decline to 23.5%, but the range of individual analyst forecasts continues to widen (26.8% to 17.5%). It will be interesting to see how and at what level this ratio bottoms out.

References:

https://investor.fb.com/investor-events/event-details/2023/Morgan-Stanley-2023-Technology-Media–Telecom-Conference/default.aspx

https://investor.fb.com/investor-news/press-release-details/2023/Meta-Reports-Fourth-Quarter-and-Full-Year-2022-Results/default.aspx