Microsoft (NASDAQ: MSFT) reported earnings for fiscal Q1 2024 after the market close on Tuesday, October 24, 2023. What happened during the release and earnings call, and what are the questions to focus on?

1. What drove the margin surprises for the key segments in fiscal Q1 2024?

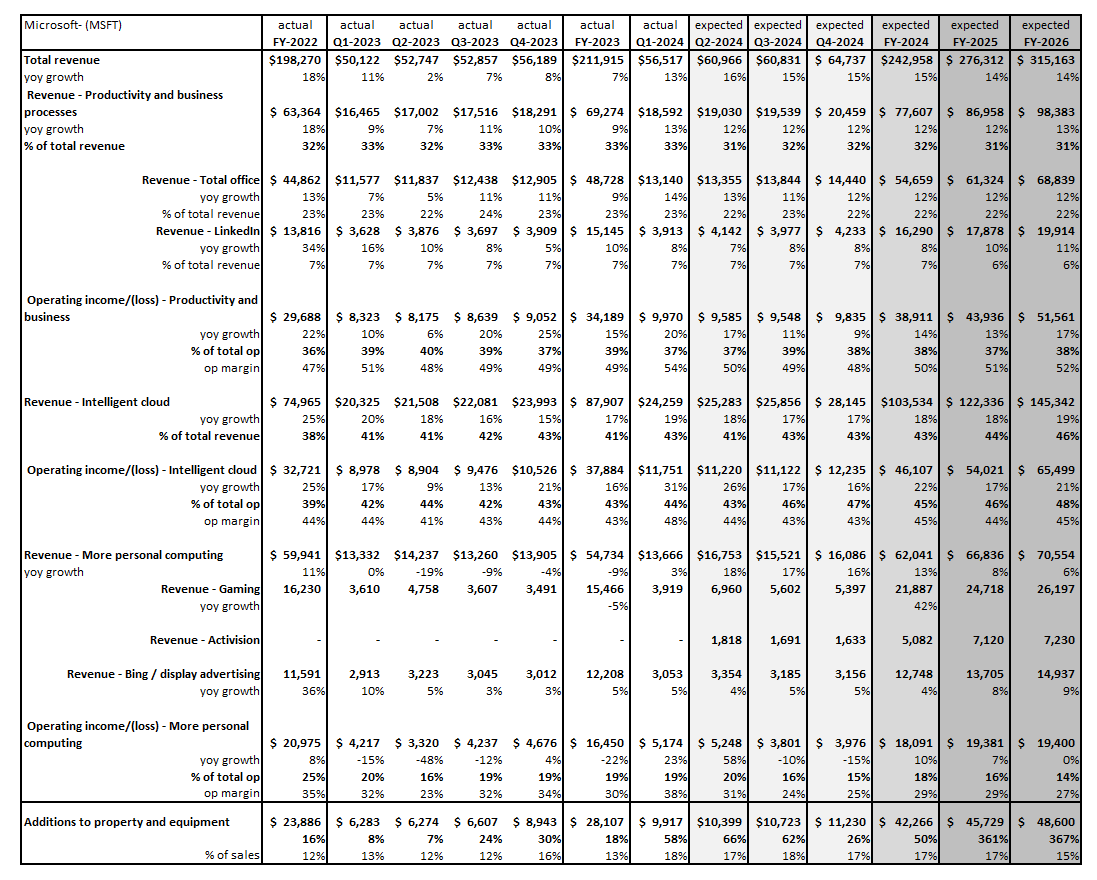

Both Productivity & Business Processes and Intelligent Cloud (including Azure) came in slightly ahead of Visible Alpha consensus estimates for sales and operating profit.

Productivity & Business Processes: In Q1, the Productivity & Business Processes segment delivered $18.6 billion in revenue and $10 billion in operating profit, resulting in a 54% operating profit margin driven by strength in Office Commercial, ahead of the 51% margin that was expected based on Visible Alpha consensus.

Microsoft guided to $18.8-19.1 billion in Productivity & Business Processes revenue for Q2, in line with analysts’ estimates of $19.0 billion. In FY 2024, the segment is expected by analysts to grow to $77.1 billion in revenue, which would be up 11% year over year.

Intelligent Cloud: Prior to the Q1 earnings release, analysts expected the Intelligent Cloud business (including Azure) to generate $23.5 billion in revenue for Q1 and $102 billion for FY 2024, and for operating margins to remain around 43% for FY 2024. In Q1, Intelligent Cloud delivered revenue of $24.3 billion and operating profit of $11.8 billion, ahead of the $10.3 billion expected, resulting in a 48% operating profit margin, well ahead of the consensus estimate of 43%.

According to management, Azure took share and got a boost from AI. Intelligent Cloud Q2 guidance of $25.1-25.4 billion with Azure up 26-27% (in constant currency) is in line with current expectations. However, it is worth noting that Microsoft was more conservative in its cloud outlook than Amazon by noting that H2 will be stable for Azure.

In FY 2024, Intelligent Cloud is expected to deliver $103.5 billion, up 18% year over year, and to grow to $122.3 billion by the end of FY 2025, according to Visible Alpha consensus. Some analysts are suggesting that the company can deliver better-than-expected growth in this business, with top-end estimates coming in closer to $105 billion in 2024 and $130 billion in 2025.

New Question: Will Office’s and Azure’s growth and margins continue in FY 2024?

2. CapEx continues to grow: Where is Microsoft investing?

Microsoft’s CapEx levels by FY 2025 are expected to be 10X from FY 2013, 5X from FY 2017, and 3X from FY 2019. CapEx for Q1 came in ahead of expectations and was up $1 billion quarter over quarter to $9.9 billion, and 58% year over year. CapEx as a percentage of revenue has ticked up to 18% from 16% in Q4 2023 and from 13% in FY 2023.

The company guided to further increased sequential CapEx spending for cloud infrastructure in FY 2024. Analysts expect total CapEx of $42.3 billion for FY 2024, up 50% year-over-year. This level of CapEx spend is likely to help drive cloud revenue and Microsoft’s position in AI.

According to CEO Satya Nadella, the easiest path for companies to adopt generative AI is via Copilot and the Cloud. Microsoft’s combination of its Copilots and its full stack approach should help customers optimize GPU utilization and may provide a compelling competitive advantage. Microsoft wants to help customers build generative AI capabilities and expects this benefit to be weighted toward H2 2024. According to CFO Amy Hood, AI-related gross margins should scale faster and the pace of adoption should be quicker than in previous cycles.

New Question: What will be the catalyst to drive revenue and profit from Microsoft’s CapEx investments?

3. What’s the expected impact of the Activision Blizzard deal?

Microsoft completed the acquisition of Activision Blizzard on October 13, 2023. Going forward, results will be in the Gaming segment under More Personal Computing. According to Microsoft, the company expects “revenue growth in the mid to high 40s. This includes roughly 35 points of net impact from the Activision acquisition.” Analysts are expecting a $1.8 billion revenue impact from Activision in Q2 2024 and $5 billion for FY 2024 from the deal. In addition, the company will move from third-party to first-party accounting.

New Question: How long will it take the Activision Blizzard acquisition to add $10 billion to Gaming revenues?

Figure 1: Microsoft’s key financial items

Source: Visible Alpha consensus (October 27, 2023)

Source: Visible Alpha consensus (October 27, 2023)