Microsoft (NASDAQ: MSFT) reported earnings for fiscal Q2 2024 on Tuesday, January 30, 2024. What happened during the release and earnings call, and what are the questions to focus on?

1. What drove the margin surprises for the key segments in fiscal Q2 2024 and will these trends drive upside to the 1-2% point margin improvement guided to for 2024?

Both Productivity & Business Processes and Intelligent Cloud (including Azure) came in ahead of Visible Alpha consensus estimates for sales and operating profit.

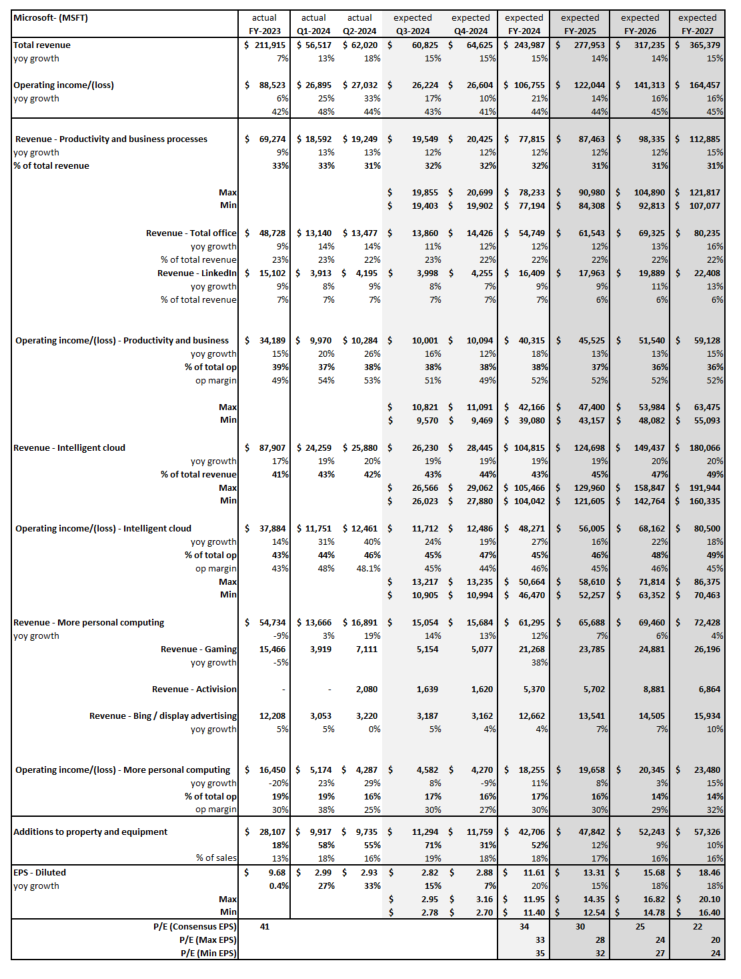

Productivity & Business Processes: In Q2, the Productivity & Business Processes segment delivered $19.3 billion in revenue and $10.3 billion in operating profit, resulting in a 53% operating profit margin, ahead of the 50% that was expected based on Visible Alpha consensus. This was driven by Office 365 ARPU expansion in the Office Commercial business.

Microsoft guided to $19.3-19.6 billion in Productivity & Business Processes revenue for Q3 2024, in line with analysts’ estimates of $19.5 billion, driven by Total Office to be up 15%, which was ahead of the 12% expected based on consensus. In FY 2024, the segment is expected by analysts to grow to $77.8 billion in revenue, which would be up 12% year over year. Operating profit for this segment is projected to be $40.3 billion, generating an estimated 52% operating profit margin for 2024. Analysts expects the margin to remain at 52% through 2026.

New Question: Will Office 365’s ARPU growth continue in FY 2024?

