Production volume is the total volume of gold recovered from mining and processing of ore. It is a function of the quantity of ore processed, head ore grade and recovery rates.

Gold & Silver Mining Industry Introduction

Gold is a rare, reddish-yellow shining metal known for being highly malleable and resistant to corrosion. These properties make it ideal for jewelry. Gold is also considered by many to be a “safe haven” investment and can be found on the balance sheet of central banks and individuals. A relatively small amount of gold demand comes from the electronics industry due to its relatively high conductivity and dentistry because it is biocompatible. It is also used in the space and healthcare (nanotechnology) industries.

The mineral extraction life cycle begins with the acquisition of ownership/mining rights. Companies conduct exploration activities, such as sample drilling, to confirm the presence of economically viable mineral resources and conduct feasibility studies to finalize the mine plan and plant configurations. Once the board approves the investment in the project, based on the feasibility study and funding plans, companies develop the mine before starting any mining activity. The development stage includes building necessary infrastructure, procuring equipment and machinery, and removing overburden (the waste material between the surface and the ore body) to expose ore for open-pit mining and building shafts for underground mining.

Once the mine is developed, the production stage begins. Companies follow various production methods depending on the ore type, geologic condition, safety standards and cost-effectiveness. This stage involves:

- Mining:

Mining is the extraction of ore from the ground through either open-pit mining or underground mining. Companies generally prefer open-pit mining if the deposits are closer to the surface and spread across a large distance. Open-pit mines are less capex intensive and help companies achieve lower unit costs by deploying large equipment (economies of scale), allowing companies to operate in low-grade ore mines. Underground mining is used when the ore body is too deep in the surface to mine economically using open-pit methods. Compared to open-pit mines, underground mines are more technically challenging, require more capex and have longer lead times to construct. To compensate for these challenges and higher costs, gold mining companies generally target high-grade ore mines for underground mining projects. - Transportation:

Shifting the ore from the mine site to processing facilities. - Processing:

Extraction of minerals from the ore. It is done through various stages of processing to attain 99.9% purity of gold.

Companies typically extend mine life by conducting additional exploration activity within the mineral property. Once the company exhausts the mining of ore, mine reclamation begins, which is the process of restoring a mine site to its previous natural state.

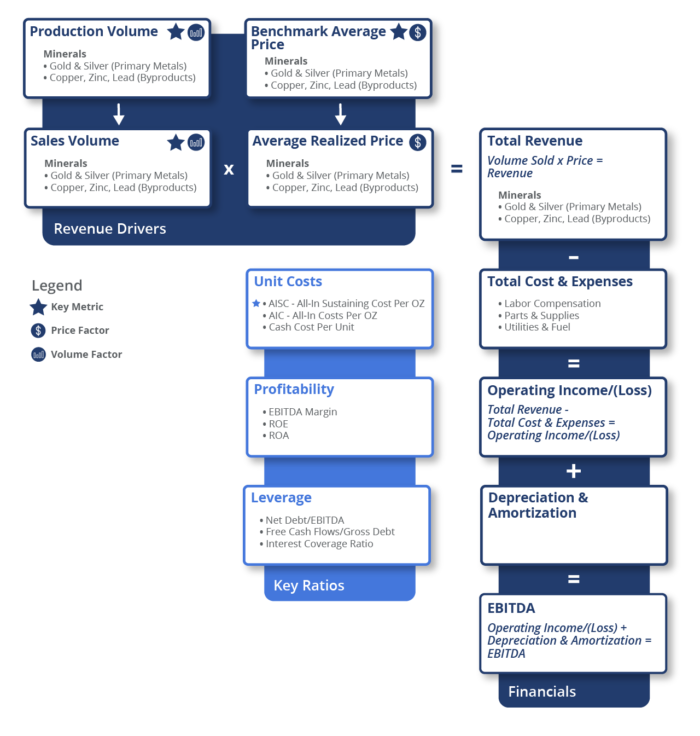

Gold & Silver Mining Business Model

Gold and silver mining companies produce and sell precious metals such as gold and silver and by-products such as copper, zinc and lead. Gold miners are price-takers due to the massive global stock compared to demand and seek to profit from producing gold at a cost less than the prevailing market price.

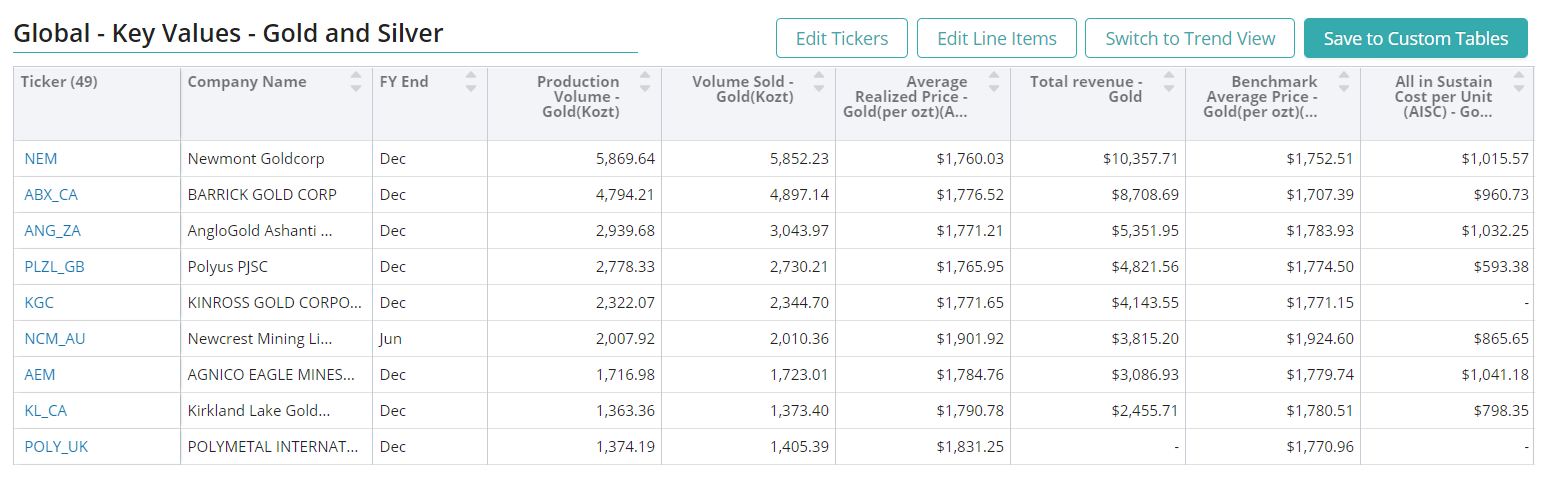

Investors focus on the gold miners’ asset base, production and sales volume trends, average realized price, and unit costs. The following section explains each of these concepts in more detail.

ASSET BASE

Rights to mineral deposits are the most important assets for gold miners. Mineral deposits are natural accumulations of minerals in the earth’s crust in the form of ore. Using drilling samples and seismic studies, companies estimate the quantity of these minerals in the deposit. Read More >

PRODUCTION & SALES VOLUME

Since mineral deposits are finite, a mining company’s production life is limited to the size of the deposit and production run rate. Mining companies often seek to explore and develop new mines to sustain and grow production volume. Read More >

AVERAGE REALIZED PRICES

Gold is an exchange-traded commodity (ETC), and therefore spot market prices drive each company’s average realized prices. The spot prices are adjusted for any quality and location differential for each mine. Given the fixed nature of mining operations, changes in average realized prices have the highest sensitivity to the company’s earnings. Read More >

KEY UNIT COSTS

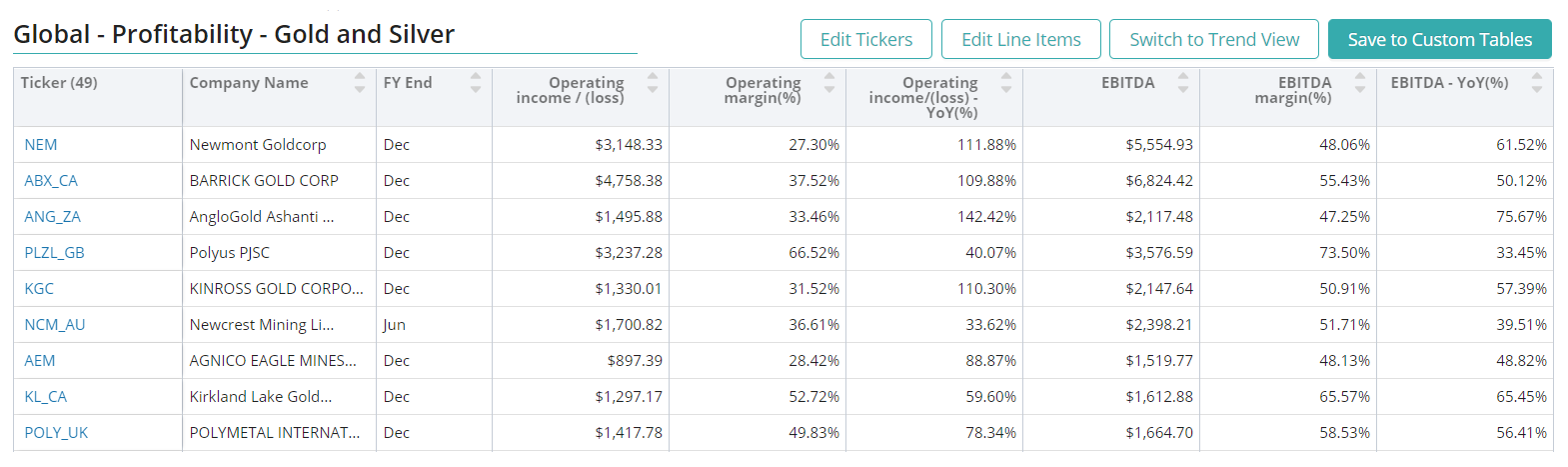

A mining company’s profitability is largely driven by its cost structure, which depends on mine geology, access to infrastructure, labor costs, taxation and operating efficiencies. Investors mainly focus on three widely reported unit costs: (1) Cash Cost Per Unit (2) All-In Sustaining Costs Per Unit (AISC); and (3) All-In Costs Per Unit (AIC). Read More >

VALUATION METHODS

Given changing ore grade over the life of mining operations, different operating lives for each mine and other geological factors, analysts usually estimate the net present value (NPV) of each mine and sum all mine NPVs to determine the enterprise value (EV) of the company. “Price to NPV” and “EV/EBITDA” are other popular relative valuation methods used in the industry, whereas “EV to 2P Reserves” is primarily used in exploration or developing stage mining companies.

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for the gold and silver mining industry, whether at a company or industry level, here are some of the gold and silver mining KPIs to consider:

Visible Alpha’s Standardized Industry Metrics

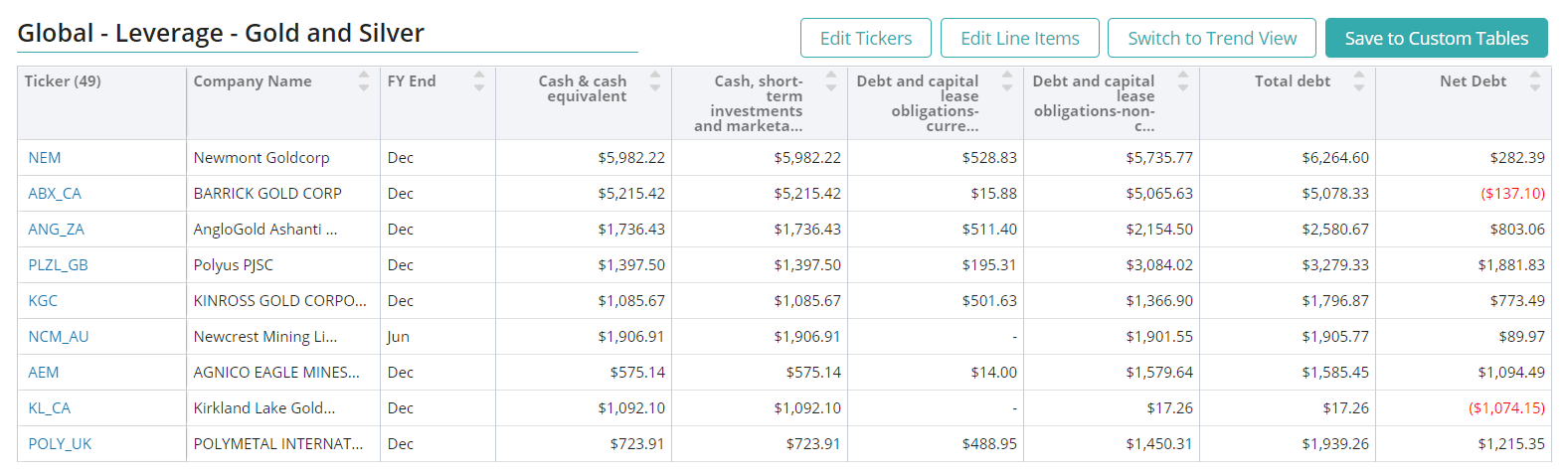

To understand market expectations for the gold and silver mining industry, a key information source is sell-side analyst estimate and consensus forecast data. The buy side, sell side and public companies leverage this type of data to conduct competitive analysis, a type of analysis conducted by professional analysts that involves comparing standardized metrics of one company with those of similar companies. Because companies report metrics differently – and sometimes report on different metrics altogether – standardizing the key metrics for each company can be a cumbersome process.

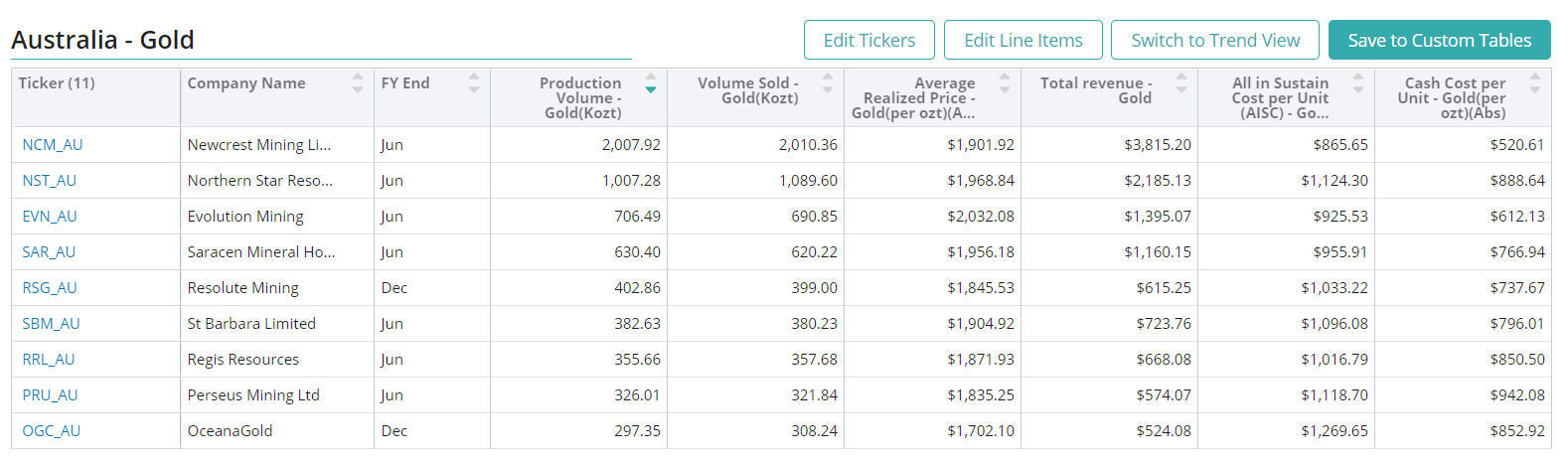

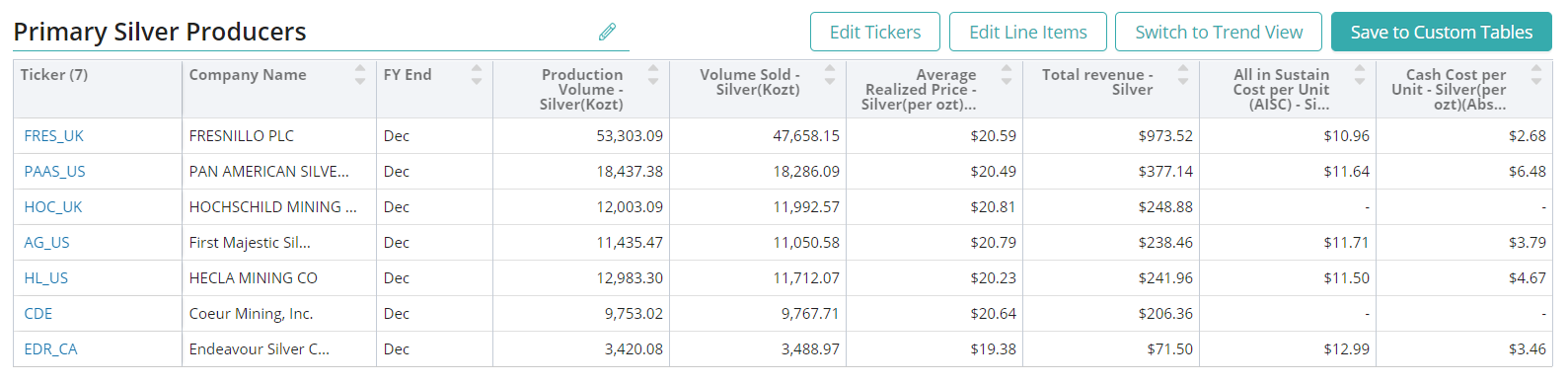

Visible Alpha Insights includes analyst data, company data and industry data at level of granularity unparalleled in the market. Our industry data – Standardized Industry Metrics – enables market participants to quantify and compare market expectations for companies across 150 industries.

Data as of January 2023

Industry KPI Terms & Definitions

Visible Alpha offers an innovative, integrated experience through real-time, granular consensus estimates and historical data created directly from the world’s leading equity analysts. Using a subset of the below KPIs, this data can help investors hone in on the key drivers of companies to uncover investment opportunities. Learn More >

Mineral Resource

A mineral resource is a concentration of solid material of economic interest in or on the earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The quantity of available minerals in a deposit is an estimated number based on the level of geological knowledge and confidence.

Mineral Reserves (2P Reserves)

Mineral reserves are the economically mineable part of mineral resources. It is the sum of proven and probable reserves.

Exploration

Exploration is the prospecting, sampling, mapping, diamond drilling and other work involved in searching for ore.

Ore

A mixture of ore minerals and gangue from which at least one of the metals can be extracted at a profit.

Reserve Grade

Reserve grade is the estimated metal content of an entire ore body based on mineral reserves. It is measured in “grams per ton of ore” in the case of precious metals such as gold, silver and platinum, and reported in “percentage on per ton of ore” for base metals such as copper and zinc.

Head Grade

Head grade is the average grade of ore fed into a mill. The higher the grade, the more gold per volume of ore.

Recovery Rate

Recovery rate is the percentage of valuable metal in the ore that is recovered by metallurgical treatment. It depends on ore quality and treatment plant efficiency.

Concentrate

Concentrate is a semi-finished product in the form of a powder containing a higher percentage of valuable metal. Concentrate is produced after the milling process.

Metal in Concentrate (MIC)

Metal is concentrate is the quantity of valuable metal available in the concentrate.

Byproduct

Byproduct is a secondary metal or mineral product recovered in the milling process.

Byproduct Credit

Byproduct credit is revenue from the sale of byproduct metals. It is deducted from total production costs in the computation of non-GAAP unit cash costs of primary metal.

Cash Cost

Cash cost includes cash operating cost (such as mining, processing, TC/RC, transportation, SG&A cost), royalties and production taxes and byproduct credits.

All-In Sustaining Cost Per Unit (AISC)

All-in sustaning cost per unit is a non-GAAP measure of fully loaded cash cost of producing a mineral at current operating mines through the life of the mine. AISC includes cash cost, sustaining exploration spending, royalties and taxes, sustaining capex and corporate overheads.

All-In Costs Per Unit (AIC)

All-in cost per unit includes AISC plus other costs unrelated to the company’s current operations, such as non-sustaining exploration costs, growth capex, etc.

Stripping Ratio

Stripping ratio is the quantity of waste removed per ton of ore mined from an open-pit mine.

Open-Pit Mine

Open-pit mine is a mine that is entirely on the surface. Also referred to as an open-cut or opencast mine.

Underground Mine

Ore body lies a considerable distance below the surface.

Gold Equivalent Ounce (GEO)

Gold equivalent ounce (GEO) is total revenue (including byproduct revenue) divided by the average gold realized price. This derived number is a synthetic/estimated volume of gold sold if 100% of the revenue were from gold.

Sustaining Capex

Sustaining capex is capital expenditures incurred to sustain and maintain existing assets at the mine at their current production capacity to achieve constant planned levels of productive output.

Reclamation

Reclamation is the restoration of a site after mining or exploration activity is completed.

24 Carat

A carat measures the grade or purity of gold, with 24-carat gold being 99.9% pure and the most malleable form of gold. Twenty-two-carat gold is 22 parts gold and two parts silver, zinc, nickel or other alloys. Twenty-two-carat gold is harder than 24 carats and therefore finds applications in jewelry. Diamond and other studded jewelry are made from 18-carat gold (75% gold and 25% other metals).

Gold Bars, Biscuits and Wafers

Investors and dealers buy gold in the form of bars (400 troy-ounce or 438.9 ounce standard). Thinner and lighter forms of bars are known as biscuits or wafers.

Conversions

1 Imperial Ounce (Oz) = 28.3495 grams

1 Troy Ounce (Oz t)= 31.103 grams (or 1.097 imperial pounce)

Production Volume

Production volume is the total volume of gold recovered from mining and processing of ore. It is a function of the quantity of ore processed, head ore grade and recovery rates.

Volume Sold

Volume sold is the total volume of refined gold sold during the period.

Benchmark Price Average

Benchmark average price is the exchange traded spot market price of gold per oz at which it can be sold or bought immediately in the international marketplace.

Average Realized Price

Average realized price is the actual selling price of gold for a given period.

Download this guide as an ebook today:

Guide to Gold & Silver Mining KPIs for Investment Professionals

This guide highlights the key performance indicators for the gold & silver mining industry and where investors should look to find an investment edge, including:

- Industry Business Model & Diagram

- Key Commercial Banking Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions