Net earned premium is the premium earned on the portion of an insurance contract that has expired. Although insurance premiums are often paid in advance, insurance companies earn the premium at an even rate throughout the policy’s term. The unearned portion of a premium that has been paid for forms a part of the unearned premium reserve.

Property and Casualty Insurance Industry Introduction

Property insurance is first-party insurance, providing coverage for loss related to a policyholder’s property. Property insurance products are generally short-tailed as they demand settlements within a short period. These insurances also cover risks from natural disasters.

Products under this line of business include:

- Homeowners insurance

- Fire and allied insurance

- Farmowners’ multiple peril insurance

- Crop insurance

- Commercial multiple peril insurance

- Inland and ocean marine insurance

- Earthquake insurance

- Warranty and burglary insurance

Casualty or liability insurance is third-party insurance, providing coverage to a policyholder against the claims made by others in the event of an injury, or property damage for which the policyholder is found responsible. Casualty insurance products are generally long-tailed as they have a longer payout period, with claim settlements that could extend beyond 10 years.

Products under this line of business include:

- Professional liability insurance

- Workers’ compensation

- Private and commercial automobile insurance

- Aviation insurance

- Surety and fidelity bonds

Personal and Commercial Business Lines

Personal lines policies cover insurance products related to property and casualty that are written for both individuals and families. Products under this line of business include:

- Homeowners insurance, a form of property insurance, covers an individual against losses from damages to the policyholder’s residence and other personal assets in the residence. Liability coverage against accidents in the policyholder’s residence or property is also included in homeowners insurance.

- Automobile insurance covers the policyholder against financial loss in the event of an accident or theft of the insured vehicle. This insurance offers coverage for both vehicle and property damage caused in the event of an accident, along with legal responsibility to others for physical injury, property damage, medical expenses and sometimes lost wages and funeral expenses.

- Personal liability insurance covers individual policyholders from claims made by others of physical injury or property damage caused either at the policyholder’s residence or outside of their residence.

- Lastly, personal lines policies also include farm owners’ insurance, boat insurance, and renters insurance, among others.

Commercial lines policies cover insurance products related to property and casualty that are written for businesses. Products under this line of business include:

- Commercial general liability insurance is a comprehensive policy that provides coverage to a business for any kind of injury or property damage caused by the business’ operations or products. It also provides coverage to a business in the event of an on-premise injury.

- Inland and ocean marine insurance provides coverage to businesses for their products, materials, and equipment while they are being transported on land, in shipping vessels, or in cargoes.

- Aviation or aircraft insurance covers losses arising from aviation risks. Aviation risks include aircraft maintenance and other related risks such as aircraft property damage, loss of cargo, or injury to people. This policy protects both the owners and the operators of the aircraft from unexpected losses.

- Professional liability insurance covers professionals such as doctors, lawyers and engineers from legal liabilities arising from negligence, malpractice or misinterpretation, and other claims initiated by their clients.

- Workers’ compensation insurance covers the medical expenses and compensates a portion of lost wages of employees injured while on the job. The insurance also protects employers from lawsuits by the injured employee.

- Surety bonds, also known as bond guarantees, are a form of financial credit. A surety bond is a contract between three parties: the obligee, the principal, and the surety. The obligee (the party to whom the bond is paid, in the event of a default) gets protection by the bond against losses, which may result from the principal’s (the party with the guaranteed obligation) failure to perform its obligation, limited up to the amount of the bond. The surety (the insurance company) accepts the obligation if the principal cannot.

- Commercial lines policies also include commercial property insurance, crime insurance, boiler and machinery, and commercial automobile insurance, among others.

Corporate Structures

In the P&C insurance industry, companies are organized under a variety of corporate structures that include publicly traded companies, mutual companies, or other corporate entities.

Publicly traded companies are companies whose ownership lies with the investors and not with the insured policyholders. Profits are not invested in the policyholders’ general reserve but instead are distributed amongst the shareholders.

Mutual companies are privately held companies that are 100% owned by the policyholders. Policyholders pool resources to provide insurance coverage to their members and hire managers to run the company on their behalf. Profits are either reinvested in the company’s reserve fund or are distributed as dividends to policy owners.