Intelligent Cloud: Prior to the Q2 earnings release, analysts expected the Intelligent Cloud business (including Azure) to generate $25.3 billion in revenue for Q2 and $103.7 billion for FY 2024, and for operating margins to remain around 44% for FY 2024. In Q2, Intelligent Cloud delivered revenue of $25.9 billion and operating profit of $12.5 billion, ahead of expectations. This resulted in a 48% operating profit margin, well ahead of the consensus estimate of 44%, which was similar to the strength observed last quarter and up significantly from 41.4% in Q2 2023.

According to management, Azure took share again and got a boost from its AI advantage. Azure IaaS/PaaS delivered $14.7 billion in revenue, up over $1 billion quarter over quarter and up 34% year over year, better than expectations. This was driven by Azure OpenAI and a strong 6 points of growth from AI services. According to CEO Satya Nadella and CFO Amy Hood, most of the Azure number was driven by inferencing and reflects the application of AI at scale. The training of large language models has not shown up in the numbers (yet).

In line with Visible Alpha consensus, Intelligent Cloud Q3 guidance of $26.0-26.3 billion will continue to be driven by Azure. In the earnings call, Nadella stated that Microsoft has “great momentum with Azure OpenAI.”

In FY 2024, analysts now expect Intelligent Cloud to deliver $104.8 billion in revenue, up 19% year over year, and to grow to $124.7 billion by the end of FY 2025, up from pre-Q levels. Operating profit for this segment is projected to be $48.3 billion, generating an estimated 46% operating profit margin for 2024. Analysts expect the margin to dip down to 45% through FY 2026.

New Question: Will Azure’s growth and margins continue to accelerate in FY 2024?

2. CapEx continues to grow: Where is Microsoft investing?

The CapEx ramp that started last year has enabled the company to scale with new data center footprints. According to Hood, these data center investments support Microsoft’s cloud demand, including scaling their AI infrastructure. It is worth noting that Alphabet has only started to ramp CapEx this quarter, suggesting Microsoft has a lead in the AI race.

Microsoft’s CapEx in FY 2024 is expected to be $42.7 billion, up 10X from FY 2013, 5X from FY 2017, and 3X from FY 2019. CapEx for Q2 came in at $9.7 billion, up 55% year over year. CapEx as a percentage of revenue has ticked back down to 16% from 18% in Q1 2024.

The company guided to further increased sequential CapEx spending for cloud and AI infrastructure in FY 2024. For Q3, CapEx is expected to surge 71% year over year to $11.3 billion, making up 19% of revenues. Analysts expect total CapEx of $42.7 billion for FY 2024, up 52% year over year. This level of CapEx spend is likely to continue to support driving cloud revenue and Microsoft’s position with respect to AI.

According to Nadella, the easiest path for companies to adopt generative AI is via Copilot and the Cloud. Microsoft’s combination of its Copilots and its full-stack approach should help customers optimize GPU utilization and may provide a compelling competitive advantage.

New Question: What will be the impact of a fully scaled AI infrastructure?

3. What will it take for Microsoft’s market cap to hit $5 trillion?

A $5 trillion market cap assumes the stock price will hit $700. Based on Visible Alpha FY 2027 consensus, the top-end EPS estimate of $20.10 and the current 35X multiple puts the stock price in that territory. This top-end estimate assumes Intelligent Cloud will hit $192 billion in revenues at over 20% CAGR at a 45% margin, driven by Azure IaaS/PaaS hitting $145 billion on Azure AI growth by FY 2027. For the Productivity and Business Processes segment, it assumes over 15% CAGR in revenues to generate $121.8 billion at a 52% margin by FY 2027, driven by Office. Given the potential strength of fundamentals in these businesses and the early innings of AI growth, could these segments exceed current analyst estimates, significantly leading to a lower multiple?

In addition, this growth assumes little contribution from gaming. Currently, Activision is projected to add only $7 billion in revenues by FY 2027, contributing to the More Personal Computing segment. However, this segment is expected to generate an operating profit of only $23.5 billion by FY 2027, from $18.2 billion in FY 2024. Could the integration of Activision lead to significant gains over the next few years that exceed current expectations?

New Question: How long will it take the Activision Blizzard acquisition to add $10 billion to Gaming revenues?