Average tower tenants are the average number of tenants leasing space on a tower company’s towers.

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for the tower industry, whether at a company or industry level, some industry KPIs to consider are:

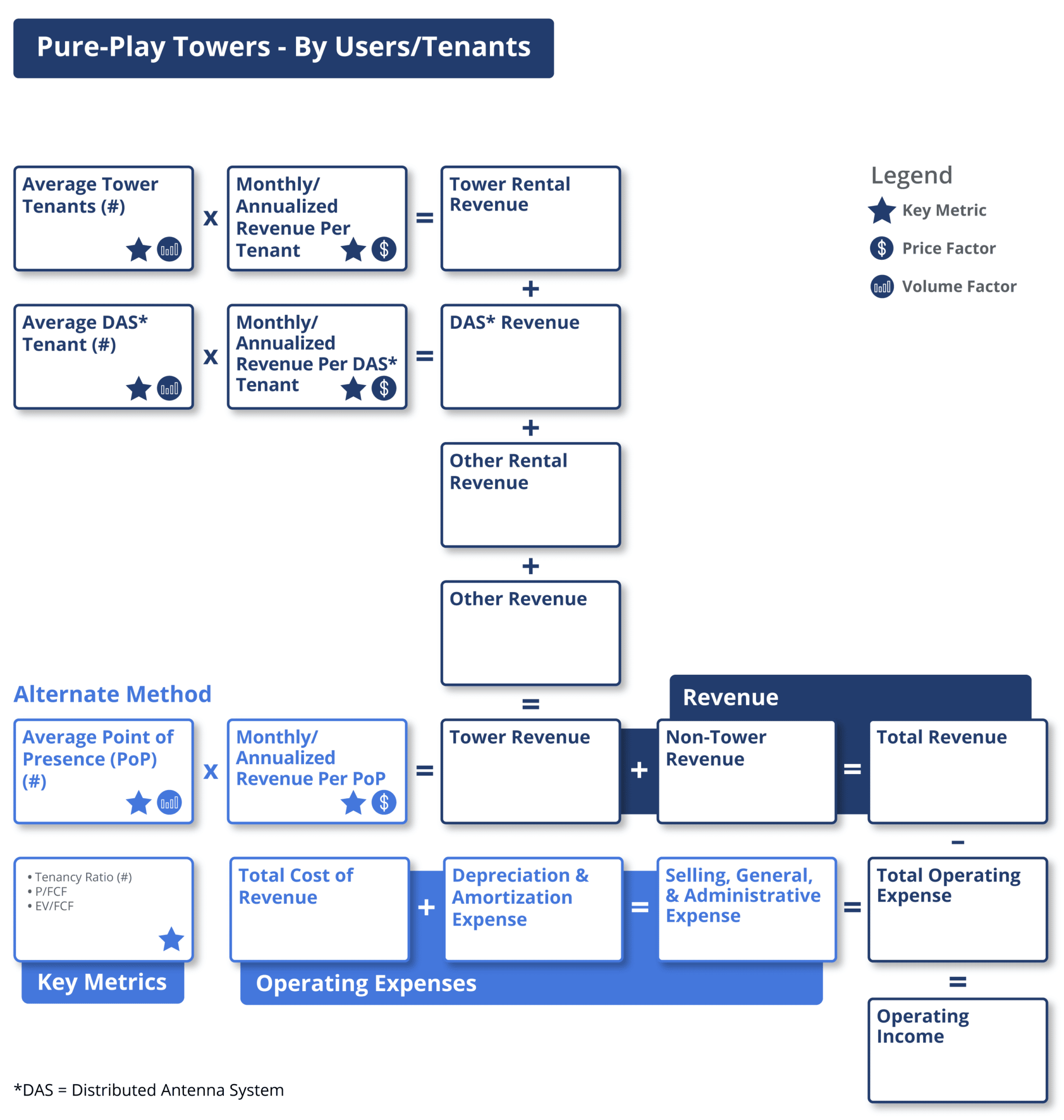

Pure-play Towers – By Users/Tenants

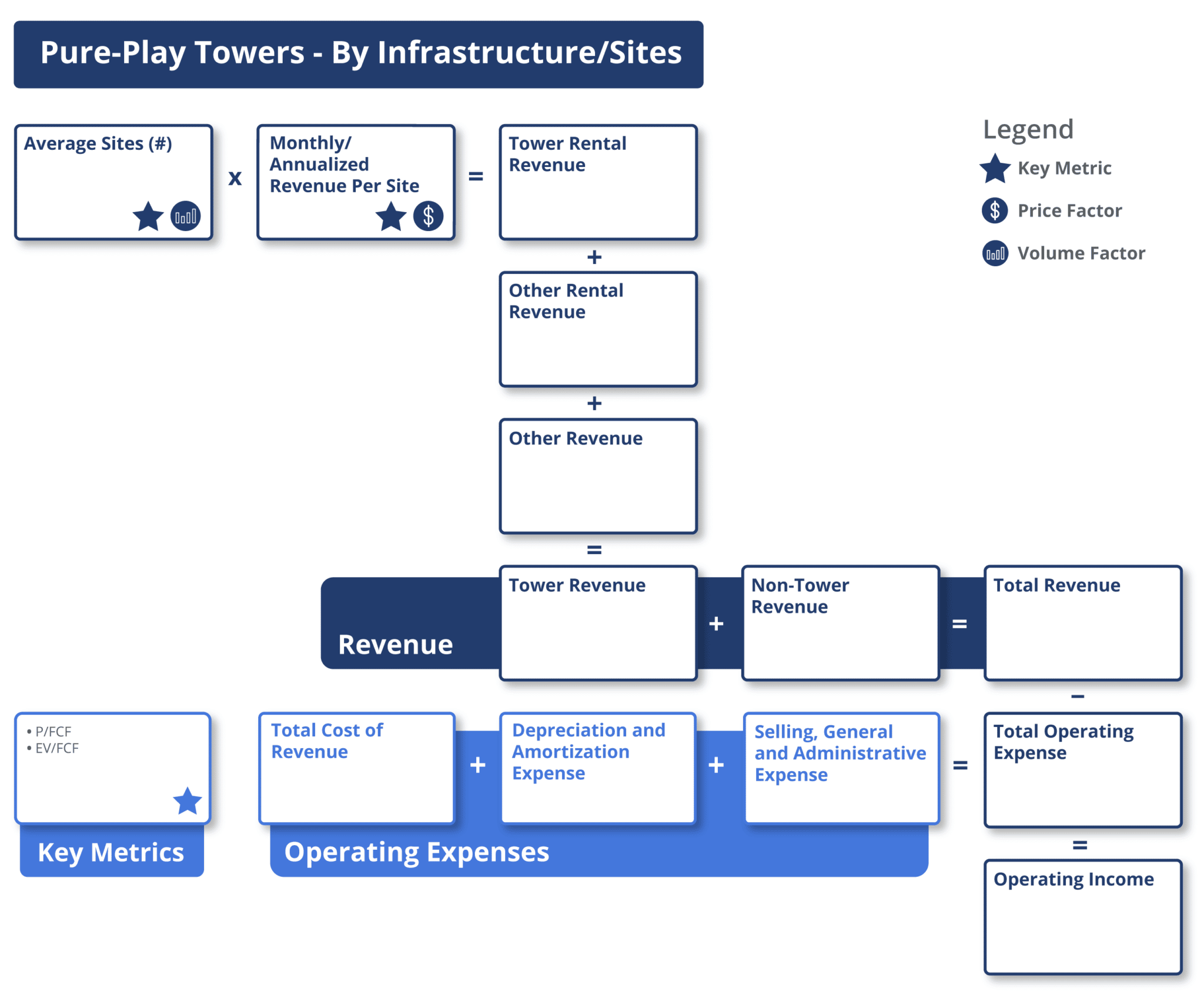

Pure-Play Towers – By Infrastructure/Sites

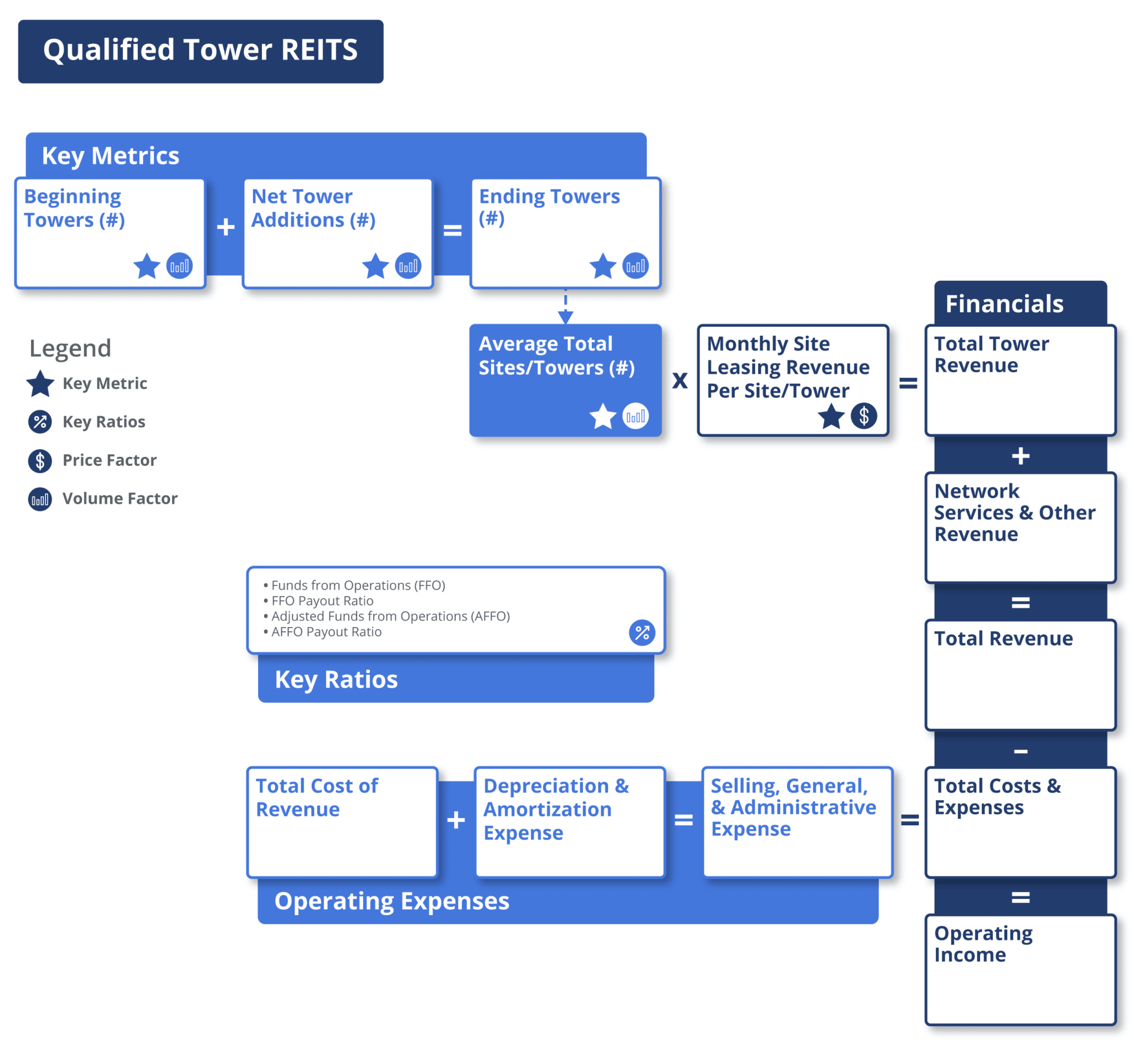

Qualified Tower REITs

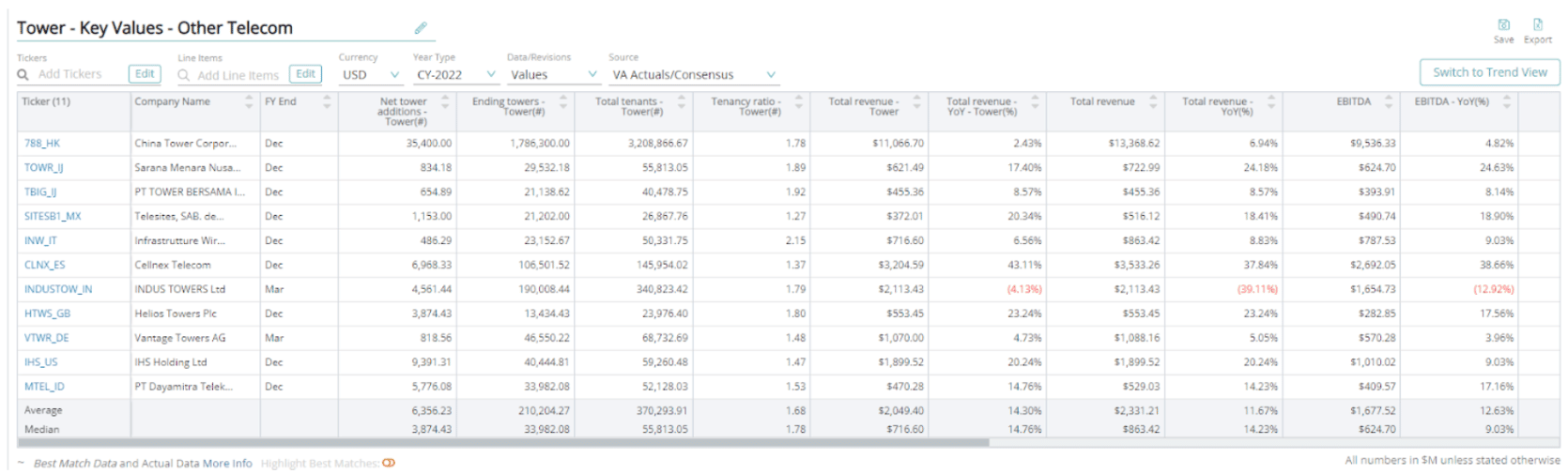

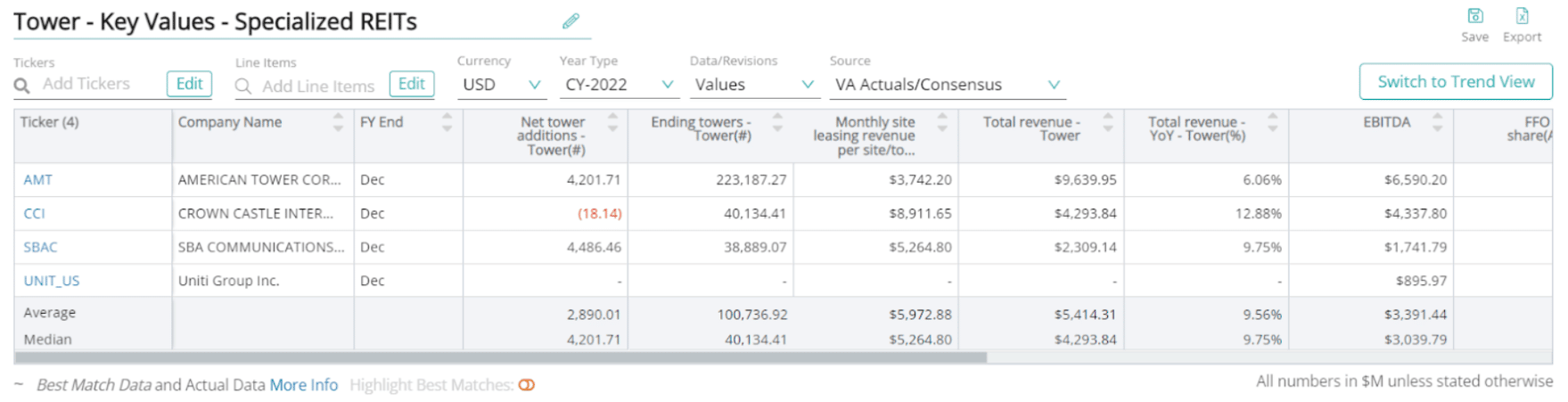

Visible Alpha’s Standardized Industry Metrics

To understand market expectations for the tower industry, a key information source is sell-side analyst estimates and consensus forecast data. The buy-side, sell-side, and public companies leverage this type of data to conduct competitive analysis, a type of analysis conducted by professional analysts that involves comparing standardized metrics of one company with those of similar companies. Because companies report metrics differently – and sometimes report on different metrics altogether – standardizing the key metrics for each company can be a cumbersome process.

Visible Alpha Insights includes analyst data, company data, and industry data at a level of granularity unparalleled in the market. Our industry data – Standardized Industry Metrics – enables market participants to quantify and compare market expectations for companies across 150+ industries.

Data as of January 2023

Industry KPI Terms & Definitions

Visible Alpha offers an innovative, integrated experience through real-time, granular consensus estimates and historical data created directly from the world’s leading equity analysts. Using a subset of the below KPIs, this data can help investors hone in on the key drivers of companies to uncover investment opportunities.

Towers

Towers or cell towers are cellular base stations, in-building solutions, rooftop or wall-mounted solutions that house electronic communication equipment, and antennas to support cellular communication.

Tenants

Tenants are the total number of customers of a tower company that have leased vertical spaces on a cell tower owned or operated by the company.

Tenancy Ratio

Tenancy ratio is the average number of tenants per tower.

Lease Liabilities

Lease liability is the obligation to make lease payments, measured at the present value of future lease payments.

Gross Debt

Gross debt is the sum of borrowings and lease liabilities.

Net Debt

Net debt is the difference between gross debt and cash.

Pure-play Towers

Average Tower Tenants (#)

Average tower tenants are the average number of tenants leasing space on a tower company’s towers.

Monthly/Annualized Revenue Per Tenant

Monthly/annualized revenue per tenant is the monthly or annual revenue generated by a tower company per tenant.

Average DAS Tenant (#)

Average DAS tenant is the average number of tenants leasing DAS systems.

Monthly/Annualized Revenue Per DAS Tenant

Monthly/annualized revenue per DAS tenant is the monthly or annual revenue generated by a tower company per DAS tenant.

Average Point of Presence (PoP) (#)

Average point of presence (PoP) is the point at which two or more different networks or communication devices build a connection with each other. PoP mainly refers to an access point location, or facility that connects to and helps other devices establish a connection with the Internet.

Monthly/Annualized Revenue Per PoP

Monthly/annualized revenue per PoP is the monthly or annual revenue generated by a tower company per point of presence.

Tenancy Ratio (#)

Tenancy ratio is the average number of tenants per tower.

Average Sites (#)

Average sites are the average number of sites owned or operated by a tower company.

Monthly/Annualized Revenue Per Site

Monthly/annualized revenue per site is the monthly or annual revenue generated by a tower company per point of site or tower.

Qualified Tower REITs

Beginning Towers (#)

Beginning towers is the number of towers at the beginning of a reporting period.

Net Tower Additions (#)

Net tower addition is the acquisition or cancellation of tenant leases in a given period.

Ending Towers (#)

Ending towers is the number of towers at the end of a reporting period.

Average Total Sites/Towers (#)

Average total sites/towers is the sum of the current period ending tower and the previous period ending tower divided by 2.

Monthly Site Leasing Revenue Per Site/Tower

Monthly site leasing revenue per site is the monthly or annual revenue generated by a tower company per tower leased.

Funds From Operations (FFO)

Funds from operations (FFO) is a measure of profitability and is calculated as net income applicable to common stockholders excluding non-cash adjustments.

FFO Payout Ratio

FFO payout ratio helps investors understand dividend payment as a percentage of earnings and is calculated as total dividends paid divided by funds from operations.

Adjusted Funds From Operations (FFO)

Adjusted funds from operations (AFFO) is a financial measure used to estimate the value of a REIT. It is calculated as FFO excluding capital expenditures and maintenance capex.

AFFO Payout Ratio

AFFO payout ratio helps investors understand dividend payment as a percentage of earnings and is calculated as total dividends paid divided by adjusted funds from operations over the same period.

Download this guide as an ebook today:

Guide to Tower Industry KPIs for Investment Professionals

This guide highlights the key performance indicators for the tower industry and where investors should look to find an investment edge, including:

- Tower Industry Business Model & Diagram

- Key Tower Industry Metrics PLUS Visible Alpha’s Standardized Industry Metrics

- Available Comp Tables

- Industry KPI Terms & Definitions