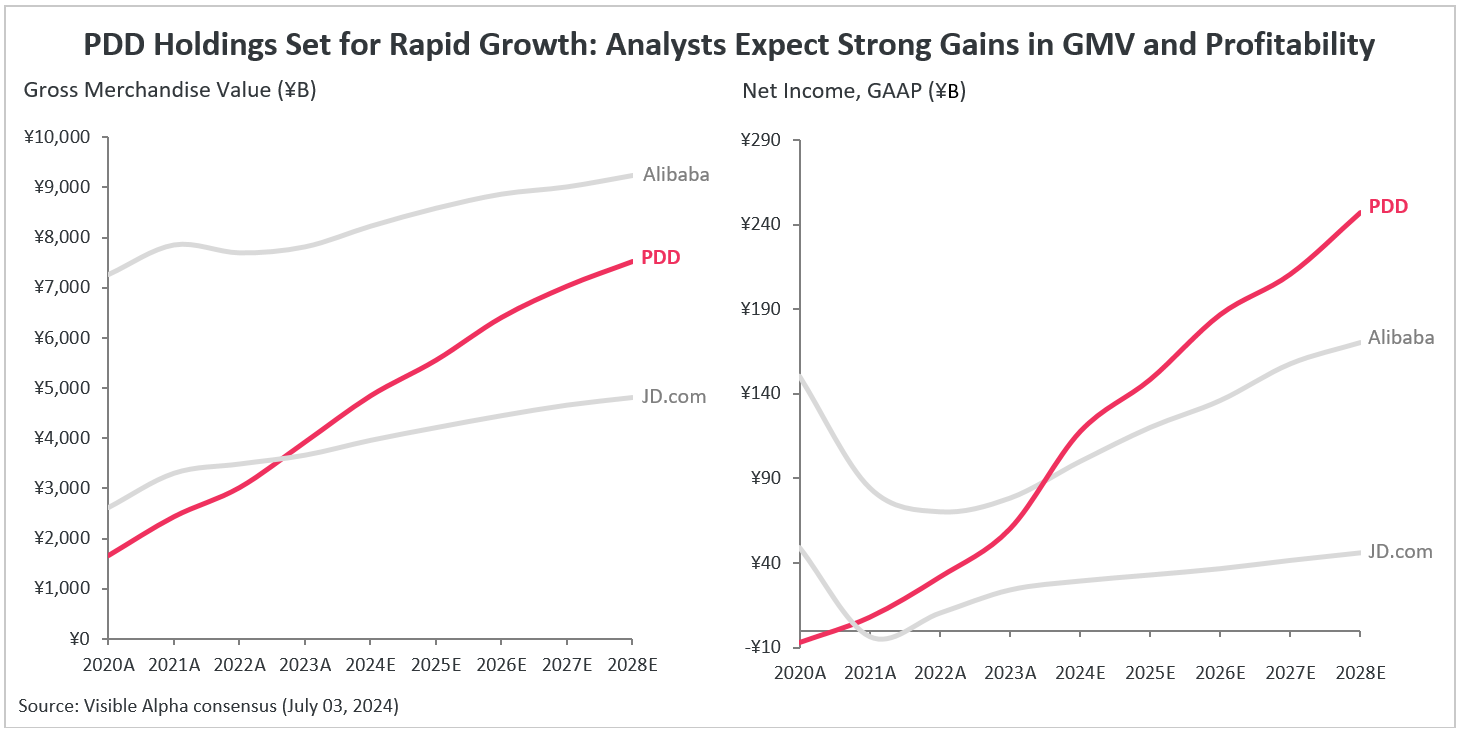

Chinese online retailer PDD Holdings (NASDAQ: PDD) has experienced rapid growth in recent years, primarily driven by its international discount app Temu. Analysts anticipate that the ecommerce company will continue to expand its market share against competitors Alibaba and JD.com. According to Visible Alpha consensus estimates, PDD, the parent company of both Temu and the Chinese discount shopping app Pinduoduo, is projected to increase gross merchandise value (GMV) and profitability significantly.

In 2024, analysts expect PDD’s GMV to rise by +23% year over year, reaching CN¥4.8 trillion. In contrast, Alibaba and JD.com are expected to achieve more modest GMV growth rates of +5% (reaching ¥8.1 trillion) and +8% (reaching ¥4 trillion), respectively. Although Alibaba is expected to lead in absolute revenue and GMV, PDD is forecasted to achieve stronger double-digit growth between 2024 and 2028. During this period, PDD’s GMV is expected to grow at a CAGR of 12%, and revenue at a CAGR of 17%. In comparison, Alibaba’s GMV is anticipated to grow at a CAGR of 3%, and revenue at 8%. Analysts also project rapid growth in PDD’s net income, with estimates suggesting that PDD will surpass Alibaba in terms of net income (GAAP) in 2024, generating net income of ¥117.5 billion compared to Alibaba’s estimated ¥99.6 billion. Additionally, PDD’s take rate has been steadily increasing, with analysts expecting it to rise to 8.6% in 2024, up from 6.3% in 2023.

PDD generates revenue primarily from two sources: online marketing services and transaction services, with the latter expanding significantly faster. Revenue from transaction services is expected to surge by +124% in 2024, totaling ¥211 billion, with Temu contributing an estimated ¥147 billion or as much as 70% to this figure.