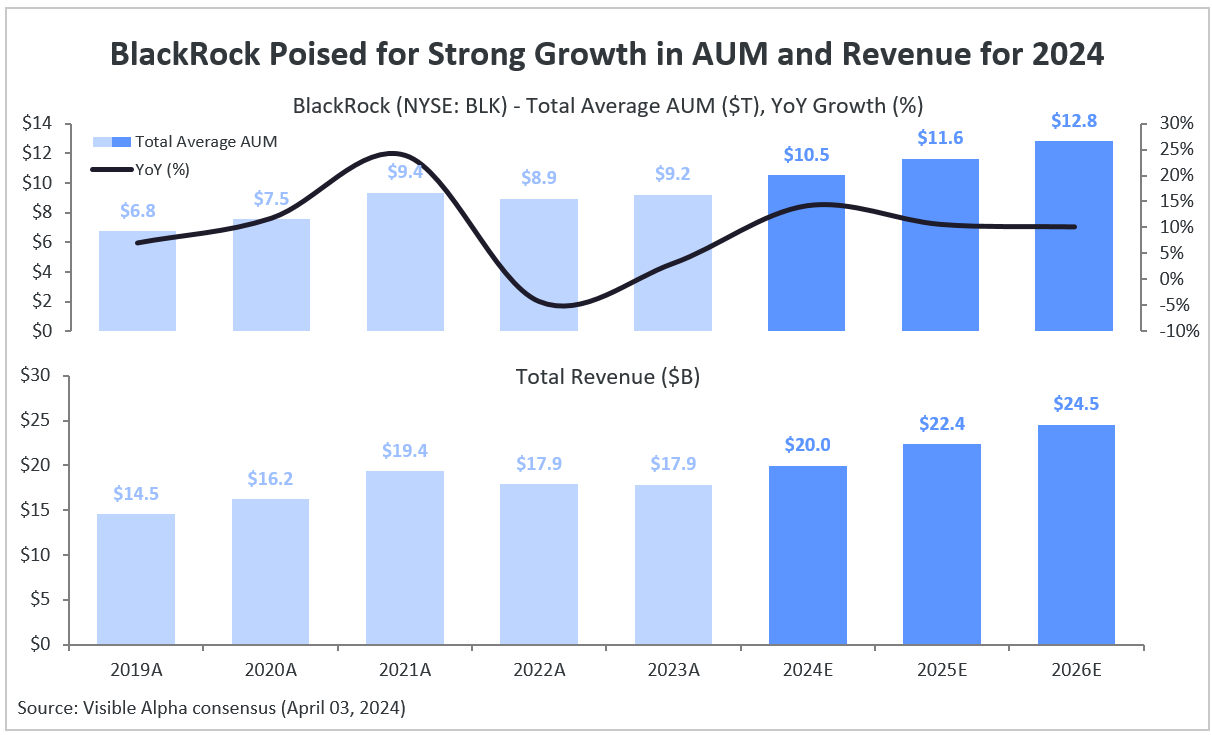

BlackRock (NYSE: BLK) is expected to experience significant growth in its total average assets under management (AUM) in 2024 and beyond, according to Visible Alpha consensus estimates. This positive outlook is influenced by the anticipation of a moderation in interest rates in 2024. The U.S. Federal Reserve has kept interest rates unchanged since July 2023, which has boosted market sentiments. Total average AUM is projected to be up +14% year over year in 2024 to $10.5 trillion. This is compared to a -4% decline in total average AUM in 2022 and a modest +3% growth in 2023.

Given that management fees, which BlackRock earns as a percentage of its total AUM, are a significant revenue source for the company, total revenue for 2024 is estimated to grow by +12% year over year to $20 billion in 2024 compared to the previous year. This growth is driven by both the impact of market movements on the total average AUM as well as rising performance fee income.