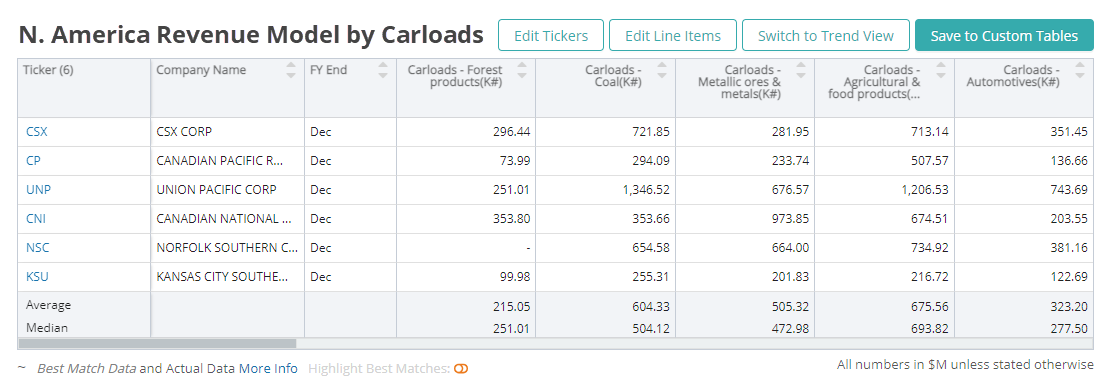

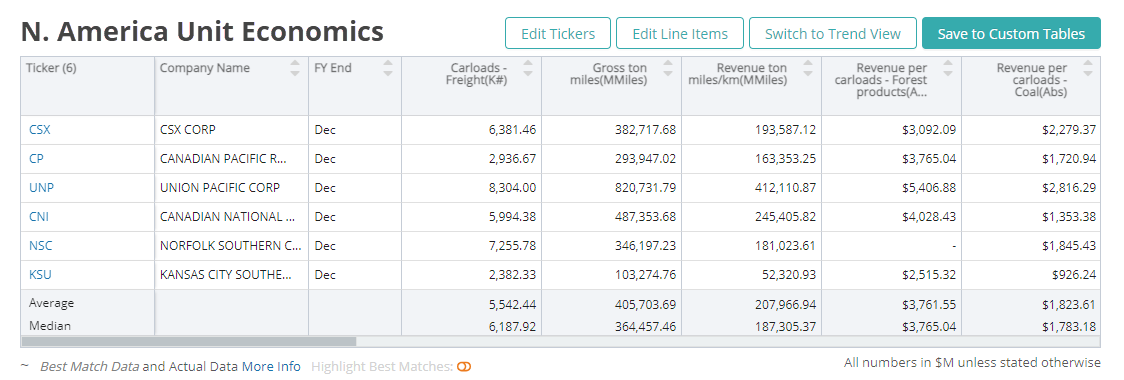

Carload is the quantity of freight loaded to its weight or space capacity. This represents volume.

Railroad Industry Introduction

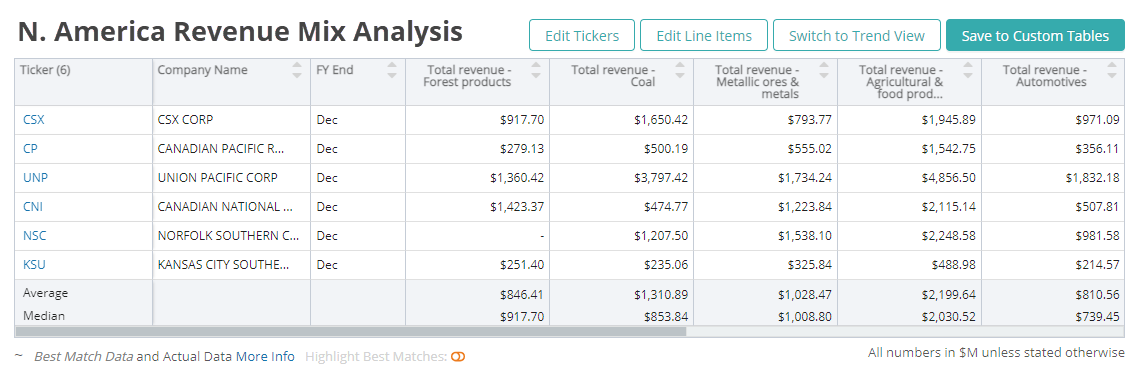

These commodities include agricultural and food products, chemicals, plastics, petroleum, automotive, forest products, metallic ores, metals, and minerals. Globally, coal is also a major commodity transported by the railroad industry. Depending on the goods being transported, different types of freight cars are used, including boxcars, covered hoppers, open-top hoppers, tank cars, and/or gondolas.

