BIOPHARMA FOR PRIVATE EQUITY & VENTURE CAPITAL

Activate Your Trial

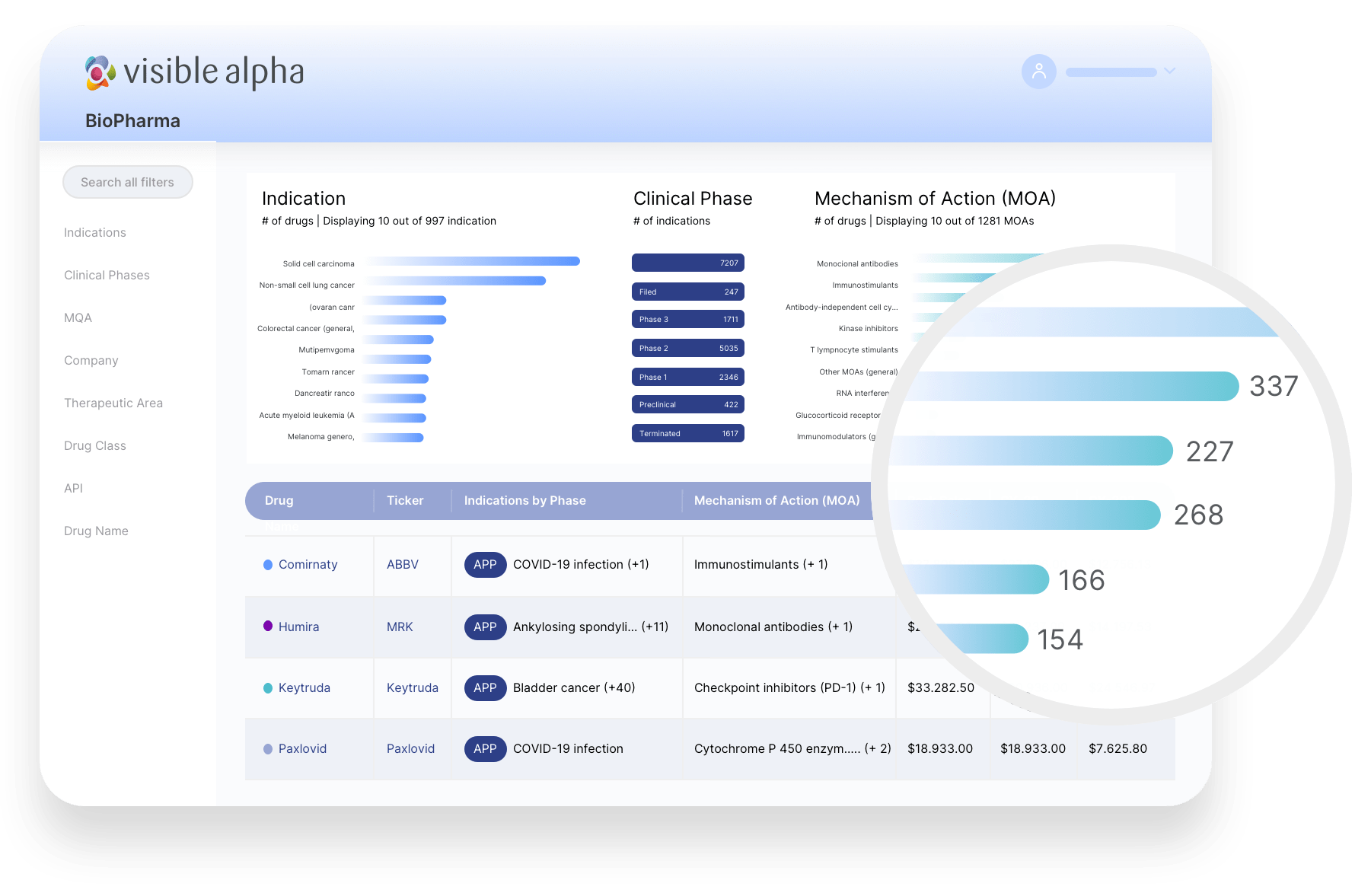

Augment your Capital IQ Pro subscription with Visible Alpha BioPharma, offering in-depth, drug-level consensus data that gives a clear and accurate view into market expectations and the competitive landscape.

Drugs Indications MOAs Contributing Brokers6,300+

1,000+

1,200+

250+