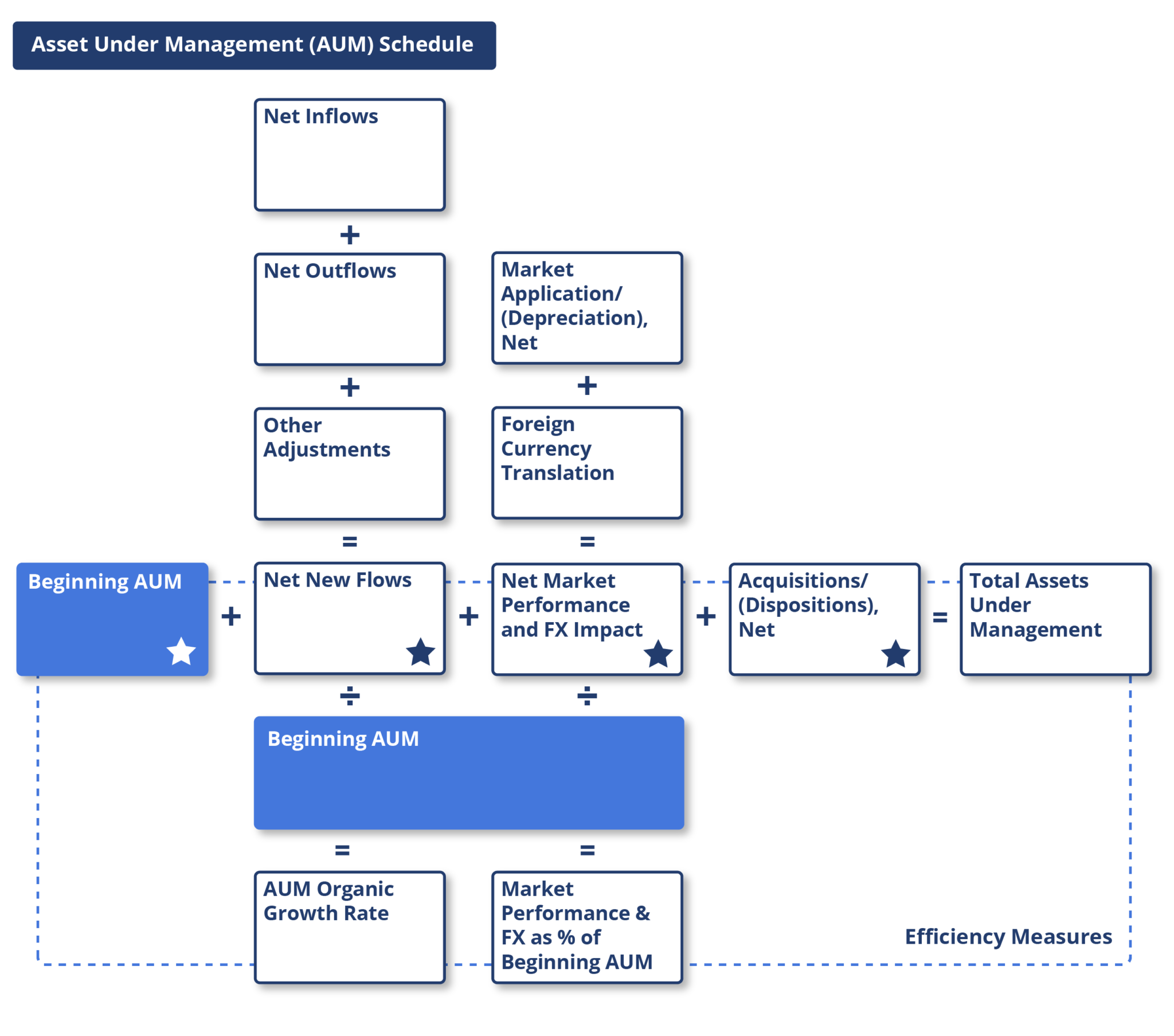

- Beginning AUM

- Net New Flows

- Net Market Performance & Fx Impact

- Total Assets Under Management (AUM)

