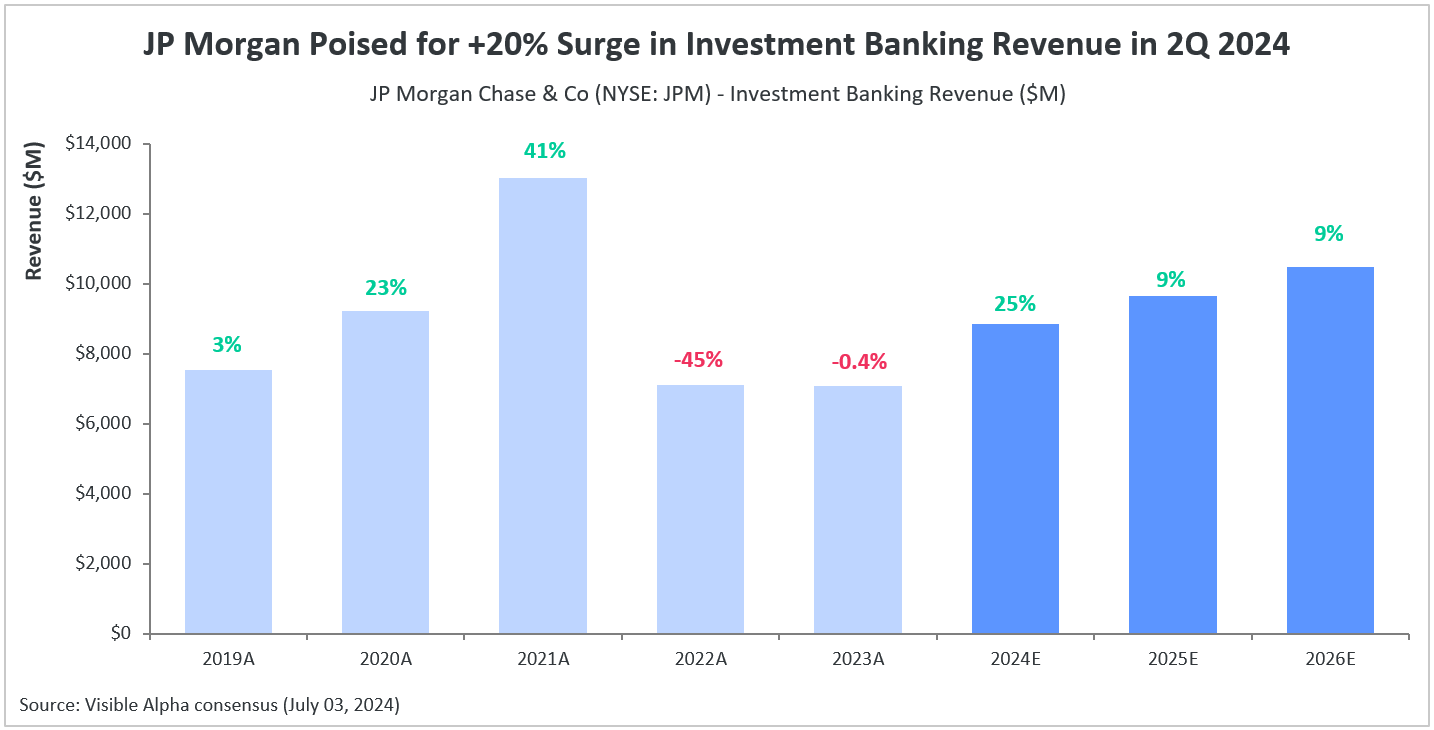

JPMorgan Chase (NYSE: JPM) is expected to see a rebound in its investment banking revenue over the coming quarters, fueled by robust capital markets. According to Visible Alpha consensus estimates, investment banking revenue is projected to increase by +27% in the second quarter of 2024, following a strong +24% growth in the previous quarter. This growth is primarily driven by higher fees from debt and stock underwriting. Specifically, total underwriting revenue for the second quarter is forecasted to reach $1.4 billion, marking a +32% year-over-year increase. This uptick is driven by a substantial +32% rise in equities underwriting fees, supported by a solid +31% increase in debt underwriting fees.

Looking at the full year, investment banking revenue is anticipated to rise by +25% year over year, reaching $8.8 billion, driven by a +43% increase in underwriting revenue and mildly offset by a -1% decline in advisory fees. The 2024 estimates still remain below the peak levels observed in 2021, when the bank’s investment banking revenue hit $13 billion. Several factors have since contributed to a decline in investment banking revenues, including concerns about a potential recession, inflation, monetary policies, and market volatility.