Key Takeaways

|

Vision Pro Demo Highlights

On Sunday, February 11, 2024, a friend and I participated in a Vision Pro demo at an Apple Store in NYC. The demo took 35 minutes and walked us through the functionality, navigation and uses.

After experiencing it myself and hearing the perspective of another user, the long-term investment opportunity is likely to come from the use of services within the Apple ecosystem. Accessing spatial videos taken on the iPhone that live in the Apple Cloud and immersive Apple Music, TV+, and Arcade with a Vision Pro may help to drive revenues of the higher margin services segment.

The placement of Alicia Keys’ performance in the Vision Pro demo and at the half-time show of the Super Bowl is probably not a coincidence. Giving users an immersive, front row seat to artists’ performances and sports events may enable Apple to grow its installed base and grab subscribers and revenues from YouTube TV and Netflix.

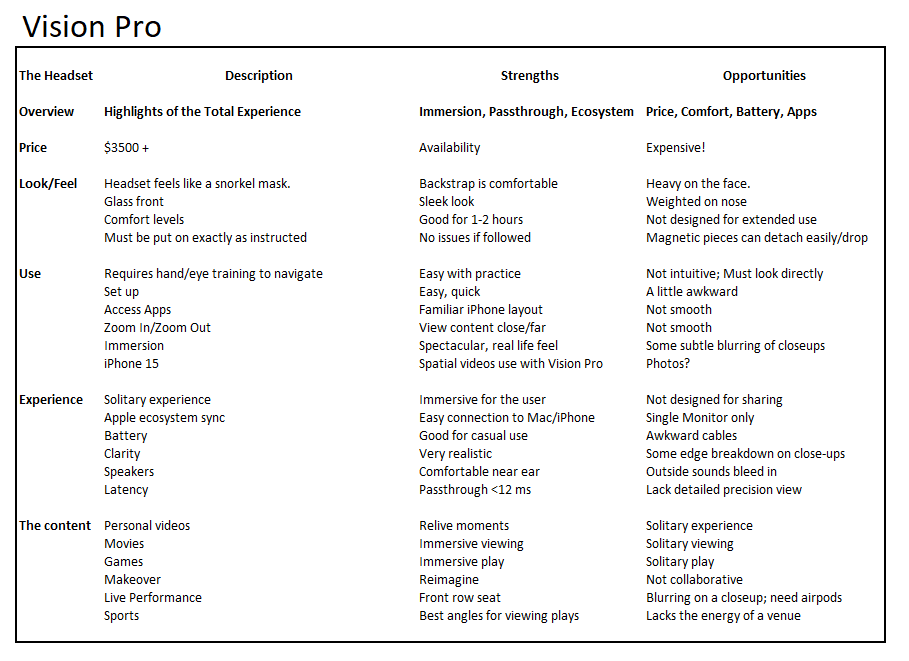

Figure 1: The Vision Pro

The Vision Pro headset feels like a heavy snorkel mask. It weighs heavily on the crown of the nose and face, making it uncomfortable to wear for extended periods.

Figure 2: Vision Pro demo

Syncing exact eye movement with the awkward pinching gesture is critical to navigating the Vision Pro experience.