Other corporate entities include Lloyd’s operations, reciprocal exchange, and state guarantee funds. Lloyd’s is not an insurance company, but an insurance and reinsurance market where members come together to insure risks. Reciprocal exchange is an unincorporated association in which members (as individuals, partnerships, trustees, or corporations) exchange contracts and pay premiums through an attorney-in-fact (AIF) to insure each other. A state guarantee fund is administered by the U.S. states to protect policyholders in the event of an insurance company defaulting on benefit payments or filing for bankruptcy.

P&C Industry Business Model

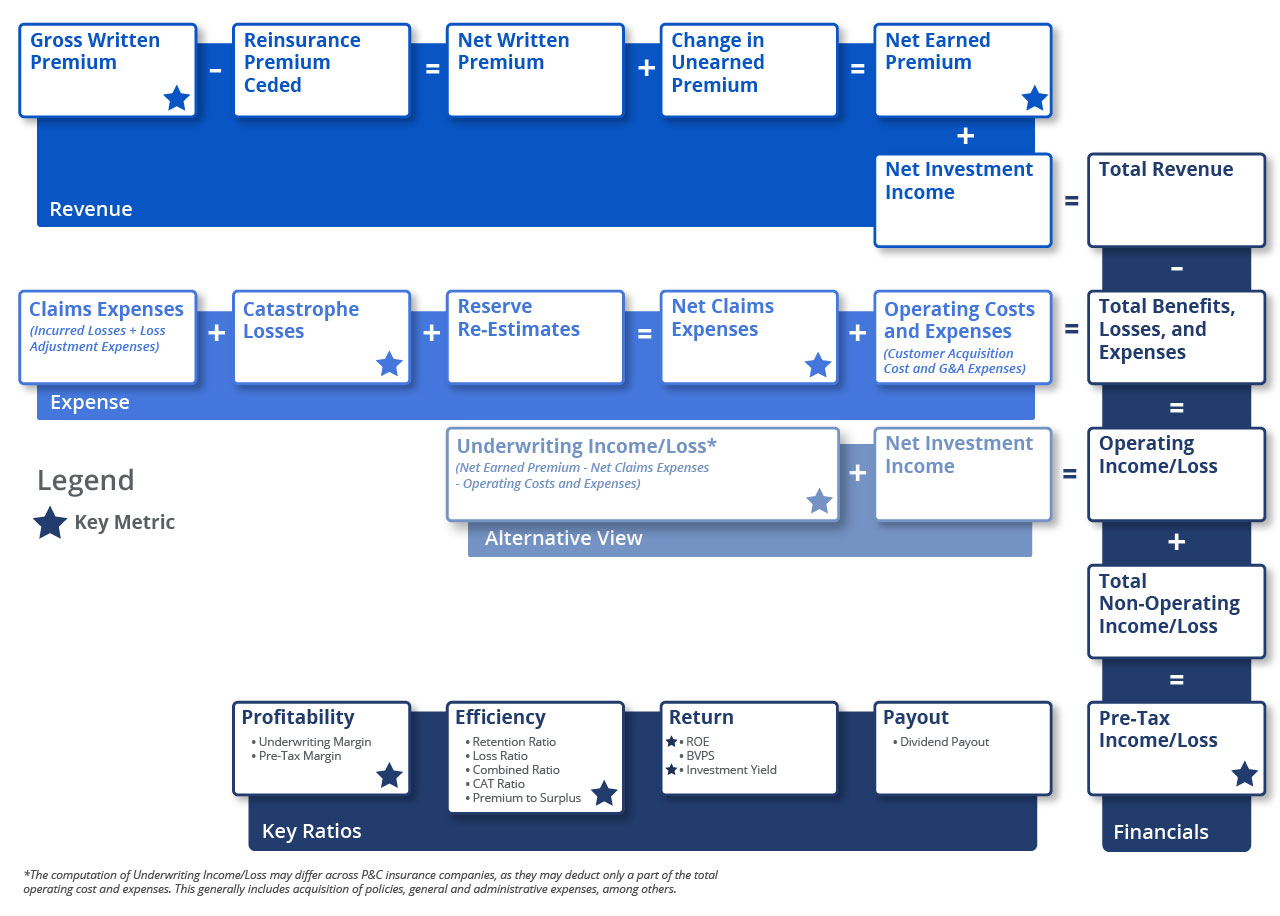

A property and casualty insurance company has three main sources of revenue or income: underwriting income, interest and dividend income, and other income (which typically includes realized gains from the sale of securities).

PREMIUM REVENUE

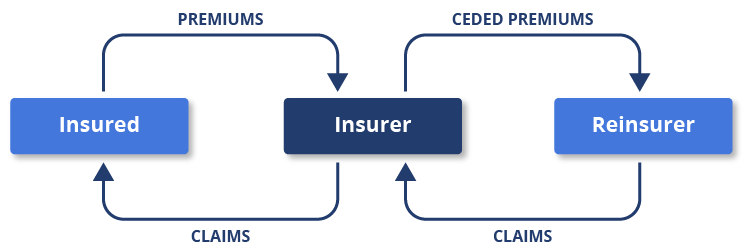

When an insurance company underwrites a policy, it charges a premium called the gross written premium (GWP). To manage the risk along with its capital needs, most insurance companies buy reinsurance by paying a ceding premium to a reinsurer. This premium is called the reinsurance premium ceded.

Net written premium (NWP) is what an insurance company is left with after paying the reinsurance premium; in other words, it is the gross premiums written by the insurance company minus the ceding premium, plus any reinsurance assumed.

The premium earned on the portion of an insurance contract that has expired is called net earned premium (NEP). These premiums are typically earned on a pro-rata basis over the life of a policy. Earned premiums are a major source of revenue for an insurance company. From an accounting and financial modeling perspective, the earned premium is calculated as NWP plus the net change in unearned premium.

An unearned premium is a premium collected by an insurance company, where the underlying portion of the insurance contract has not expired. In the case of premature termination of a contract, these premiums are returned to the policyholder.

POLICY-RELATED EXPENSES

Incurred losses can be in the form of either paid claims (the amount paid to the policyholders) or expenses associated with establishing a loss reserve to pay a claim in the future.

A loss reserve is a liability on an insurance company’s balance sheet. When a claim that has been reserved is paid, the loss reserve, as well as the cash, shrinks by that amount.

Along with the paid claims, an insurance company must also pay, or reserve for, loss adjustment expenses (LAE), which are reserves set aside for legal fees to investigate and settle insurance claims. Incurred losses along with loss adjustment expenses are recognized as total policy-related costs, which account for a major portion of the total costs and expenses of an insurance company and vary depending on the line of insurance business.

Policy-related costs may also include catastrophe losses and reserve re-estimates (change in reserves during a period).

Catastrophe losses arise from infrequent events that cause severe losses, injury, and/or property damage to a large population, as in the case of natural disasters. For P&C insurers, catastrophe losses can lead to large losses, impacting capitalization and requiring a distinct risk management approach. Catastrophe losses can create significant financial pressures for an insurance company, reducing earnings and statutory surpluses, possibly forcing asset liquidation to meet cash needs, and bearing the risk of a rating downgrade.

Reserve re-estimates are the changes in loss reserves. Loss reserves are typically the largest liability on a P&C insurance company’s balance sheet and are evaluated closely when analyzing the financial statements. Loss reserves are established for both claims that have been reported to the insurance company (case reserves) and for claims that are yet to be reported to the insurance company (incurred but not reported, or IBNR). When premiums increase for a P&C insurer, risk exposures also increase and the associated loss reserves expand.

The number of catastrophe losses and an increase/(decrease) in loss reserves (i.e. reserve re-estimates) have a direct impact on policy-related costs and simultaneously on operating incomes. An increase in catastrophe losses or reserves impacts policy-related costs positively and operating income negatively. The reserve level maintained by P&C insurance companies is highly subjective and could vary depending on the management’s decisions. In terms of disclosures, certain jurisdictions require insurance companies to disclose their annual P&C reserves in detail.

OTHER FINANCIAL STATEMENT ITEMS

Operating costs and expenses include expenses related to customer acquisitions and other general and administrative expenses.

When premium revenue is sufficient to cover both underwriting expenses and claims, an insurance company generates an underwriting income. On the contrary, when the premium revenue is insufficient, it generates an underwriting loss. The process of underwriting involves collecting premiums, paying for losses and paying underwriting expenses.

Net investment income is the second most important contributor to total revenue for most insurance companies, after earned premiums. Between collecting premiums and paying claims and expenses, there is an interval when an insurance company invests funds collected as premiums in various securities and investment vehicles. The interest and dividend income generated from these investments account for a bulk of the overall operating earnings for most insurers.

