BofA Merrill Lynch, Citi, Jefferies, Morgan Stanley and UBS partner to improve access to and usefulness of data, models and analysis from multiple firms

New York, N.Y., May 14, 2015 – Five of the world’s leading investment banks – BofA Merrill Lynch, Citi, Jefferies, Morgan Stanley and UBS – have announced the formation of a new company, Visible Alpha LLC, to create a common language and platform for analysts’ financial models and forecasts. Visible Alpha extracts and makes comparable the data and logic from analyst spreadsheet models that clients often struggle to use effectively, delivering a rich and dynamic solution for company analysis.

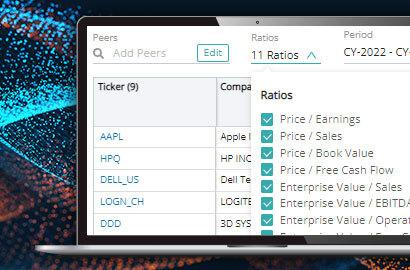

Currently in a limited beta release, Visible Alpha provides individual analyst and consensus forecasts across all aspects of corporate performance, including full P&L, balance sheet and cash flow statements as well as segment financial forecasts, product-level sales and pricing projections, and company and industry-specific operational metrics and assumptions.

“Earnings models differ in content, methodology and format because they are the distillation of our analysts’ diligent but varied efforts and thinking,” said Candace Browning, head of global research for BofA Merrill Lynch. “Our clients are eager for us to deliver that information in a more useful, accessible and directly comparable way. With Visible Alpha, they will now have the ability to access our forecasts with unprecedented granularity and on a side-by-side basis with our peers.”

Fueled by the logic and structure of the analyst models, Visible Alpha goes beyond presenting static data alone and allows clients to generate their own data-driven projections, in Excel and online.

“This is not just better data, this is transformational for our clients,” said Peter Forlenza, global head of equities at Jefferies. “Building models from the ground up based on market-validated assumptions is critical to evaluating fundamental investment ideas, but time-consuming and hard to do well. With Visible Alpha, investors can instantly create their own scenarios and then compare them to those of other analysts and the consensus to quantify the potential value of their insights.”

While initially populated with content from the founding partners, Visible Alpha intends to include participation from a broad spectrum of research providers.

“Visible Alpha’s wide and market-driven coverage will be faithful not only to the needs of our institutional clients, but also to the brokers and independent research firms that create the intellectual capital on which investors rely and upon which our service will be built,” said Scott Rosen, chief executive officer of Visible Alpha. “This will be a conduit for trusted research providers, beyond just the largest global firms.”

Media Contact

Eric Soderberg

Forefront Communications for Visible Alpha

914-414-2884

[email protected]