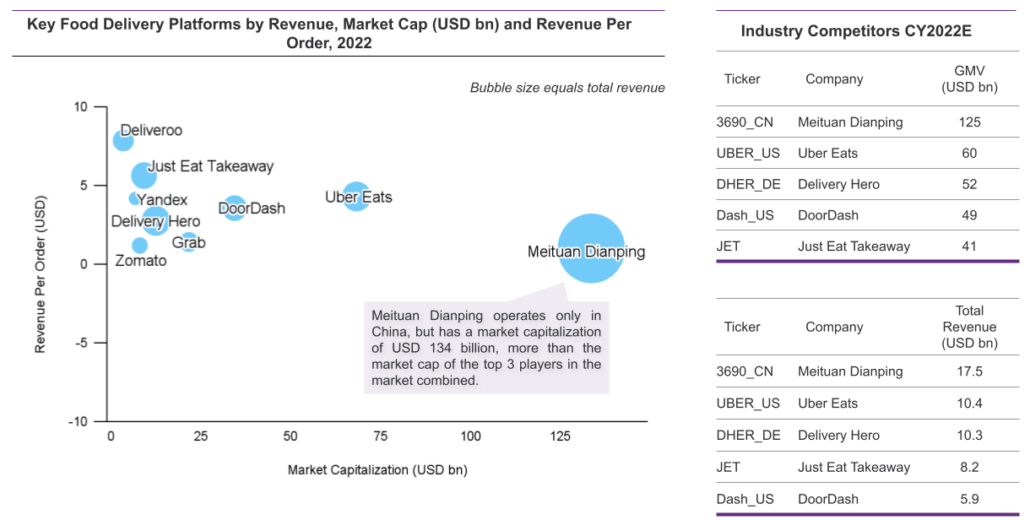

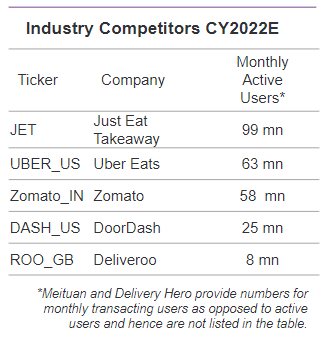

The last-mile food delivery industry has become a market worth $46.2 billion in CY21, according to the Visible Alpha consensus. Visible Alpha’s granular consensus data offers a unique, bottom-up perspective on the industry, which has seen its revenue grow at an aggregate CAGR of 39% between 2020-2022. The Covid-19 pandemic, with its lockdowns and social distancing norms, gave a boost to the industry with analysts projecting it to generate $119.5 billion in revenue by 2026, growing from $46.2 billion in 2021 at a CAGR of 21%. Over the past few years, investment has continued to pour into the space. Recent IPOs – DoorDash in December 2020, Deliveroo in March 2021, Zomato in July 2021, and Grab in December 2021 – further illustrate the excitement and uncertainty that surrounds this sector.

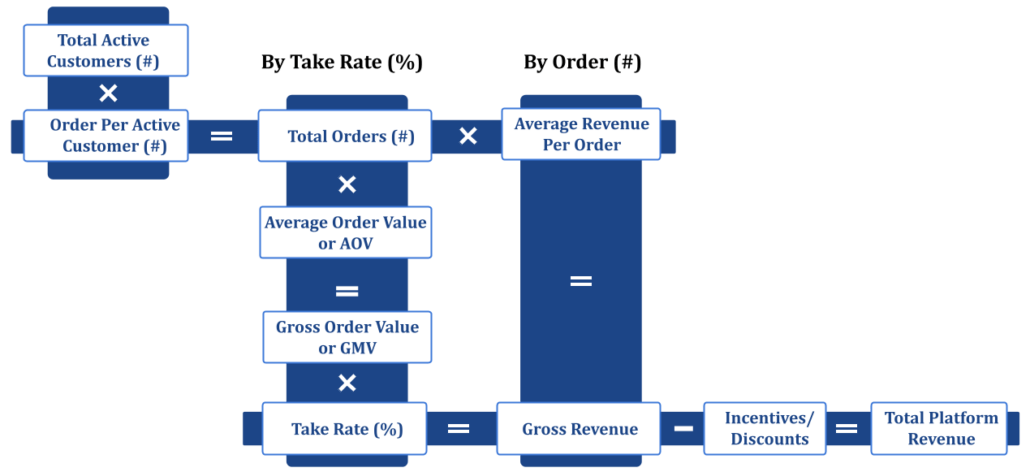

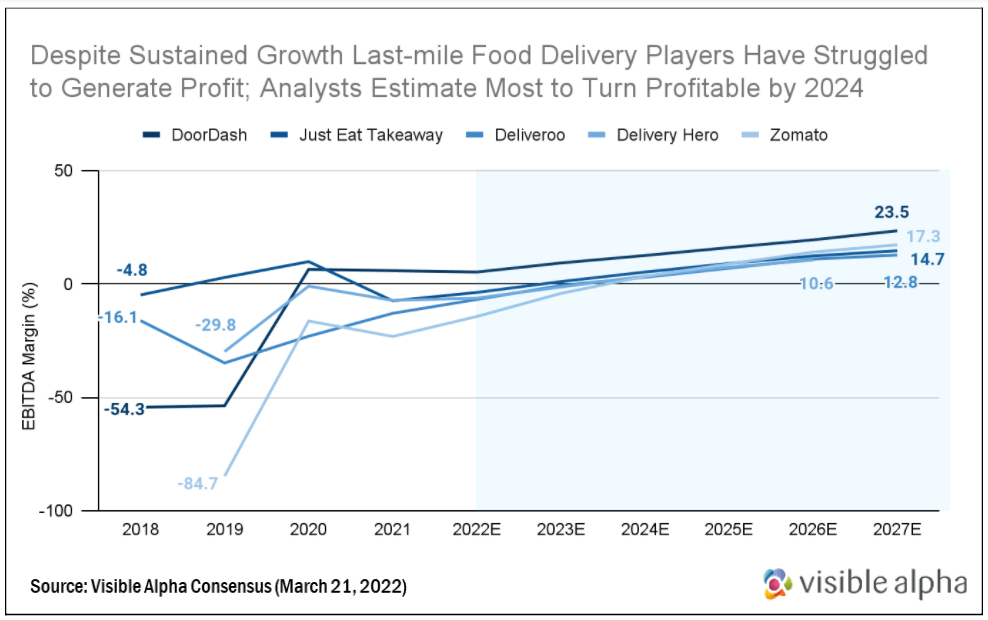

Profitability, however, remains a challenge for a majority of food delivery platforms. Despite the growth that the industry has experienced in recent years, delivery companies are still struggling to develop a sustainable business model with analysts projecting most players to see profitability improve only by 2024. In the race to profitability, expanding customer base and driving up order volumes remains a key priority for last-mile food delivery players, especially as these companies continue to receive flak for their high take rates. Many are experimenting with subscription models, cloud kitchens, dark store concepts, and grocery deliveries to offer differentiated services and mount their presence as serious contenders in the on-demand space.

Profitability, however, remains a challenge for a majority of food delivery platforms. Despite the growth that the industry has experienced in recent years, delivery companies are still struggling to develop a sustainable business model with analysts projecting most players to see profitability improve only by 2024. In the race to profitability, expanding customer base and driving up order volumes remains a key priority for last-mile food delivery players, especially as these companies continue to receive flak for their high take rates. Many are experimenting with subscription models, cloud kitchens, dark store concepts, and grocery deliveries to offer differentiated services and mount their presence as serious contenders in the on-demand space.

Another path to profitability for many last-mile delivery companies has been through market consolidation. The industry has seen further consolidation in recent years, specifically, with Uber’s acquisition of Postmates in December 2020, Just Eat Takeaway acquiring Grubhub in July 2021, in the U.S., DoorDash acquiring Wolt in Finland in November 2021, and Zomato looking at possible options to acquire Blinkit (formerly Grofers) in India as of March 2022.

Key last-mile delivery platforms by region

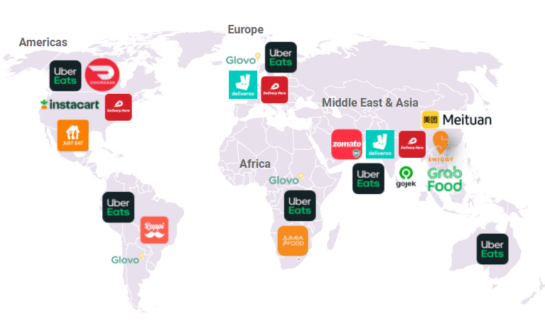

Last-Mile Delivery Industry Revenue Model

The industry’s schematic diagram shows that the economics of last-mile delivery platforms are largely driven by the take rate (%) or commission fee that delivery providers charge restaurants listed on their platform, and the order volume or the total number of orders (#) placed on the delivery platforms.

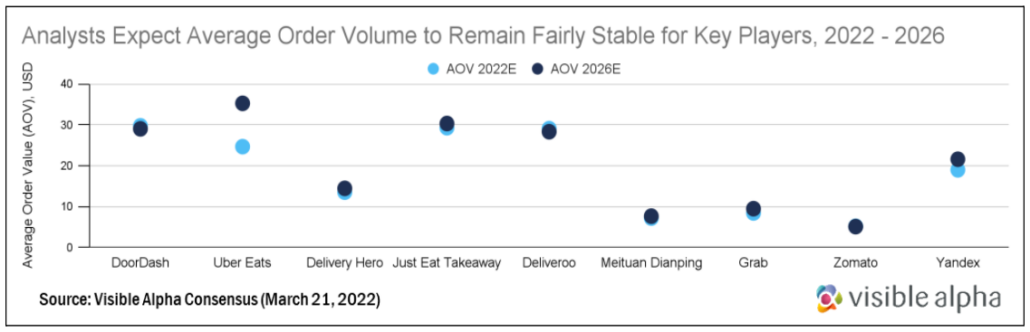

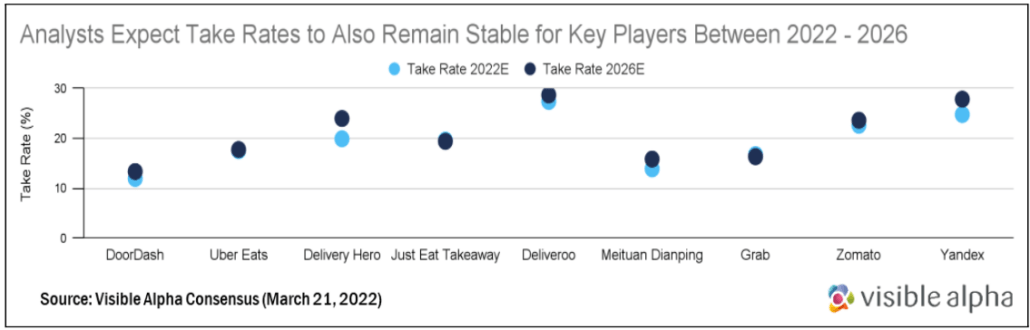

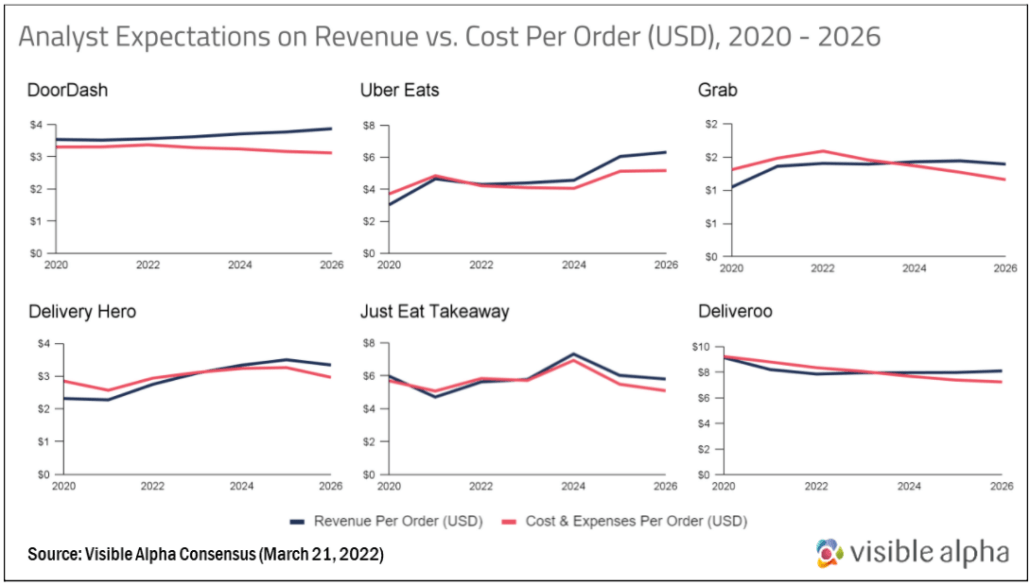

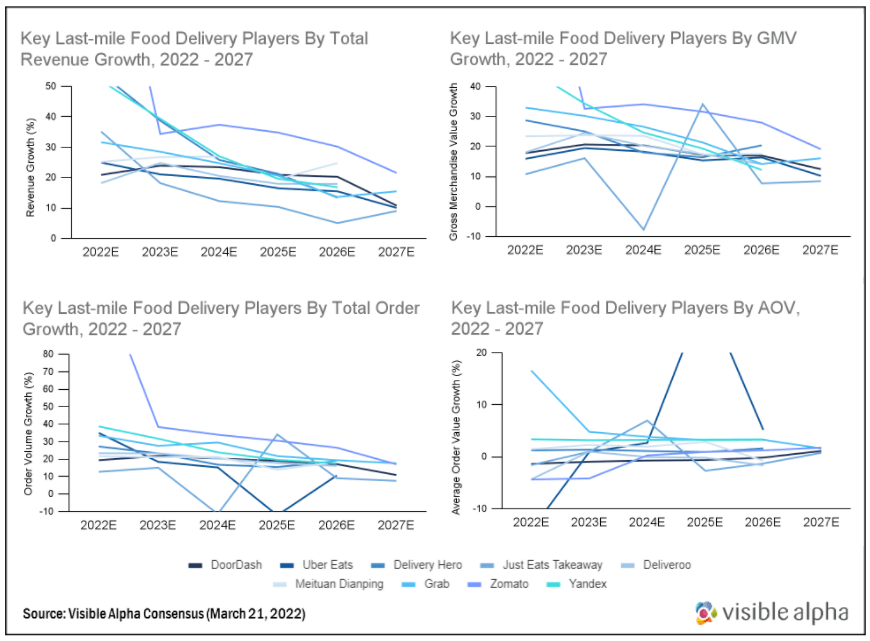

To drive revenue generation, delivery platforms can either charge a higher commission to restaurants listed on their platforms, drive up total active customers, or increase the total order volume. Analysts forecast the average order value and take rates to remain fairly stable over the coming years for most key players (see chart below), as food delivery providers can only increase commission rates to a certain level before partner restaurants no longer find the third-party delivery business a profitable venture or begin moving to other platforms.

Furthermore, in some countries such as the U.S., during the pandemic, many local and state governments imposed caps on take rates, and some are even considering making them permanent. More recently, China announced that food delivery platforms should further reduce the service fees they charge partner restaurants to lower the operating costs for the food and beverage businesses. In India, the National Restaurants Association of India (NRAI) has accused key players Zomato and Swiggy of charging high commission rates, and the two parties have yet to come to a consensus, all of which makes take rates a rather controversial issue for food delivery platforms.

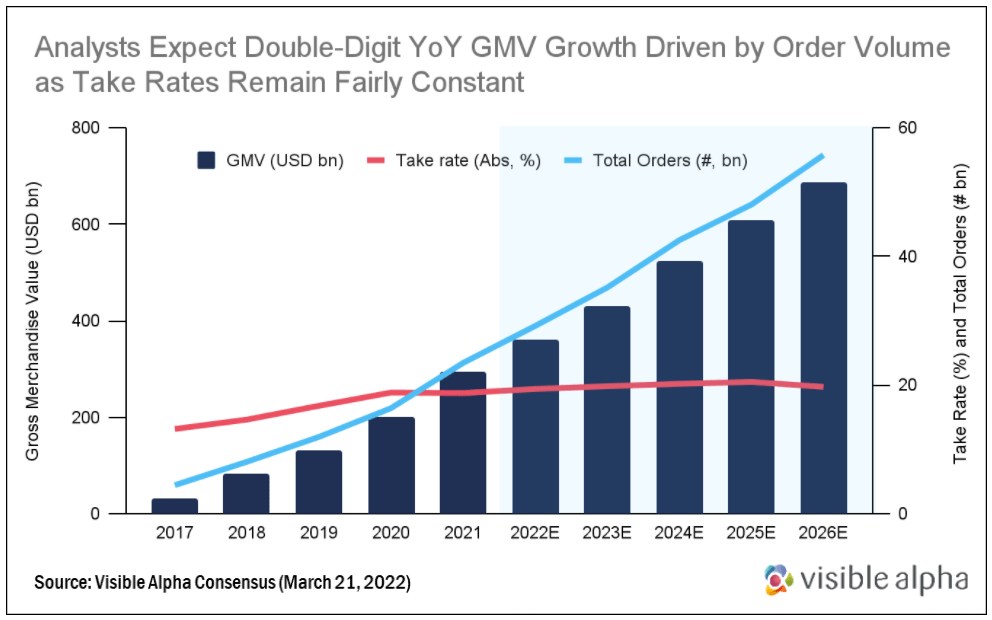

On the other hand, analysts have been steadily raising their estimates for gross merchandise value (GMV) along with total order volumes, while takes are expected to remain rather constant as shown in the chart above. This suggests that analysts believe growing total order volume remains the key revenue driver for companies in the industry. This may also explain why many last-mile food delivery companies are actively pursuing mergers and acquisitions that further expand their customer base and drive order volumes inorganically.

Profitability Remains A Challenge for Food Delivery Players

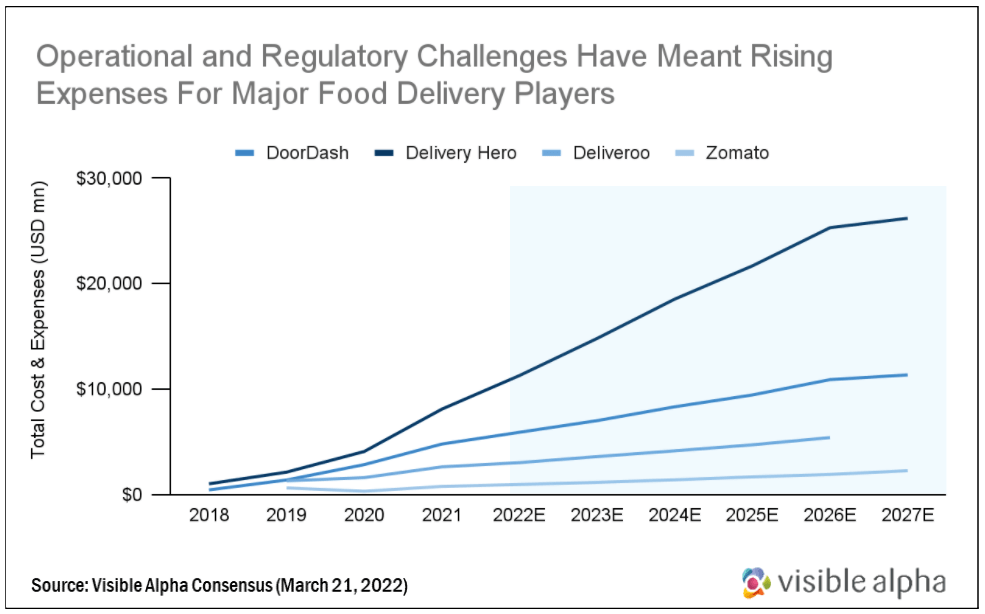

Even as the industry continues to expand and garner interest, key challenges remain, such as high operating costs including high supply chain and logistics costs, operational complexities, regulatory frameworks around take rates, and delivery partner compensations, among others.

Supply chain and logistics costs are unlikely to decline substantially, as the economics of last-mile delivery remains challenging, particularly with increasing on-demand expectations. Rising general and administrative expenses have added further cost pressure for delivery companies. Changing regulatory laws around labor, including Spain’s 2021 ‘Rider Law’ recategorizing platform workers as employees entitled to protections, the EU’s proposed law that ensures labor rights and social benefits for delivery partners, and other such conversations across countries will only further exacerbate this. Another important consideration is the selling and marketing expense. With many players competing in the food delivery space, the cost of attracting customers is ever-mounting, especially as food delivery players venture into the grocery delivery market.

Additionally, if costs continue to rise while average order values remain fairly constant, last-mile food delivery platforms will continue to face pressure on operating margins. All these factors combined have meant that although the industry has seen enormous growth in recent years, with a few exceptions such as DoorDash and Uber Eats, most last-mile delivery platforms are still struggling to make a profit with margins expected to remain low until 2024, which is when analysts expect key players to turn profitable.

*We have excluded Meituan Dianping and Uber Eats from the chart above given that the two companies have a much larger ecosystem outside the food delivery space.

Future Outlook of Food Delivery Companies

Although most food delivery players enjoyed significant growth due to the pandemic push, Visible Alpha consensus estimates suggest it isn’t until 2024 that delivery platforms will see margin growth. The rising cost of labor and marketing expenses, especially as consumers head back to restaurants, and increasing regulatory challenges around take rates, will make it harder for food aggregators to turn a profit. Food inflation – which the ongoing Ukraine crisis will aggravate – is the industry’s next big hurdle. So how promising is the future of the last mile? Probably the bigger questions are; will consumer demand suffice in driving overall volume growth for the industry? And, can food delivery players achieve economies of scale to bring down their costs as they grow, or will expenses grow linearly with volume and cost pressures forever plague the industry?

1 Based on the following nine companies: Meituan Dianping, Uber Eats, Just Eat Takeaway, Delivery Hero, DoorDash, Deliveroo, Grab, Zomato, and Yandex.