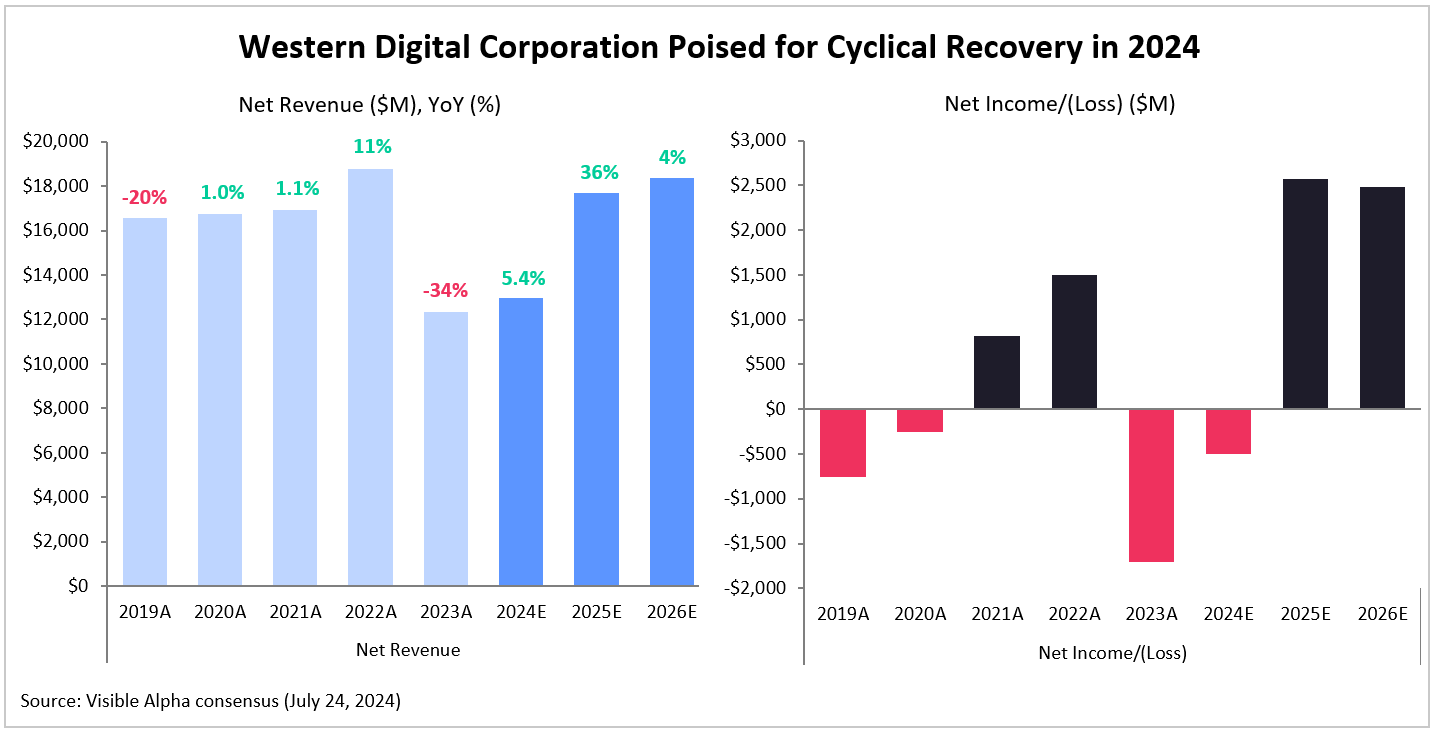

Western Digital Corporation (NASDAQ: WDC) is poised for a cyclical recovery in 2024 after experiencing significant declines in prices and revenues last year. Like others in the memory industry, the company faced challenges in 2023, as NAND flash prices dropped due to oversupply, while DRAM weakened amidst inventory adjustments and slowing demand for computers and smartphones. However, the U.S.-based memory giant began showing signs of recovery in Q3 2024, reporting $3.5 billion in net revenues, a 23.3% year-over-year increase, and a 14% sequential increase. Analysts anticipate a robust 40% year-over-year growth in net revenues in the next earnings release — fiscal Q4 2024 — driven by a robust 43.7% increase in HDD (hard disk drive) business and a 36.8% growth in the company’s flash business as market conditions stabilize and demand rebounds from oversupply.

For the full year, analysts expect Western Digital to achieve a moderate 5% year-over-year net revenue growth, reaching $13 billion. Looking ahead to 2025, net revenues are projected to experience robust growth of +36%. Western Digital Corporation is scheduled to announce its Q4 results on July 31, 2024.