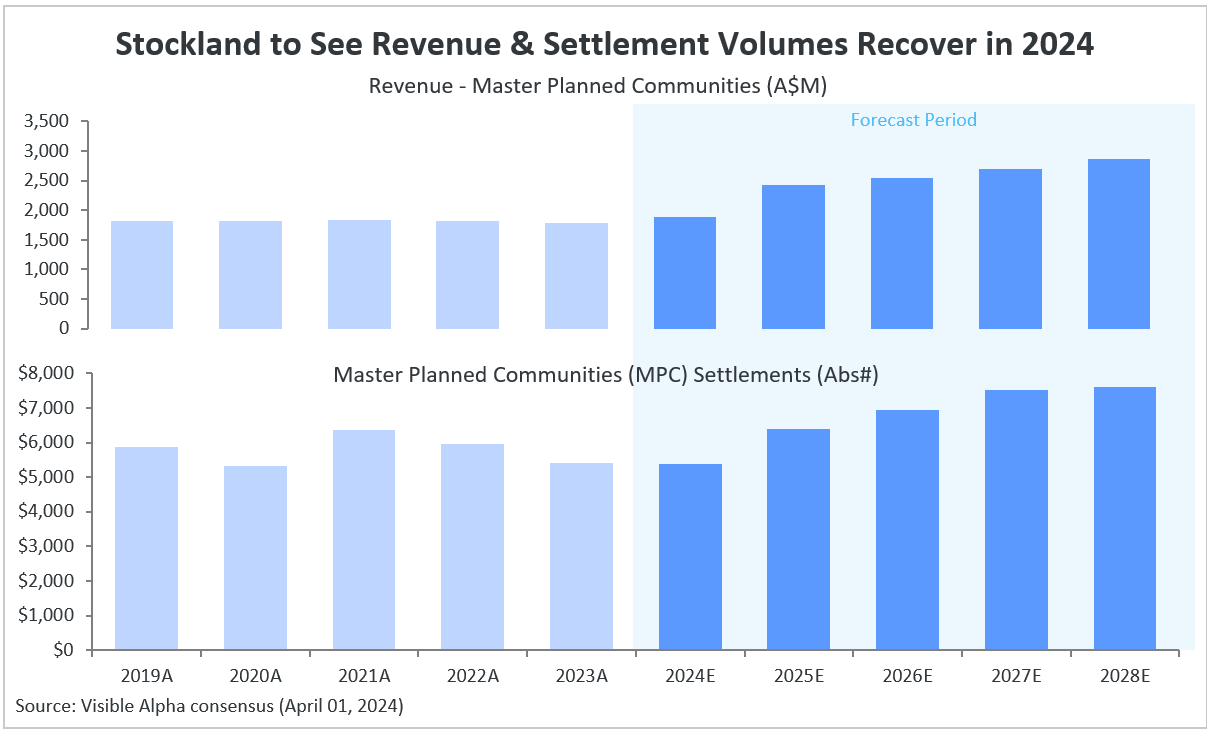

Australian diversified residential developer, Stockland (ASX: SGP), faced headwinds in the fiscal year 2022 – 2023 as a higher interest rate environment dampened demand for new homes. This led to a -2% year over year revenue decline from master-planned communities in 2023, along with a -9% year over year decrease in Master Planned Communities (MPC) settlement volumes. However, analysts are expecting a modest recovery for Stockland in 2024, followed by a strong rebound in 2025.

According to the Visible Alpha consensus, revenue from master-planned communities is forecasted to increase by +6% year over year in 2024, reaching A$1.9 billion. By 2025, analysts anticipate an even stronger growth of 28% in revenue from master-planned communities. Among Stockland’s geographic revenue segments, growth is expected to be mainly driven by New South Wales and Queensland. These states are poised to see increased sales volume, benefiting from pent-up demand. Overall, the rise in revenue is projected to be boosted by a substantial increase in MPC settlement volumes. Analysts estimate an MPC settlement volume of 5,382 lots in 2024, rising to 6,384 lots by 2025, compared to 5,403 lots in 2023.