Senior living facilities, also known as retirement communities, are residential housing complexes designed for older adults who are generally able to care for themselves independently. These facilities cater to the unique needs and preferences of seniors, offering various levels of care, amenities, and services.

Key performance indicators (KPIs) are an industry’s most important business metrics. When understanding market expectations for the healthcare REIT industry, whether at a company or industry level, some KPIs to consider include:

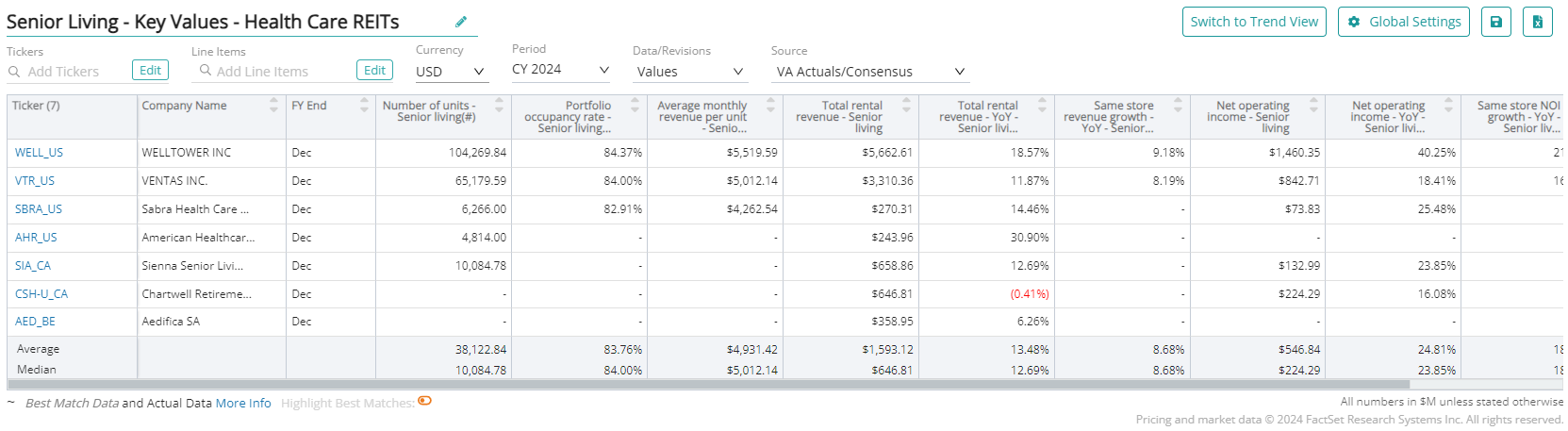

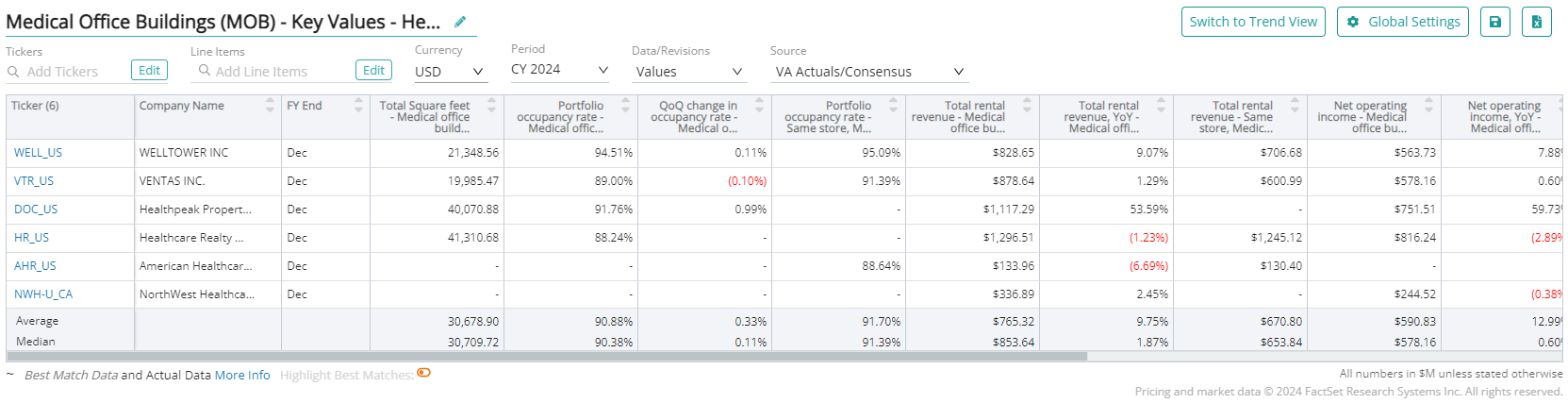

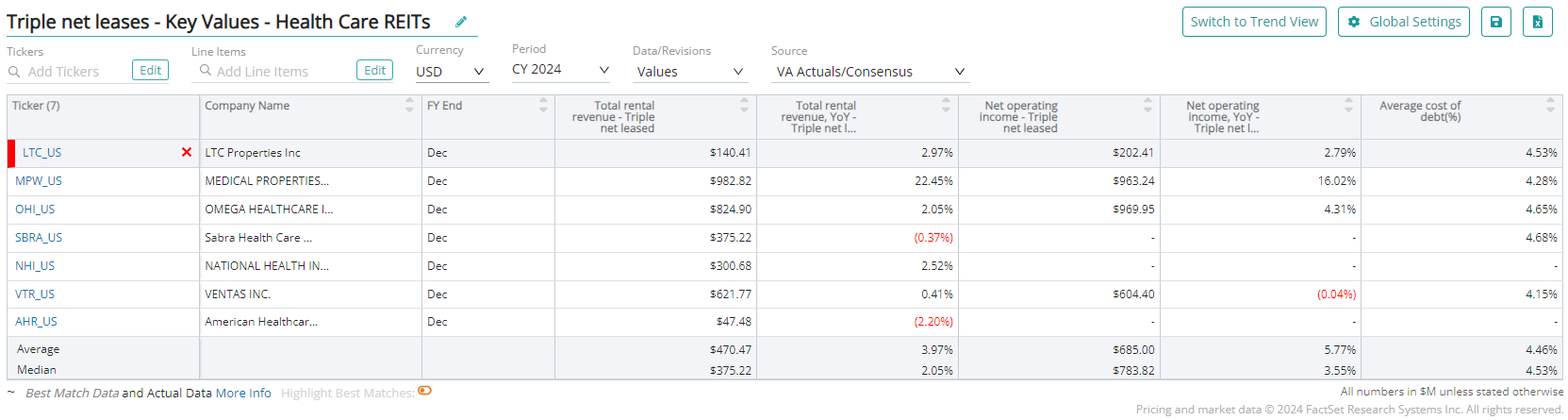

Visible Alpha’s Standardized Industry Metrics

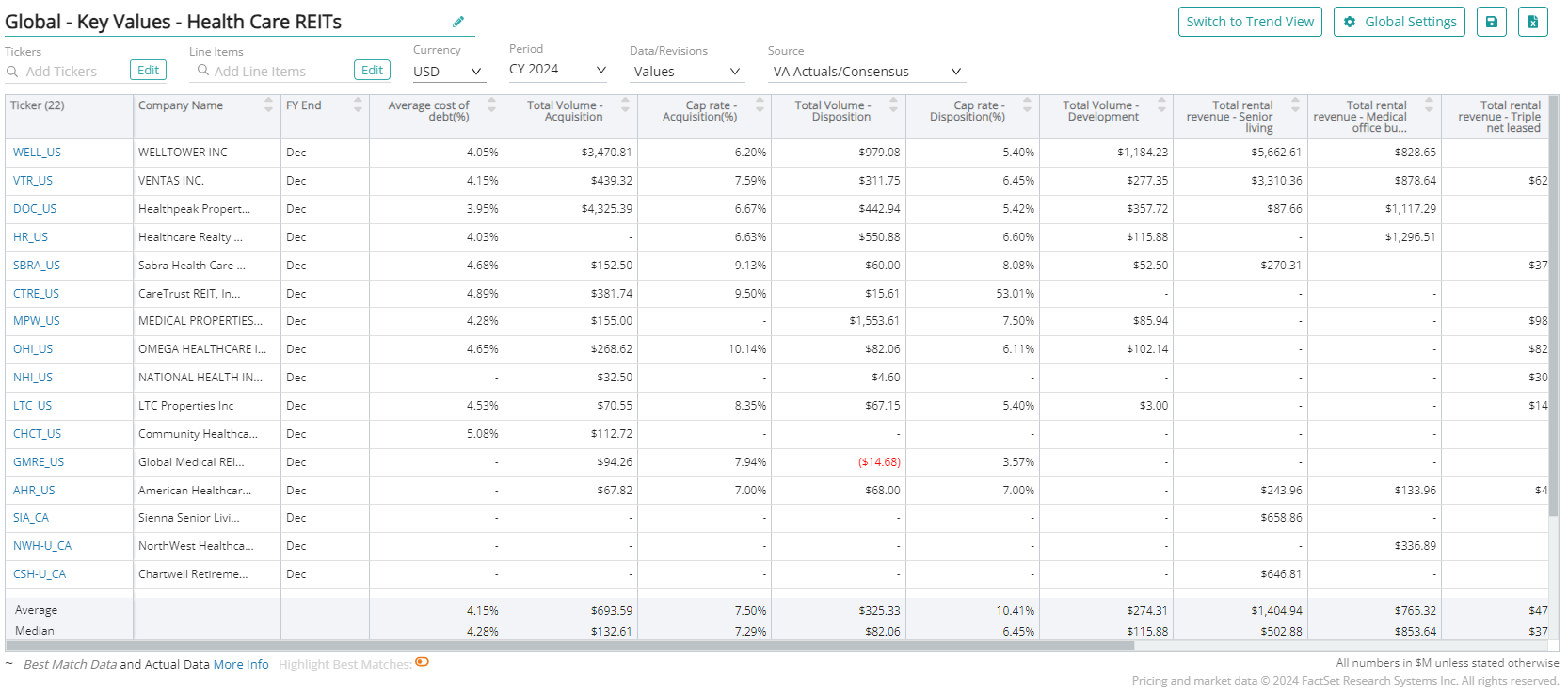

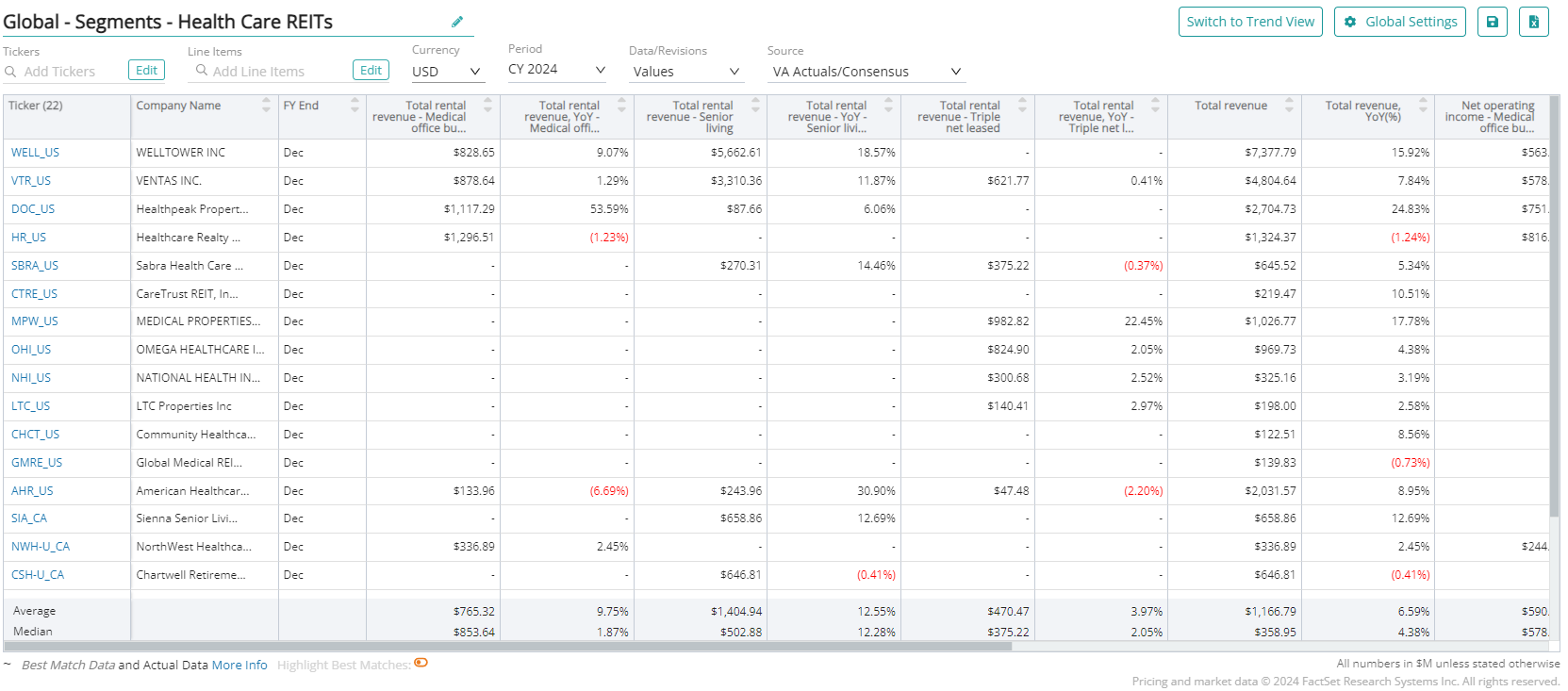

To understand market expectations for the healthcare REIT industry, sell-side analyst estimates and consensus forecast data are key information sources. The buy-side, sell-side, and public companies leverage this type of data to conduct competitive analysis, a type of analysis conducted by professional analysts that involves comparing standardized metrics of one company with those of similar companies. Because companies report metrics differently – and sometimes report on different metrics altogether – standardizing the key metrics for each company can be a cumbersome process.

Visible Alpha Insights includes analyst data, company data, and industry data at a level of granularity unparalleled in the market. Our industry data – Standardized Industry Metrics – enables market participants to quantify and compare market expectations for companies across 150+ industries.

Data as of April 23, 2024

Industry KPI Terms & Definitions

Visible Alpha offers an innovative, integrated experience through real-time, granular consensus estimates and historical data created directly from the world’s leading equity analysts. Using a subset of the below KPIs, this data can help investors hone in on the key drivers of companies to uncover investment opportunities.

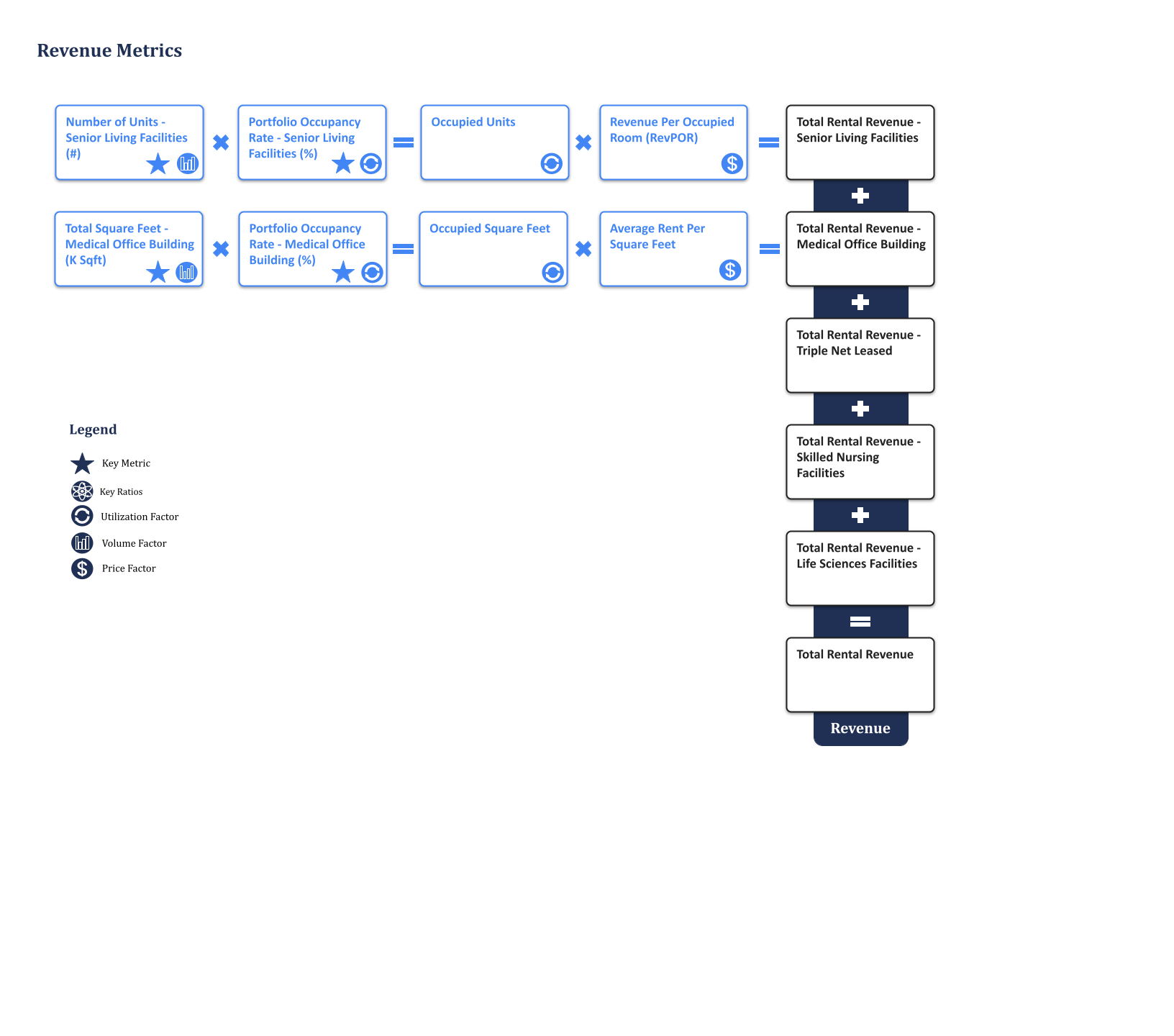

Senior Living Facilities

Senior living facilities, also known as retirement communities, are residential housing complexes designed for older adults who are generally able to care for themselves independently. These facilities cater to the unique needs and preferences of seniors, offering various levels of care, amenities, and services.

Medical Office Buildings (MOBs)

Medical office buildings (MOBs) are specialized commercial real estate properties designed and built for healthcare providers and related medical services. These buildings house a variety of medical practices, including physicians, dentists, specialists, outpatient clinics, diagnostic centers, laboratories, and other healthcare-related businesses.

Triple-Net Leased (NNN)

Triple-net leased (NNN) properties are commercial real estate leases in which the tenant agrees to pay all property expenses associated with the property in addition to the base rent. These expenses typically include property taxes, insurance, and maintenance costs, hence the term “triple net” or “NNN”.

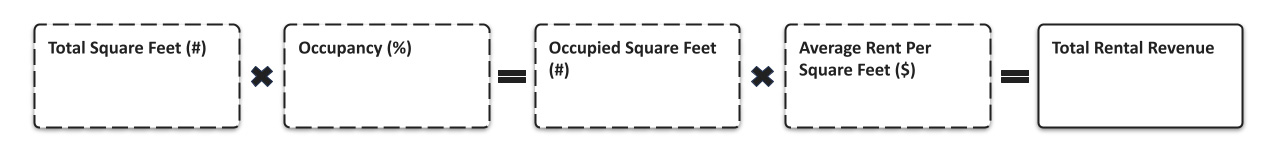

Total Square Feet (K)

Total square feet (K) is the total amount of floor space available for rent to retail tenants.

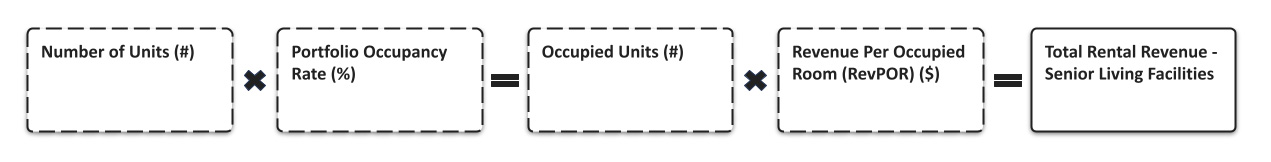

Number of Units

Number of units refers to the total count of individual properties or real estate assets within the REIT’s portfolio.

Total Occupied Units

Total occupied units refer to the total number of units within the REIT’s portfolio that are currently leased or rented out to tenants.

Portfolio Occupancy Rate

Portfolio occupancy rate measures the occupancy rate or the percentage area of a REIT’s property that has been leased. It is calculated as leased space divided by total leasable area. Portfolio occupancy rate is a measure of success that a REIT has had in attracting tenants and leasing the space it owns. The higher the occupancy rate for a REIT over time (compared to its peers), the better.

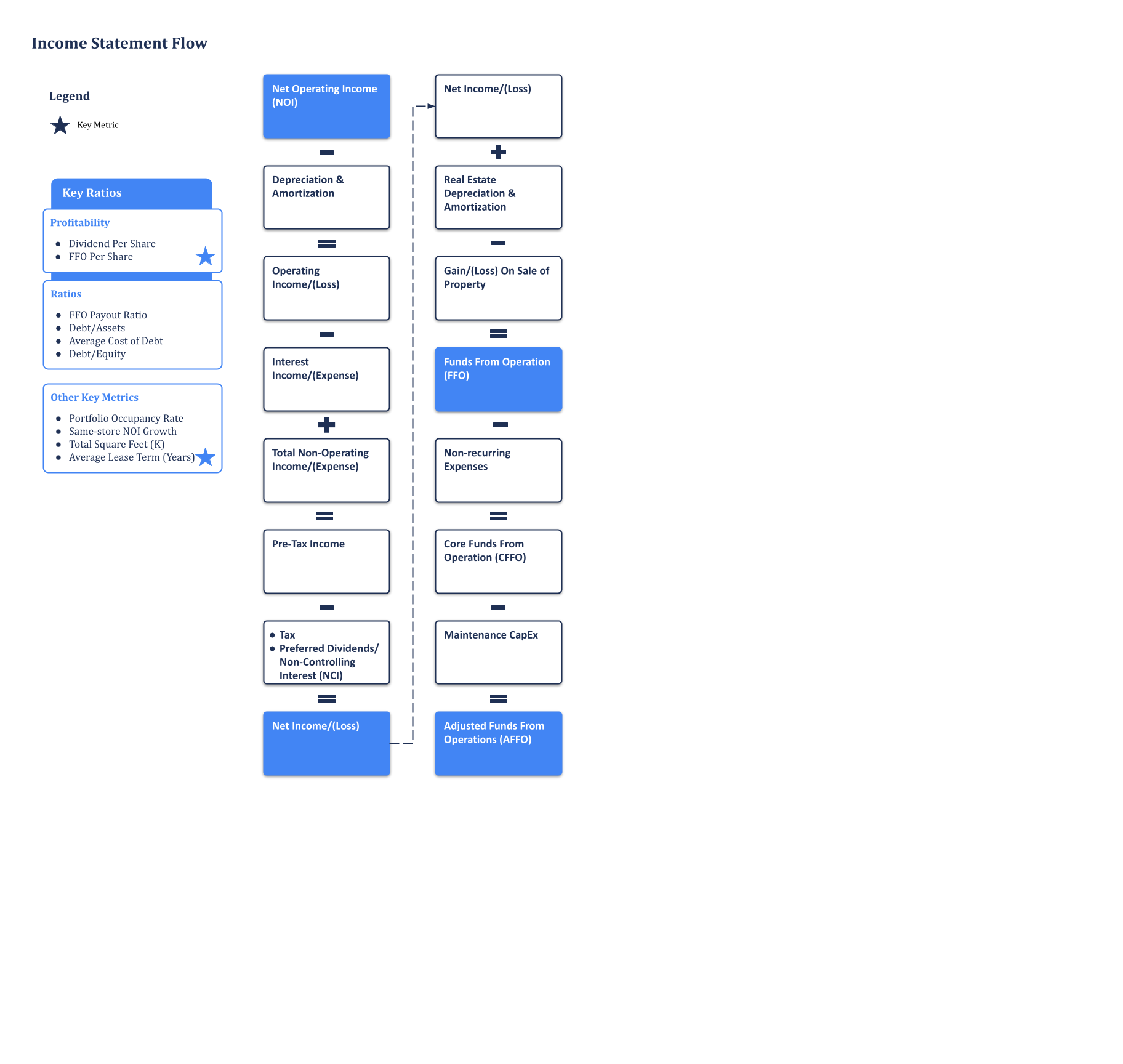

Funds From Operation (FFO)

Funds from operations (FFO) are useful to investors in measuring the operating and financial performance of a REIT. It is calculated as net income applicable to common stockholders excluding non-cash adjustments.

FFO Per Share

FFO per share measures the cash generated by a REIT’s operations. It is calculated as FFO divided by the total number of shares outstanding for a REIT.

Core Funds From Operations (CFFO)

Core funds from operations (CFFO) measure the cash flow generated by a REIT’s core operating activities. CFFO is calculated as FFO minus non-core and non-recurring items. The value of CFFO is obtained by making one-time adjustments to the FFO.

Adjusted Funds From Operations (AFFO)

Adjusted funds from operations (AFFO) is a financial measure used to estimate the value of a REIT. It is calculated as FFO minus capital expenditures and maintenance CapEx.

Average Cost of Debt (%)

Average cost of debt is a measure of the average interest rate paid to fund a business. It is calculated as interest expense divided by average debt (secured and unsecured loans and revolving credit facilities).

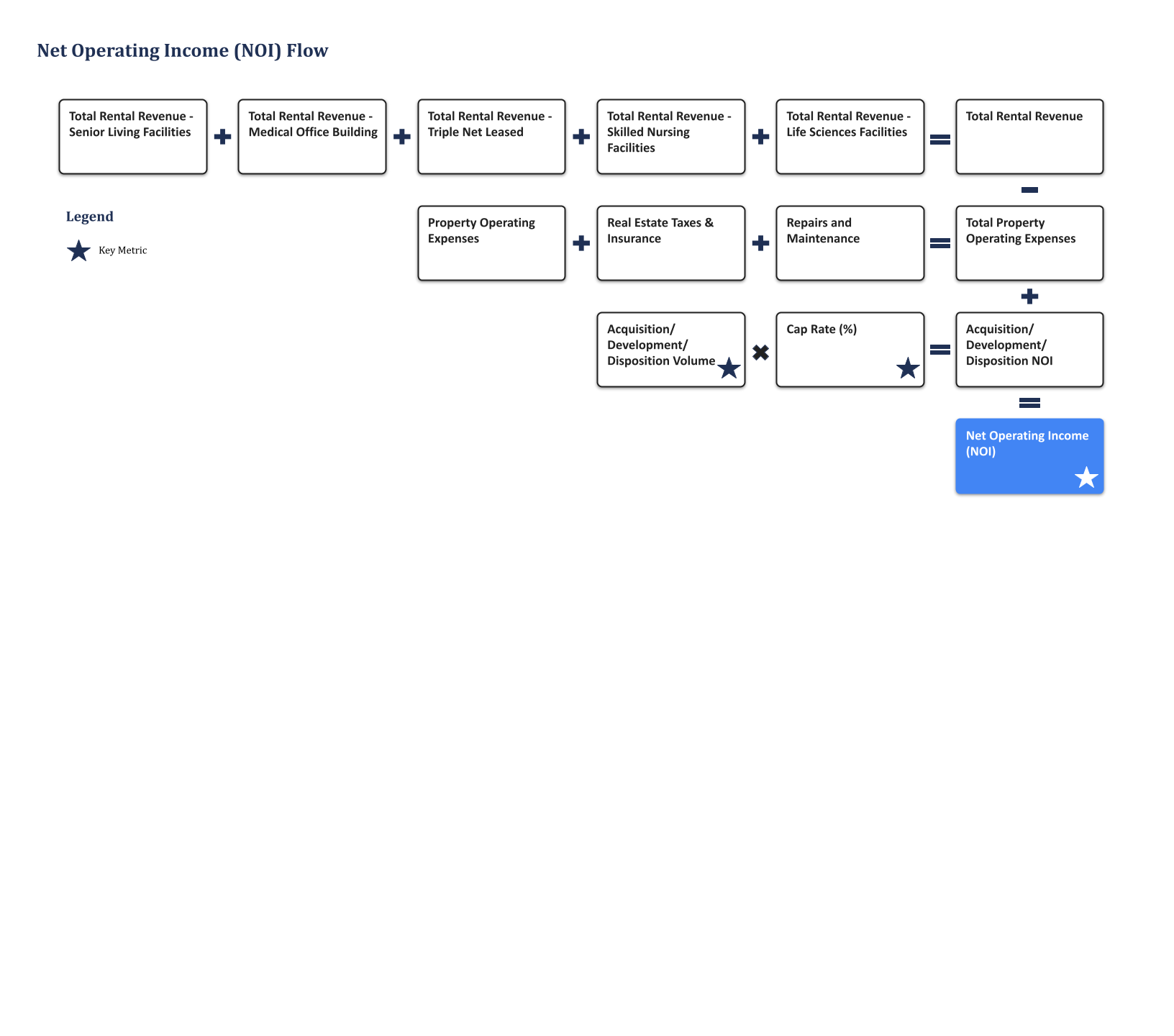

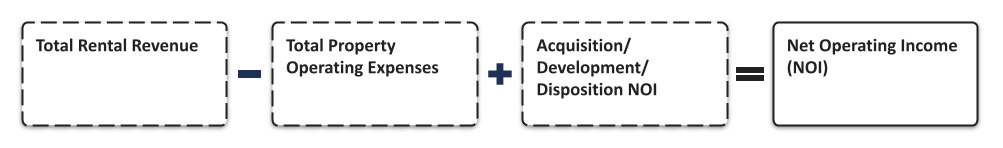

Net Operating Income (NOI)

Net operating income (NOI) is a measure of the income generated from a REIT’s properties after subtracting operating expenses.

Same-store Net Operating Income (NOI) Growth (%)

Same-store net operating income (NOI) growth is a key measure of profitability for a retail REIT. It is growth that excludes certain non-cash and non-comparable items. Same-store NOI is calculated as same-store revenues minus same-store operating expenses, including property taxes.

Acquisition Rate

Acquisition rate refers to the yield that is generated from an acquired property.

Acquisition Volume

Acquisition volume refers to the additions to a retail REIT’s portfolio of investment properties. This may take the form of transactions in real estate.

Development Rate

Development rate refers to the yield that is generated from a property in development.

Development Volume

Development volume is a measure of a new construction or previously agreed upon re-developments.

Disposition Rate

Disposition rate refers to the yield that is generated from a disposed property.

Disposition Volume

Disposition volume refers to the sale of real estate holdings by retail REITs.

Capitalization Rate (%)

Capitalization rate, or cap rate, is the initial yield on a real estate investment. The cap rate is computed by dividing the cash flow in year 1 by either the acquisition/disposition price or the total expected development cost.

Average Lease Term (Years)

Average lease term (years) measures the average period during which all leases in a REIT’s property or portfolio will expire.

Download this guide as an ebook today:

Guide to Healthcare REIT Industry KPIs for Investment Professionals

This guide highlights the key performance indicators for the healthcare REIT industry and where investors should look to find an investment edge, including:

- Healthcare REIT Industry Business Model & Diagram

- Key Healthcare REIT Industry Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions