This is the first part of a three-part series.

In the U.S., publicly traded companies routinely reward shareholders with cash payouts. There are two types of common payout vehicles:

- Cash dividend per share

- Share repurchases

Dividend-focused research has been quite popular across the financial industry for a long time, but a lack of reliable data has led quantitative researchers to ignore the impact of buyback programs on stock returns. This is particularly notable given that buybacks represent a greater share of payouts than dividends. Visible Alpha’s data science team analyzed a novel dataset that captures both the buyback and dividends expectations, resulting in the first analysis of forward-looking total payout expectations.

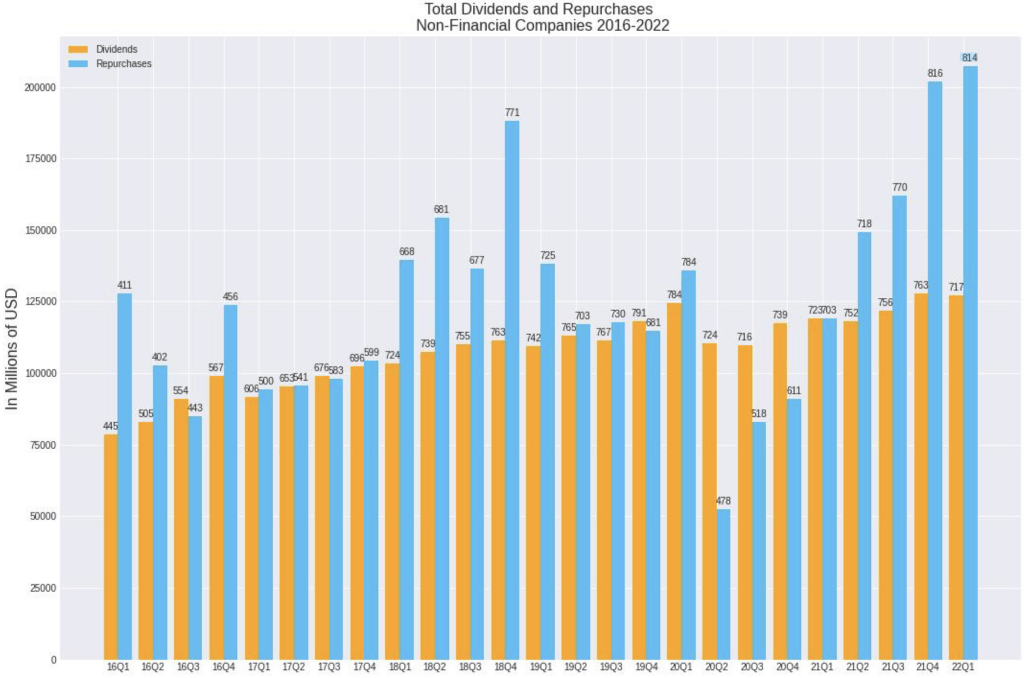

Buybacks today form a larger part of aggregate payouts; they are also more volatile in time. The figure below plots the total quarterly payouts for the non-financial sample since 2016. Total money spent on share repurchases tends to be on par with total dividends even though the buybacks are more volatile. For example, 2020Q2, as the first impact of Covid-19 began, shows a steep decline in both the number and amount spent on buybacks, while the number of firms that suspended or reduced dividends appears minuscule. Moreover, buybacks came back roaring after the first Covid shock. As of 2021Q4 and 2022Q1, buybacks exceeded dividends by 60%.

Download the full white paper here >

Register For a Live Presentation

Ihsan Saraçgil, Senior Principal Data Scientist at Visible Alpha, will present on the data, methodology, and key findings of the analysis during a webinar presentation on July 12, 2022. Register Now >