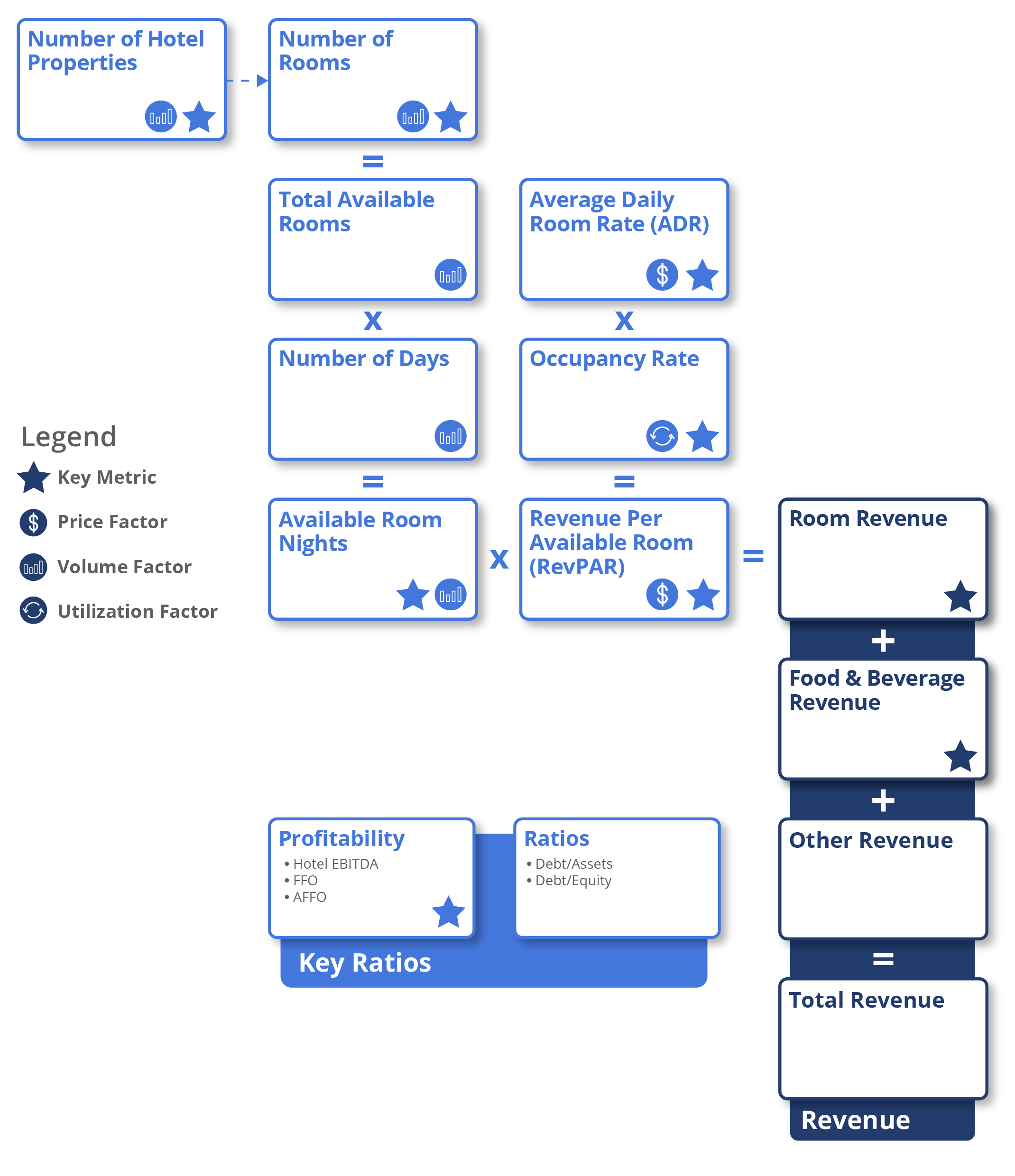

Number of hotel properties is the total number of hotels owned by a hotel & resort REIT.