Companies in the railroad industry are cyclical in nature and as a result, are sensitive to business cycles. An up or downturn of economic activity directly impacts the demand for rail services. A boom in industrial activity and the resulting increase in trade leads to an increased demand for transportation and rail services. Alternatively, increased interstate trade through rails enables access to previously difficult-to-obtain products, thereby increasing product demand as the market expands and promoting economic growth. These factors combined make the rail industry a good indicator of industrial and economic trends. It is also important to note that railroads, due to their involvement in goods transport, are a vital part of the supply chain for many industries.

In the transportation industry, rails compete with other freight enablers such as trucks, ships, barges, and pipelines (for crude oil). The competition varies widely, depending on the route and the freight category being transported. Trucks have an advantage on shorter routes given their speed and flexibility, while rails have an upper edge on the long hauls, given their ability to transport bulk freight. Railroads are also preferred in the case of fixed delivery networks or routes. From a cost and energy-efficiency perspective, moving freight by rails reduces cost as rails consume less fuel compared to trucks. This makes rails a viable mode of transport in a high fuel price environment. Apart from the cost factor – which is not the only deciding factor when selecting a mode of transport – rails are preferred also because of the shorter time-in-transit and the reliability they provide.

Trucks, airlines, and barges operate on highways, airways, and waterways that are financed by taxpayers and the government. In contrast, companies in the railroad industry operate almost exclusively on an infrastructure that they own, build, maintain and pay for, by themselves with little or no government assistance.

Railroad Industry Business Model

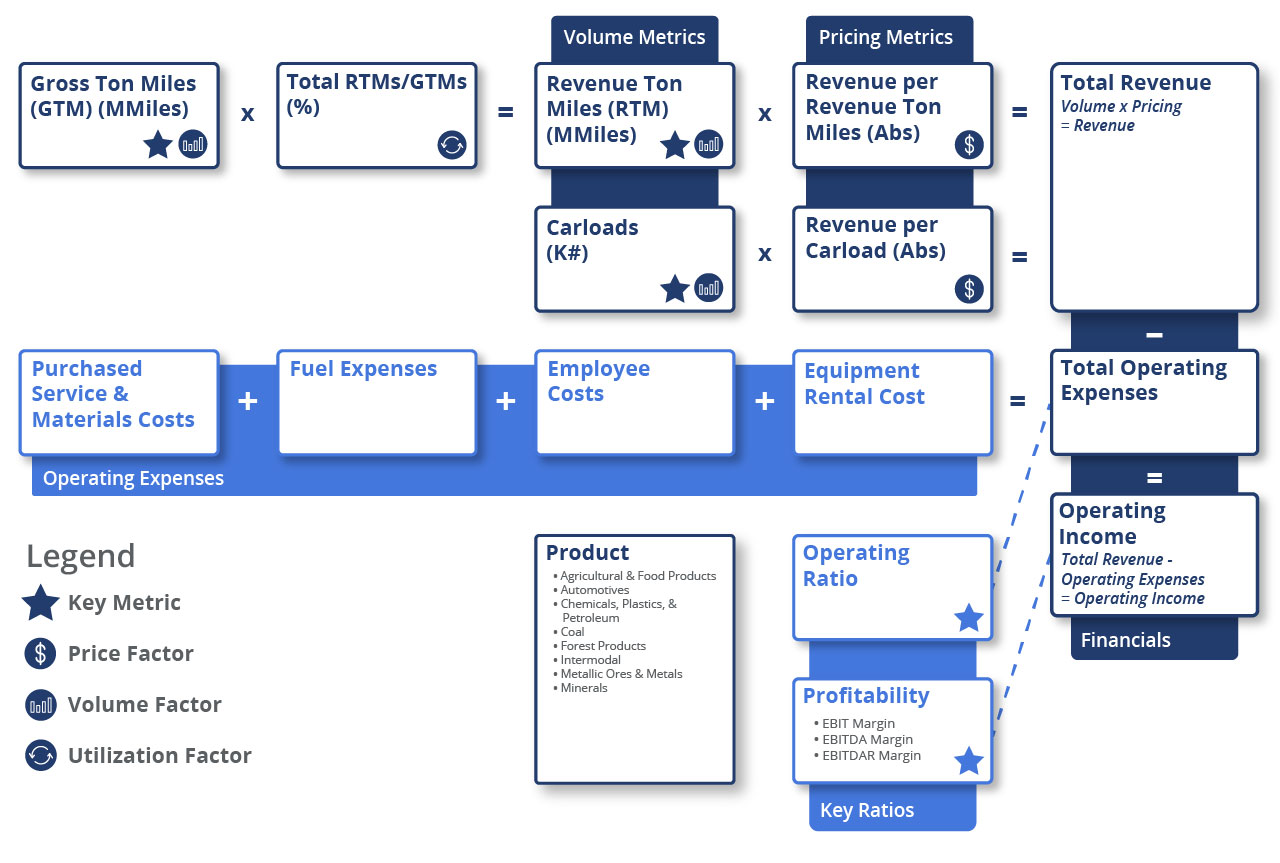

Companies in the railroad industry generate revenue by billing their customers for carrying cargo on a rate per carload basis or a rate per ton basis. The prices charged depend on the transportation service agreements or a publicly disclosed tariff rate.

REVENUE ANALYSIS

Companies in the railroad industry use two methods to compute revenue:

- Carloads multiplied by revenue per carload; and

- Revenue ton-miles multiplied by revenue per revenue ton-miles

Each method is driven mainly by how the industry measures volumes. The calculation is done separately for each category of the commodity being transported and then added together to calculate the total revenue.

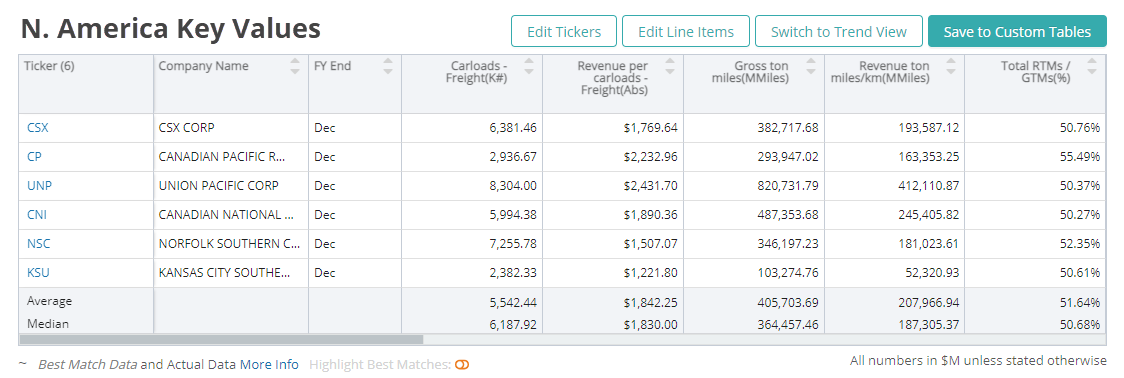

In the two methods, both carload and revenue ton-miles represent volume. Carload is the quantity of freight loaded on a railcar given its weight-bearing or space-carrying capacity. Revenue ton-miles refer to the movement of one revenue-producing ton of freight over a distance of one mile in a rail car.

Revenue per carload and revenue per revenue ton-mile on the other hand represent pricing. Revenue per carload is the amount of revenue earned for every carload moved. It is calculated by dividing the revenue for a commodity by the number of carloads of the commodity transported in a given period. Revenue per revenue ton-mile is the revenue earned for transporting one ton of freight across one mile.

COMMODITIES/GOODS TRANSPORTED BY RAILROADS

Railroads transport enormous amounts of finished goods and raw materials such as:

- Agricultural products including grains, grain mill products, farm, and food products

- Chemicals such as ethanol, fertilizers, and plastic & petroleum including gasoline, kerosene distillate fuel oil, among others

- Coal including hard coal, black coal, and brown coal

- Forest products such as lumber and wood products, pulp, and other paper products

- Metallic ores and metals including iron, copper, zinc, among others

- Automotives include motor vehicles, passenger car bodies, motor bus or truck bodies, motor vehicle parts and accessories, truck trailers, and used vehicles

- Minerals such as crushed stone, sand, gravel, non-metallic minerals, stone, clay, and glass products

Note that intermodal transport uses multiple modes of transportation. It relies on the use of standardized containers/trailers that can be transferred from ship to rail to truck with no reloading or unloading of the freight itself.

Industries that drive volumes and revenue for railroad companies along with the commodities they transport include:

| Suppliers/Visible Alpha Industries | Commodities Transported |

|---|---|

| Agricultural products | Agricultural & food products |

| Auto manufacturers, auto parts, commercial vehicles & trucks | Automotives |

| Commodity chemicals, diversified chemicals, specialty chemicals | Chemicals, plastics & petroleum |

| Coal & consumable fuels, coal mining | Coal |

| Paper & forest products | Forest products |

| Trucking, delivery air freight & logistics | Intermodal |

| Metals & mining | Metallic ores & metals |

EXPENSE ANALYSIS

Labor costs, fuel expenses, purchased services & material costs and equipment rental costs are all important expenses for a railroad operator. A highly tracked efficiency ratio for expenses in the railroad industry is the operating ratio and it is calculated by dividing the total operating expense by the total revenue.

The most important expense for a railroad company is employee cost followed by depreciation and amortization expense and purchased services and material costs.

Capital Expenditure (CapEx): Railroads have a complex infrastructure to maintain and upgrade which includes:

- Track structure

- Bridges, culverts, tunnels

- Signal and communications systems

- Locomotive and freight car maintenance and/or replacements

Over the last several years, the CapEx/depreciation ratio of railroad companies has seen a downward trend, indicating that the railroad industry is not delaying its track structure expansion (capacity projects), replacement (program projects), and replacement of locomotive/freight cars.

PROFITABILITY ANALYSIS

The profitability of a company in the railroad industry can be gauged by looking at the earnings before interest & taxes (EBIT), earnings before interest, taxes, depreciation & amortization (EBITDA) and earnings before interest, taxes, depreciation, amortization & restructuring or rent costs (EBITDAR). EBITDA is an important metric given the industry’s high depreciation and amortization costs, while EBITDAR is analyzed to normalize the differences arising from each company using different accounting standards for their rent expenses.

Key performance indicators (KPIs) are the most important business metrics for an industry. When understanding market expectations for railroads, whether at the company or the industry level, these are some of the railroad KPIs to consider:

Visible Alpha’s Standardized Industry Metrics

To understand market expectations for the railroad industry, a key information source is sell-side analyst estimate and consensus forecast data. The buy side, sell side and public companies leverage this type of data to conduct competitive analysis, a type of analysis conducted by professional analysts that involves comparing standardized metrics of one company with those of similar companies. Because companies report metrics differently – and sometimes report on different metrics altogether – standardizing the key metrics for each company can be a cumbersome process.

Visible Alpha Insights includes analyst data, company data and industry data at level of granularity unparalleled in the market. Our industry data – Standardized Industry Metrics – enables market participants to quantify and compare market expectations for companies across 150+ industries.

Data as of January 2023

Industry KPI Terms & Definitions

Carloads

Carload is the quantity of freight loaded to its weight or space capacity. This represents volume.

Revenue Per Carload

Revenue per carload is calculated by dividing the total revenue by the number of carloads. Revenue per carload represents pricing.

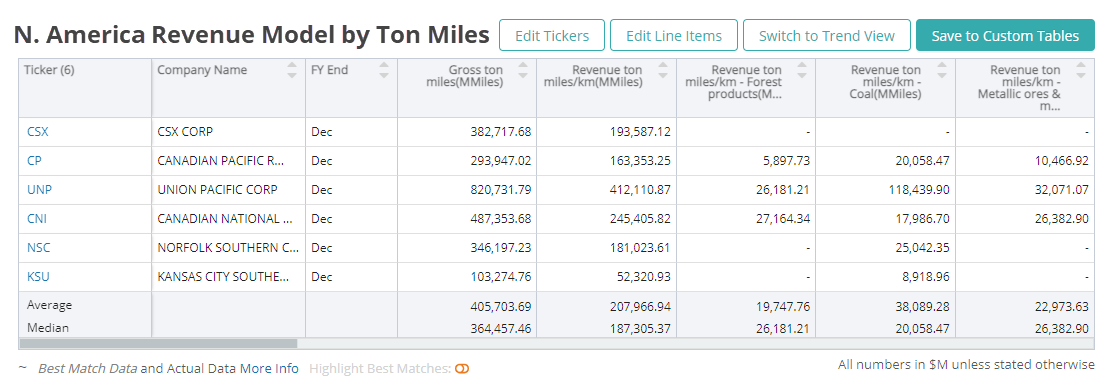

Gross Ton-Miles (GTM)

Gross ton-miles is the movement of one ton of train weight over one mile. GTMs are calculated by multiplying the total train weight by the distance the train moved. This is a volume factor.

Revenue Ton-Miles (RTM)

Revenue ton-miles is the movement of one revenue-producing ton of freight over a distance of one mile. This represents volume.

Revenue Per Revenue Ton-Mile

Revenue per revenue ton-mile is calculated by dividing the total revenue by revenue ton-miles. Revenue per revenue ton-mile represents pricing.

Gross Ton-Kilometer (GTK)

Gross ton-kilometer is the movement of one ton of train weight over one mile. GTMs are calculated by multiplying the total train weight by the distance the train moved. This is a volume factor.

Revenue Ton-Miles (RTK)

Revenue ton-kilometer is the movement of one revenue-producing ton of freight over a distance of one mile. This represents volume.

Revenue Per Revenue Ton-Kilometer

Revenue per revenue ton-kilometer is calculated by dividing the total revenue by revenue ton-miles. Revenue per revenue ton-kilometer represents pricing.

Operating Ratio

The operating ratio is calculated by dividing operating expenses by net revenue. The operating ratio shows how efficient a company’s management is at keeping costs low while generating revenue or sales.

Train Speed

Train speed is a velocity factor.

Terminal Dwell Hours

Terminal dwell hours is the time either a loaded or empty rail car spends in a terminal awaiting movement towards its destination.

Fuel Expenses

Fuel expense includes locomotive diesel fuel as well as non-locomotive fuel. This expense is largely driven by the market price and the locomotive consumption of diesel fuel.

Fuel Cost Per Unit

Fuel cost per unit is calculated by dividing fuel expenses by fuel consumption per gallon.

Employee Cost

Employee cost includes employee wages and related payroll taxes, health and welfare costs, pension, other post-retirement benefits, and incentive compensation.

Average Number of Units per Full-Time Employee

Average Number of Units – FTE is calculated by taking the average of employees employed – beginning and end of the period.

Average Cost per Full-Time Employee (FTE)

Average cost per employee – FTE is calculated by dividing employee costs by the average number of units – full-time employees (FTE).

Depreciation and Amortization Expenses

Depreciation expense primarily relates to recognizing the cost of capital assets, such as locomotives, railcars, and track structures, over their respective useful lives, which is reviewed periodically. This expense is impacted primarily by the capital expenditures made each year.

Equipment Rents

Equipment rent includes net rent paid for freight cars owned by other railroads or private companies. This category of expenses also includes expenses for short-term and long-term lease costs of locomotives, railcars, containers and trailers, offices, and other rentals.

Purchased Services and Material Costs

Purchased services and material costs primarily consist of contracted services to maintain infrastructure and equipment, terminal and pier services, and professional services. This category also includes costs related to materials, travel, casualty claims, environmental remediation, train accidents, property and sales tax, utilities, and other items including gains on property dispositions.

EBITDAR

EBITDAR stands for earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs. It is used to analyze a company’s financial performance where the company rent expenses are higher than average.

Total RTM / GTM

Total RTM (revenue ton-miles) / GTM (gross ton-miles) is calculated by dividing revenue ton-miles by gross ton-miles. Total RTM / GTM represents the capacity utilization of the railroad industry.

Total RTK / GTK

Total RTK (revenue ton-kilometers) / GTM (gross ton-kilometers) is calculated by dividing revenue ton-miles by gross ton-kilometers. Total RTK / GTK represents the capacity utilization of the railroad industry.

Download this guide as an ebook today:

Guide to Railroad Industry KPIs for Investment Professionals

This guide highlights the key performance indicators for the railroad industry and where investors should look to find an investment edge, including:

- Railroad Industry Business Model & Diagram

- Key Railway Industry Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions