Amazon’s (NASDAQ: AMZN) AWS Financial Services Symposium 2024 took place on June 6, 2024 in New York City.

This event featured an array of organizations operating in the financial services space. The generative AI (GAI) theme was strong, bringing together topics about risk, data, infrastructure, LLMs, costs, hallucinations, and the challenges of scaling GAI.

Speakers were largely from the technology side of the enterprise and their presentations incorporated a perspective on the GAI tech stack. Most of the presenters agreed that LLMs are very useful, but were quick to highlight the high cost and complexity, especially for external-facing GAI solutions.

Key takeaways from AWS Financial Services Symposium 2024

- Move to the cloud: Significant amounts of data still lives on-premises, especially within the financial services industry. However, the cloud seems to provide a better environment for working with LLMs, given the significant computing needs for GAI. AWS seems likely to benefit from the increasing transition by financial services enterprises to move more to the cloud.

- ROI vs FOMO: Companies that do successfully implement and deploy use cases may make their organizations more productive and competitive. However, the ROI, given the high cost, seems to be driven more by FOMO than by quantifiable improvements to the business fundamentals.

- The devil is the domain: Domain expertise seems to be an important component to successful deployment of GAI solutions to end users. These solutions cannot be developed in a technology silo. The customers’ or end-users’ distinct perspective needs to be included at each layer of the stack. Domain experts need to be leveraged to identify hallucinations and the integrity of the GAI interactions.

While financial services is only one vertical, the presentations and discussions provided a peek into the complexities of creating GAI products and solutions. Based on data shared by Deloitte at the Symposium, budgets are seeing a 2x to 5x increase from 2023, driven by spending on AI. AWS looks well-positioned to benefit from these trends and the overall increased transition to the cloud by enterprises, as GAI gains momentum.

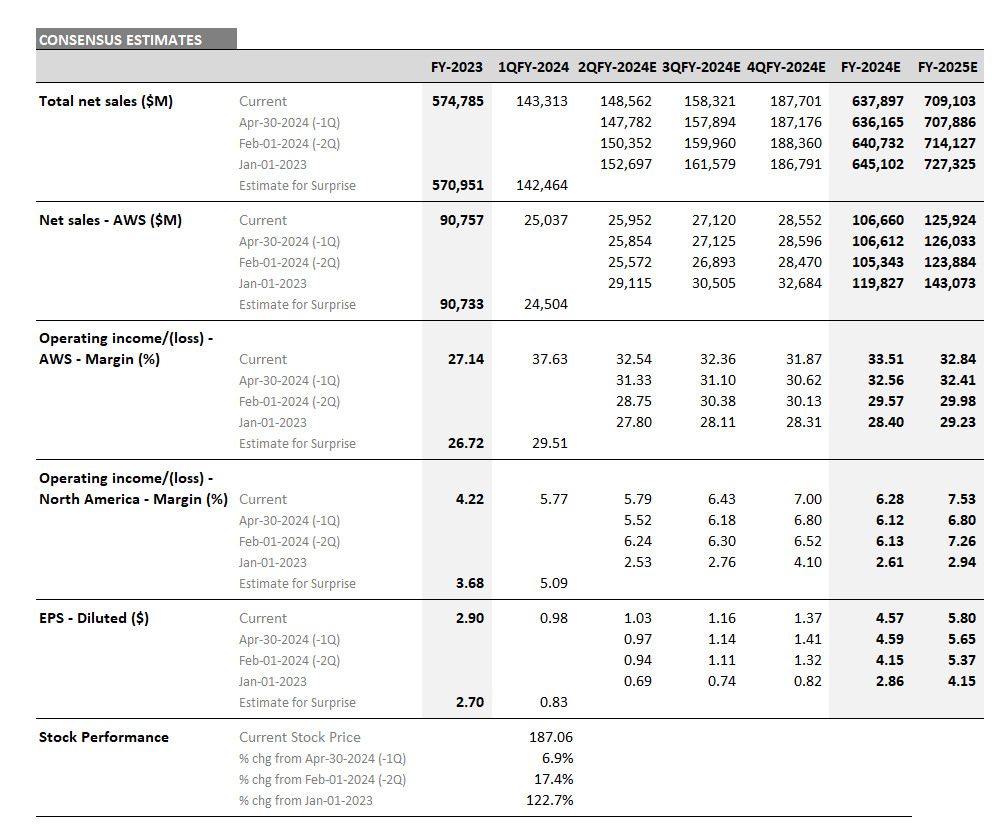

Based on Visible Alpha consensus, AWS margin has steadily been increasing since last year. In particular, AWS margin for Q2 has ticked up over 120 basis points since April 30, 2024. The FY 2024 AWS margin is now expected to be 33.5%, up over 500 bps since January 2023. Will AWS margin continue to expand in 2025 and beyond?