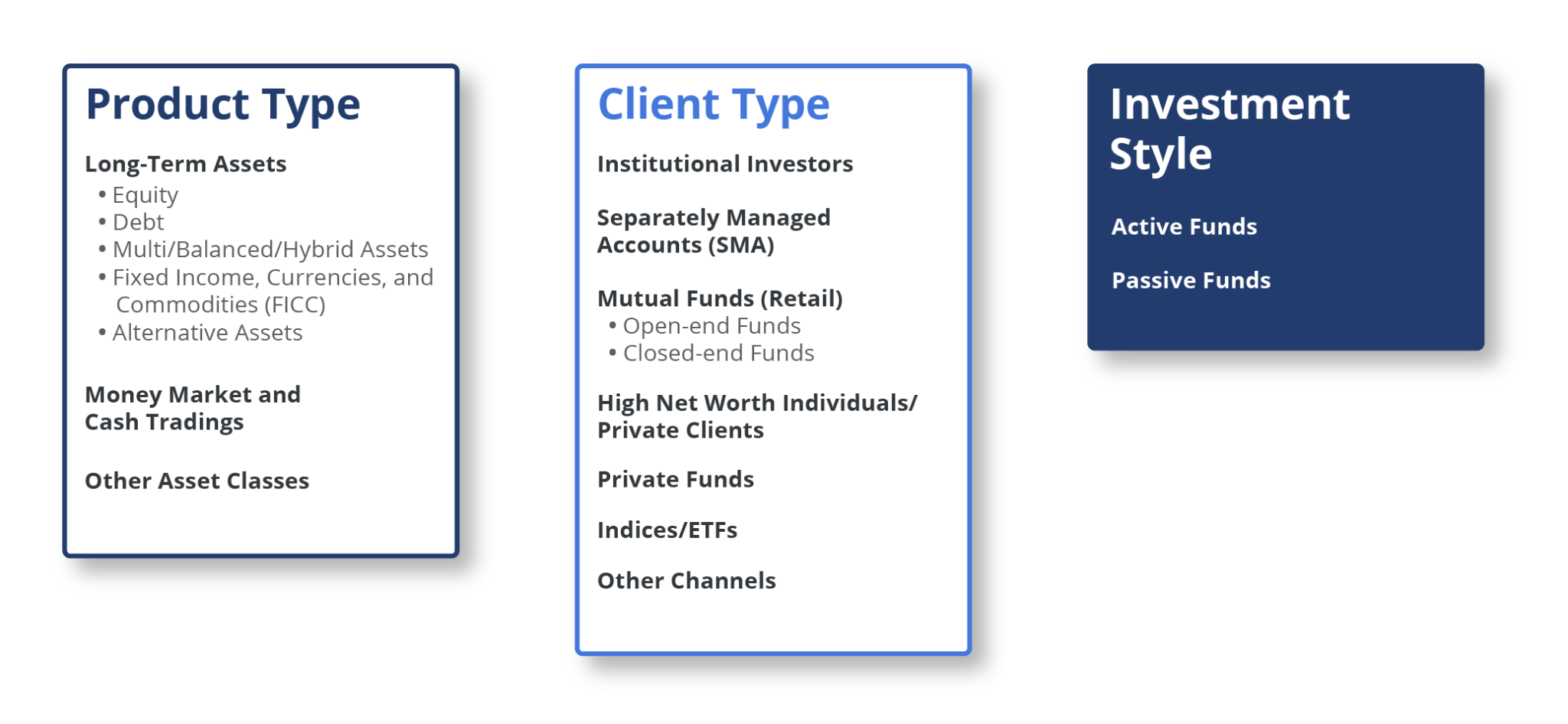

Industry Classification

The Asset Management Industry can be classified into three sub-industries:

- Traditional Asset Management Companies

- Traditional asset management companies are open-ended mutual funds, which invest primarily in equities, debt, and money market instruments.