The earnings stability that P&C insurers are known for often comes from the predictable and highly recurring nature of their investment income. However, the returns earned and the long-term growth of their investments depend on the level of interest rates.

Other income/loss typically represents realized gains (or losses) generated from the sale of securities or credit impairments, which also contribute to the revenue of P&C insurers. Although realized gains generally flow through the income statement of a P&C insurer and are added to retained earnings, they are not considered while computing operating earnings.

RATIOS USED TO ANALYZE P&C INSURANCE STOCKS

Retention ratio (net written premium / gross written premium) measures the efficiency of a P&C insurance company. It exhibits the percentage of businesses covered by the insurance company which is not transferred to the reinsurance companies. Companies with efficient underwriting decisions have higher retention ratios, which in turn drives higher profitability. However, reinsurance through risk spreading increases the stability of the company.

Loss ratio (policy-related costs / net premium earned) measures the underlying efficiency of a P&C insurance company and its ability to manage claims. A higher loss ratio indicates a higher number of paid claims, which can be an indicator of financial distress.

The combined ratio (loss ratio + expense ratio) measures the overall underwriting efficiency of a company. A combined ratio of 100% means that an insurer is breaking even on its underwriting activities.

The catastrophe ratio (catastrophe losses / net earned premium) measures catastrophic losses as a percentage of net earned premium. A higher catastrophe ratio will hit the underwriting earnings of the company which in turn hits the profitability of the company.

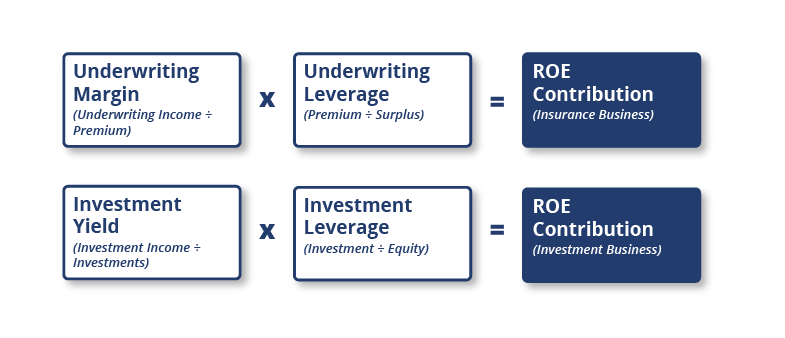

Return on equity (ROE) (net income/(loss) / average stockholders’ equity) measures the return per dollar on equity investments. Profitability for all business activities is measured through ROE. A lower ROE indicates poor underwriting discipline or less than adequate returns on investments relative to the cost of capital. The metrics used in the diagram below are often used by analysts to break down the ROE based on the contributions from core insurance operations (i.e. operations which exhibit underwriting efficiency) and from investment operations (i.e. operations which depict investing efficiency) of the P&C insurance business.

Premium-to-surplus ratio (premium written, net / (total assets – total liabilities)), also known as underwriting leverage, measures the efficiency with which an insurance company uses its capital resources to generate business. A relatively low premium-to-surplus ratio indicates the underutilization of capital, which means the company has more room for growth without having to dilute existing shareholders’ resources. Less volatile insurance products (such as personal auto insurance) have higher underwriting leverage while high volatile insurance products (such as property catastrophe insurance) have lower underwriting leverage. Aggressive underwriting may lead to significant losses, especially in soft markets, which are characterized by stable or falling premium rates, relaxed underwriting conditions, and increased capacity of an insurer, among other things). This ratio also measures a company’s exposure to pricing errors in its current book of business. Net written premium indicates potential losses due to underpricing of policies, while policyholder surplus indicates the cushion available to absorb such losses.

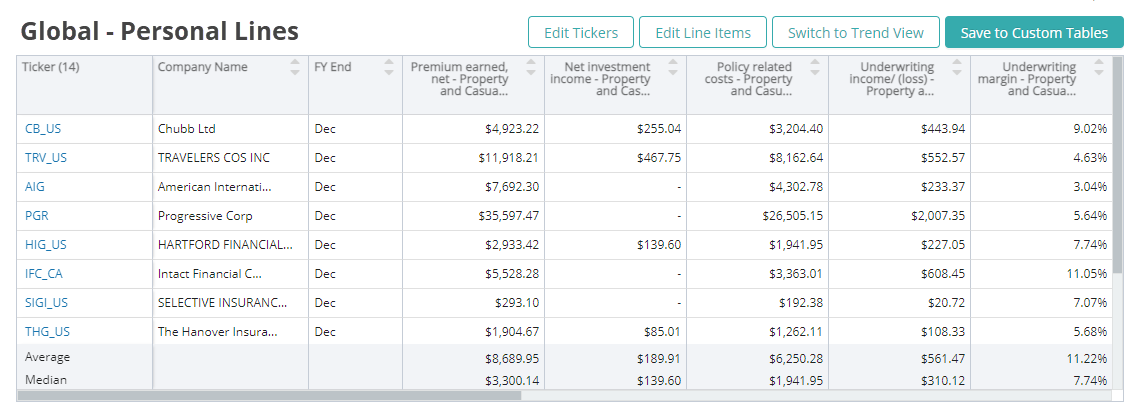

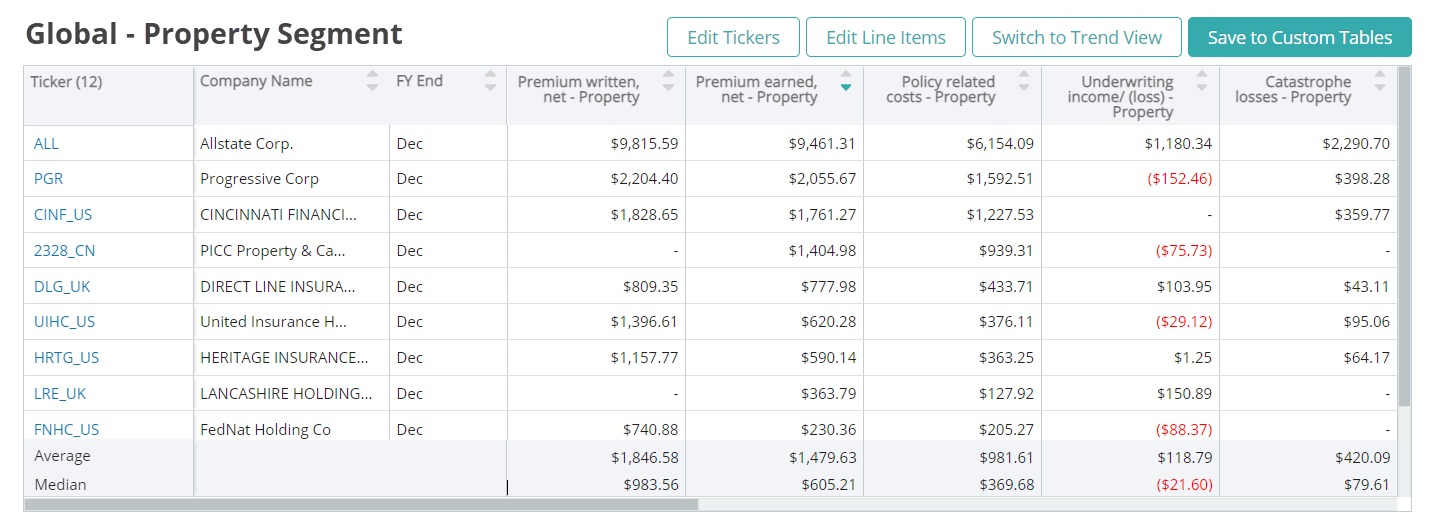

Underwriting margin (underwriting profit/(loss) / premium earned, net) measures the profit that a P&C insurer derives from insurance operations only (i.e. excluding investments).

Investment yield (net investment income / investments) measures the profitability of investments and purports to reflect the ability to manage investments successfully.

Investment leverage is defined as invested assets divided by equity. Invested assets are largely the investment portfolio built up from the premiums collected by a P&C carrier. The average of the P&C industry’s investment leverage depends on the length of the tail or the claims payout period.

Book value per share is a popular ratio for P&C insurance business and is measured as total stockholders’ equity excluding minority interest & preferred shares / number of shares outstanding. P&C insurance business is a capital intensive or balance sheet-based business, where book value per share is an important metric used for valuation purposes. Additionally, most assets and liabilities of P&C companies are constantly valued at market prices.

Tangible book value per share is an enhancement to book value per share and is measured as total stockholders’ equity excluding minority interest & preferred share – intangible assets / number of shares outstanding.

