CONSENSUS ESTIMATES FOR INVESTMENT RESEARCH

Request a Demo of Visible Alpha Insights

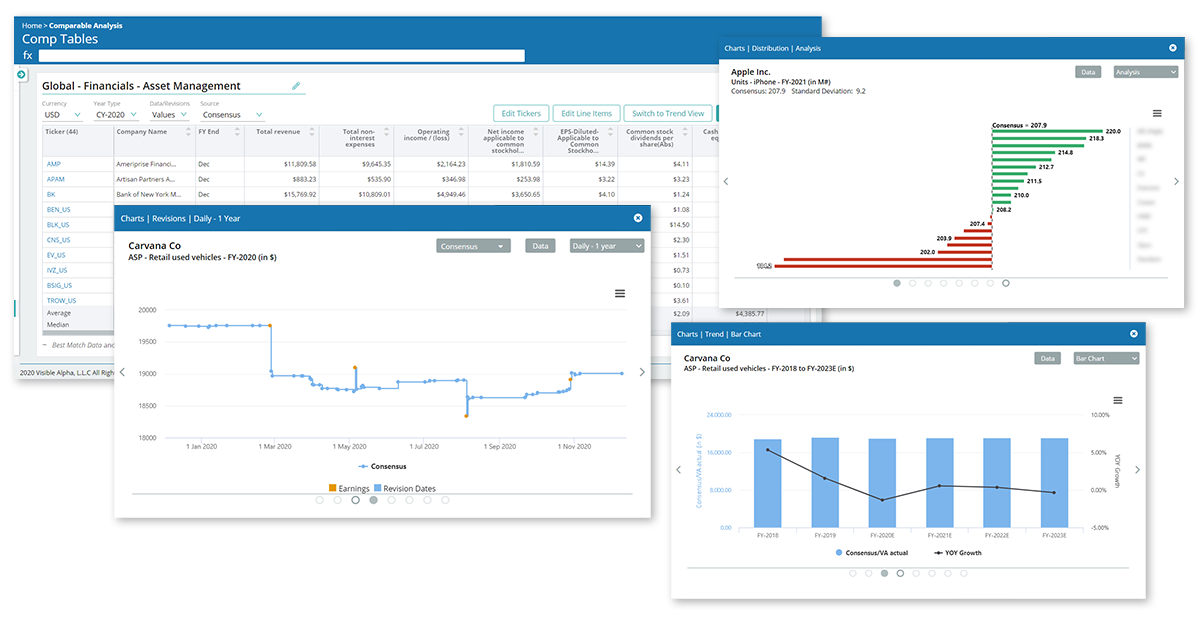

Let us show you how institutional investors are leveraging our innovative, integrated platform to optimize their workflow through instant access to full working sell-side models and granular consensus estimates.