This is the third part and final part of this series.

In the U.S., publicly traded companies routinely reward shareholders with cash payouts. There are two types of common payout vehicles:

- Cash dividend per share

- Share repurchases

Dividend-focused research has been quite popular across the financial industry for a long time, but a lack of reliable data has led quantitative researchers to ignore the impact of buyback programs on stock returns. This is particularly notable given that buybacks represent a greater share of payouts than dividends. Visible Alpha’s data science team analyzed a novel dataset that captures both the buyback and dividends expectations, resulting in the first analysis of forward-looking total payout expectations.

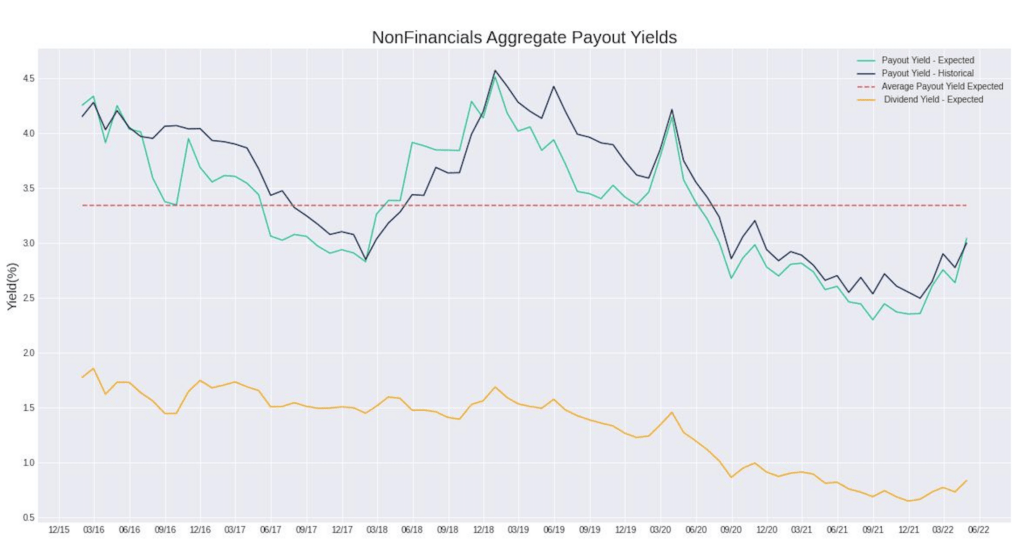

The figure below plots the aggregate expected and realized payout yields using market cap weighting. The aggregate payout yield appears to cycle around the sample average of 3.35% annually. Generally, higher payouts lead to higher yields, but the pandemic episode after March 2020 until 2022 is exceptional – the payouts during this time rose while the payout yield fell steadily, suggesting that the market values far outpaced the payouts. The orange line is the expected dividend yield. The average dividend yield in the sample period is 1.3%, as opposed to 3.35% when buybacks are included in the total payout, with almost half the standard deviation of payout yield. We find that the aggregate payout yield expectations have significant explanatory power over the next 12-month broad market returns but the dividend yield’s contribution is the least important compared to earnings and buybacks.

Download the full white paper here >

Register For a Live Presentation

Ihsan Saraçgil, Senior Principal Data Scientist at Visible Alpha, will present on the data, methodology, and key findings of the analysis during a webinar presentation on July 12, 2022. Register Now >