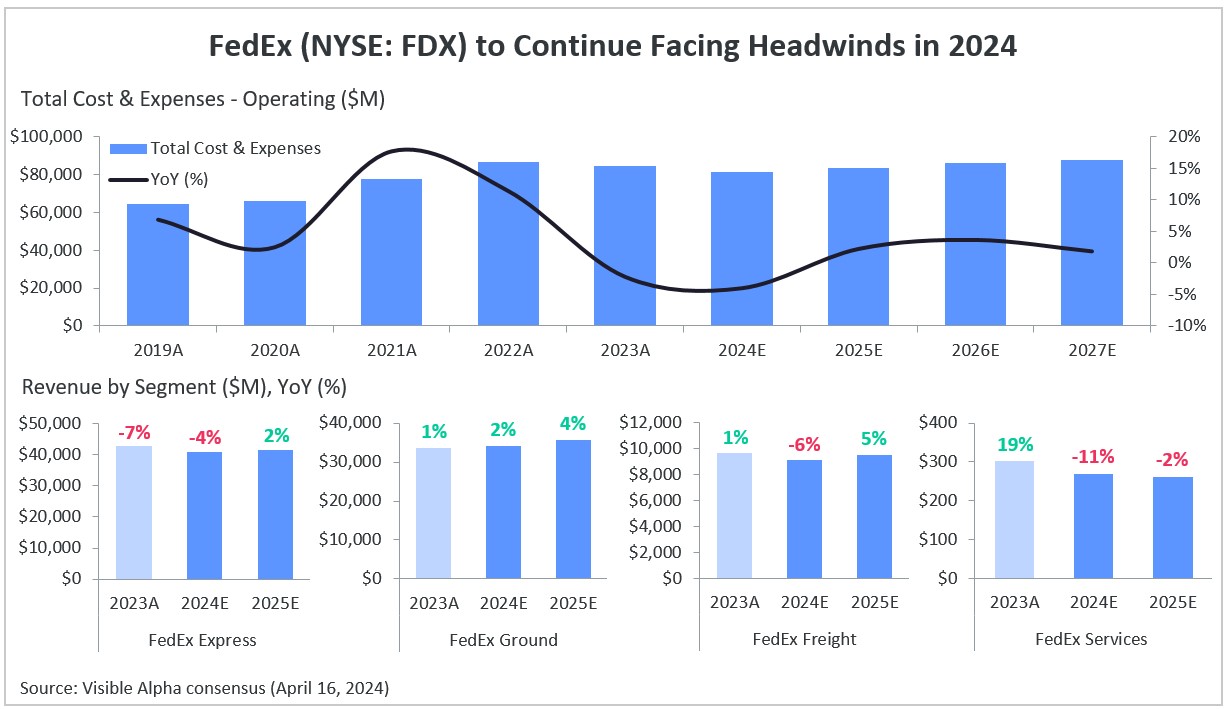

FedEx (NYSE: FDX) is focusing on lowering operating costs and achieving profitable growth through its DRIVE transformation program, which was first introduced in fiscal year 2023. In the program’s first year, FedEx successfully reduced its total non-GAAP costs & expenses by -2% year over year, to $84.8 billion. Based on Visible Alpha consensus, FedEx is set to continue this trend, with an estimated -4% year over year decline in total non-GAAP costs & expenses in 2024. This decrease is expected to be driven primarily by reduced costs in the company’s FedEx Express and FedEx Freight segments.

While costs are estimated to decrease, analysts anticipate a continued downward trend in the company’s total revenue, which is expected to decline further by -3% year over year in 2024, to around $87.7 billion. Within the company’s revenue segments, FedEx Services is projected to see the largest decline in 2024, with revenues projected to be down -11% year over year, followed by FedEx Freight at -6% and FedEx Express at -4%. FedEx Ground, on the other hand, is estimated to see moderate growth of +2% in 2024. This overall growth decline is due to several factors, including reduced fuel surcharges, volatile macroeconomic conditions, and inflationary pressures, all contributing to decreased customer demand for FedEx services.

In terms of parcel volumes, FedEx Express, which makes up 47% of the company’s total revenue, is forecasted to see a -11% year over year drop in volume in 2024, compared to a -14% decline in 2023. Volume for FedEx Ground services is projected to see a slight increase of 0.3%, having declined by -8% in 2023.