- Alternative Asset Management Companies

- Alternative asset management companies are closed-end funds, which invest primarily in alternative asset classes such as private equities, real estate, derivatives, and commodities. These companies usually charge higher management fees compared to traditional asset management companies. Alternative investment funds usually have a prescribed lock-in period for investment.

- Investment Holding or Business Development Companies

- Investment holding companies are means by which an individual or a group of individuals pool their funds and make investments around a specific investment objective or strategy. These companies raise capital (both equity and debt) and appoint an external investment manager(s) to manage their funds. The revenue generated by investment holding companies includes dividends from the invested companies and return on the sale of investments. Management fees paid to the external fund manager are the biggest cost for these companies.

In this guide, we mainly focus on traditional asset management companies.

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for Asset Management, whether at a company or industry level, some Asset Management KPIs to consider include:

Visible Alpha’s Standardized Industry Metrics

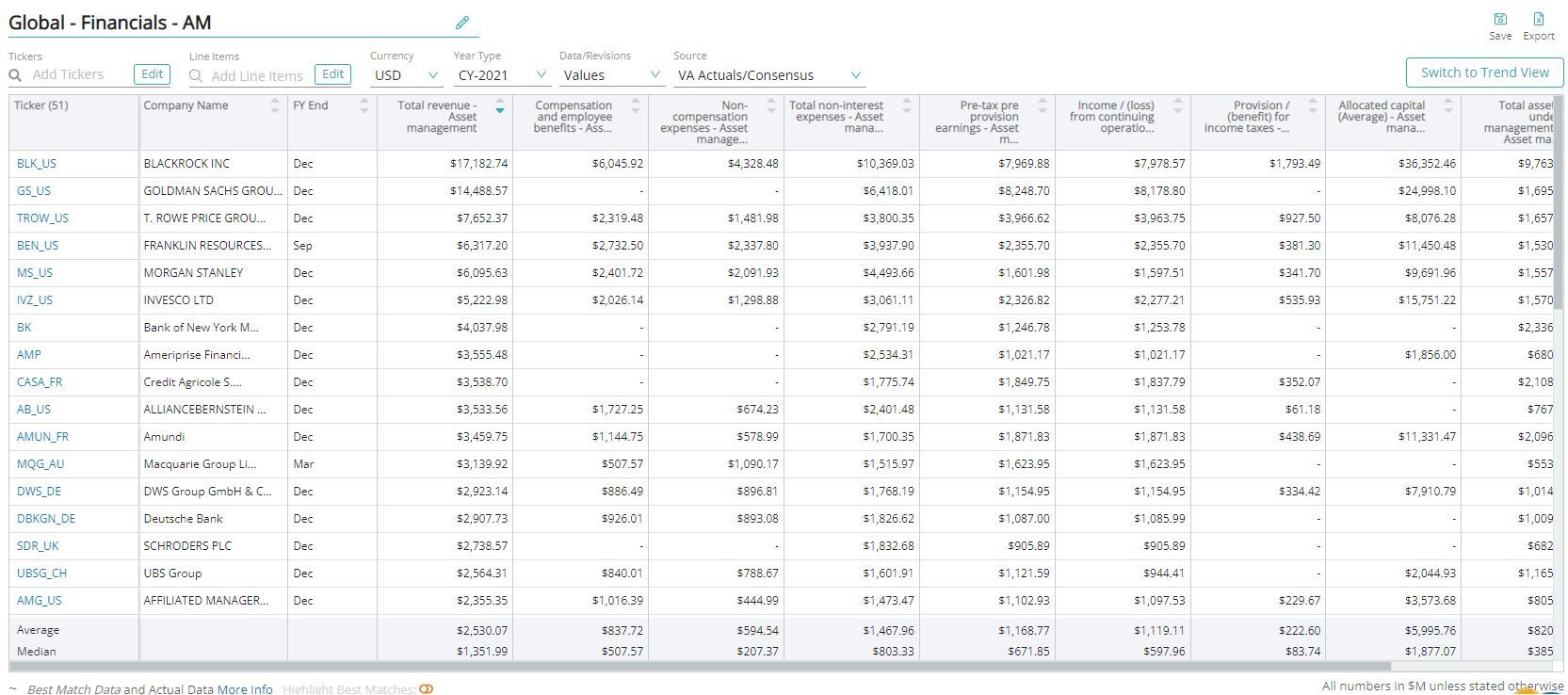

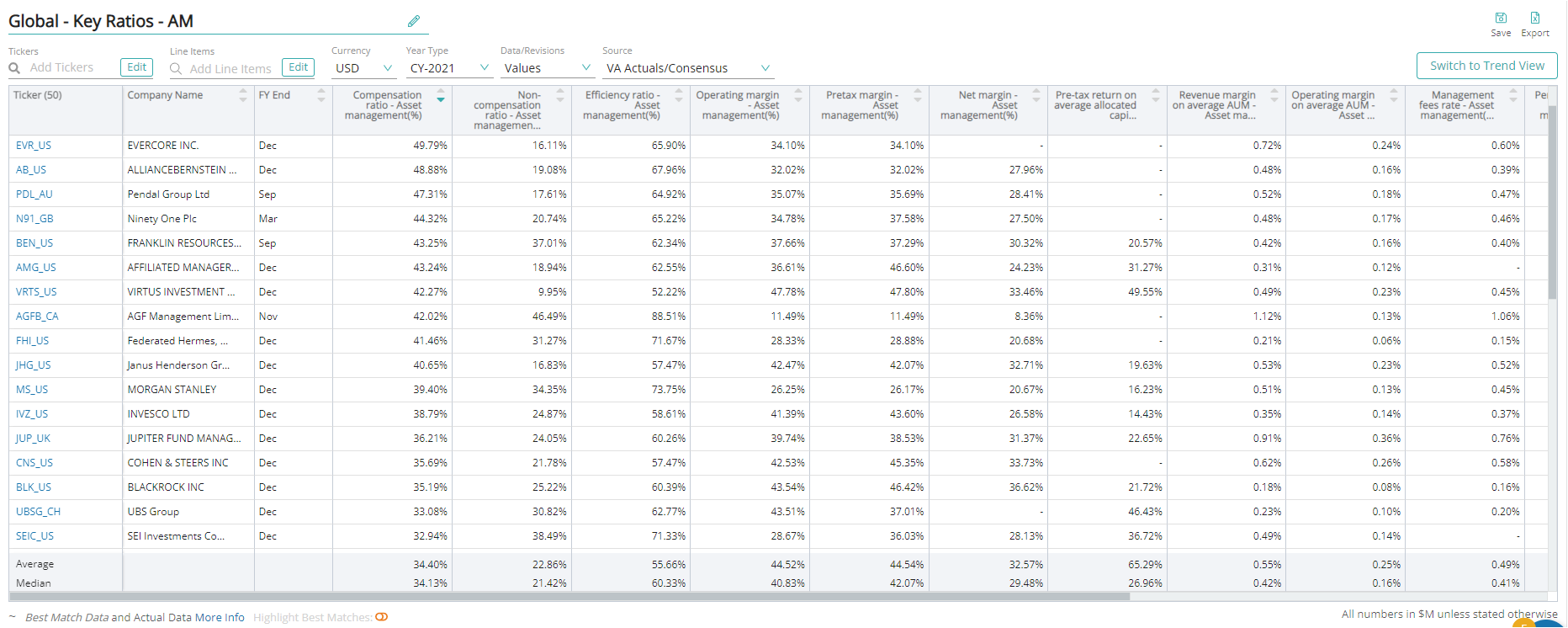

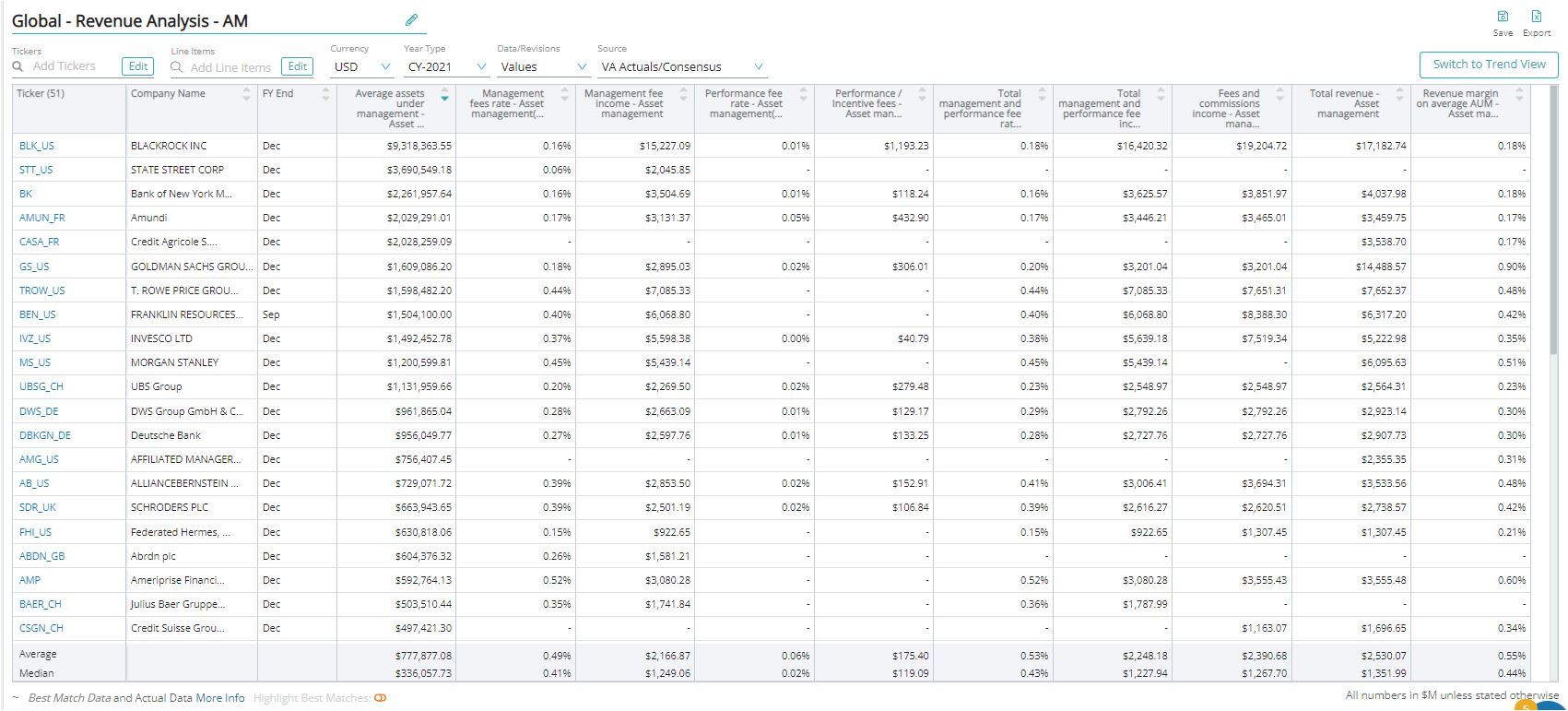

To understand market expectations for the Asset Management industry, a key information source is sell-side analyst estimate and consensus forecast data. The buy-side, sell-side, and public companies leverage this type of data to conduct competitive analysis, a type of analysis conducted by professional analysts that involves comparing standardized metrics of one company with those of similar companies. Because companies report metrics differently – and sometimes report on different metrics altogether – standardizing the key metrics for each company can be a cumbersome process.

Visible Alpha Insights includes analyst data, company data, and industry data at a level of granularity unparalleled in the market. Our industry data – Standardized Industry Metrics – enables market participants to quantify and compare market expectations for companies across 150+ industries.

Data as of January 2023

Industry KPI Terms & Definitions

Visible Alpha offers an innovative, integrated experience through real-time, granular consensus estimates and historical data created directly from the world’s leading equity analysts. Using a subset of the below KPIs, this data can help investors hone in on the key drivers of companies to uncover investment opportunities. Learn More >

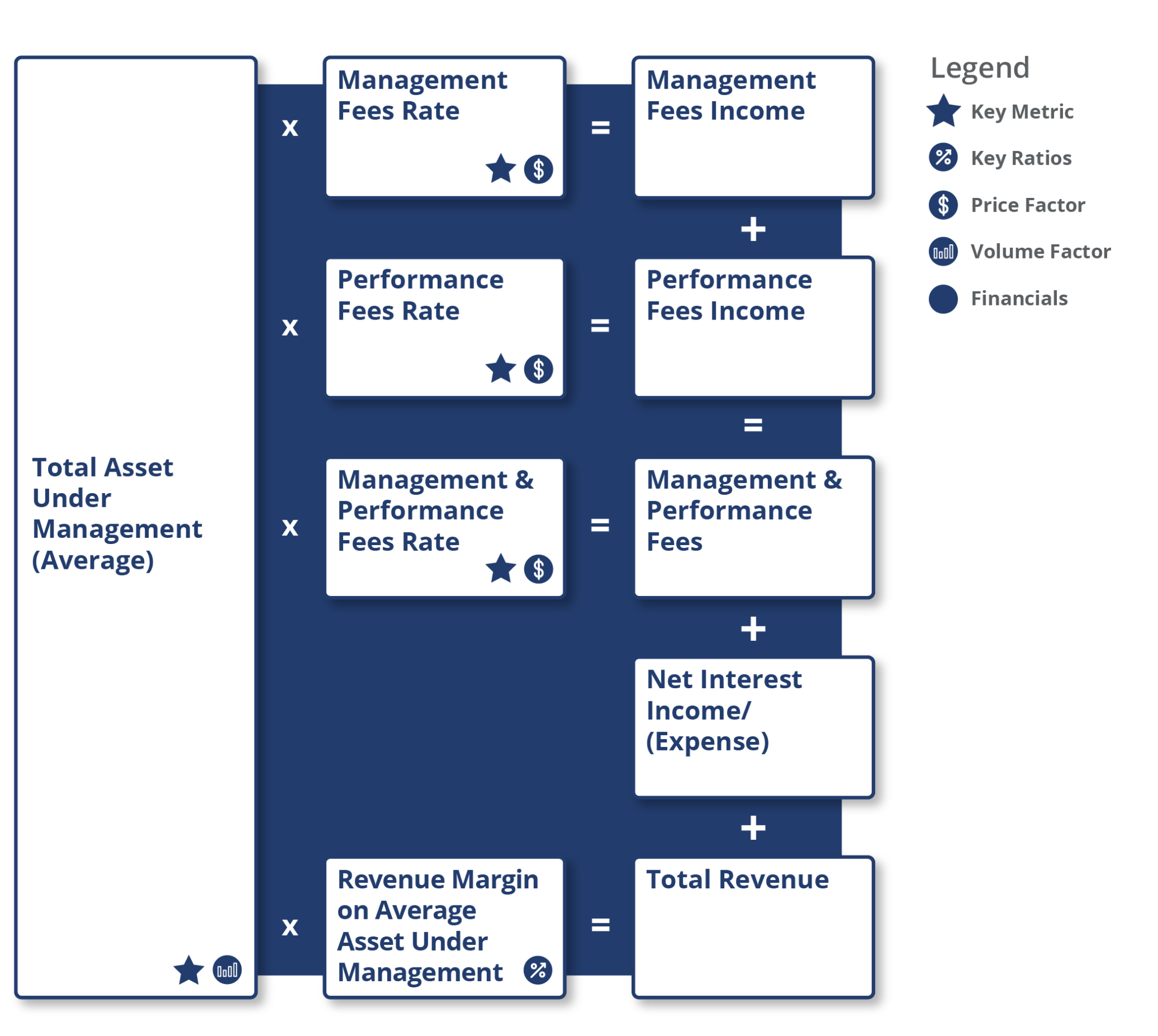

Management Fees

Management fees are charged as a percentage of assets under management (AUM) and are received by the asset manager on a monthly or quarterly basis.

Performance/Incentive Fees

Performance/incentive fees are received by an investment advisor depending on the fund’s performance in a given period, relative to various predetermined benchmarks.

Fee and Commissions Income

Fee and commissions income comprises management fees, performance fees, and other fees charged by asset management companies for the assets they manage on behalf of their clients.

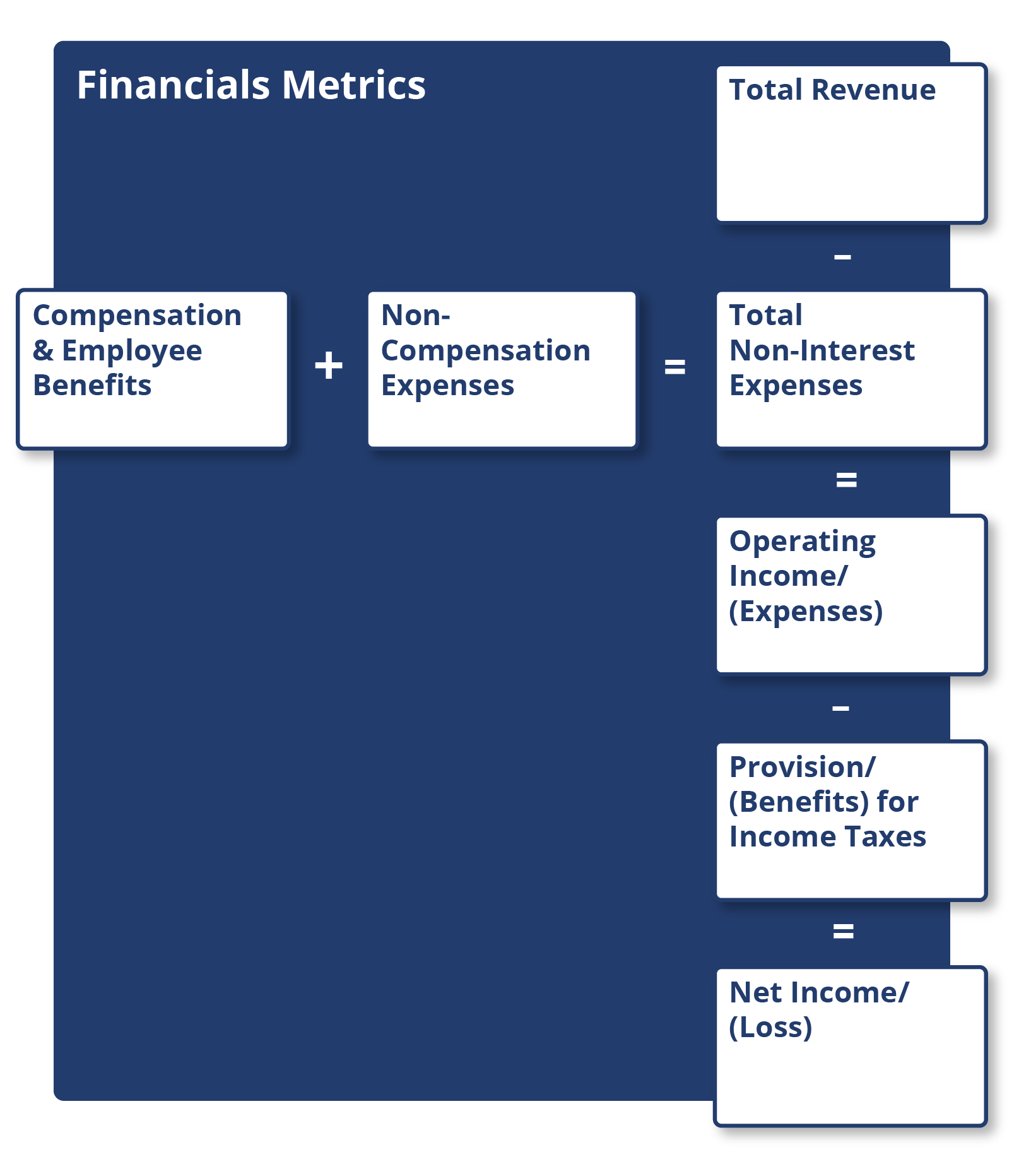

Total Revenue

Total revenue includes fees charged by asset managers to manage the fund which includes Management and performance fees and distribution service fees for asset management companies.

Operating Income /(Loss)

Operating income is the amount of profit generated from the operations of an asset management company, after deducting operating expenses such as compensation, distribution cost, and other general and administrative expenses.

Net Income Applicable To Common Stockholders

Net income applicable to common stockholders is the amount of revenue a company reports after tax and dividend payments are deducted from the total income earned.

Earnings Per Share (EPS)

Earnings per share (EPS) is computed by deducting preferred stock dividends from a company’s net income. Diluted EPS is a calculation used to understand the quality of a company’s EPS if all convertible securities were exercised.

Common Stock Dividends Per Share

Common stock dividends per share are the number of declared dividends issued by a company for every common share outstanding.

Total Stockholders Equity Including Minority Interest

Total stockholders equity including minority interest is the remaining amount of assets available to shareholders after all liabilities have been paid.

Efficiency Ratio

Efficiency ratio is a key measure of productivity and cost control. It is defined as non-interest expenses as a percentage of total revenue. Other terms used for the efficiency ratio are cost-to-income ratio and expense ratio.

Dividend Payout Ratio

Dividend payout ratio is dividends declared per common share as a percentage of diluted earnings per common share.

Total Payout Ratio

Total payout ratio is total common dividends declared plus common stock repurchases as a percentage of net income available to common shareholders.

Return On Average Assets

Return on average assets is net income applicable to common shareholders as a percentage of average assets. It shows the management’s ability to generate a return over the assets it controls.

Return On Average Equity

Return on average equity is net income applicable to common shareholders as a percentage of average common shareholders’ equity. It shows management’s ability to generate a return on shareholders’ equity. This ratio can be compared to peers and against the cost of equity capital to identify asset managers’ ability to create shareholder value.

Management Fee Rate

Management fee rate is calculated as annualized management fee income divided by average assets under management (AUM).

Performance Fee Rate

Performance fee rate is calculated as annualized performance fee income divided by average assets under management (AUM).

Net New Flows

Net flows represent assets acquired and withdrawn by a client within a specified period. Net flow is a major driver of change to assets under management (AUM).

Net Market Appreciation/(Depreciation)

Net market appreciation/(depreciation) reflects how the market fluctuations impact a fund’s assets. This indicator will rise when the asset generates positive returns and will fall when it generates a negative return.

Foreign Currency Translation

Foreign currency translation reflects the impact of translating foreign-denominated AUM into domestic currency for reporting purposes.

Net Market Performance & FX Impact

Net market performance & FX impact is the total of net market appreciation/(depreciation) and FX movements.

Average Assets Under Management (AUM)

Average Assets under management (AUM) is the average of the Total asset under management of an asset management company.

Beginning Assets Under Management (AUM)

Beginning AUM is the ending value of the total assets under management (AUM) in the previous period.

Total Assets Under Management (AUM)

Total Assets under management (AUM) is the sum of the market value for all of the investments managed by an asset management company.

AUM Organic Growth Rate

Assets under management (AUM) organic growth rate represents growth in the size of assets under management due to the addition of new client money and withdrawals. It is calculated as net new flows divided by beginning assets under management.

Download this guide as an ebook today:

Guide to Asset Management Industry KPIs for Investment Professionals

This guide highlights the key performance indicators for the asset management industry and where investors should look to find an investment edge, including:

- Asset Management Industry Business Model & Diagram

- Key Asset Management Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions