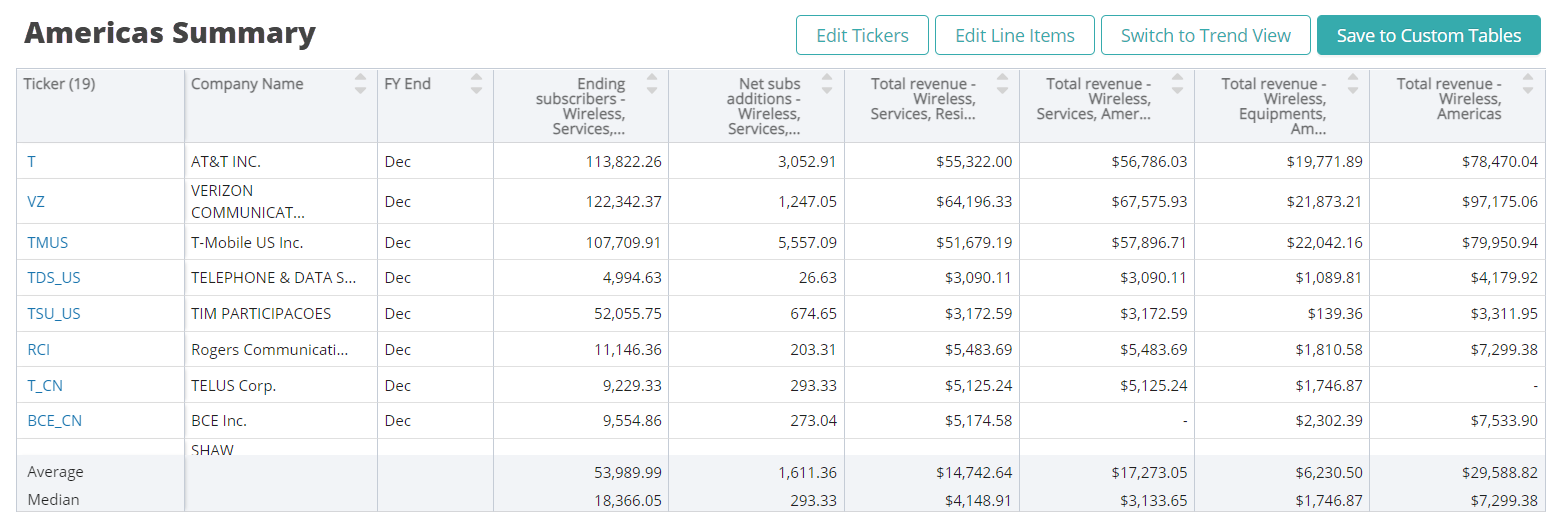

Ending subscribers represents the number of subscribers a company has at the end of the period, which reflects the net additions to existing subscribers over a given period.

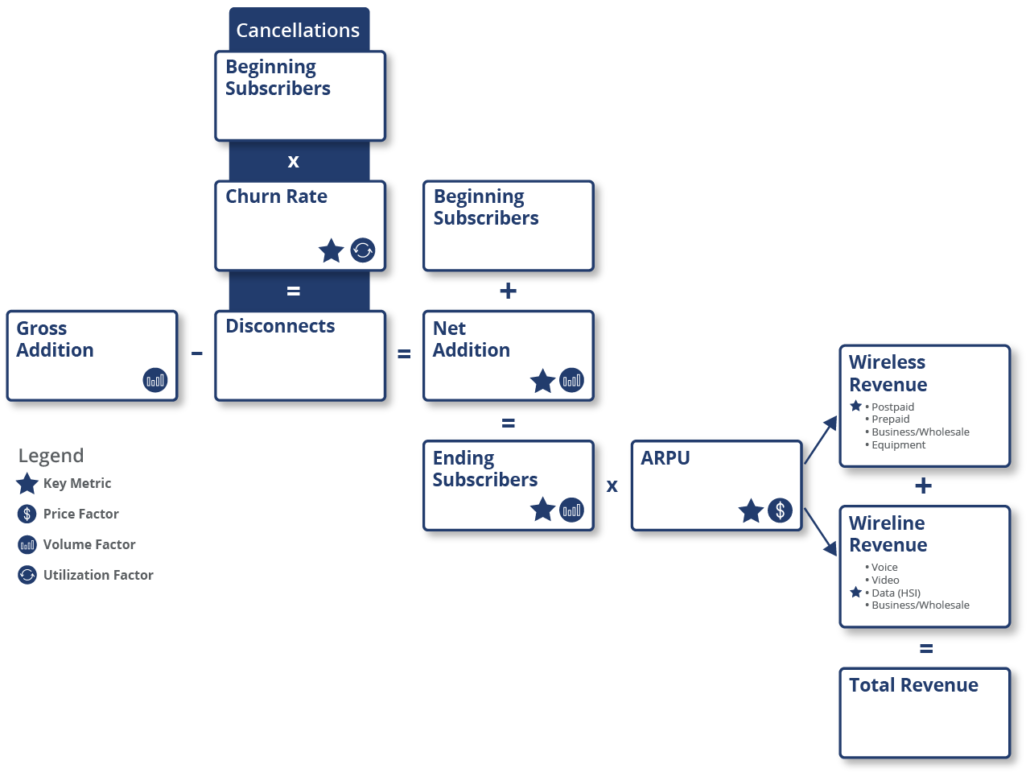

Telecom Business Model

REVENUE

Telecom service providers (TSPs) generate revenue by providing products and services to retail and business customers using their wireless and wireline networks, through either single or bundled arrangements. The services provided can involve multiple deliverables that include products, services or a combination of both.

A TSP’s primary business model is driven by the volume of their subscribers and the price they charge for the services rendered (typically measured as average revenue per user or ARPU). Revenue is modeled as average subscribers in a period multiplied by the average monthly revenue per user for that period for each service segment. The typical service segments include prepaid and postpaid voice, data and video to retail and business customers.

As a customer-facing business, one of the key metrics tracked by investors for TSPs is ending subscribers. Increases and decreases in subscribers are also closely monitored and are identified as net additions. Every new subscriber (gross subscriber addition) adds new revenue for a TSP, and every subscriber disconnecting the service increases the churn rate for the company and represents a loss of revenue.

TSPs also earn a small portion of revenue by cross-selling wholesale mobile virtual network operator (MVNO) services to other telecom companies, and through the sale of telecommunication equipment by leasing contracted phone devices. For example, T-Mobile earns wholesale revenue by sharing their network with Verizon and DISH. Similarly, AT&T has commercial arrangements with telecom providers to share their network, which generates wholesale (reseller) revenue.

Companies in the industry will typically report revenue from wireless and wireline services to retail, business and wholesale customers, as well as from equipment revenue. For traditional wireless services, equipment revenue often refers to the equipment plans provided to customers to purchase smartphones and other internet devices using installments.

EXPENSES

There are two broad categories of expenses for telecom companies:

- Operating costs and other expenses: Network costs is one of the main operating costs for a telecom, representing spectrum charges, infrastructure rent and maintenance costs. Selling, general and administrative expenses are another key expense for a telecom company and include the cost of acquiring new customers. Due to the capital-intensive nature of the industry, depreciation and amortization is another large expense for telecoms.

- Capital expenditures (Capex): A capital-intensive industry, telecom companies require extensive network infrastructure to provide fixed line and wireless services, which are accounted for as a capital expenditure. Capital expenditures also cover the cost of purchasing spectrum, government licensing fees, hardware (fiber cables, BTS) and the software required for their infrastructure.

OTHER KEY ITEMS & RATIOS

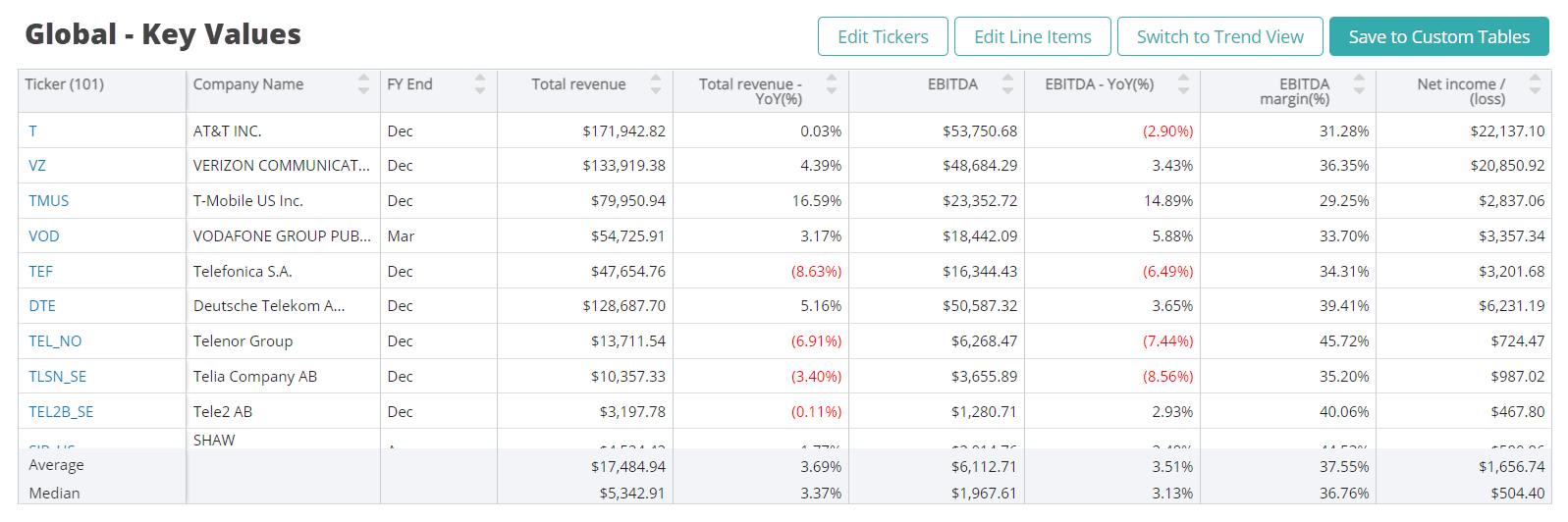

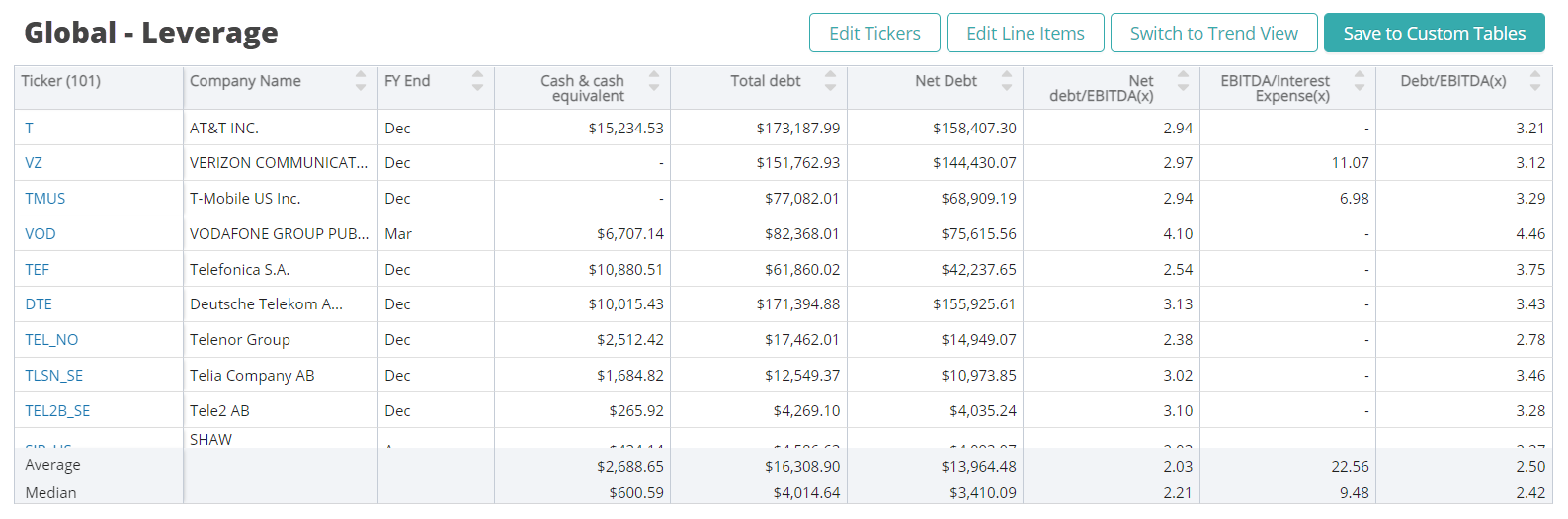

Investors evaluate profitability by looking at the level and directional change of EBITDA margin while free cash flow (FCF) helps track operational efficiency.

The capex-to-sales ratio helps investors measure how much revenue is ploughed back into capital expenses as these companies continuously maintain, replace and upgrade productive assets.

Finally, investors monitor EBITDA/interest expense and net debt/EBITDA for investment efficiency and leverage.

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for integrated telecommunications, whether at a company or industry level, here are some of the telecom KPIs to consider:

Visible Alpha’s Standardized Industry Metrics

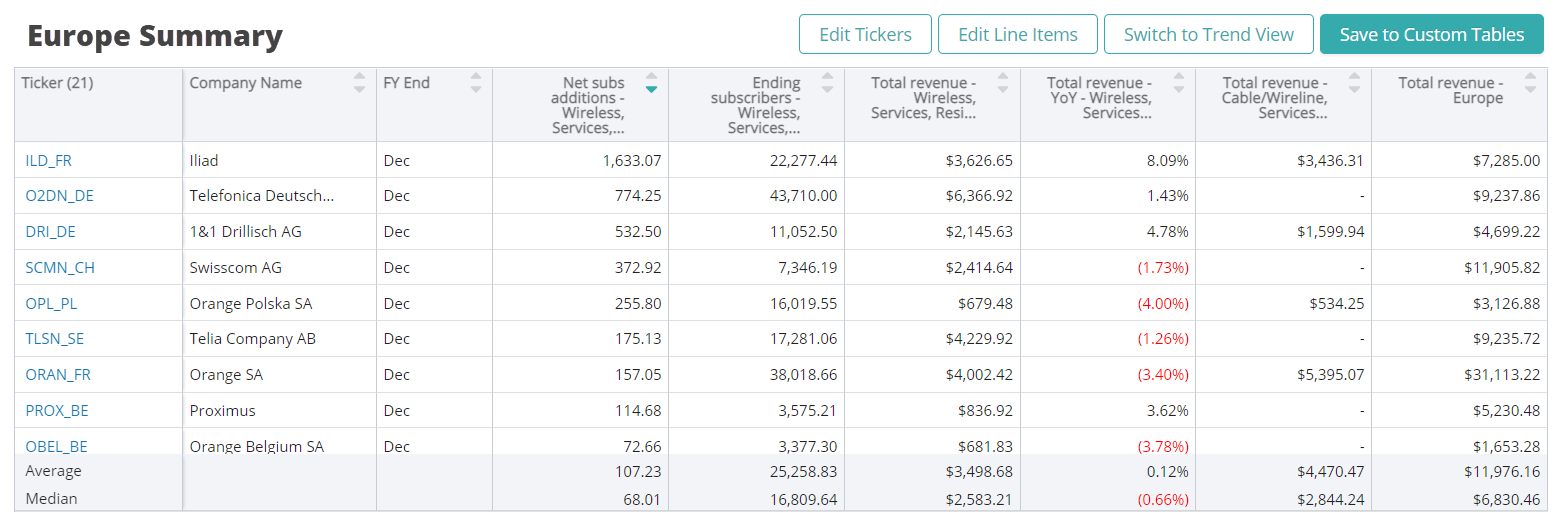

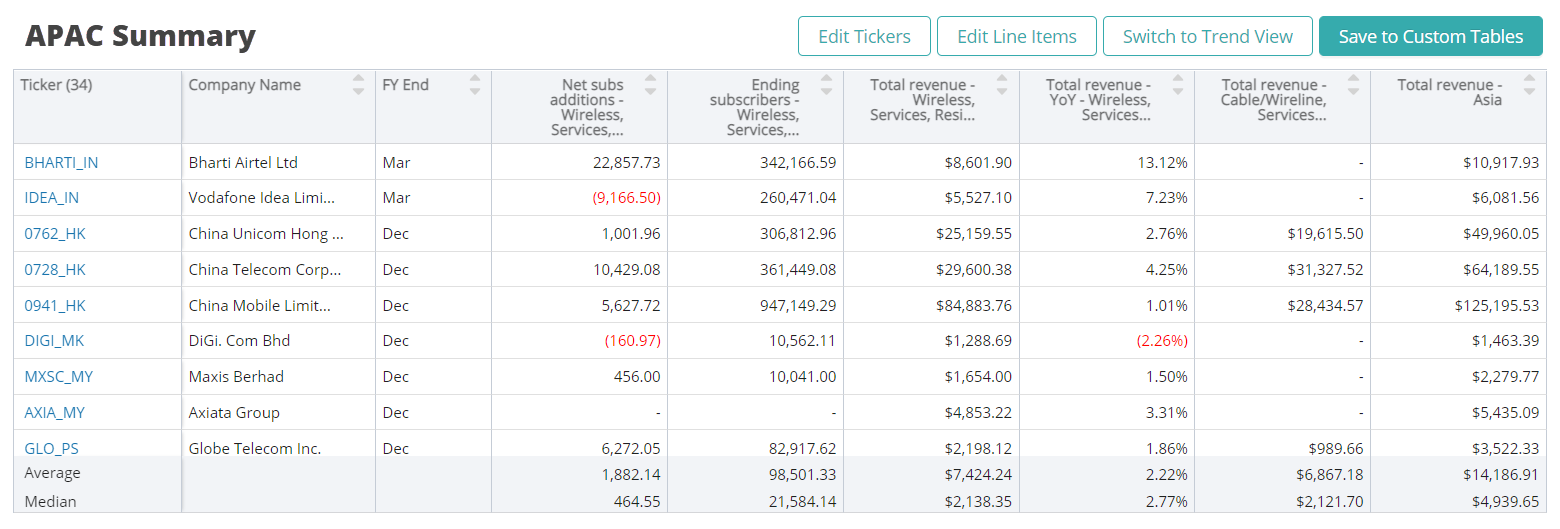

To understand market expectations for the integrated telecommunications industry, a key information source is sell-side analyst estimate and consensus forecast data. The buy side, sell side and public companies leverage this type of data to conduct competitive analysis, a type of analysis conducted by professional analysts that involves comparing standardized metrics of one company with those of similar companies. Because companies report metrics differently – and sometimes report on different metrics altogether – standardizing the key metrics for each company can be a cumbersome process.

Visible Alpha Insights includes analyst data, company data and industry data at level of granularity unparalleled in the market. Our industry data – Standardized Industry Metrics – enables market participants to quantify and compare market expectations for companies across 150+ industries.

Data as of January 2023

Industry KPI Terms & Definitions

Visible Alpha offers an innovative, integrated experience through real-time, granular consensus estimates and historical data created directly from the world’s leading equity analysts. Using a subset of the below KPIs, this data can help investors hone in on the key drivers of companies to uncover investment opportunities. Learn More >

Churn Rate

Churn rate is the percentage of subscribers who discontinue or do not renew their subscription. Churn is calculated as the number of disconnected subscribers divided by the number of beginning subscribers. Churn rate measures service efficiency.

Disconnects

Disconnects are the number of subscribers who discontinue or drop service over a given period.

Gross Additions

Gross additions are a client volume factor measuring the actual number of total new subscribers added before subtracting disconnects for a given period.

Net Additions

Net additions measure the volume of net subscribers left after subtracting disconnects from gross additions.

Ending Subscribers

Ending subscribers represents the number of subscribers a company has at the end of the period, which reflects the net additions to existing subscribers over a given period.

Average Subscribers

Average subscribers is the average number of subscribers in a period. This number is often calculated by taking the average of beginning and ending subscribers of a period.

Average Revenue Per User (ARPU)

For telecom companies, average revenue per user is the average monthly revenue that a company receives per user. ARPUs are expressed as monthly or annual value and can be calculated as total revenue divided by the average number of subscribers for a particular period. ARPU is a unit pricing factor.

Postpaid

Postpaid is the service/plan type for which billing is generated after the service is delivered. Postpaid clients generally deliver higher ARPUs, higher margins and a lower churn rate.

Prepaid

Customers of prepaid services/plans, pay upfront and in advance of using the service typically resulting in upfront payments and recharges. The prepaid business generally has lower ARPUs and higher churn rates.

EBITDA Margin

EBITDA (earning before interest, tax and depreciation) margin measures a company’s operating profit (before depreciation) as a percentage of revenue.

Capex to Sales

Capex to sales measures how much capital expenditures incurred as percentage of sales (revenue). In telecommunications, most of the capital expenditure is in terms of spectrum charges and network development.

Download this guide as an ebook today:

Guide to Integrated Telecom KPIs for Investment Professionals

This guide highlights the key performance indicators for the integrated telecommunications industry and where investors should look to find an investment edge, including:

- Telecom Industry Business Model & Diagram

- Key Telecom Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions