ONEaccess solves MiFID II compliance challenges with smart tools for implementing and managing a sustainable research valuation and RPA framework.

New York, March 16, 2017 — ONEaccess, a Visible Alpha company, today announced new enhancements to its platform that will allow asset managers to comply with MiFID II requirements, including regular assessment of research quality, management of research budgets, and enforcement of stricter controls around inducements.

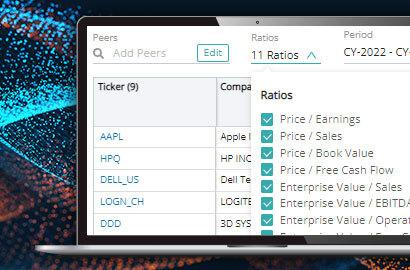

The ONEaccess platform enables asset management firms to monitor, aggregate and analyze all of their interactions with research providers in one place, ensuring that consumption is aligned with the firm’s research budgets. Evaluating research in this way continues to be a pain point for firms according to the FCA (Financial Conduct Authority).

To facilitate the assessment of research quality, customizable research provider scorecards let firms assign weightings to valuable research services including analyst meetings and models, corporate access, and bespoke work. With this information, firms can build broker votes from the bottom-up using detailed consumption and value metrics that satisfy FCA, AMF (Autorité des Marchés Financiers) and other requirements.

“MiFID II regulations will profoundly change how asset managers consume and pay for research,” said Richard Johnson, Vice President of Market Structure and Technology at Greenwich Associates. “Investment firms will need to establish robust research budgeting, evaluation and payment processes.”

New to the ONEaccess solution is the ability to automatically initiate payments based on research provider valuations and seamlessly integrate into any RPA (research payment account) or CSA (commission sharing agreement).

“Putting a research valuation framework in place is not only paramount to complying with MiFID II regulations in the EU, but it’s also a best practice for firms everywhere,” stressed Mike Stepanovich, CEO of ONEaccess at Visible Alpha.

“By partnering with ONEaccess, we are able to help our investor clients meet MiFID II compliance requirements,” said Tom Conigliaro, Managing Director of Markit Brokerage and Research Services at IHS Markit. “Through our combined offering, clients gain access to an end-to-end solution for managing, evaluating and paying for their interactions with research providers.”

“Asset managers are looking for ways to simplify the way they discover, track and value research, models and corporate access,” said Scott Rosen, CEO of Visible Alpha. “With the coming together of Visible Alpha and ONEaccess, our solution is the only holistic destination for investors to accomplish this.”

Additionally, ONEaccess will add “reverse” entitlement capabilities that will restrict access to services at a granular user level to help eliminate the risk of inducements across all vendor platforms.

WEBINAR: How MiFID II Data Can Be a Lever in the Pursuit of ROI – (EVENT OVER)

ONEaccess will be hosting an exclusive webinar entitled, “How MiFID II Data Can Be a Lever in the Pursuit of ROI” on Friday, March 24, 2017 at 10:00 AM EDT. ONEaccess gave a similar talk on March 1 to a group of more than 60 chief investment officers at Institutional Investor’s “The New Marketplace for Investment Research after MiFID II” conference in Madrid.

About ONEaccess

ONEaccess, a Visible Alpha company, is a content and interactions analytics hub that is changing the way the Buy-side and the Sell-side collaborate with one another. Founded in 2014, ONEaccess improves the efficiency of discovering, analyzing and valuing events and interactions between professionals on both sides of the market. Our growing suite of intuitive productivity tools fosters trust and transparency in the broker-client relationship, and frees up time for generating alpha in the process.

Media Contact

Eric Soderberg

Forefront Communications for Visible Alpha

914-414-2884

[email protected]