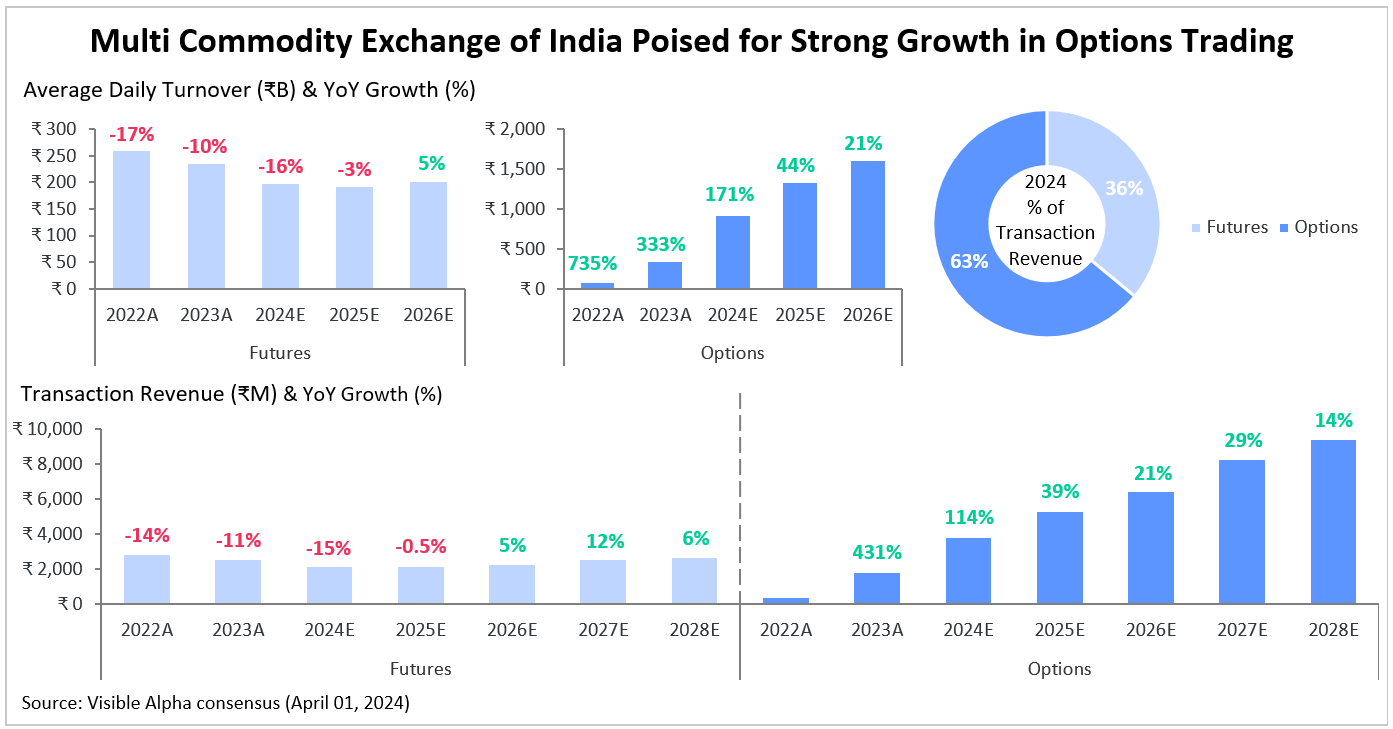

Leading commodity exchange in India, Multi Commodity Exchange of India (NSE: MCX) is projected to see strong growth in transaction revenue from Options, according to Visible Alpha consensus. Options trading boomed for MCX post 2022, following approval by the Securities and Exchange Board of India (SEBI) for Options trading on index commodities. Before this approval, only Futures trading were permitted on index commodities. Furthermore, analysts attribute increased retail participation in the options market, along with new product launches, and the ongoing volatility in crucial commodity prices as the key factors driving the growth of Options.

Options accounted for 42% of MCX’s total transaction revenue in 2023. In 2024, analysts expect Options to account for 63% of the exchange’s total transaction revenue. While transaction revenue from Futures trading has been on a decline since 2022, Options trading has been seeing significant growth–a trend projected to continue in the forecast period. Between 2024 and 2028, transaction revenue from Options trading is expected to grow at a CAGR of 26%. In comparison, revenue from Futures trading is expected to grow at a more conservative CAGR of 6%.