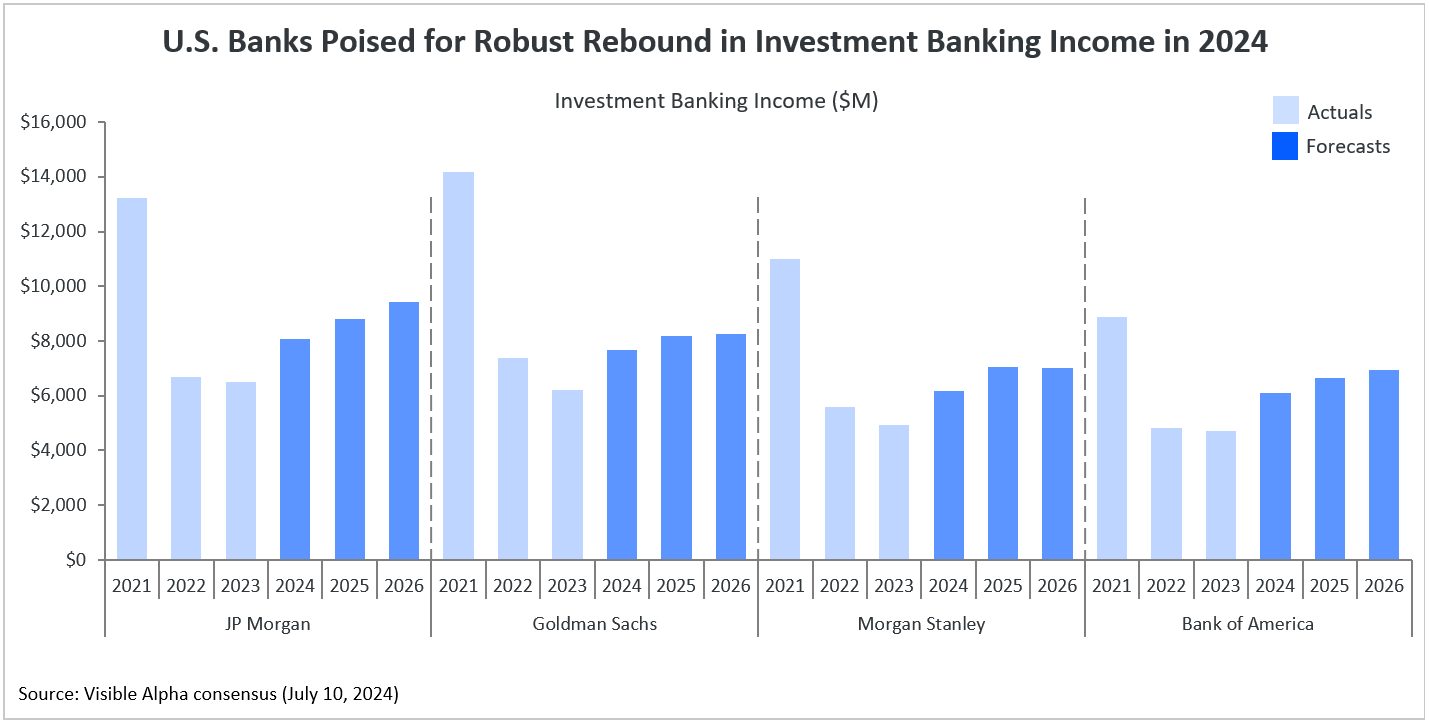

Investment banking revenues at major U.S. banks are projected to bounce back in 2024, fueled by increased activity in mergers and debt transactions following a two-year downturn. According to Visible Alpha consensus estimates, income from investment banking operations at JPMorgan Chase (NYSE: JPM), Goldman Sachs (NYSE: GS), Morgan Stanley (NYSE: MS), and Bank of America (NYSE: BAC) is expected to increase by an average of 25% year over year in the upcoming second-quarter earnings.

For the full year, Bank of America is anticipated to experience the most significant growth in its investment banking income, rising by 29.3% from the previous year to $6.1 billion. Morgan Stanley is expected to see a 25.5% increase to $6.2 billion, followed by Goldman Sachs with a 23.7% rise to $7.7 billion, and JPMorgan Chase with a 23.6% increase to $8.1 billion.

Despite these gains, the 2024 estimates are still below the peak levels observed in 2021, when average investment banking revenue surged by 41% year over year, driven by record-low interest rates and government intervention during the pandemic.

JPMorgan Chase is set to report second-quarter results on July 12, with Goldman Sachs following on July 15, and Morgan Stanley and Bank of America announcing their earnings a day later.