Figure 3: Vision Pro highlights

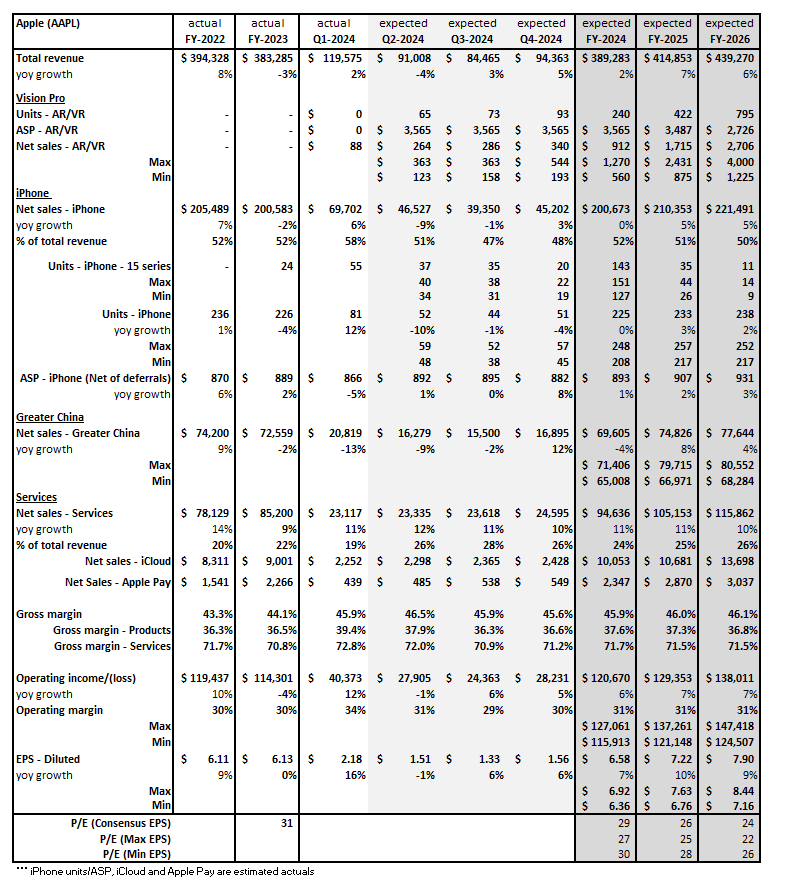

Q1 and the Outlook

1. What happened with iPhone sales and what does the outlook look like?

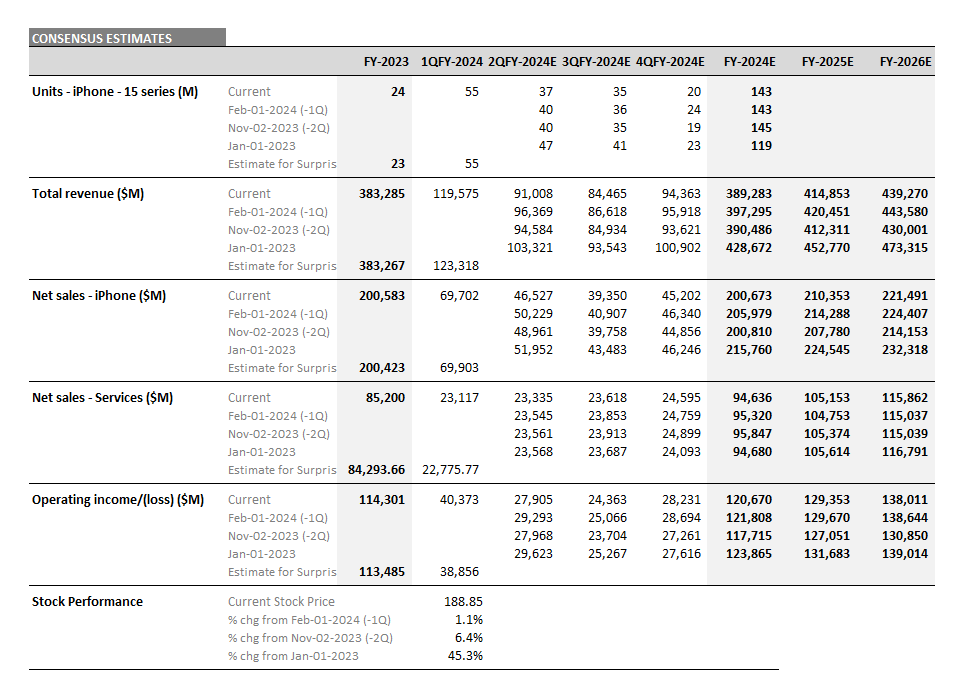

Apple’s (NASDAQ: AAPL) fiscal Q1 2024 total company revenues came in slightly above consensus expectations at $119.6 billion, driven by better than expected sales of iPhone units. However, other product categories and the Greater China region were disappointing.

Going into earnings, analysts were expecting the company to guide Q2 2024 to be $96.4 billion, up 2%. However, Apple guided below expectations to down ~5%, driven mostly by a weaker outlook for iPhone and China. According to Visible Alpha consensus, analysts are now expecting $91.1 billion in Q2 and $397.3 billion for 2024.

There has been increasingly bearish sentiment on Apple due to its exposure to China and the slowing iPhone upgrade cycle. The current iPhone estimates for FY 2024 revenues have come back down to the November 2023 net sales levels of $200 billion, driven by the iPhone 15. For Q2, analysts now expect iPhone 15 units to be around 37 million in Q2, down from 40 million before the Q1 earnings release, and 143 million for 2024. For total iPhone units in 2024, analysts range from 208 million to 248 million, due to varying views about end demand, especially in China and other emerging markets.

The company highlighted again that the opportunity in India continues. However, it is unclear how big this market can be for Apple/iPhone. While India may not generate the same volume of revenues as China’s estimated $71.7 billion, it may still increase penetration and make a meaningful contribution to revenue over the next few years. This market may begin to break away from other emerging markets as penetration increases. The company also noted strength overall in several other emerging markets.

Figure 4: Expectations for FY 2024 and beyond

Source: Visible Alpha consensus (February 11, 2024). Stock price data courtesy of FactSet. AAPL’s current stock price is as of the market close on February 9, 2024.

2. How did the Services segment perform and what’s next for this segment?

In Q1, Services performed in line with expectations, coming in at $23.2 billion, and given the much higher gross margin (71%), this segment has been helping to smooth out operating income.

For Q2 2024, Services are expected to deliver $23.3 billion, up 11% year over year, driven by cloud, music, and ads. For FY 2024, analysts currently forecast Services revenue to grow 11% to $94.6 billion, and another $22 billion to $116 billion by the end of FY 2026.

Cloud: For FY 2024, Apple is projected to generate nearly $10.0 billion in cloud sales. However, expectations of $10.7 billion for 2025 are not looking for much growth. Could the filming of spatial videos on the iPhone 15 for viewing in the Vision Pro help drive Cloud growth?

Apple Pay: For FY 2024, analysts, on average, are now projecting $2.3 billion, down from an expected $3 billion in sales last quarter.

Margins: Services currently generate a 71% gross margin, nearly double the 36% for the Products segment, and could shift Apple toward higher profitability. The company’s total operating profit is expected to grow 6% year over year in FY 2024 to $120.6 billion, driven by an increase in mix toward Services.

Growth: Apple’s significant installed base of 2 billion devices, with nearly 1 billion estimated to be iPhone, may be a great platform for growing ads, cloud, payments, and other content revenues (like music, games, and TV). It is worth noting that Apple has been relatively quiet about Generative AI and we wonder what will propel the next leg of growth in this segment.

3. What did Apple’s performance in China reveal?

In Q1, Greater China generated $20.8 billion in revenues, down 13% year over year and $1.3 billion below Visible Alpha consensus. While CEO Tim Cook noted his optimism for the China market, questions linger about the company’s performance in this market. There is some debate about what the region will deliver for sell-through units in FY 2024 and beyond.

Competition is likely to weigh on Apple in the China market, as sales are expected to drop 9% year-over-year to $16.3 billion in Q2. For FY 2024, analysts project China to deliver $69.6 billion in revenues, down 4% from 2023 levels. The verdict is still out on how China will perform beyond 2024. Currently, analysts expect China to return to 2022 levels in 2025 and then to begin to grow again by the end 2026, delivering $77.6 billion.