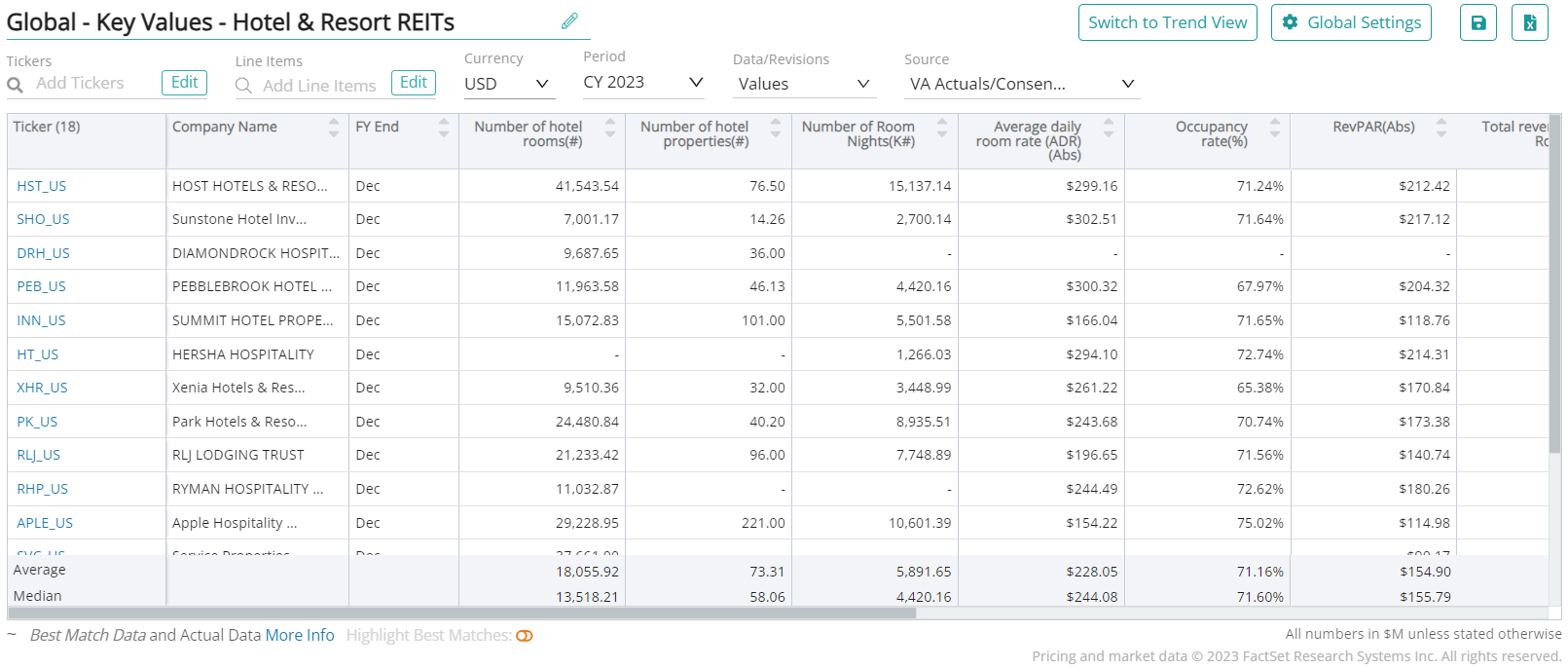

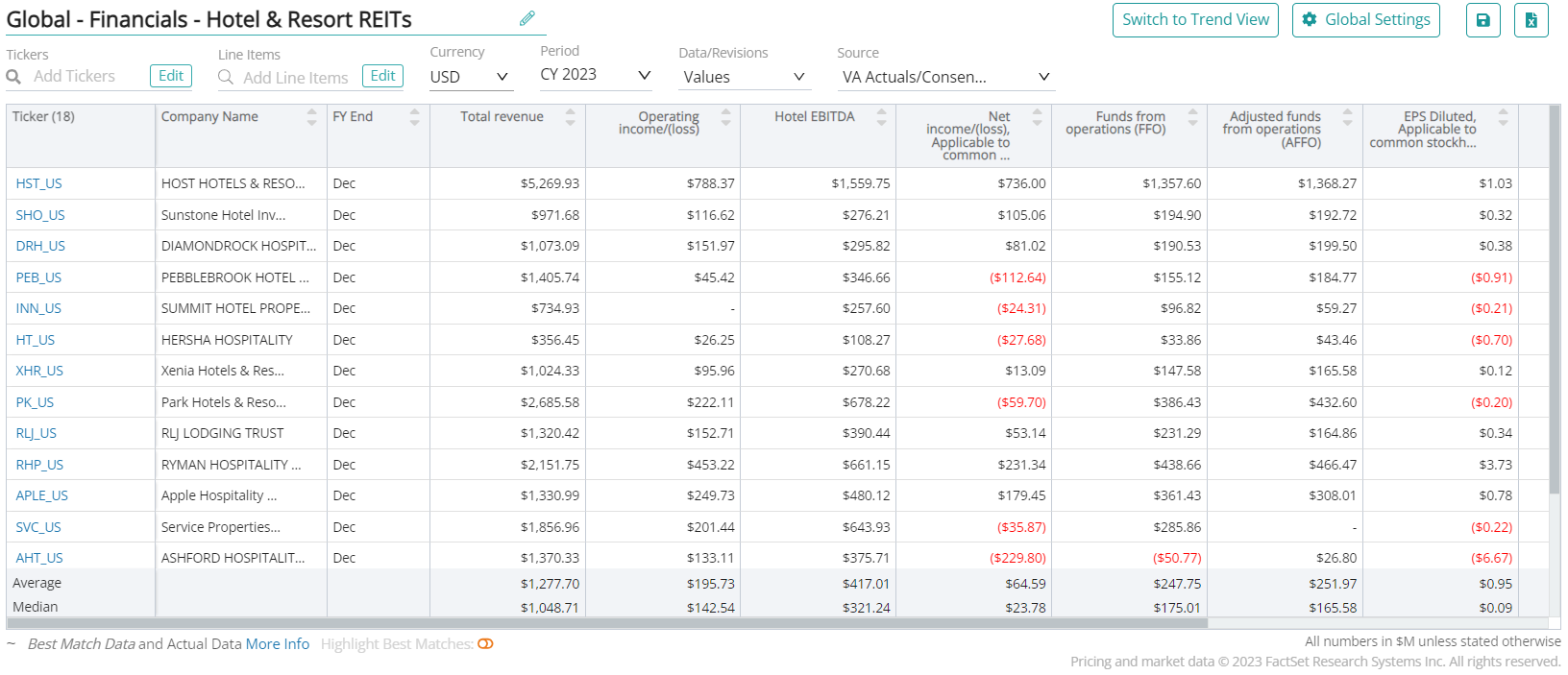

Key performance indicators (KPIs) are an industry’s most important business metrics. When understanding market expectations for the hotel REITs industry, whether at a company or industry level, some KPIs to consider include:

Visible Alpha’s Standardized Industry Metrics

To understand market expectations for the hotel REIT industry, sell-side analyst estimates and consensus forecast data are key information sources. The buy-side, sell-side, and public companies leverage this type of data to conduct competitive analysis, a type of analysis conducted by professional analysts that involves comparing standardized metrics of one company with those of similar companies. Because companies report metrics differently – and sometimes report on different metrics altogether – standardizing the key metrics for each company can be a cumbersome process.

Visible Alpha Insights includes analyst data, company data, and industry data at a level of granularity unparalleled in the market. Our industry data – Standardized Industry Metrics – enables market participants to quantify and compare market expectations for companies across 150+ industries.

Data as of May 2023

Industry KPI Terms & Definitions

Visible Alpha offers an innovative, integrated experience through real-time, granular consensus estimates and historical data created directly from the world’s leading equity analysts. Using a subset of the below KPIs, this data can help investors hone in on the key drivers of companies to uncover investment opportunities.

Number of Hotel Properties

Number of hotel properties is the total number of hotels owned by a hotel & resort REIT.

Number of Rooms

Number of rooms is the total number of rooms available in a property owned or managed by a hotel & resort REIT.

Number of Room Nights

Number of room nights are the number of rooms available multiplied by the number of days in a given period. It is used as a measure of capacity in the hotel industry.

Occupancy Rate

Occupancy rate measures the utilization or occupancy of available rooms in a hotel during a specific period, often expressed as a percentage. It is calculated by dividing the number of rooms occupied by the total number of rooms available in a given period.

Average Daily Room Rate (ADR)

Average daily rate (ADR) is the average price or rate at which each hotel room was sold for a specific day. ADR is also a financial indicator to measure how successful the performance of a hotel is compared to other hotels with similar offerings, such as hotel size, amenities, services, location and the hotel’s historical trend.

Revenue Per Available Room (RevPAR)

Revenue per available room (RevPAR) is calculated by multiplying a hotel’s occupancy rate by its average daily rate (ADR). RevPAR is also derived by dividing a hotel’s total room revenue by the total number of available rooms.

Funds From Operation (FFO)

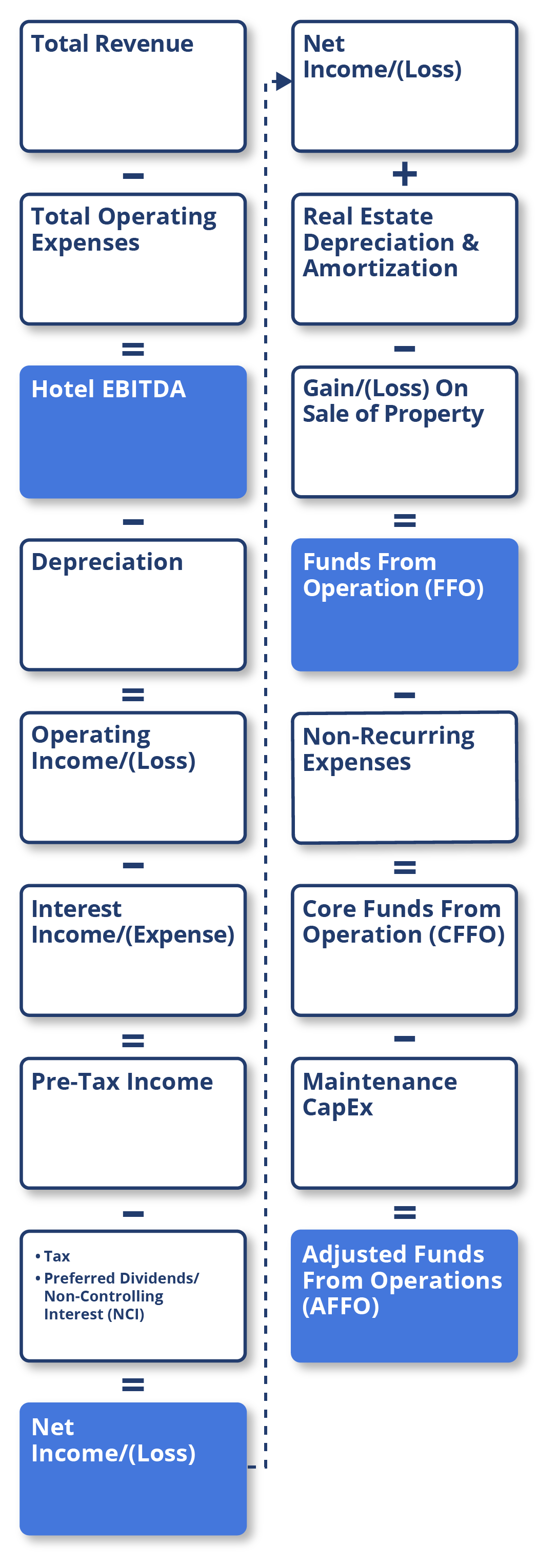

Funds from operations (FFO) is useful to investors in measuring the operating and financial performance of a REIT company. It is calculated as net income applicable to common stockholders excluding non-cash adjustments.

Core Funds From Operations (CFFO)

Core funds from operations (CFFO) measure the cash flow generated by a REIT’s core operating activities. CFFO is calculated as FFO minus non-core and non-recurring items. The value of CFFO is obtained by making one-time adjustments to the FFO.

Adjusted Funds From Operations (AFFO)

Adjusted funds from operations (AFFO) is a financial measure used to estimate the value of a REIT. It is calculated as FFO minus capital expenditures and maintenance capex.

Average Cost of Debt (%)

Average cost of debt is a measure of the average interest rate paid to fund the business. It is calculated as interest expense paid divided by average debt (secured and unsecured loans and revolving credit facilities).

Hotel EBITDA

Hotel EBITDA is a hotel’s operating income, which includes revenue generated from room sales, food and beverage services, and other core hotel operations, minus all operating expenses (such as employee wages, utilities, and maintenance) but excluding interest, taxes, depreciation, and amortization.

Hotel EBITDA Margin

Hotel EBITDA margin measures a hotel’s profitability as a percentage of its total revenue.

Room Revenue

Room revenue is revenue generated from rooms, calculated by multiplying the total number of room nights by RevPAR.

Food & Beverages Revenue

Food & beverage revenue is revenue generated from on-site restaurants, bars, cafes, and room service.

Download this guide as an ebook today:

Guide to Hotel REIT Industry KPIs for Investment Professionals

This guide highlights the key performance indicators for the hotel REIT industry and where investors should look to find an investment edge, including:

- Hotel REIT Industry Business Model & Diagram

- Key Hotel REIT Industry Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions