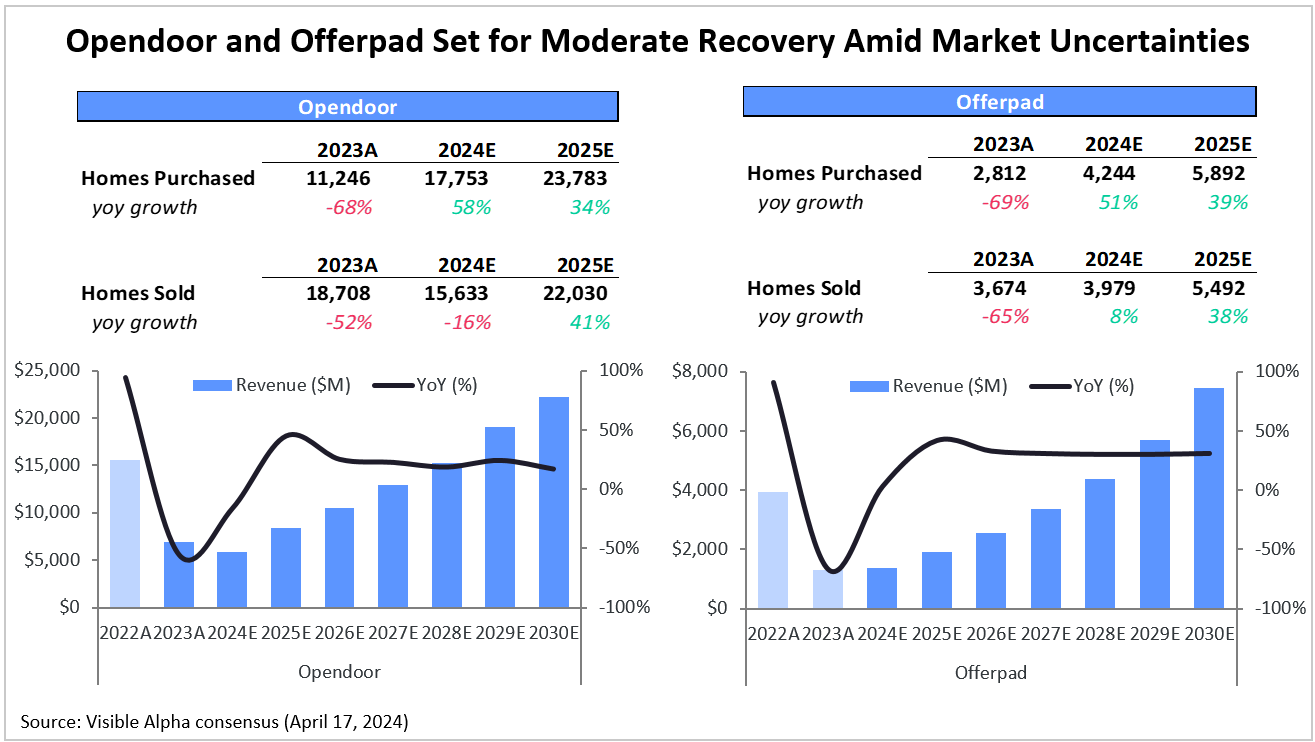

U.S.-based tech-enabled platforms for residential real estate, Opendoor (NASDAQ: OPEN) and Offerpad (NYSE: OPAD), are anticipated to experience significant increases in home purchases in 2024. Analysts expect a +58% increase for Opendoor and a +51% increase for Offerpad compared to the previous year, indicating expectations of a more balanced housing market than in 2023. Both Opendoor and Offerpad are online real estate iBuying platforms, specializing in buying and selling residential properties.

Although Opendoor is expected to see a continued decrease in the number of homes sold, with a projected -16% year over year decline in 2024, this decline is less steep than the -52% decrease observed in 2023. Conversely, Offerpad is forecasted to improve its number of homes sold, with an estimated +8% YoY growth in 2024, contrasting with a -65% decline in 2023.

However, uncertainties persist regarding the macroeconomic outlook for the housing market and potential interest rate cuts, which may continue to negatively impact revenue expectations in 2024. According to Visible Alpha consensus, Opendoor’s revenue is expected to decline by -16% YoY in 2024, while Offerpad is projected to achieve revenue growth of +3%. Recovery is anticipated in 2025, with both companies expected to experience robust growth across key metrics.