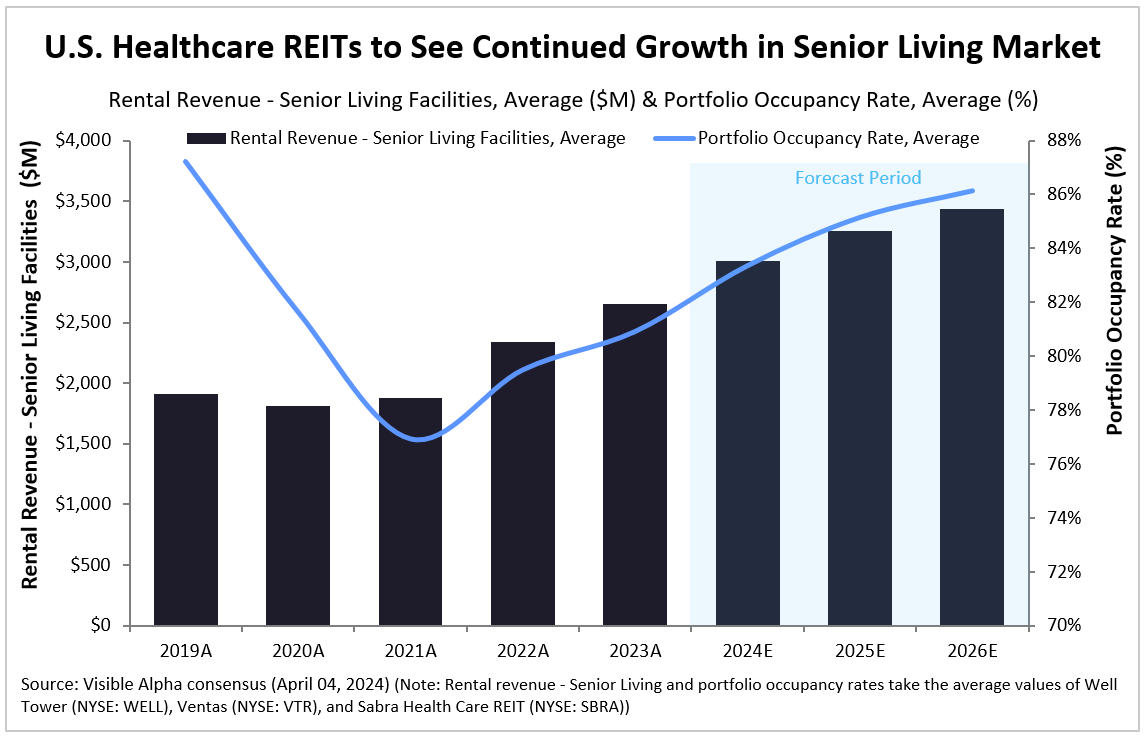

Healthcare Real Estate Investment Trusts (REITs) in the U.S., focusing on senior housing facilities, are expected to continue benefiting from several post-pandemic trends. These include increased demand, an aging population, higher healthcare spending, and favorable supply/demand dynamics, as a fall in new construction activities has led to higher funding costs. Major players in this industry, such as Welltower (NYSE: WELL), Ventas (NYSE: VTR), and Sabra Health Care REIT (NYSE: SBRA), are anticipated to experience consistent growth in both the occupancy rates of their senior living facilities and rental revenues throughout 2024.

After a significant decline in portfolio occupancy rates for these REITs in 2021 due to the COVID-19 pandemic, rates have been steadily improving since 2022. In 2024, Welltower and Ventas are projected to reach an 84% occupancy rate, while Sabra Health Care REIT is expected to hit 83%. This marks a notable increase from Welltower’s 74% occupancy rate in 2021 and Ventas’s and Sabra Health Care’s 78% rates.

Additionally, rental revenue from senior living facilities experienced a strong rebound in growth in 2022 following the pandemic-induced slowdown. The momentum is expected to continue, with Welltower estimated to see a +16% year over year increase in total rental revenue from senior living facilities in 2024, reaching $5.5 billion. Similarly, both Ventas and Sabra Health Care are estimated to see a +10% year over year rise in senior living rental revenue in 2024, reaching $3.2 billion and $259 million, respectively.