Return on assets (ROA) (net income/(loss) / average assets) is an indicator of how well a company utilizes its assets, determined by how profitable a company is with respect to its total assets. ROA gives a manager, investor, or analyst an idea of how efficient a company’s management is at utilizing its assets to generate earnings.

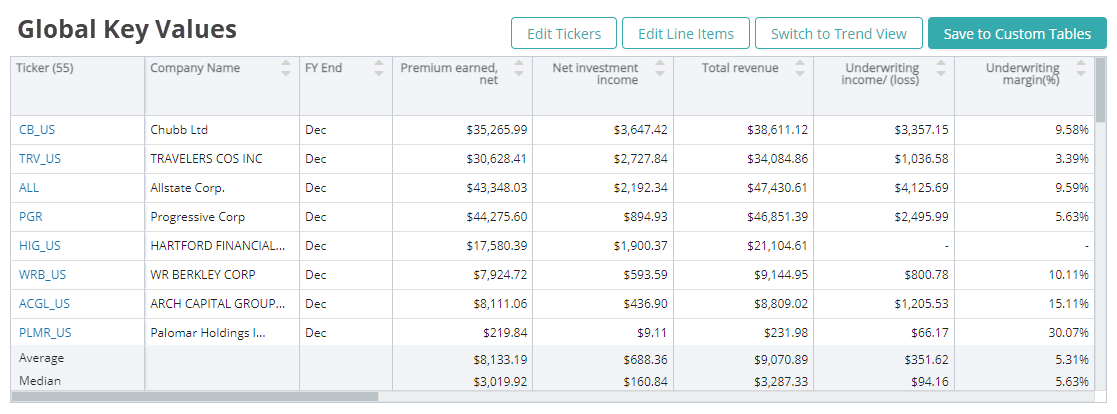

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for Property and Casualty Insurance, whether at a company or industry level, here are some of the P&C Insurance KPIs to consider:

Visible Alpha’s Standardized Industry Metrics

To understand market expectations for the P&C insurance industry, a key information source is sell-side analyst estimate and consensus forecast data. The buy side, sell side and public companies leverage this type of data to conduct competitive analysis, a type of analysis conducted by professional analysts that involves comparing standardized metrics of one company with those of similar companies. Because companies report metrics differently – and sometimes report on different metrics altogether – standardizing the key metrics for each company can be a cumbersome process.

Visible Alpha Insights includes analyst data, company data and industry data at level of granularity unparalleled in the market. Our industry data – Standardized Industry Metrics – enables market participants to quantify and compare market expectations for companies across 150+ industries.

Data as of January 2023

Industry KPI Terms & Definitions

Visible Alpha offers an innovative, integrated experience through real-time, granular consensus estimates and historical data created directly from the world’s leading equity analysts. Using a subset of the below KPIs, this data can help investors hone in on the key drivers of companies to uncover investment opportunities. Learn More >

Gross Written Premium (GWP)

Gross written premium is the total premium collected by an insurance company before adjusting reinsurance and ceding commissions. GWP also includes a gross policy premium, which is collected as of the issue date of the policy, regardless of the payment plan.

Net Written Premium (NWP)

Net written premium is the premium collected by an insurance company after adjusting reinsurance ceded.

Net Earned Premium (NEP)

Net earned premium is the premium earned on the portion of an insurance contract that has expired. Although insurance premiums are often paid in advance, insurance companies earn the premium at an even rate throughout the policy’s term. The unearned portion of a premium that has been paid for forms a part of the unearned premium reserve.

Net Investment Income

Net investment income is the income generated by an insurance company from investments, excluding investment-related expenses.

Policy-related Costs (aka Losses Incurred or Net Claims Incurred)

Policy-related costs are the total amount of claims paid by an insurance company which includes paid claims, or expenses associated with establishing a loss reserve to pay a claim in the future and loss adjustment expenses. It does not ordinarily include incurred but not reported (IBNR) losses.

Underwriting Income or Loss

Underwriting income/(loss) is the profit/(loss) generated by an insurance company by providing insurance or reinsurance coverage, excluding the profit or loss generated from investments.

Underwriting Margin

Underwriting margin is the margin or profit generated from underwriting activities.

Pre-tax Margin

Pre-tax margin is the margin or profit generated from pre-tax income.

