Alphabet Inc.’s (NASDAQ: GOOGL) Google Cloud CEO Thomas Kurian hosted the latest Google Cloud Next conference last week. What happened during the conference, and what are the questions to focus on?

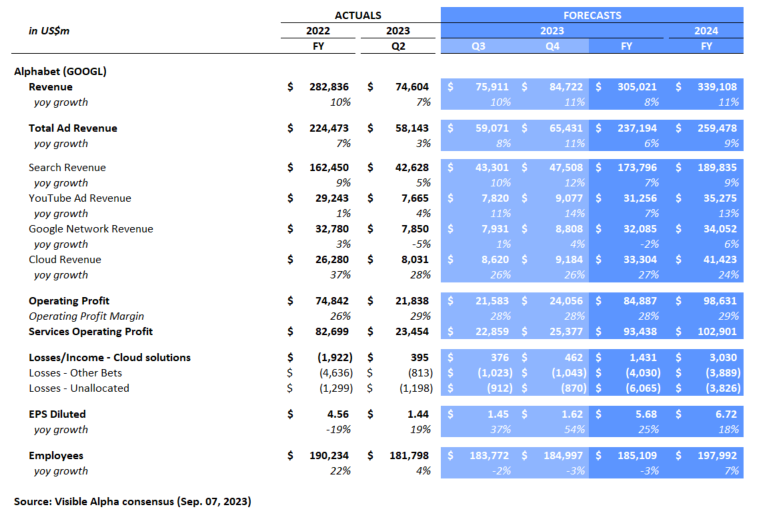

One of the key aspects of the Alphabet investment story is about Google Cloud continuing to improve its operating margin. This business recently broke even and is projected by analysts to generate a 4% operating profit margin in FY2023, or $33 billion in revenue and $1.4 billion in operating profit. Based on Visible Alpha data, Google Cloud is expected to generate a 7% operating margin, or $3 billion in operating income on $41 billion in revenue, by the end of FY2024. While this margin improvement for Google Cloud is positive, it remains far from the profitability of some of the company’s Cloud competitors, especially Microsoft.

At the Google Cloud Next 2023 conference, the company showcased a number of AI-related demos, including Duet AI for Workspace/Cloud and Vertex AI for Developers. Could the innovations from Duet AI and Vertex AI help to drive margin expansion for Google Cloud in FY2024 and beyond?

Figure 1: Google Cloud CEO Thomas Kurian giving opening keynote at Google Cloud Next ‘23

Commercializing Duet AI

For $30/month/seat, Duet AI can be accessed in a user’s Workspace tools, like Gmail, Docs, Sheets, and Slides, as of August 29, 2023, and will be integrated to the Cloud later this year. These innovations are designed to add value to the user’s existing workflows by helping to make the user more efficient and productive with their existing tools. However, it is unclear how meaningfully these AI product innovations will drive revenues and profitability in the Google Cloud business segment, especially among small enterprise and individual users.

Management noted that they have 10 million paying enterprise customers in this business, but the impact to revenues and operating profit seems to remain relatively small, at least in the near term. Google Cloud will need to deepen its monetization with all users to move the needle meaningfully on revenues and operating profit, which may prove challenging given Microsoft’s size and profitability in Cloud and legacy workplace tools.

Figure 2: Alphabet’s segment breakdown

Cloud Competition

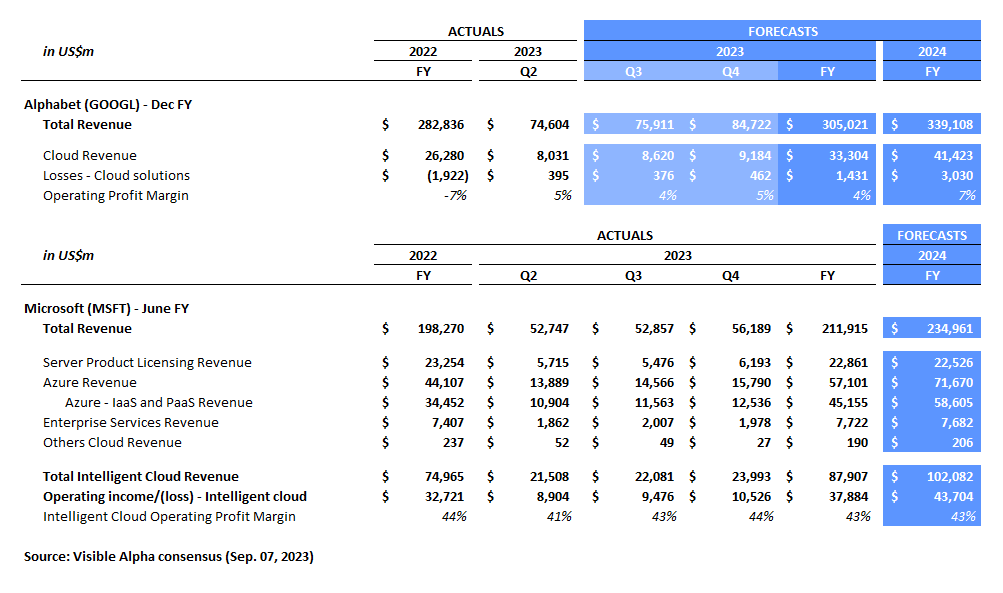

In contrast to Google Cloud, Microsoft’s Intelligent Cloud business is projected to generate a much larger 42.8% operating margin on $102 billion in revenues by the end of FY2024. Microsoft has also been aggressively integrating Generative AI (GAI) tools and development capabilities to Azure.

Microsoft’s Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) are key to its Azure cloud business and are projected to generate an additional $13.5 billion in revenue for the company from FY2023 to FY2024, an uptick of 30% year over year. Given the existing profitability of this business, it will be interesting to monitor the direction of margins and growth at both Google Cloud and Microsoft Azure as the GAI trends begin to scale and take hold.

At the moment, Microsoft’s Intelligent Cloud margins are superior, but Google Cloud’s have started expanding significantly. From the end of FY2022 to FY2024, Google Cloud’s operating profit is projected to swing from -$1.9 billion to $3.0 billion, an improvement of over 1400 basis points in margin. Can Google Cloud maintain this momentum in their operating profit margin or has the low-hanging fruit already been picked?

Figure 3: Alphabet and Microsoft Cloud Businesses

Final Thoughts

The development and adoption of GAI is in its infancy, but evolving quickly. Google Cloud and Microsoft Azure both seem poised to benefit from this technology shift. However, how the profitability of these businesses will ultimately shake out will be a critical long term investment question for these stocks. With the help of Duet AI and Vertex AI, will Google Cloud be able to carve out a profitable place in the Cloud landscape and move more quickly toward a double-digit operating profit margin?