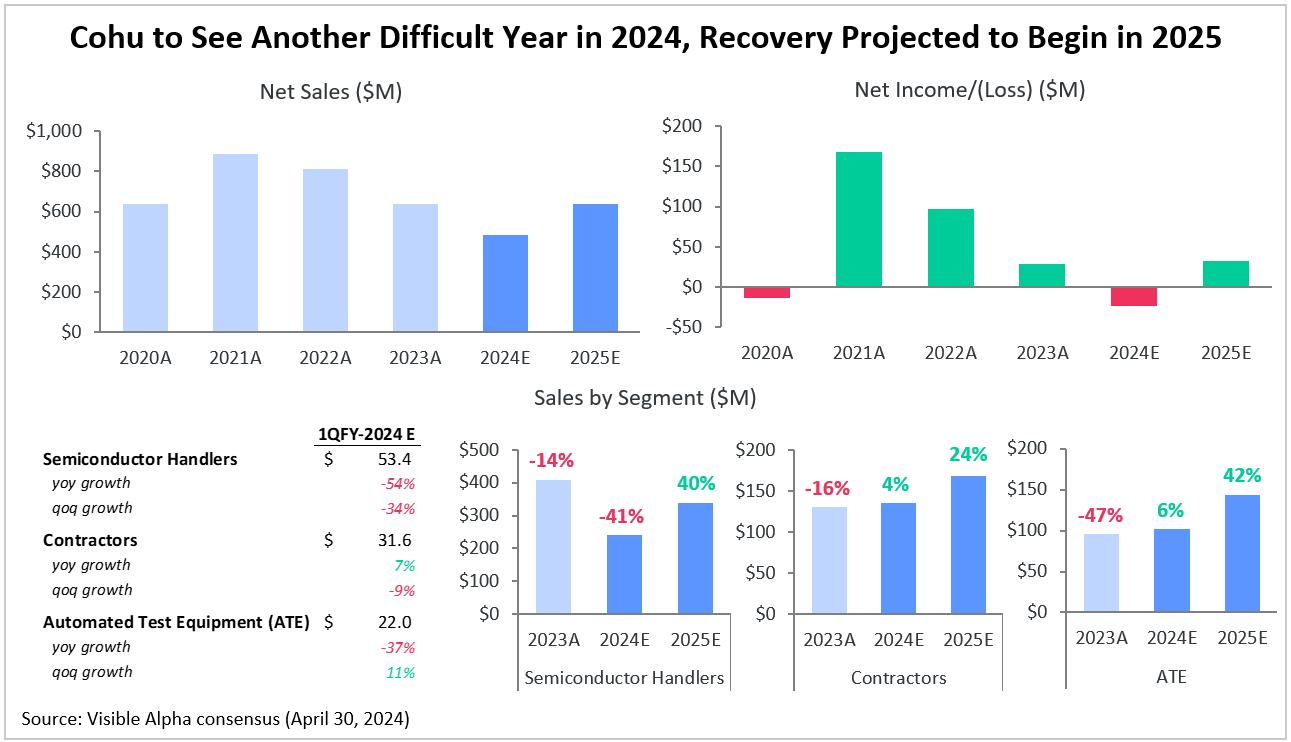

Semiconductor equipment manufacturer Cohu (NASDAQ: COHU) is anticipated to experience yet another quarter of significant declines, with net sales estimated to be down -40% year over year in the first quarter of 2024. This decline follows a trend of decreasing revenues since 2022, impacted by challenges within the semiconductor industry and the softening of demand from its automotive and industrial customers.

Based on Visible Alpha consensus, Cohu is projected to experience a further decline for the full year, with total net sales estimated to decline -24% year over year, totaling $486 million. This decline is primarily attributed to a substantial -41% drop in Cohu’s Semiconductor Handlers segment, which contributes approximately half of the company’s total net sales. However, there is optimism regarding the Automated Test Equipment (ATE) segment and the Contractors division. Both segments are expected to rebound in 2024, with ATE projected to grow by +6% year over year compared to a steep decline of -47% in 2023, and Contractor sales anticipated to increase by +4% compared to a -16% drop in 2023.

Cohu is actively pursuing strategic initiatives to drive growth, including the launch of AI inspection software and the opening of a new factory in the Philippines to ramp manufacturing of test contactors. Looking ahead to 2025, analysts estimate a notable recovery in Cohu’s growth trajectory. A sharp rebound is expected in 2025, with net sales projected to surge by +31% year over year. The company is scheduled to report its first-quarter 2024 results on Thursday, May 2.

Check out our latest AI Monitor for a view of Cohu’s AI-exposed revenues and potential for growth.