Catastrophe Losses (CAT Loss)

Catastrophe losses are losses that arise from infrequent events causing severe losses, injury, and/or property damage to a large population, as in the case of natural disasters.

Re-estimates or Redevelopment Reserve

Reserve re-estimate is the increase/decrease in incurred claims and claims adjustment expenses as a result of re-estimation of claims and claims adjustment expense reserves at successive dates for a given set of policies.

Retention Ratio or Reinsurance Retention Ratio

Retention ratio measures the percentage of risk being carried by an insurance company as opposed to what has been passed to a reinsurer.

Loss Ratio

Loss ratio measures claims paid as a percentage of earned premiums. This ratio indicates the operating efficiency of a company.

Catastrophe Loss Ratio (or CAT Ratio)

Catastrophe loss ratio is the ratio of catastrophe losses to earned premiums.

Reserve Re-estimate Ratio

Reserve re-estimate ratio measures the change in reserves as a percentage of net earned premium. Change in reserves during the year is added to net claims incurred in the income statement. Thus, any change in reserves also impacts operating earnings.

Expense Ratio

Expense ratio measures the operational efficiency of a company and its ability to manage operating activities. A higher expense ratio will reduce the operating income of a company. Expenses include acquisition cost, servicing cost and other general and administrative expenses.

Combined Ratio

Combined ratio is the sum of the loss ratio to the expense ratio. A combined ratio of less than 100% generally indicates profitable underwriting by a company.

Loss Ratio excluding CAT Ratio and Reserve Re-estimate Ratio

Loss ratio excluding CAT and reserve re-estimate ratio measures the underwriting efficiency of a company after excluding catastrophe loss ratio and reserve re-estimate ratio. A higher ratio indicates higher claims excluding catastrophe losses and changes in reserves. This can be an indicator of poor claims management.

Combined Ratio excluding CAT Ratio and Reserve Re-estimate Ratio

Combined ratio excluding CAT and reserve re-estimate ratio measures the overall underwriting profitability of a company after excluding catastrophe ratio and reserve re-estimate ratio. A higher ratio implies larger claims or increased operating expenses and could be an indicator of poor claims and expense management.

Premium-to-Surplus Ratio

The premium-to-surplus ratio, also known as underwriting leverage, shows how effectively a company is using its capital resources to generate business.

Annualized Investment Yield

Annualized investment yield measures the profitability of invested assets of a P&C insurance company.

Return on Equity

Return on equity measures the return per dollar on equity investments.

Book Value per Share

Book value per share is used to measure the net value of a company’s assets as per the books of accounts that are available to the shareholders in case of liquidation of the company.

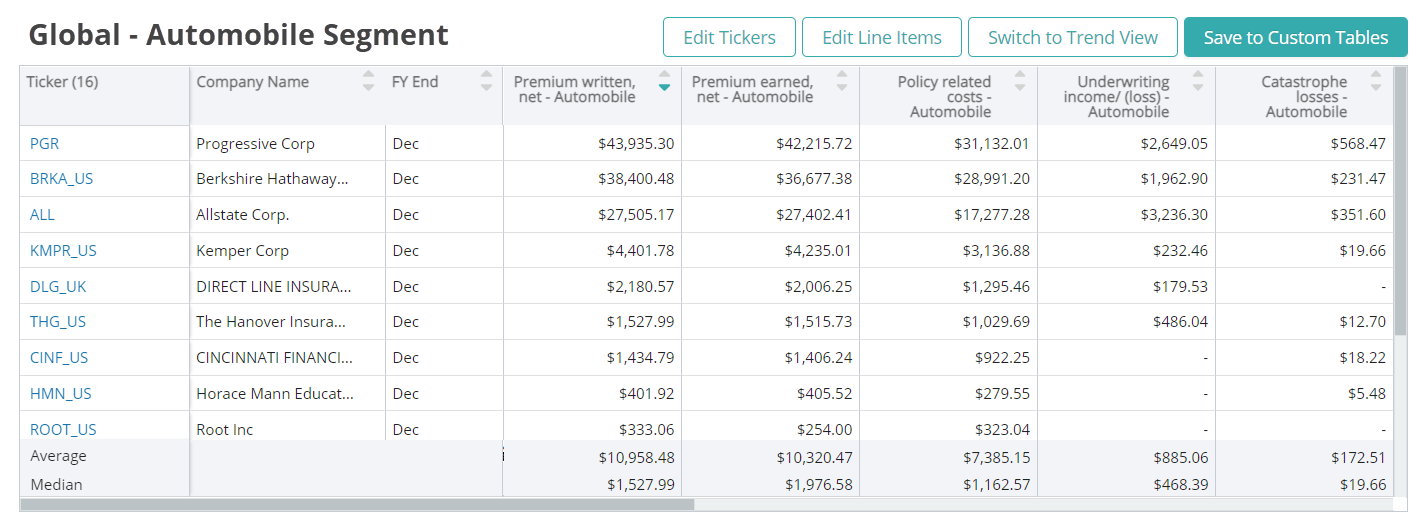

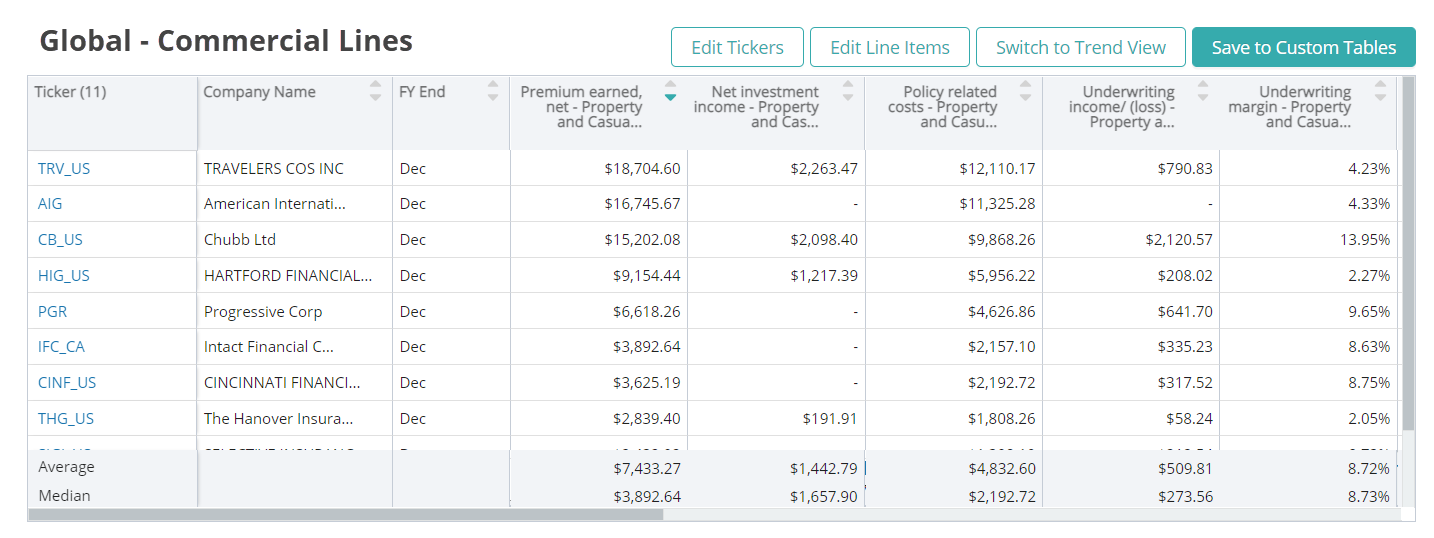

Segment Reporting

In addition to estimates of the consolidated business, analysts also produce forecasts for individual business and product lines. Some of the more commonly available metrics in our database include:

- Premium written, Net – Automobile, Personal

- Premium earned, Net – Automobile, Personal

- Policy related costs – Automobile, Personal

- Underwriting income/(loss) – Automobile, Personal

- CAT ratio – Automobile, Personal

- Reserve re-estimate ratio – Automobile, Personal

- Loss ratio excl. CAT and reserve re-estimate ratio – Automobile, Personal

- Loss ratio – Automobile, Personal

- Expense ratio – Automobile, Personal

- Combined ratio – Automobile, Personal

- Retention ratio – Automobile, Personal

Download this guide as an ebook today:

Guide to P&C Insurance KPIs for Investment Professionals

This guide highlights the key performance indicators for the P&C insurance industry and where investors should look to find an investment edge, including:

- Property and Casualty Insurance Industry Business Model & Diagram

- Key P&C insurance Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions