INSIGHTS FOR CORPORATES

Visible Alpha provides instant access to sell-side analyst models and deep consensus data on thousands of companies globally and across 170+ industries. Our granular data and powerful analysis tools enable investor relations and corporate strategy teams to uncover and explore the market’s view of their company, competitors and suppliers.

Whether you are an investor relations professional preparing for investor meetings or a corporate strategist seeking greater insight into cross-industry dynamics, Visible Alpha Insights for Corporates is here to give you an edge.

Analyst Comparison

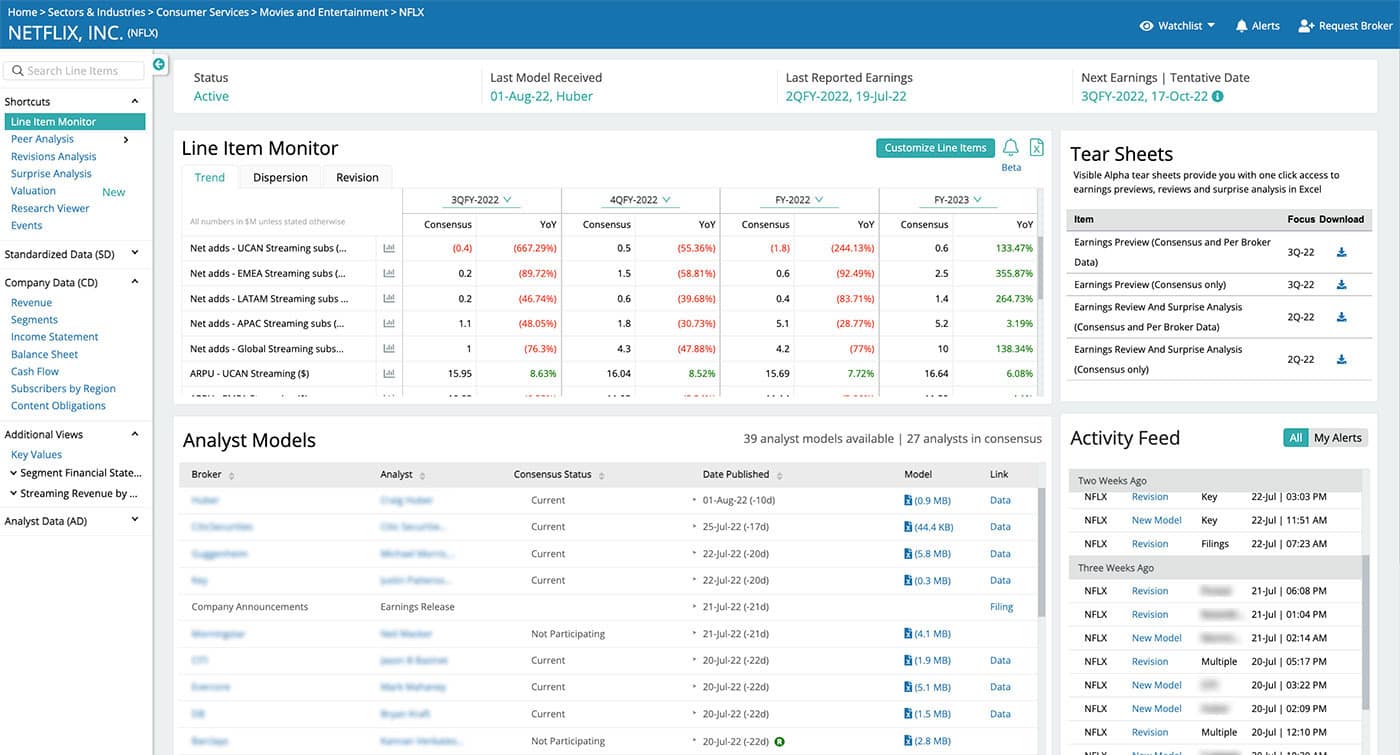

Compare granular analyst forecast data and benchmark against deep consensus data

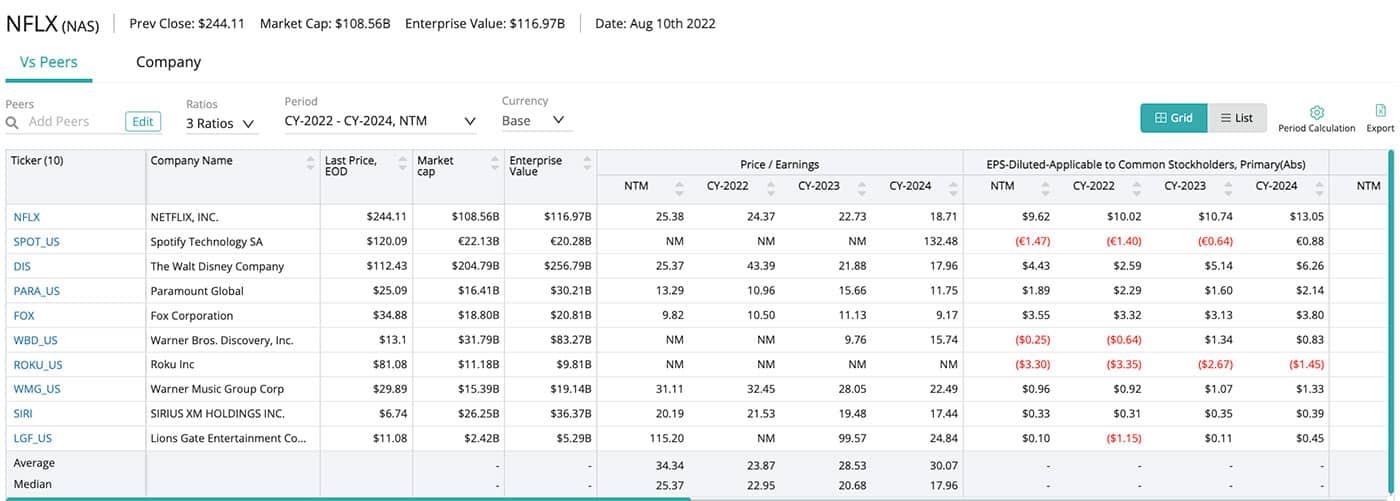

Relative Analysis

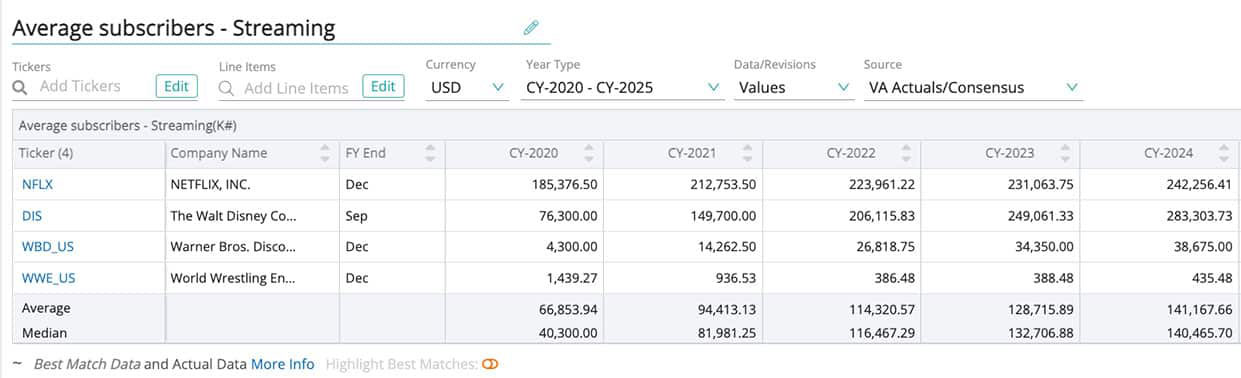

Conduct relative analysis with our proprietary standardized industry metrics

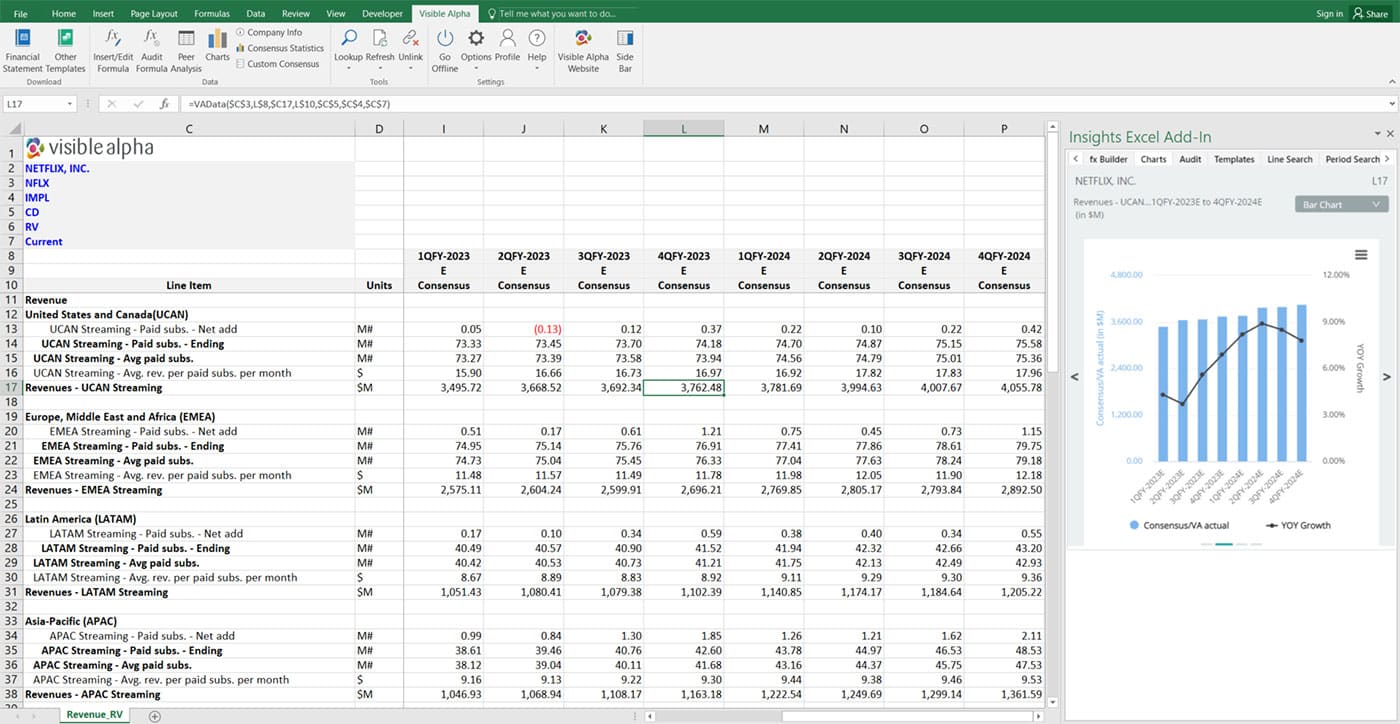

Intuitive Excel Add-In

Seamlessly integrate consensus estimates into your financial models

Direct Model Downloads

Easily download the latest sell-side analyst models

From Granular Company Data to Granular Industry Data

ANALYST DATA

Extracted directly from sell-side analyst models, presented as each analyst models each line item

COMPANY DATA

Analyst data made comparable for each company, including segment-level data and key company drivers. Available by analyst and in consensus.

INDUSTRY DATA

Company data made comparable within an industry, including all financial and operating metrics for easy relative analysis. Available by analyst and in consensus.

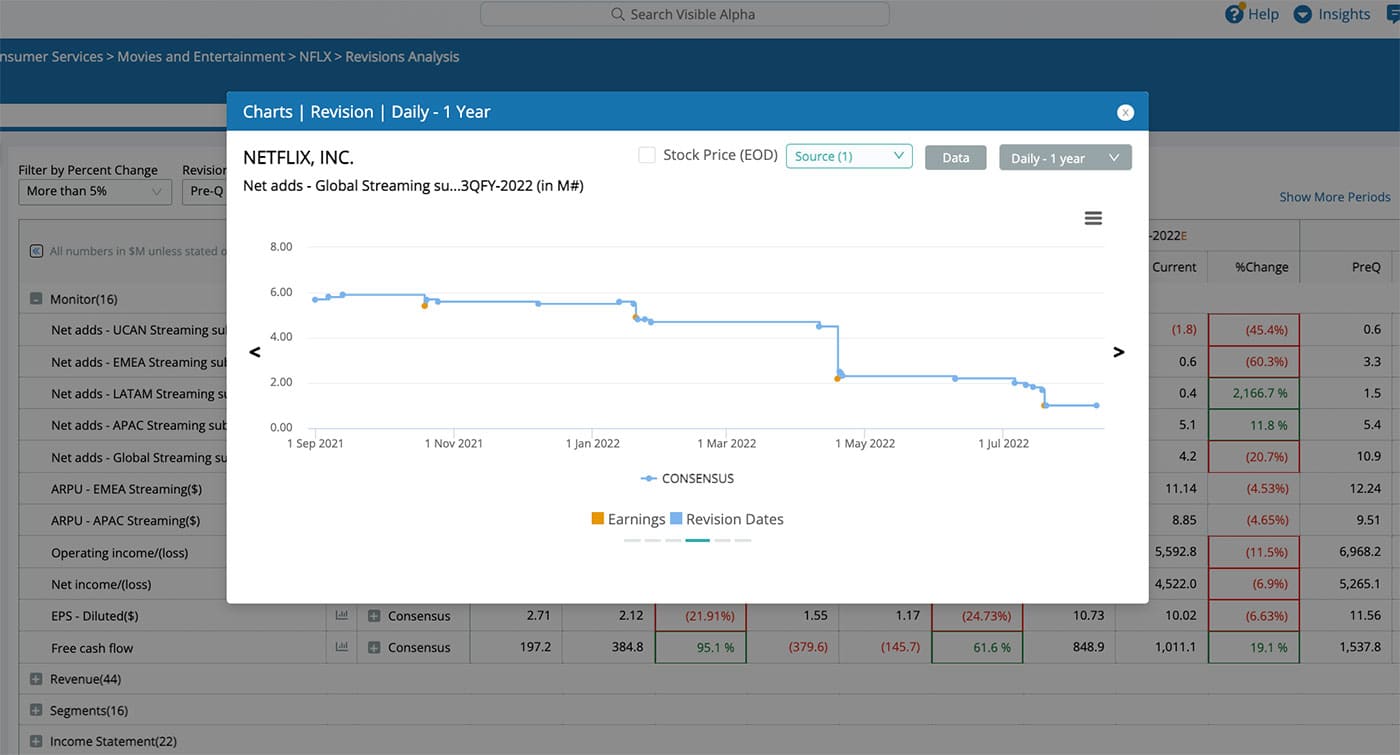

With robust charting, visualization and analytics tools, you can extract more valuable insights from analyst estimates and consensus forecasts. Instantly discover analyst outliers, identify trends, visualize analyst revisions and compare broker estimates for each granular line item.

Visualization and analytics tools

Robust charting tools

Forecasting Returns with Shareholder Payout Yield

Learn about buyback and dividends expectations, resulting in the first analysis of forward-looking total payout expectations.

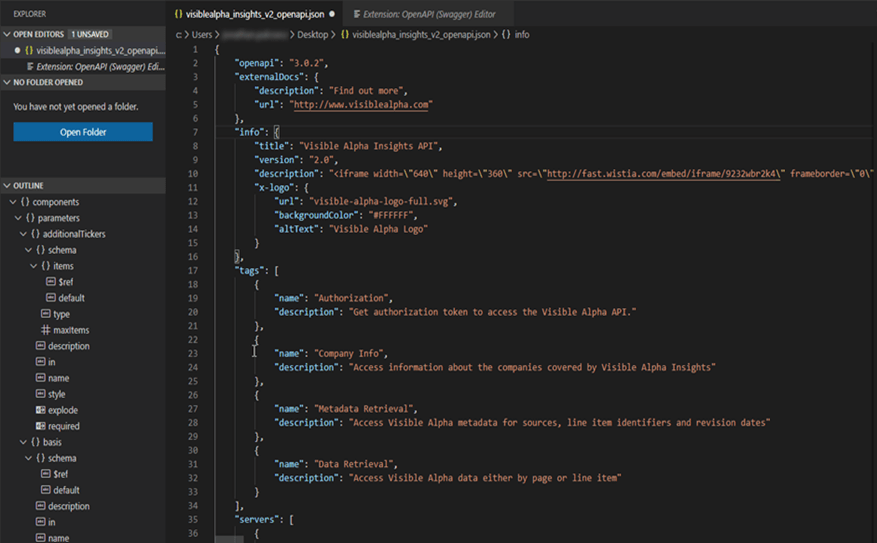

Data how you want it

We provide the market’s view to enable you to extract valuable insights and gain an investment edge. To do that, we provide multiple ways for you to access and incorporate our data directly into your workflow.

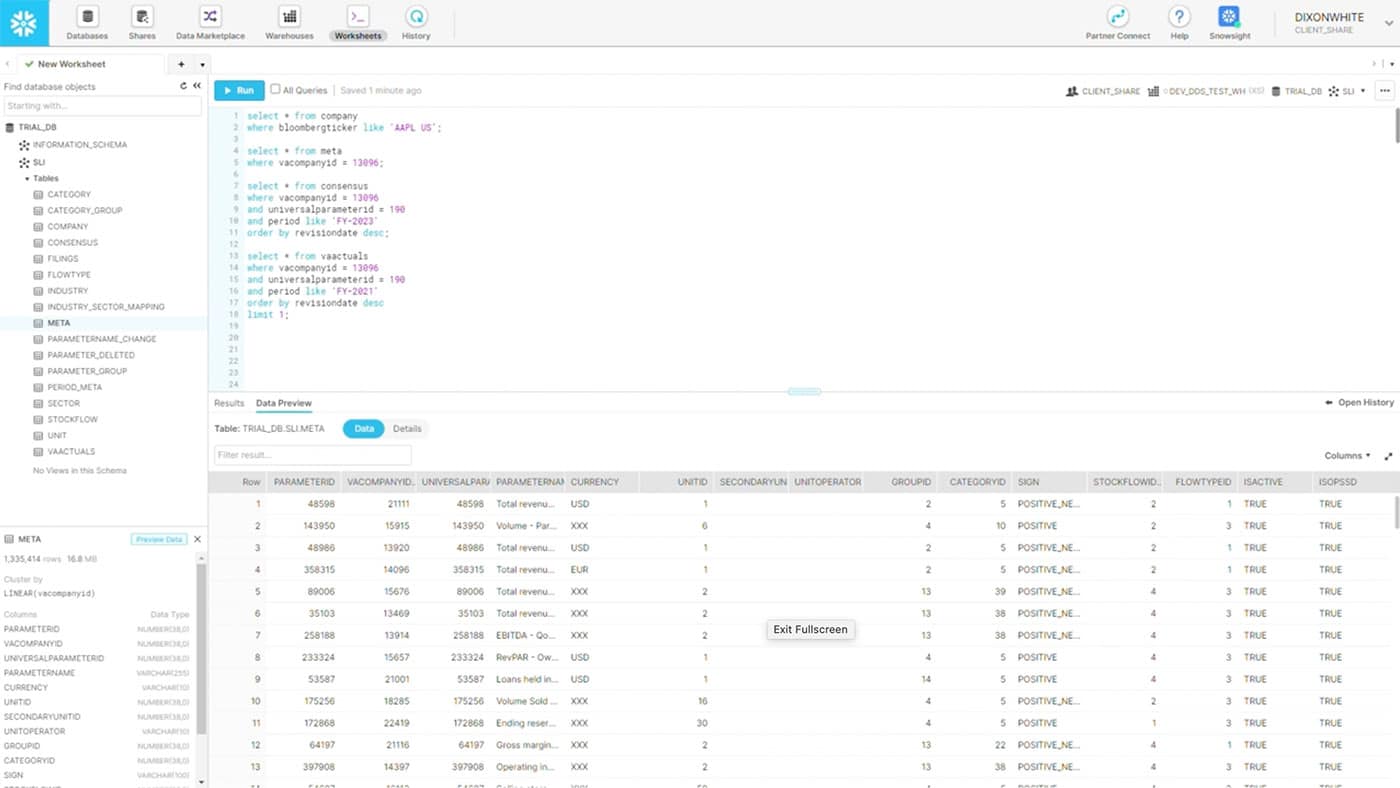

Our web-based interface includes data visualizations, comp tables, alerts and direct downloads of raw analyst and consensus models. We offer charting tools to enable you to discover analyst outliers and view growth trends over time on any line item, as well as a suite of visualization and analytics tools to quickly view revisions, surprises and dispersions.

Frequently Asked Questions

Where is the data sourced?

Our data is sourced directly from sell-side analyst models. 250+ brokers contribute their spreadsheet models to Visible Alpha Insights, enabling us to capture every detailed line item analysts forecast in their coverage universe. For a full list of brokers, click here >

How do you create consensus?

We process full working models from the sell side; apply machine learning to extract all of the assumptions buried deep within analyst models; create detailed consensus models across all of a company’s products, segments, geographies and business drivers; and continually update consensus with every new analyst model and revision received. This provides you with a normalized view of all the relevant metrics and key drivers in a clean, comparable consensus model.

How is Visible Alpha different from other consensus estimates providers?

Our unique relationships with 250+ brokers gives us access to their analysts’ full working models. While traditional consensus providers offer limited line items and forecast periods, Visible Alpha Insights has more consensus data on crucial line items, with higher source count and quality.

Does Visible Alpha add new companies to the platform?

We are continually adding new companies across the globe to the platform. Users can request coverage on any company from within the platform.

Does Visible Alpha ever onboard new brokers onto the platform?

We are always increasing coverage with new and current brokers. If a broker you work with is not contributing to our platform, we will work with you to onboard their content. If you are a broker who would like to start contributing content to Visible Alpha, please contact us.

Who uses Visible Alpha Insights?

Hedge funds, asset managers, corporations, investment banks, equity research departments, quantitative funds, independent research providers, private equity, wealth managers, family offices, academia and media outlets.