Gilead Sciences’ (NASDAQ: GILD) acquisition of CymaBay Therapeutics in March strategically expands Gilead’s established liver disease franchise. The acquisition was priced at $32.50 per share in cash, valued at $4.3 billion.

Gilead’s acquisition was driven by CymaBay’s lead product, seladelpar, for treating second-line primary biliary cholangitis (PBC), a chronic and progressive cholestatic (slowing of bile flow through the biliary system) liver disease that fits well with GILD’s existing liver portfolio. PBC is an autoimmune disease in which bile ducts in the liver are attacked and inflamed by misdirected immune cells, likely in response to chronic exposure to environmental insults. Seladelpar is an oral, selective peroxisome proliferator-activated receptor delta (PPARδ) agonist. PPARδ are nuclear receptors that regulate important metabolic and liver disease pathways and are implicated in PBC, among other diseases.

From the clinical and regulatory viewpoint, seladelpar is a relatively de-risked asset — Phase 3 trials for seladelpar have been completed and the FDA has accepted the New Drug Application (NDA). The FDA granted seladelpar priority review with a Prescription Drug User Fee Act (PDUFA) target action date of August 14, 2024. Furthermore, seladelpar has received Breakthrough Therapy Designation from the FDA, PRIority MEdicines (PRIME) status from the European Medicines Agency (EMA), and Orphan Drug Designation in the U.S. and Europe for treating PBC patients.

Seladelpar will compete with Ocaliva (obeticholic acid), a farnesoid X receptor (FXR) agonist also approved for second-line PBC, developed by Intercept Pharmaceuticals. Seladelpar has a potentially differentiated and improved safety and efficacy profile compared to Ocaliva. A major advantage seladelpar may have over Ocaliva is in reducing pruritus (acute skin itching); Ocaliva seems to worsen pruritus.

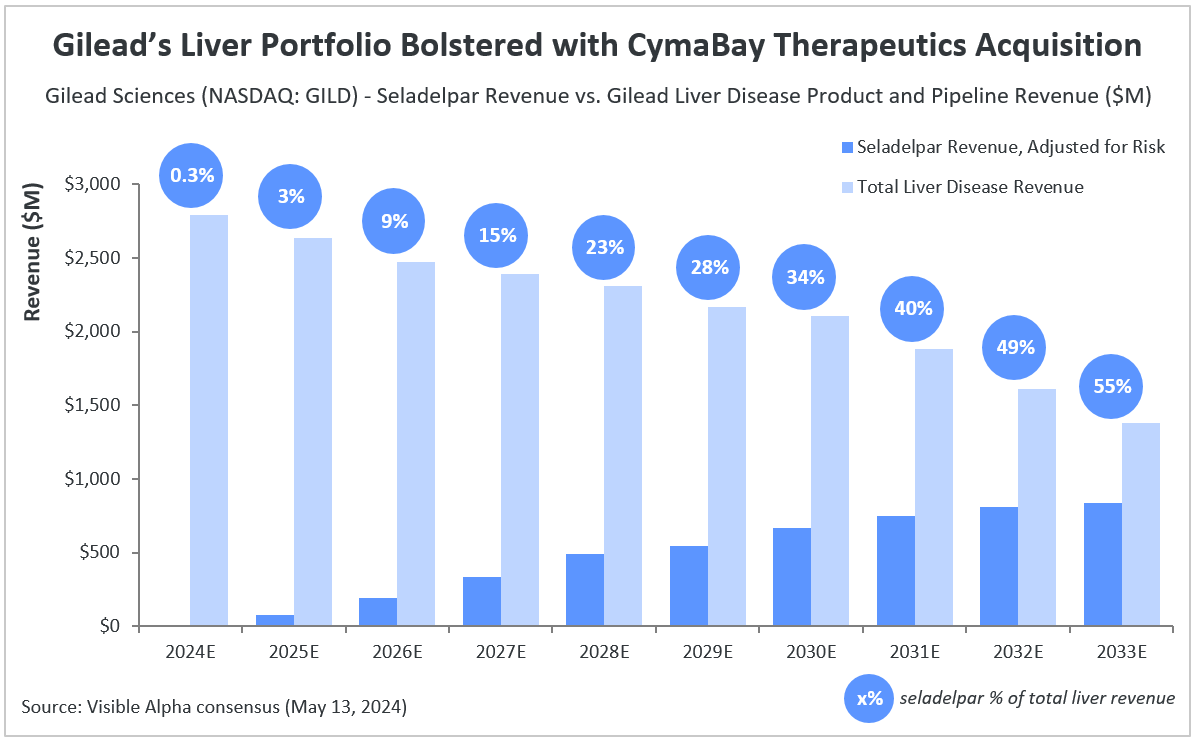

Based on Visible Alpha consensus, seladelpar is projected to generate $9.5 million in risk-adjusted revenues in 2024 (assuming market entry late in 2024), reaching $839 million by 2033. Based on analysts’ projections of GILD’s current liver disease pipeline and product portfolio, seladelpar accounts for an estimated 55% of total revenues in 2033.